Hey traders!

It wasn’t the brightest week for crypto, but several major updates still set the tone for the future. Let’s take a look at what happened:

quick weekly news

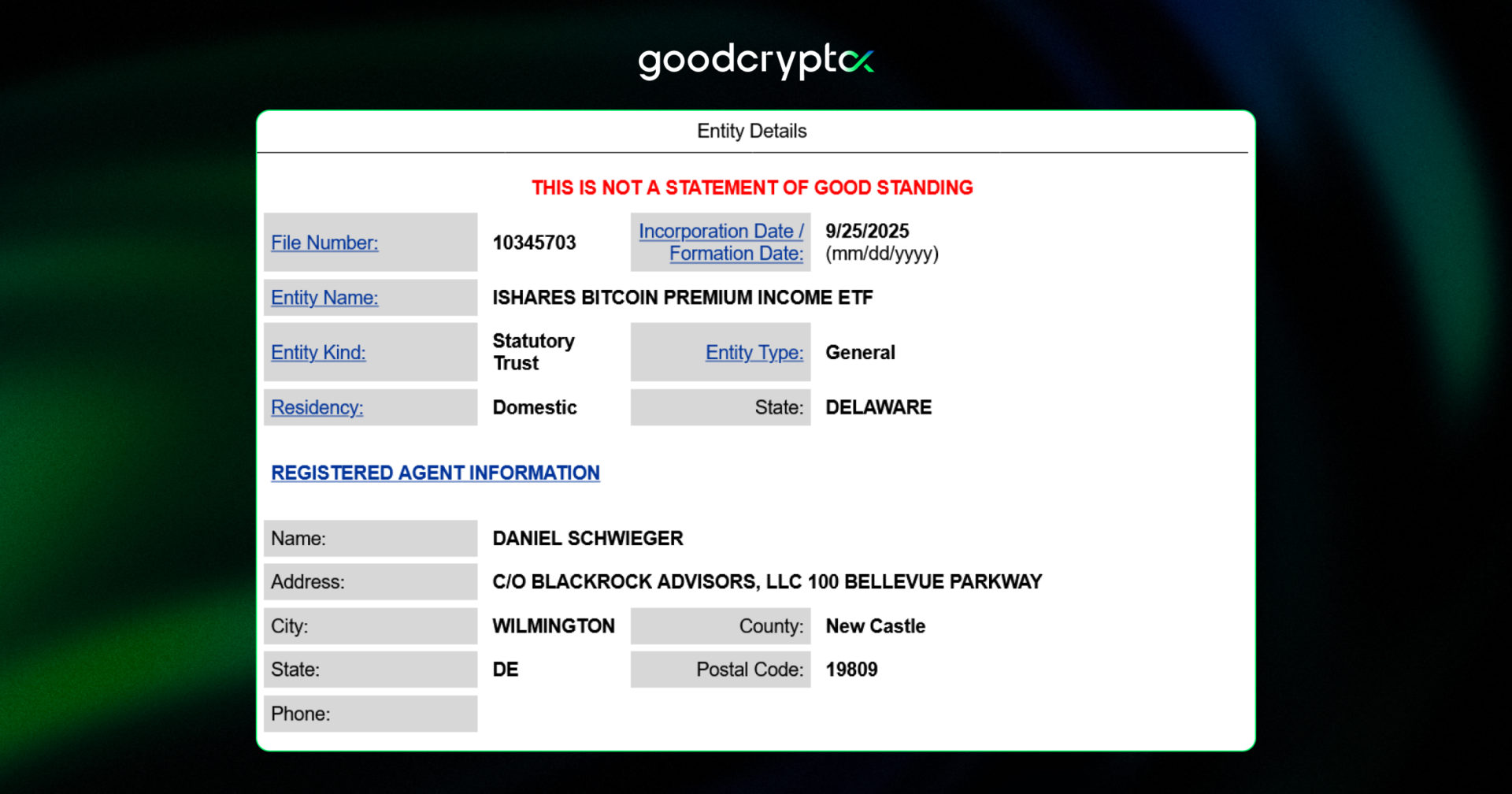

BlackRock chases Bitcoin yield in latest ETF as a ‘sequel’ to IBIT

BlackRock has registered a Delaware trust company to back its proposed Bitcoin Premium Income ETF, a yield-focused product designed as a “sequel” to its $87B iShares Bitcoin ETF (IBIT). The new fund would generate returns by selling covered call options on Bitcoin futures, collecting premiums to provide regular income, but at the cost of limiting upside exposure compared to IBIT.

Source: Delaware

The filing signals an imminent SEC registration process, as BlackRock looks to expand its Bitcoin lineup amid growing regulatory openness, in line with Donald Trump’s promise to make America the “crypto capital of the world”. IBIT remains the dominant spot Bitcoin ETF, with over $60B in inflows since launch, far ahead of Fidelity’s $12.3B FBTC.

If approved, the Premium Income ETF would join a small but growing set of yield-generating Bitcoin products in the US, addressing a long-standing gap for TradFi investors seeking income from non-yielding assets like BTC. While rivals race to file altcoin ETFs, BlackRock appears committed to building around Bitcoin and Ether, leaving the competition for other coins wide open.

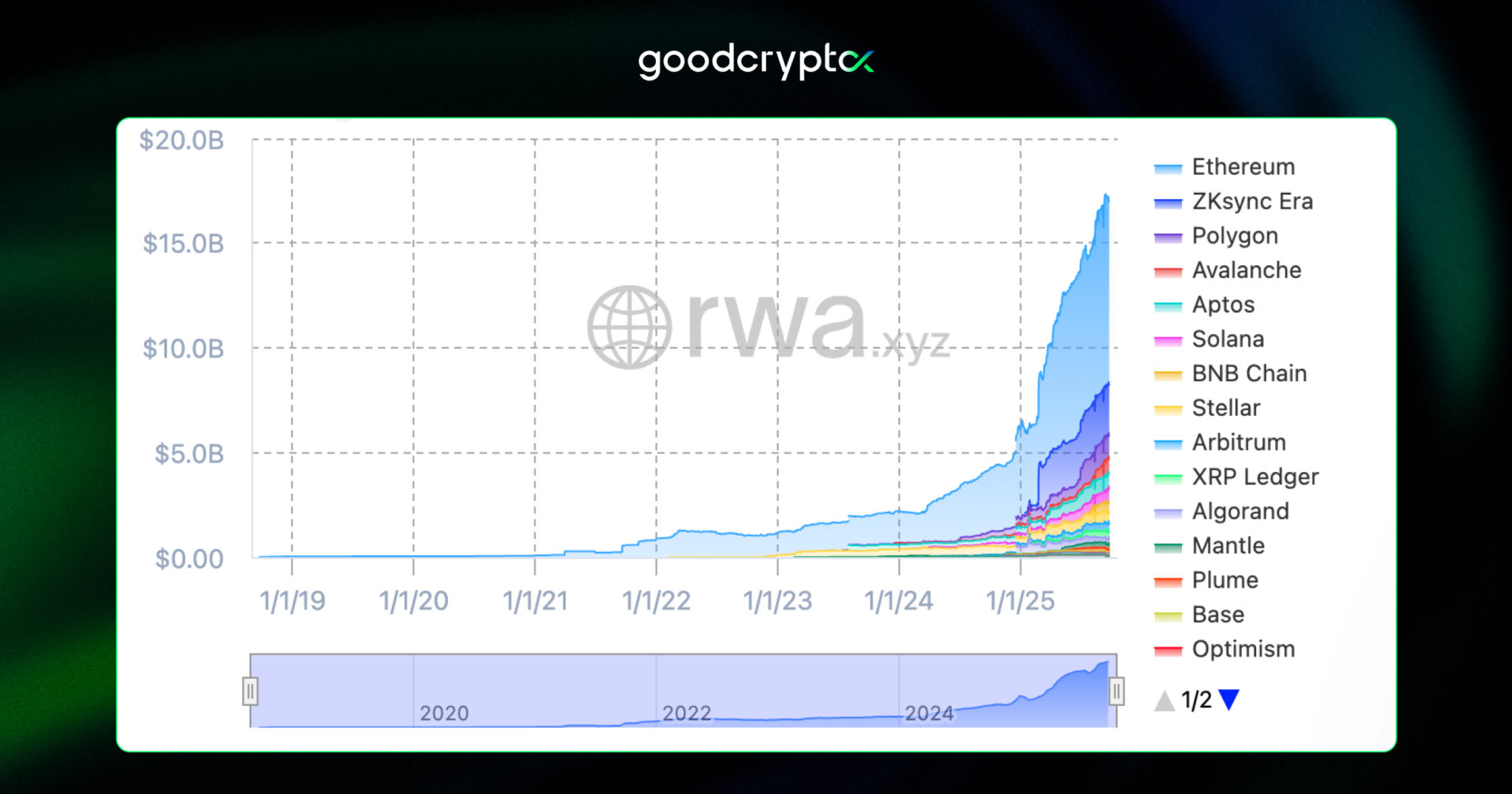

Chintai and Splyce target retail access to tokenized securities on Solana

Chintai and Splyce launched S-Tokens on Solana, offering retail investors indirect exposure to institutional-grade tokenized securities like Treasurys and corporate bonds. These tokens mirror underlying RWAs through a loan-backed structure, while embedding compliance guardrails, giving users access to stable yield streams previously limited to accredited investors.

The move adds momentum to Solana’s rapidly expanding RWA ecosystem, which has already crossed $656M in tokenized assets this year (+260%).

Key drivers include Ondo’s Treasury products and BlackRock’s BUIDL fund, launched earlier this year. Beyond fixed income, projects are pushing into real estate, equities, and structured credit, widening the tokenization landscape.

By combining deep liquidity, low fees, and retail-first accessibility, Solana is positioning itself as a leading RWA hub, bridging traditional finance yields with on-chain accessibility and complementing its strong presence in DeFi, payments, and memecoins.

Hashdex expands Crypto Index US ETF under SEC generic listing standards

Asset manager Hashdex has broadened its Crypto Index US ETF (NCIQ) on Nasdaq to include XRP, Solana (SOL), and Stellar (XLM), in addition to its existing Bitcoin (BTC) and Ether (ETH) holdings. The expansion follows the SEC’s new generic listing standards, which streamline approvals for multi-asset crypto ETFs.

To qualify, cryptocurrencies must be classified as commodities or have CFTC-regulated futures and be subject to the Intermarket Surveillance Group. This marks the second multi-asset crypto ETF approved in the US, after Grayscale’s Digital Large Cap Fund, which includes BTC, ETH, XRP, SOL, and Cardano (ADA).

The change is expected to trigger a wave of new crypto ETF filings, giving traditional market participants easier access to digital assets and potentially blurring the line between traditional finance and on-chain investments

SEC Chair Paul Atkins is championing a more innovation-friendly approach, including a proposed “innovation exemption” sandbox, which would allow crypto projects to experiment with new technologies under a lighter regulatory framework.

Aster dethrones Hyperliquid with $1.25B surge in open interest

Aster, a BNB Chain-based decentralized perpetuals exchange, has rapidly emerged as a top challenger to Hyperliquid after a staggering 33,500% surge in open interest, jumping from just $3.7M last week to $1.25B in less than a week. On Wednesday, the platform also overtook rivals in trading activity, recording $24.7B in daily perpetual volumes, ahead of Hyperliquid’s $10B, edgeX’s $8.25B, and Lighter’s $6.18B.

Source: DefiLlama

Alongside volumes, Aster’s TVL jumped 196% in five days, reaching $1.85B, up from $625M, a signal of strong trader liquidity inflows. While Hyperliquid continues to dominate longer-term metrics with $66B weekly and $300B monthly volumes, Aster’s breakout highlights shifting trader attention in the DeFi perpetuals market.

The surge was fueled by ecosystem support: BNB Chain and YZi Labs (ex-Binance Labs) provided mentorship and resources, while CoinMarketCap’s CMC Launch program boosted visibility with 400M homepage impressions, 3M tweet impressions, and 500K direct clicks to Aster’s project page.

Aster’s momentum positions it as the fastest-growing perpetuals DEX in 2025, but sustaining growth against Hyperliquid’s entrenched liquidity and trader base will test whether it can hold its new top spot.

how to spot a gem?

📚 The crypto market moves fast, and some of the most profitable opportunities live in small-cap tokens on decentralized exchanges. These “hidden gems” can deliver massive returns, but only if you know where to look, how to filter them, and how to manage risk. Here’s what to do:

🔸 Filter Smart: Focus on liquidity, active holders, and trading volume to avoid dead or pump-and-dump tokens;

🔸 Monitor & Act: Use on-chain bots or real-time alerts to catch new tokens and early price moves;

🔸 Manage Risk: Set Stop Loss and Take Profit levels, diversify, and account for volatility to protect your capital.

🚀 Learn, test, profit: dive into sniper bot trading in goodcryptoX and explore our case study to level up your DeFi game. Your next gem could be just a click away. 😉

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!