Hey there! 👋

Another red week as macro pressure hits crypto. Another week of painful declines as macro events shake crypto. Is recovery in sight? Let’s find out in this weekly digest:

quick weekly news

Bitcoin extends selloff as macro pressures and leverage unwind

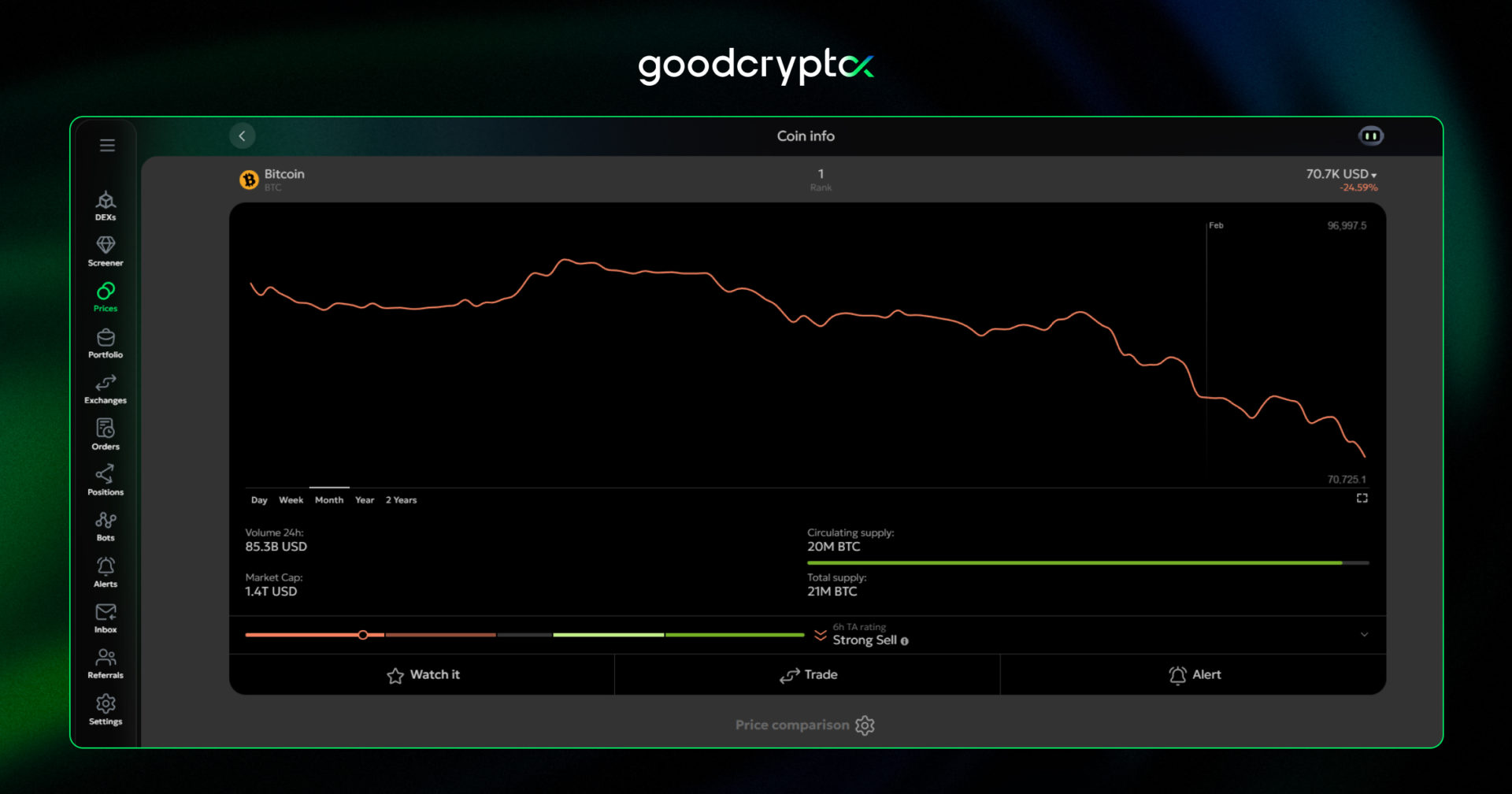

Let’s kick off this digest with the most painful moment of the week, the Bitcoin sell-off. For the third week in a row, $BTC has been sliding hard. In just three weeks, the market flipped from “we are almost back at $100K, bull run continues” to full-blown disbelief and panic selling.

Since mid-January, Bitcoin is down over 24%, falling from around $91K to ~$71K.

The main catalyst this week was Donald Trump’s proposed pick for the next Fed chair, Kevin Warsh. According to multiple media reports, the nomination eased concerns over the Fed’s future independence from the presidential administration, triggering a rebound in the U.S. dollar. At the same time, Trump continued pressuring current Fed chair Jerome Powell to cut rates more aggressively, pushing markets to price in tighter policy expectations despite persistent inflation risks.

Markets expect Warsh to stay tough on inflation. That implies lower systemic risk for the economy, but less liquidity for markets – a combo that sent gold, Bitcoin, and U.S. equities lower almost in sync. On one side, gold and silver investors, previously hedging against inflation fueled by aggressive rate cuts, regained confidence in the dollar. On the other hand, investors in risk assets like U.S. stocks and Bitcoin woke up to the reality of potential liquidity shortages. Adding fuel to the fire, this shift also challenged Bitcoin’s narrative as an inflation hedge, as noted by Decrypt.

That said, Warsh still has to pass a U.S. Senate hearing, a process that may get messy, given his name surfaced in the recent Epstein file release.

HYPE holds strong as Hyperliquid plans to add prediction markets and options

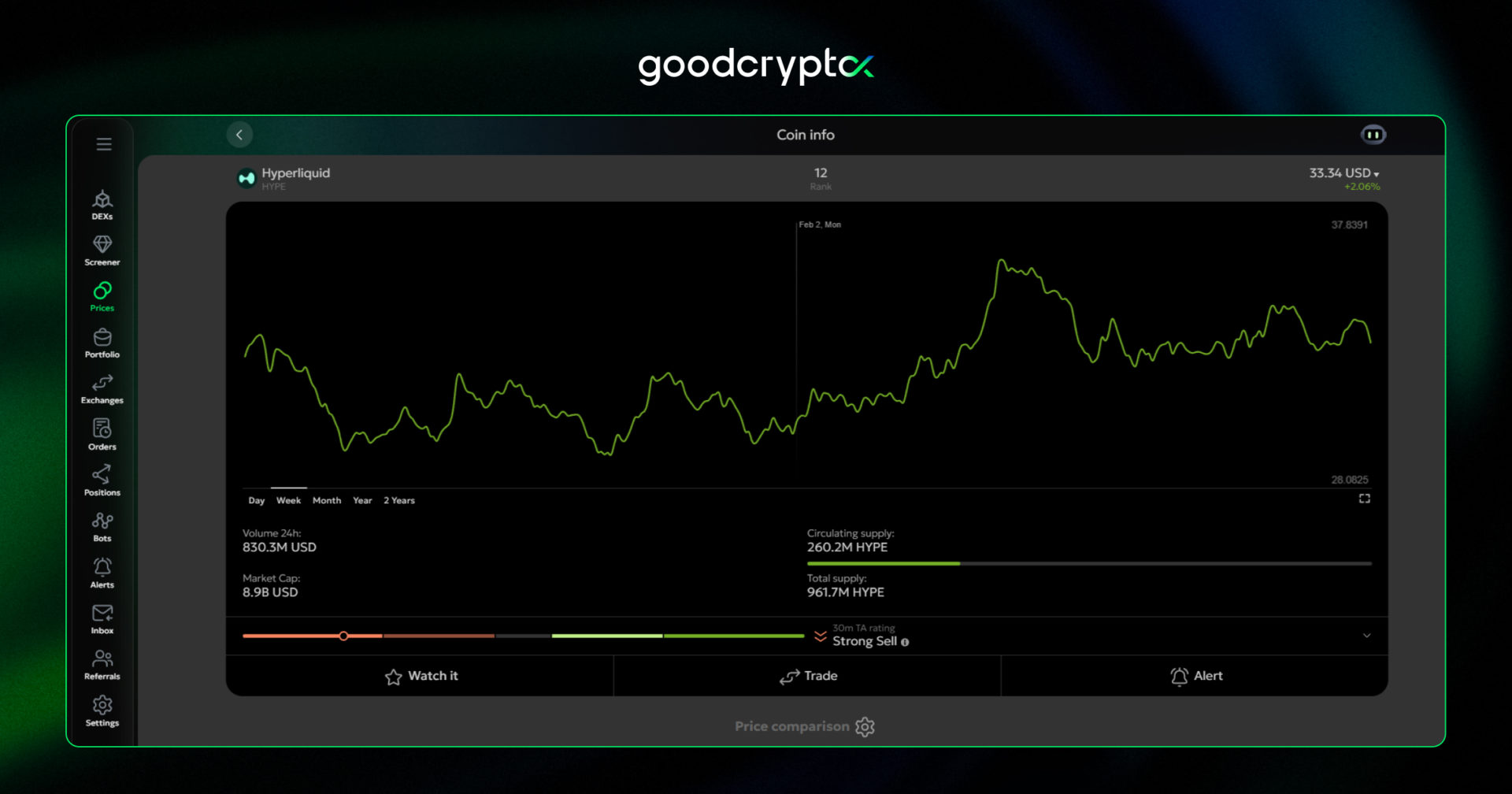

Nevertheless, while the broader crypto market was bleeding, one token refused to flinch. For the second week in a row, Hyperliquid’s $HYPE has held strong, and even pushed higher, despite the bearish macro backdrop.

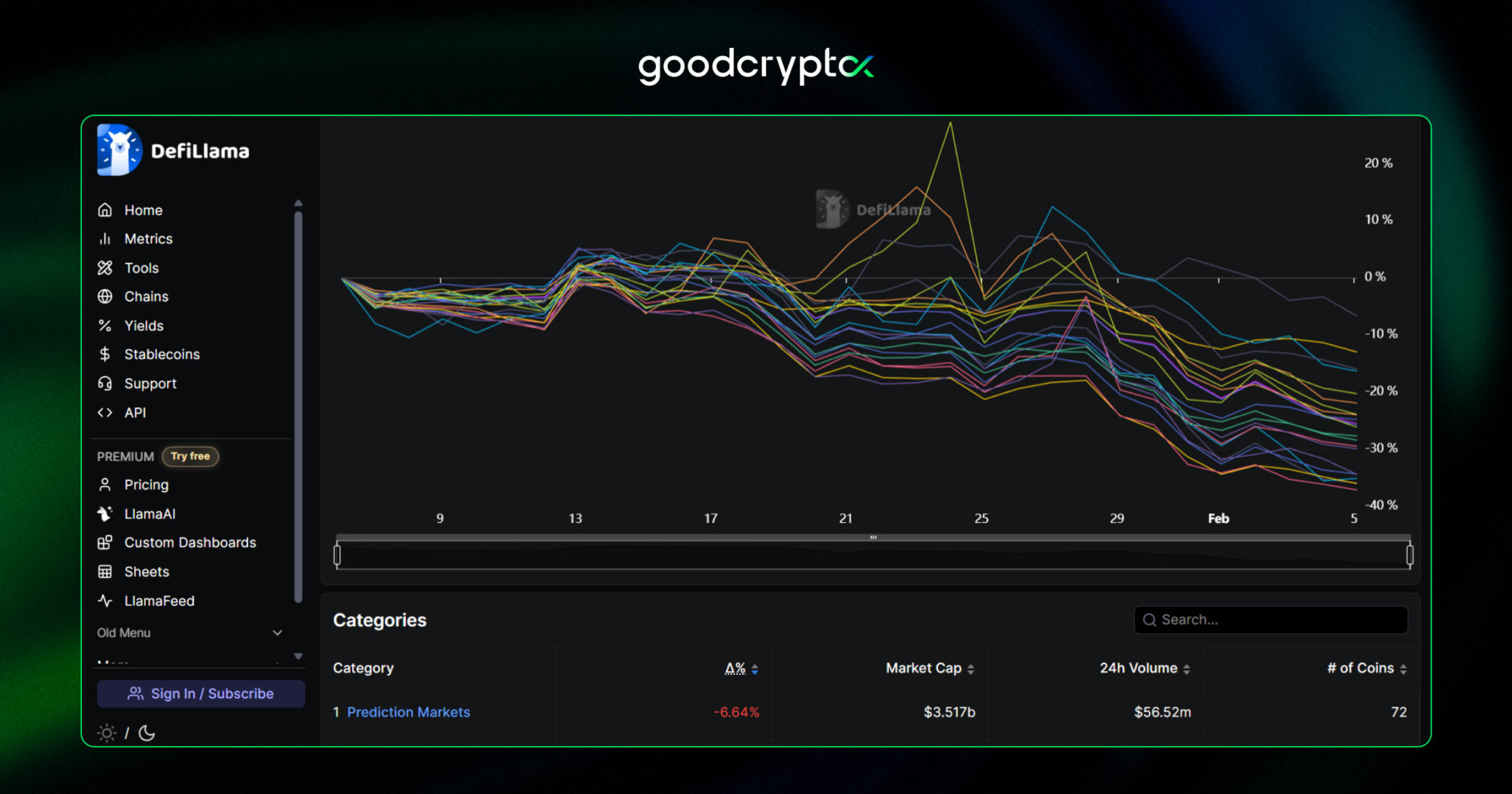

The driver behind $HYPE’s strength is Hyperliquid’s recent announcement of the upcoming HIP-4 upgrade. According to the post on X, HyperCore will soon support outcome and options trading. This matters. Outcomes trading is one of the hottest narratives in crypto right now, with over $3B in total market cap, according to CoinGecko, and ranked as the #1 narrative on DeFiLlama.

If executed well, this integration could further cement Hyperliquid’s dominance. The platform already generates the highest monthly revenue in crypto, and as of February 2026, it ranks 3rd among all Web3 protocols, trailing only the two stablecoin giants, Tether and Circle.

Vitalik Buterin on the future role of Ethereum L2s

Meanwhile, the Ethereum ecosystem is heating up fast. A recent X post from Ethereum founder Vitalik Buterin ignited a wave of debate around the future of Layer 2s.

According to Vitalik, “L1 itself is scaling.” With Ethereum fees becoming “very low,” while many L2s are still struggling to reach Stage 2, the original value proposition of rollups is now being questioned. In his words, the old vision of L2s no longer fully makes sense, and Ethereum “needs a new path.”

Vitalik suggested reframing L2s not as parallel chains competing for users, but as extensions of Ethereum L1, systems that add differentiated value while leveraging Ethereum’s security and liquidity. This could include non-EVM execution environments, built-in oracles, or purpose-built, non-financial applications that go beyond simple scaling.

Still, this isn’t an existential threat, it may be a reset. According to CoinDesk, Ben Fisch from the Espresso Foundation believes this marks the beginning of a new phase: “It’s the start of Layer 2s flourishing and becoming independent from Ethereum.”

In this model, L2s may evolve into sovereign app-chains, using Ethereum L1 as a settlement and security layer, while building their own ecosystems, narratives, and business models on top.

Will this kill L2s? Or will it force them to grow up? What do you think?

Security Alliance rescues over $100,000 in Ethereum from decade-old smart contract

Adding more news on Ethereum, on February 4, 2026, a decade-old vulnerability from TheDAO hack of 2016 saw a whitehat recovery of funds. Over 50 $ETH (~$100K) were rescued from an insecure contract, according to Giveth, whose co-founder, Griff Green, previously worked on TheDAO.

Back in 2016, TheDAO was exploited for 3.6M ETH, worth around $60M at the time, today, nearly $8B. Whitehat hackers acted to secure the funds themselves, preventing blackhats from accessing the remaining ETH and buying the community time to develop a long-term solution. This event eventually led to Ethereum’s hard fork, restoring the blockchain to its pre-hack state.

The recovered funds will now be used to partly compensate original DAO investors, or, if unclaimed, to fund Ethereum security initiatives, ensuring the community benefits from this decade-long cleanup.

Ichimoku Cloud explained

📊 The Ichimoku Cloud is a powerful all-in-one indicator that helps you spot trends, key support/resistance levels, and potential reversals. It’s ideal for predicting market direction and timing your entries and exits in the crypto markets.

Ichimoku Cloud usecases:

- Bullish Trend: When the price is above the cloud, and the cloud is green, with both Tenkan Sen and Kijun Sen above the cloud, this signals a strong buy opportunity;

- Bearish Trend: When the price is below the clou,d and the cloud is red, with both Tenkan Sen and Kijun Sen below the cloud, this indicates a go-to sell signal;

- Neutral Zone: If the price is inside the cloud, it’s a consolidation zone, where you should avoid entering trades until clearer signals appear.

🔥 As the market heats up, you need to stay ahead of the game. Arm yourself with the knowledge and take full advantage of the market with our complete Ichimoku Cloud guide by goodcryptoX. 🚀

Receive an instant notification when a new coin is listed with goodcryptoX PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the goodcryptoX app!