Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want these updates as soon as we post them, follow us on Twitter.

quick weekly news

Bitcoin ETFs surge past $1 billion in daily inflows

The US market for spot Bitcoin exchange-traded funds is experiencing explosive growth. For the first time ever, these ETFs surpassed $1 billion in daily net inflows on March 12th, marking a significant milestone. This surge comes on the heels of a 13-day period that saw a total of $11.1 billion flow into these investment vehicles.

BlackRock’s iShares Bitcoin ETF (IBIT) is leading the charge, attracting a whopping $849 million in inflows on March 12th. Other notable contributors include ARK 21Shares Bitcoin ETF (ARK), VanEck Bitcoin Trust ETF (HOLD), and Fidelity Wise Origin Bitcoin Fund (FBTC), though their contributions were smaller.

The impact of these inflows extends beyond the ETF market itself. As a result of the increased interest in Bitcoin through these ETFs, the daily inflow of capital being stored on the Bitcoin network has reached a new high of $2 billion. This signifies a growing adoption and potential future growth for the cryptocurrency.

Bitcoin breaks records: will the halving spark a $150,000 surge?

The record-breaking climb of Bitcoin to $73,700 has sparked debate among analysts about a potential pre-halving correction. Historically, Bitcoin has experienced price dips before halving events, with corrections of 20% and 38% observed in 2020 and 2016 respectively. Analyst Rekt Capital anticipates a similar trend this time, with a possible retracement lasting up to 77 days. However, recent pullbacks in January (-18%) and early March (-14%) might indicate a milder correction compared to previous cycles.

This bull run, however, presents unique features. Unlike past halving cycles, Bitcoin has already established a new all-time high before the event. Furthermore, some analysts believe Bitcoin is currently lagging its historical growth trajectory. Data from Ecoinometrics suggests Bitcoin’s price could be anywhere between $100,000 and $300,000 if it followed the path of previous halvings, implying there’s still room for growth before the halving.

Looking ahead, wealth management firm Bernstein is optimistic about Bitcoin’s long-term potential. They predict a significant price increase after the halving, with Bitcoin potentially reaching $150,000 by mid-2025. This bullish outlook is fueled by the surge in demand for spot Bitcoin ETFs, which have already surpassed Bernstein’s initial inflow estimates for 2024. With analysts divided on the short-term future, Bitcoin’s path remains to be seen, but one thing’s for sure: the cryptocurrency market continues to be a hotbed of activity and speculation.

Tim Berners-Lee envisions AI assistants and movement-based web

Tim Berners-Lee, the inventor of the World Wide Web, shared his thoughts on the future of the internet during a recent interview. He believes AI, VR, and a shakeup of big tech companies will define the next era.

Berners-Lee envisions trustworthy AI assistants that function like helpful advisors. He also predicts a shift towards VR and spatial computing, where users interact with the digital world through their physical movements. This could involve using VR headsets alongside traditional screens, with a seamless transition between devices. This technology, intrinsically linked to the metaverse concept, might replace the current keyboard, mouse, and touchscreen interaction methods.

Interestingly, Berners-Lee didn’t mention cryptocurrency or blockchain technology, but his predictions on VR and spatial computing align with the metaverse concept. He also addressed the possibility of government intervention to break up big tech companies, highlighting potential concerns about their dominance.

security researchers flag potential vulnerability in older Trust Wallet iOS app

Security researchers at SECBIT Labs claim a vulnerability in Trust Wallet’s iOS app from 2018 might still be affecting some accounts. The vulnerability reportedly existed between February and August of 2018 and could allow attackers to steal users’ crypto funds.

According to SECBIT, the vulnerability stemmed from two functions within the app’s code that were meant for testing purposes only. Trust Wallet allegedly included these functions despite warnings against their use. These functions might have generated weak seed phrases, making it possible for attackers to guess them and steal cryptocurrency.

Trust Wallet refutes these claims, stating that the issue only impacted a small number of users in 2018 and that they were all notified and migrated to new wallets. The company also denies that the majority of the hacked accounts originated from their app.

support and resistance basics

Support and resistance are fundamental concepts in technical analysis, used to identify potential buying and selling zones.

🔹 Support: A price level where buying interest is strong enough to prevent the price from falling further.

🔹 Resistance: A price level where selling pressure is strong enough to prevent the price from rising further.

These levels are visualized as zones rather than exact lines due to price fluctuations.

How to identify support and resistance?

- Look for areas on the chart where the price has bounced off multiple times in the past.

- Support zones can turn into resistance zones if the price breaks below them, and vice versa. This is called an “S&R flip.”

Uncover more 🌎

Our in-depth guide dives deeper into identifying these zones and using them for smarter trading decisions.

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

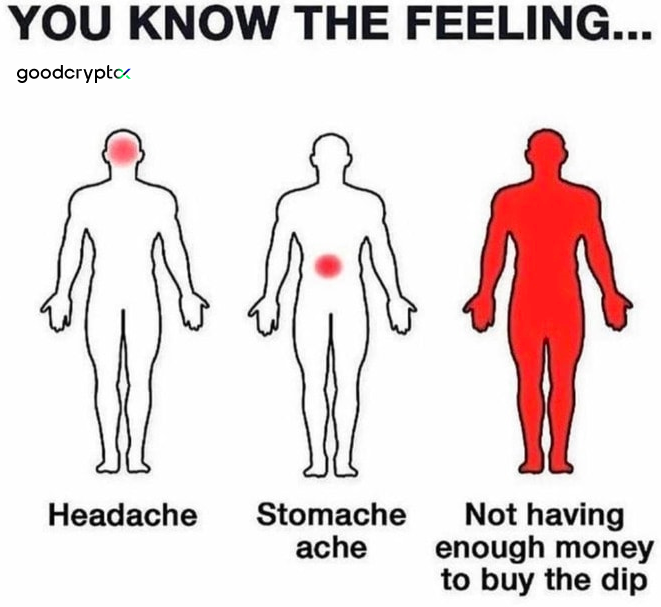

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!