Hello everyone, this is our weekly crypto digest. Here you’ll find everything from a weekly market summary and top news to the hottest new listings on exchanges, and even memes to cheer you up. To get these updates as soon as we post them, follow us on Twitter.

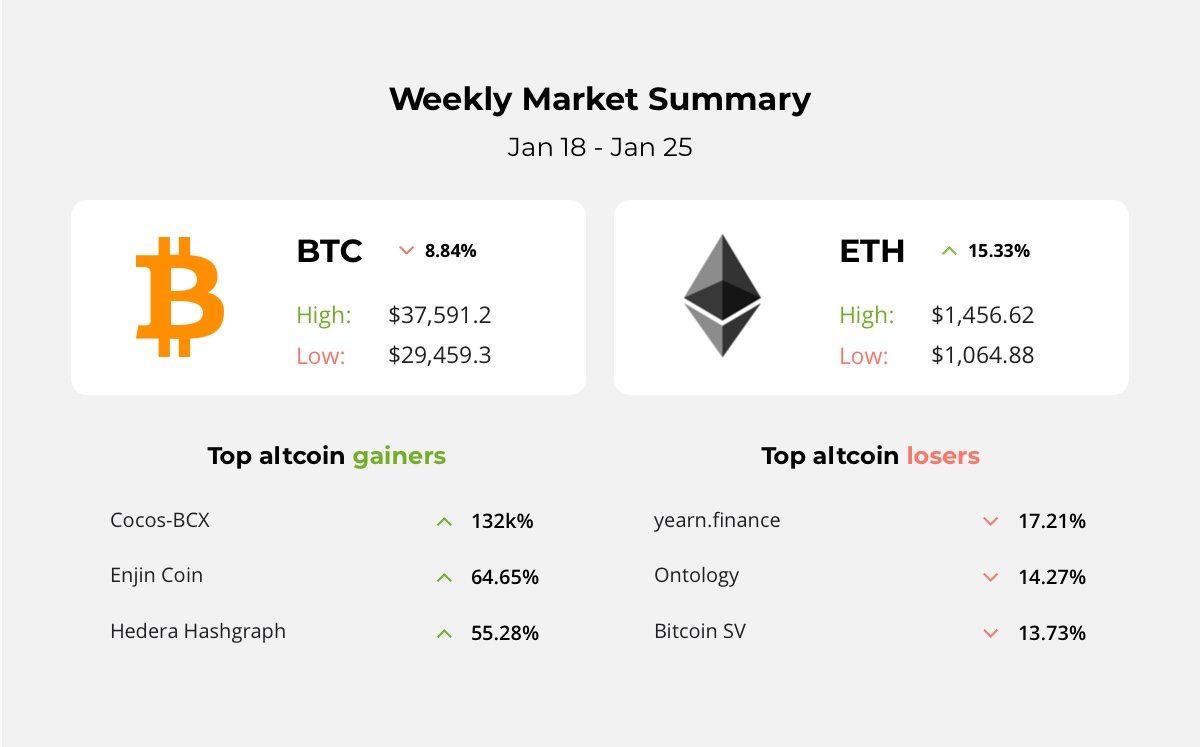

Weekly Market Summary

Bitcoin, the world’s largest cryptocurrency by market cap, has lost over 22% of its value since setting an all-time high of over $41,900 in December last year.

The asset currently trades at $32,700 after a sell-off in the wee hours this morning. As a result of this price action, Bitcoin’s market cap now sits at $600 billion compared to over $750 billion in December—representing a mammoth $150 billion loss in value.

Despite the falling prices, analytics firm Glassnode suggests investors are purchasing large amounts of Bitcoin, instead of selling the asset and taking profits.

On-chain data from the past month shows over 270,000 Bitcoin was withdrawn from crypto exchanges to addresses marked as “HODLers,” or crypto wallets that are known to stack large amounts of Bitcoin instead of selling/spending it.

According to the Wall Street Journal, a former member of Ripple’s board of directors is likely to become the next Comptroller of the Currency.

Comptroller of the Currency serves as the administrator of the federal banking system, and is the chief officer of the Office of the Comptroller of the Currency (OCC). The WSJ described it as one of the most powerful banking regulators:

“The comptroller oversees hundreds of bank supervisors stationed inside large U.S. financial firms, making the person in the job one of the most powerful bank regulators.”

The official decision is yet to be finalized. But if approved, Michael Barr would be the second appointee with a cryptocurrency experience on the position.

Quick weekly news:

-

Bitpanda Launches Debit Card That Lets Users Spend Fiat, Crypto and Precious Metal: Read more here.

-

DeFi payments protocol Celo readies launch of a euro-pegged stablecoin: Read more here.

-

Guggenheim CIO expects Bitcoin to drop to $20,000: Read more here.

- Rick & Morty Creator Sells Ethereum Art for $1.65 Million: Read more here.

Other notable events include:

– Coinbase updates infrastructure

– New all-time high price for ETH

Updating the base

Coinbase, a bellwether for bull runs, is updating its infrastructure to prevent outages during periods of heavy volatility. It will also focus on updating its customer support. Coinbase is expected to go public later this year, and has already filed its draft S-1 statement with the Securities and Exchanges Commission.

Out of the ether

Ether (ETH), the native cryptocurrency of the Ethereum blockchain network, hit a fresh high of $1,439.33, $19 up from a previous record level of $1,420 in 2018. The currency has broken above 1,000% since the initial public sale of ETH in 2015. It has a different value proposition from bitcoin and offers full programmability, developer-friendly community, and is the home of such crypto trends as ICOs and DeFi.

Here are the hottest exchange listings of the last week:

New Listing on Binance:

– TrueFi (TRU/BTC TRU/BUSD TRU/USDT)

– DeXe (DEXE/ETH DEXE/BUSD)

New Pairs on Binance:

– USDC/BUSD EOS/EUR TUSD/BUSD PAX/BUSD LTC/BRL

New Listing on Huobi:

– Injective Protocol (INJ/USDT INJ/BTC INJ/ETH)

– Badger DAO (BADGER/BTC BADGER/ETH BADGER/USDT)

– Mass (MASS/ETH MASS/BTC MASS/USDT)

– Reef (REEF/ETH REEF/USDT REEF/BTC)

New Pairs on Huobi:

– ZEN/USDT

New Pairs on FTX:

– WBTC/USD

– ONT-PERP

– BTT-PERP SUN/USD JST/USD

By the way, our PRO plan includes new Exchange Listing alerts for all 27 exchanges in the app. Become a PRO and receive an instant notification when a new coin is listed on Coinbase Pro, Binance or your exchange of choice!

Hedera Hashgraph is a platform for smart contracts and decentralized applications (dApps). It is a platform for developers to develop services and run them via a distributed ledger.

HBAR is the network’s native cryptocurrency. The cryptocurrency is used as fuel for network services, such as when using smart contracts, saving a file or making payments in the network.

The cryptocurrency was designed to be able to carry out both fast peer-to-peer transactions and micropayments. They also serve as a stake for the nodes. There will be a total of 50 billion HBAR. More than 3 billion are already in circulation.

😋Recent announcements:

HEDERA HASHGRAPH vs BITCOIN: “a BETTER store of value”

Hedera Hashgraph (HBAR) Price Prediction for 2020-2025

🔥DYOR:

– Website

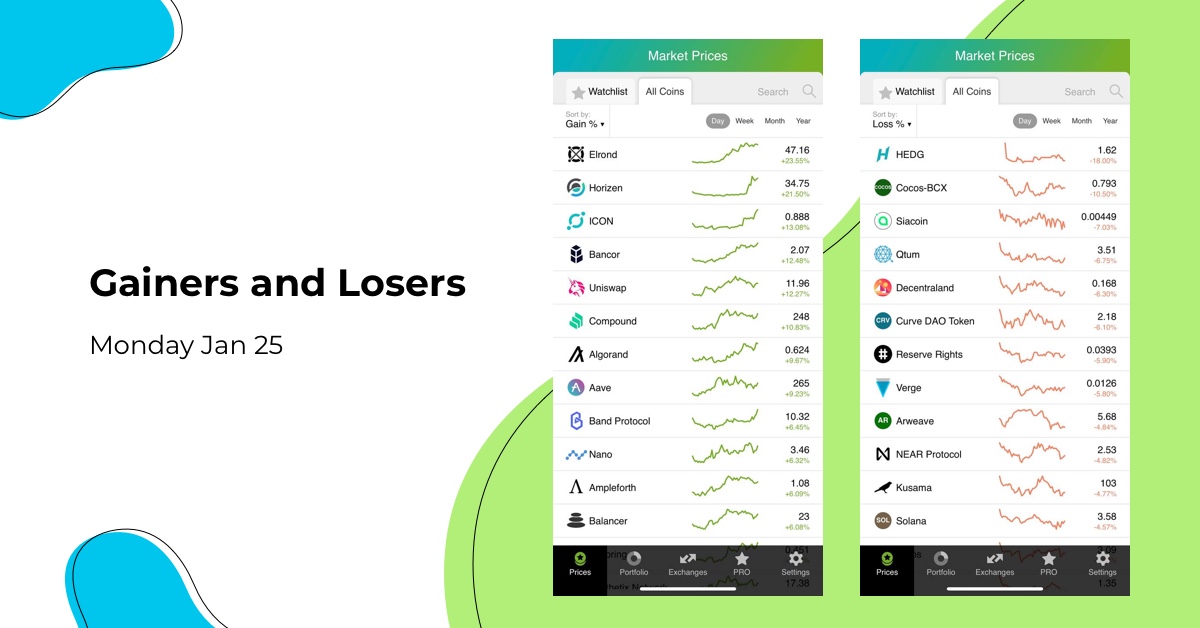

We have prepared for you top-performing coins of Jan 25.

Elrond has managed to become the best performing asset from TOP-100, gaining 23.55% within the last 24 hours.

HEDG was the worst-performing asset from TOP-100 (again), losing 18.00% within the last 24 hours.

To get up-to-date reports on gainers and losers during the week, follow us on Twitter.

Top cryptomeme of the week

We hope you found this digest useful and informative! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter. Happy trading with the Good Crypto app!