Hello there! 👋

We have brought together the past week’s most exciting events in this GoodCrypto digest. If you’d like to stay updated on the crypto market, follow us on Twitter.

quick weekly news

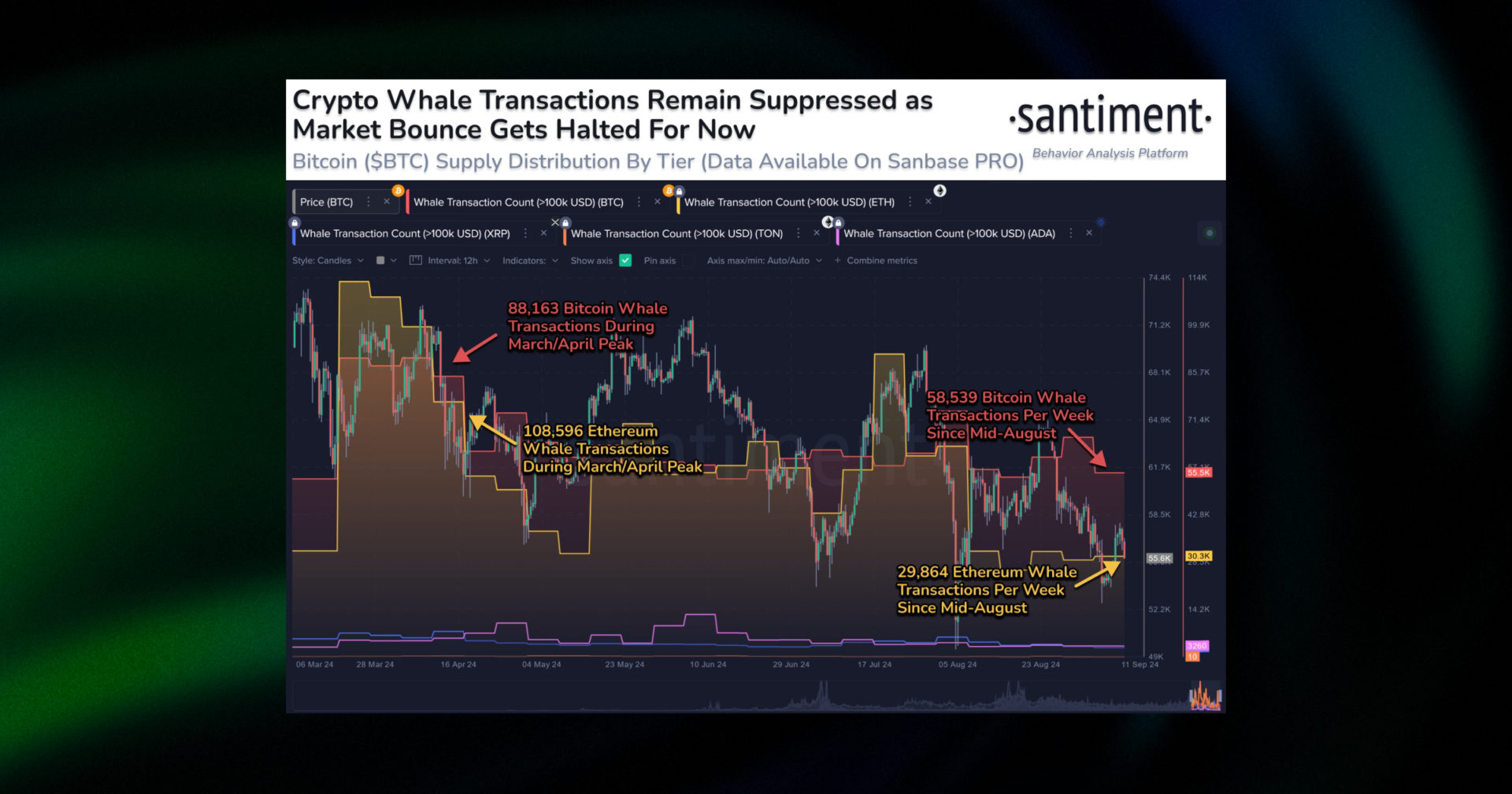

Bitcoin whale transactions see “noticeable” drop since March price peak

The crypto analytics platform Santiment wrote in a September 11 X post that crypto whale transactions have seen a significant drop as whales bide their time to see the next market move. Since March 13, the day of Bitcoin’s ATH — Bitcoin whale transactions have decreased by over 33.6%, while Ethereum has lost more than 72.5% of its whale transactions.

Source: Santiment on X

Notably, in March 2024, Ethereum had over 20,000 more active whale transactions than Bitcoin. However, Ethereum whale activity has dropped so sharply that Bitcoin now leads this race by more than 30,000 transactions.

According to the analysis firm, this doesn’t necessarily indicate a bearish trend for both cryptocurrencies, as whales become more active during both bear and bull markets. “Large key stakeholders continue to bide their time as they wait to make their next moves during times of extreme crowd greed or fear,” said Santiment. It also added that if Bitcoin drops near the $45,000 level, it may trigger massive doubt and uncertainty among crypto investors, while a recovery to $70,000 would cause FOMO in the market.

However, not all analysts share this view. Conversely, 10x Research Head of Research Markus Thielen recently stated in a post that Bitcoin’s lows in the $40,000 range present an ideal opportunity for the “next bull market entry,” projecting his belief that the bull market will occur even if Bitcoin hits $40,000. Meanwhile, other traders, like Ajeet Khurana, remained bullish on Bitcoin in the long term, adding, “In times of market turbulence, it’s easy to lose sight of the bigger picture,” and suggesting to “focus on fundamentals.”

Friend.tech team sold $52M in 6 months, faces rug pull allegations

The Paradigm-backed SocilFi platform Friend.tech is facing a rug pull accusations as its token loses over 95% of its value from its token launch and protocol’s recent shutdown.

To recall, on September 8, the project’s team stated that they relinquished control of the smart contracts and handed the admin right to the Ethereum null address, ensuring there won’t be any change in fees or functionality of the platform in the future. This news caused drop of its token by over 26% of the value it had at that moment.

Later, pseudonymous crypto analyst Waleswoosh released a post on its X account and stated that “Friend.tech rugged,” describing it as a “Ponzi” scheme. He says at first concept was interesting and people were even expecting Frend.tech to become the next Instagram. But then it evolved from a social finance (SocialFi) app into advanced trading.

At its peak, within a year, the platform has managed to make over $60M in fees, but, over time the interest to the platform among crypto users waned. Even when the long-awaited airdrop occurred, most of the users sold tokens right away and moved on, leading token to drop by over 95% according to the lookonchain. Now as the Friend.tech team clarified it hand over all the rights to the Ethereum null adress, and all the in-app assets like users’ keys and shares, have became worthless.

Notably, Lookonchain also reaported that around $52M among $60 earned, have been sold by the Friend.tech team, which also underpins statements by the team that it doesn’t plan to make any updates on the protocol.

Major memecoins are down 63% on average despite market frenzy

Data from the recently released post by CoinTelegraph shows that despite the ongoing narrative of trading memecoins, the top-10 tokens currently trade 63% lower on average from their peak. However, it’s not just the top memecoins that have been hit. According to some industry insiders interviewed by Cointelegraph, memecoins have “sucked the life out of this bull run.”

The main reason for this is the fact that the market rules have “changed” with the emergence of safe-launch services like pump.fun, Sunpump, or BaseJump. These platforms have removed technical and financial barriers to launching a memecoin, significantly shifting the competition in the memecoin space.

Carlos Mercado, a data scientist at blockchain analysis firm Flipside Crypto, told Cointelegraph that the increase in memecoin launches encourages short-term thinking, as traders now pivot to more recently launched coins. He also added that most safe-launch tokens last only 24 hours, with around 1% of successful coins lasting two to six days.

Diving deeper into the analytics, it’s interesting to note that only 1.3% of the ~2M tokens launched on Pump.fun have been able to “graduate,” meaning they achieved a market cap of $69,000 and got listed on the Raidium DEX. Adding to this, another study by Cointelegraph posted a few weeks ago, showed that users have better odds of winning at a casino than picking a winning memecoin on Pump.fun. However, this hasn’t stopped users from continuing to follow the trend.

Choke Point 2.0 is hurting Kamala Harris’ “crypto reset”

The FED’s actions against the cryptocurrency-friendly United Texas Bank indicate that Operation Choke Point policies may still be in play.

According to the Cointelegraph, Dan Spuller, the Blockchain Association’s head of industry affairs, recently stated that the actions against Texas banks seem to be the latest in the Choke Point 2.0 policies under the Biden administration. By saying “Choke Point 2.0,” he references the original Operation Choke Point campaign, where the U.S. government pressured banks to refuse service to politically controversial (yet legal) businesses like gun shops or cannabis dispensaries. In his opinion, the same is happening with the crypto industry in the U.S., as the White House has discouraged banks from holding cryptocurrency, proposed a 30% tax on energy costs, and taken other steps to press on the crypto-related businesses.

Some Democrats expect Harris-Walz to bring a more positive approach to regulating Web3 businesses. For instance, some Democrats attended a virtual fundraiser on August 14, aiming to raise awareness about their efforts to change cryptocurrency policy. However, there have been no public comments from Kamala Harris as well as the Democratic Party’s 2024 platform regarding their cryptocurrency policy. As a result, Cointelegraph’s guest and policy analyst at the Cato Institute’s Center for Monetary and Financial Alternatives, Nicholas Anthony, stated that there is little to be hopeful about at the moment.

Supertrend indicator trading strategy

The Supertrend indicator helps you spot buy and sell signals in the market, assisting you in setting up entry and exit points on your chart. It consists of one or multiple red and green lines that indicate the current market trend and allow you to spot market reversals once the line’s color under the chart changes.

Supertrend Indicator Trading Strategy

🔸 Scalping: Use the EMA 200 and Supertrend’s buy & sell signals to enter positions on a 1-minute chart. Set your Take Profit between 0.3% and 0.5%, and use the Supertrend lines as your stop loss. Focus only on short positions if the price is trending below the 200 EMA, and on long positions if it’s the opposite.

🔸 Double Supertrend Lines: Set up additional Supertrend lines with different parameters, to receive extra confirmation signals for entering and exiting trades.

🔸 Triple Supertrend Strategy: Use a combination of EMA 200 and three Supertrend lines with different parameters to spot entry and exit points most efficiently. Focus only on signals during a confirmed trend above or below the 200 EMA. You can also set up the RSI to assess overbought and oversold positions.

Wanna learn more about Supertrend trading strategies? Check out the comprehensive Supertrend indicator review by GoodCrypto and discover how to use this powerful tool on a full scale! 📈

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!