- 1. Intro

- 2. What are Bollinger Bands?

- 3. How to read Bollinger Bands?

- 4. How to use Bollinger Bands? Two Classic Strategies

- 5. Bollinger Bands vs. Keltner Channels

- 6. Good Crypto, the best crypto trading terminal

Intro

In this article, we dive into one of the most popular technical indicators of today. Bollinger Bands were created by John Bollinger in the 1980s. The Bollinger Bands, or BB bands, help to see if a market is oversold or overbought and help traders with analyzing if a market is trending or in a range. Based on these observations, trades can be made accordingly. Good Crypto offers traders over 10,000 cryptocurrency markets on 35+ exchanges, and Bollinger Bands can be enabled on every single one of them. Today, we will get Bollinger bands explained and go deeper into the most common strategies and their application. Let’s begin!

What are Bollinger Bands?

How are Bollinger Bands calculated? The bands consist of two elements or three lines.

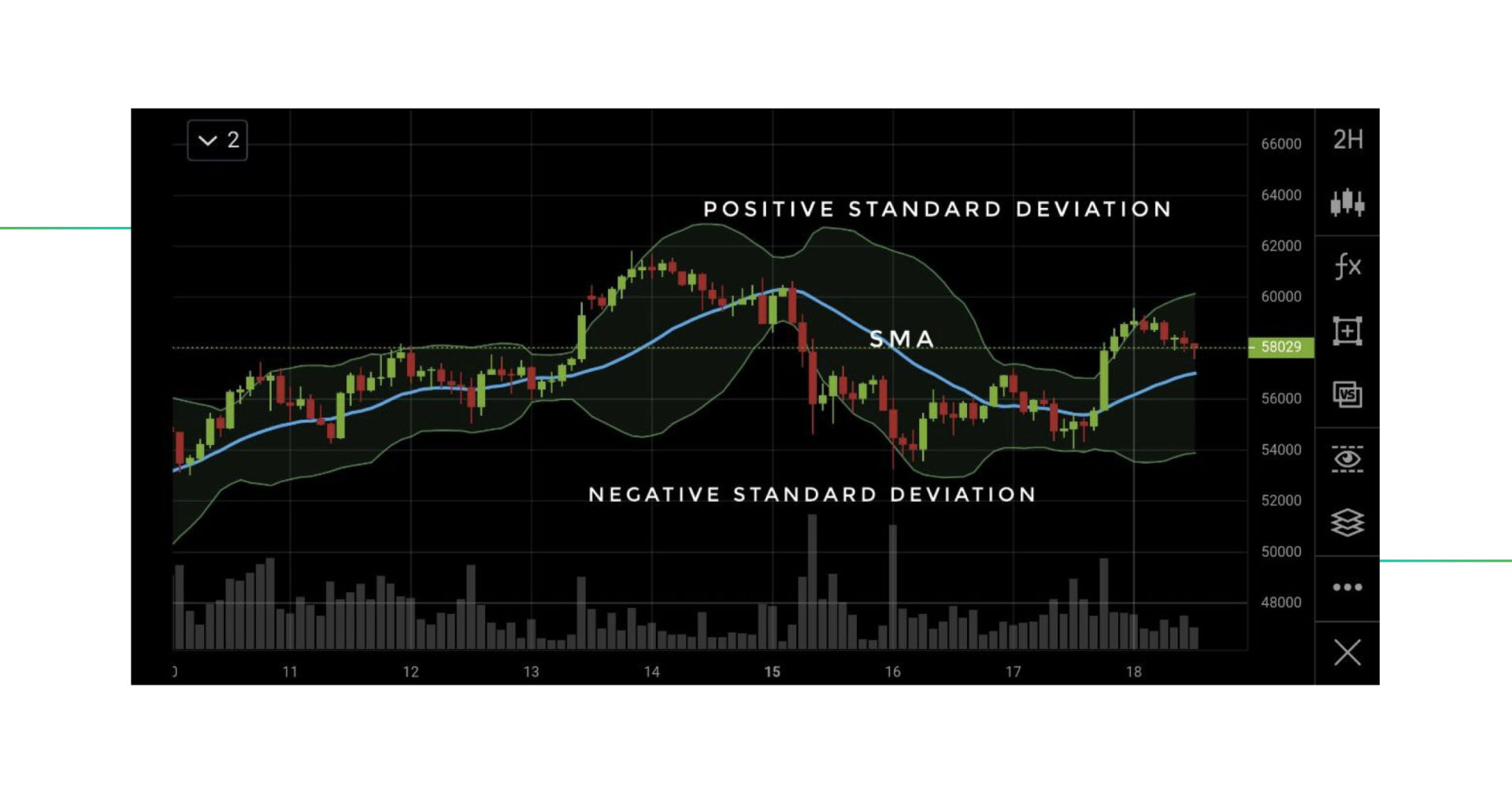

- One line that indicates a Simple Moving Average (SMA) usually based on the last 20 periods. Simple Moving Average is calculated by adding the closing price of the last 20 candles and dividing the result by 20.

- Two lines, which are standard deviations from SMA (positive and negative respectively), define the upper and lower bands, showing the Bollinger Band width. Standard Deviation (SD) is calculated by taking the square root of variance. Variance is calculated by taking the average of all data points and subtracting it from every one of these data points. The resulting values are then squared, and the squares are summed. The sum of the squares is then divided by the number of data points less than one. For more information click here.

- To conclude, the more volatile the SMA, the wider the bands. The less volatile, the smaller the bands are.

The Simple Moving Average is usually set at 20, this means that the closing price of the last 20 periods is used to calculate the average and the Standard Deviations.

PRO TIP: Signals given by the Bollinger Bands will be stronger if the SMA is longer/higher. A 100 SMA signal is stronger than a 20 SMA signal because it includes a longer period. This means that you can gain more insight when adjusting the settings. However, the longer the SMA period is, the fewer signals will be generated. In a way, it’s a tradeoff between quantity and quality.

Cryptocurrency settings for Bollinger Bands

Playing with the settings of the Bollinger Bands can yield interesting results. Usually, the original settings of an indicator are based on the daily chart. This means that a 20 SMA represents the moving average of 4 weeks since traditional markets are only open 5 days out of 7. The original settings create bands that show 95% of price action inside them.

However, cryptocurrency markets are open 24/7, which means that one month is represented by a 28 SMA or a 30 SMA, and not a 20 SMA. Changing these Bollinger Bands settings as a cryptocurrency trader could give you a better result, therefore, it’s recommended to adjust what needs to be adjusted to fit how you trade.

Remember, Bollinger Bands based on a lower/shorter SMA period will give more signals, but the signals will be less reliable.

Higher/longer SMA will give fewer signals, but they will be stronger.

For the purposes of this article, the Bollinger Bands settings will be based on the 20 SMA because it is the most common setting band settings.

The default setting for Standard Deviation is 2 in most terminals, meaning the Bollinger Bands width will reflect 2 Standard Deviations from SMA. Changing the deviation to a higher number will widen the Bollinger Bands. This will result in fewer signals, but they will be much stronger.

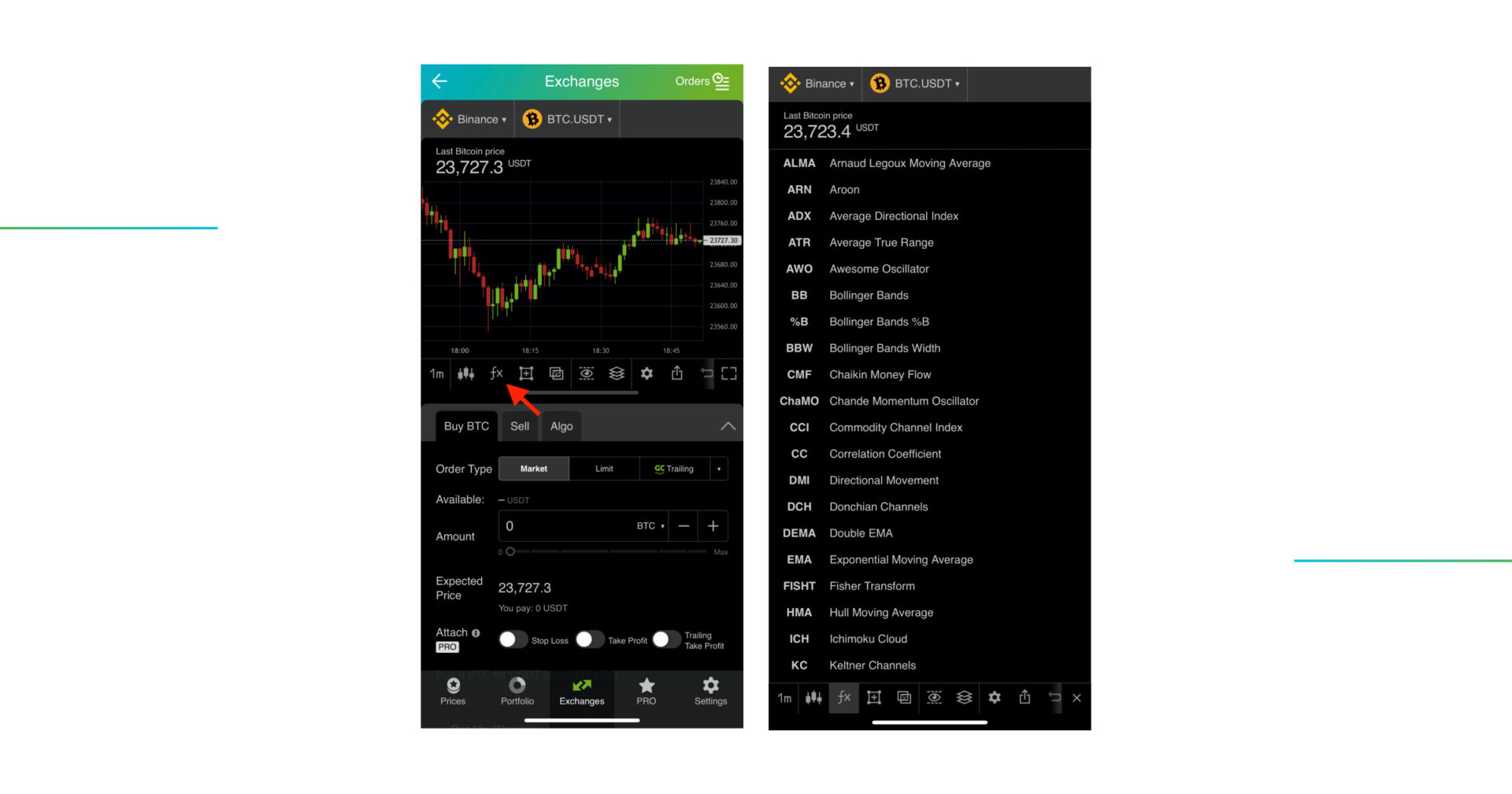

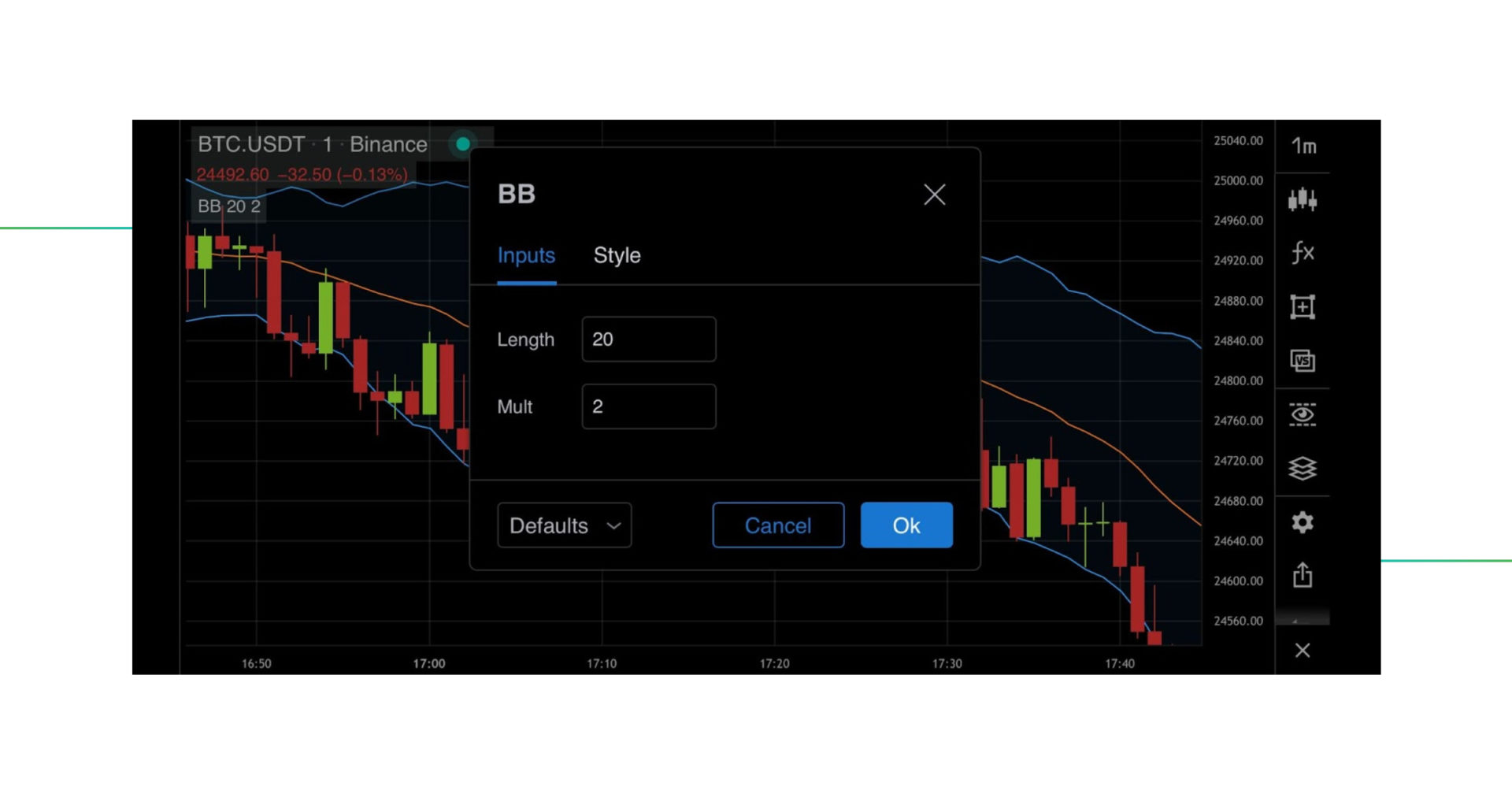

Setting up Bollinger Bands in Good Crypto app

Inside the Exchanges section of the Good Crypto app, the advanced charts are enabled by default. If they are not – you can find the advanced charts by tapping the fx tab.

Once you have enabled the advanced chart, you will find more options. Tap fx to find the list of indicators available.

At the time of writing, there are 45 indicators available inside the Good Crypto app.

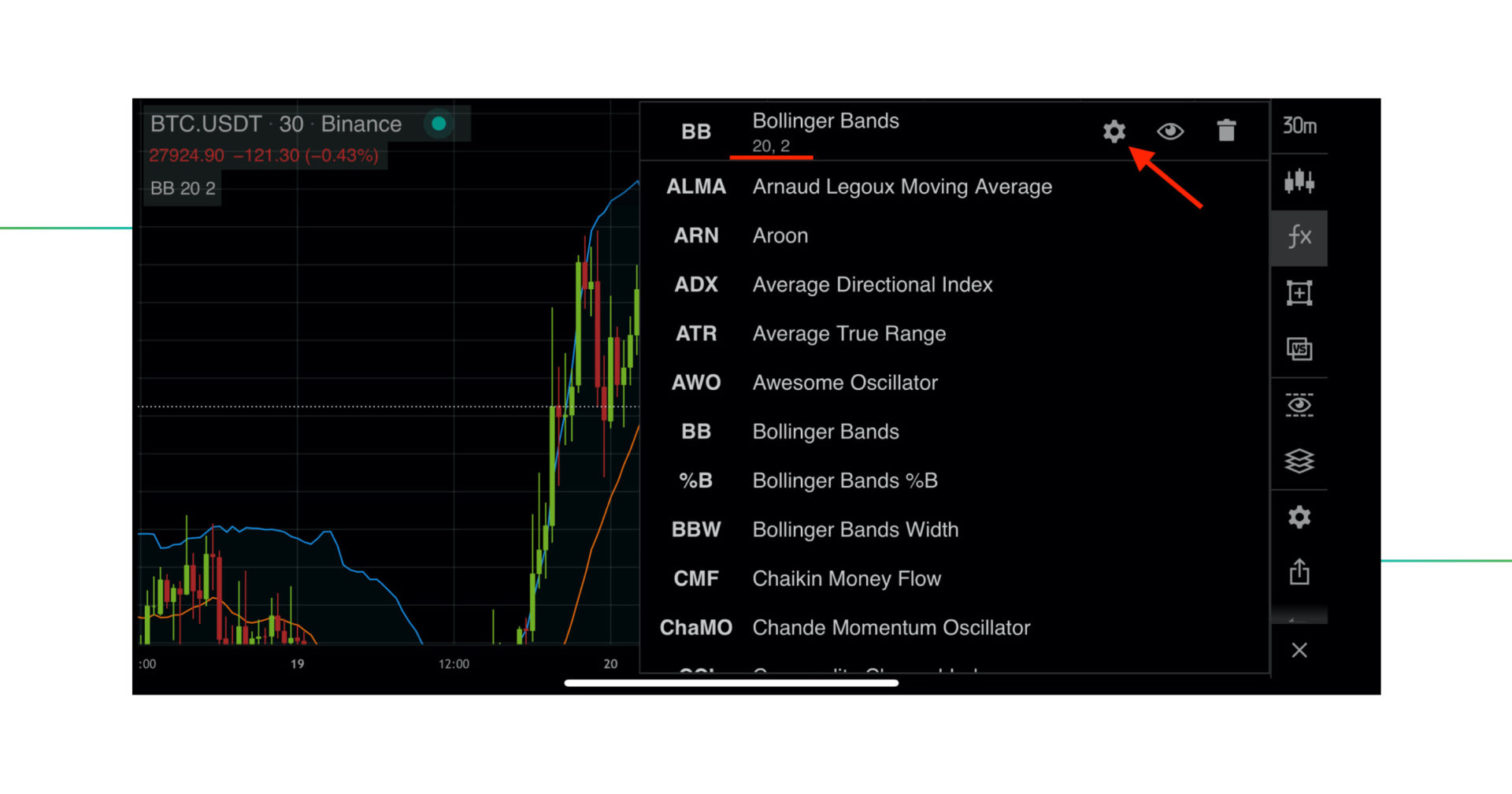

After you’ve chosen Bollinger Bands, the indicator will appear at the top of the list, showing the default settings: 20 for SMA and 2 for SD. You can tap the cogwheel icon to change them.

Tapping the cogwheel will bring the Settings menu up. Length of Bollinger Bands is the number of periods of the SMA line – 20 in this case, and Mult denotes the number of Standard Deviations used for Bollinger Bands width – 2 in this case.

You can change the visual appearance of the indicator via the Style menu in settings.

You can access the indicator’s settings right from the Bollinger Band chart by double-clicking it.

Tapping the indicator once will highlight it. Tapping twice will also open the menu. Once inside the menu, you’ll be able to change both the inputs and the visual style of an indicator. Tapping “defaults” will give you the possibility to save your preferences.

How to read Bollinger Bands?

The price is trending above the SMA and keeps pushing up the upper band. This is a sign of potential positive continuation.

After being in a range, the price dropped below the lower band. This is a sign of potential negative continuation.

The Bollinger Bands will give you an immediate sense of market direction when looking at the SMA (the red line in the example depicted above). Besides that, we have an upper and a lower Bollinger Band (the blue lines in the example), together creating the Bollinger Bands. When this range of Bollinger Bands is tight, it is said to be in a squeeze. When this range is wide, we can expect the market to be very volatile.

- SMA indicates short-term price direction.

- The width of the upper and lower bands indicates volatility.

Before you can use the Bollinger Bands for analysis, it’s crucial to identify if a market is in a range (flat) or a trend (consistently moving up or down). This will define how you can trade and which signals are useful and which aren’t.

A market in a range means that the price is bouncing between support and resistance levels, and the price remains stable.

- A range will contract the Bollinger Bands since volatility is relatively low.

A trend means that the price makes consistent new higher highs and higher lows. In case of a negative trend, the price makes consistent new lower highs and lower lows.

- A trend will widen the Bollinger Bands since volatility is higher than when ranging.

How to recognize if the market is in a trend or in a range

- When the price is constantly bouncing between the bands, the market is in a range.

- A range is created when the price keeps going up and down inside the same region, creating a level of support below, and a level of resistance above. More information here.

- When the price is constantly above the SMA, and hitting the upper band for a longer period of time, the market is in a trend.

- A trend can be ascending or descending. More information here.

How to use Bollinger Bands? Two Classic Strategies

Before reading how the Bollinger Bands are used for trading, it’s important to understand the risks of trading. When trading with real funds, make sure you have a successful trading plan on paper. This means that you have tested your strategy before applying it. And finally, this means that you can manage your risks by taking a position size that does not risk too much of your portfolio when a Stop Loss order is hit, for example, only 1%.

Is your risk management on point? Awesome, let’s move on!

Trading based on the Bollinger Bands is only advised once you have recognized if the market is trending or in a range. The following two Bollinger Bands strategies are the most common ones.

- Trading the range, using the bands.

- Trading breakouts, indicated by the tightness of Bollinger Bands.

When using the Bollinger Bands, you should always keep in mind that this indicator is not actually meant to be used by itself. The creator, John Bollinger, advises using the Relative Strength Index (RSI), the Moving Average Convergence Divergence (MACD), or the On Balance Volume (OBV), combined with the Bollinger Bands. Either way, both strategies discussed below are Bollinger Bands trading strategies that work.

Good Crypto also has the Bollinger Bands Width (BBW) oscillator available in the app, which indicates the width of the Bands, representing volatility.

Bollinger Band Trading Strategy #1: Trading the range

Bollinger Bands create a range, which can be successfully used on different timeframes. However, most often, this method of trading is only used for short-term trades, or also called scalping.

When scalping, the Bollinger Bands create an easy-to-use range, marking an upper edge and a lower edge. When the price hits an edge, you can buy or sell accordingly.

Many professional traders that scalp for small profits advise taking profits when the price has touched the SMA instead of waiting for the complete opposite edge.

Again, this method is not advised if you are not able to recognize if a market is trending or in a range.

An example of how a range can be traded using Bollinger Bands, below the volume you can see the Bollinger Bands Width indicator.

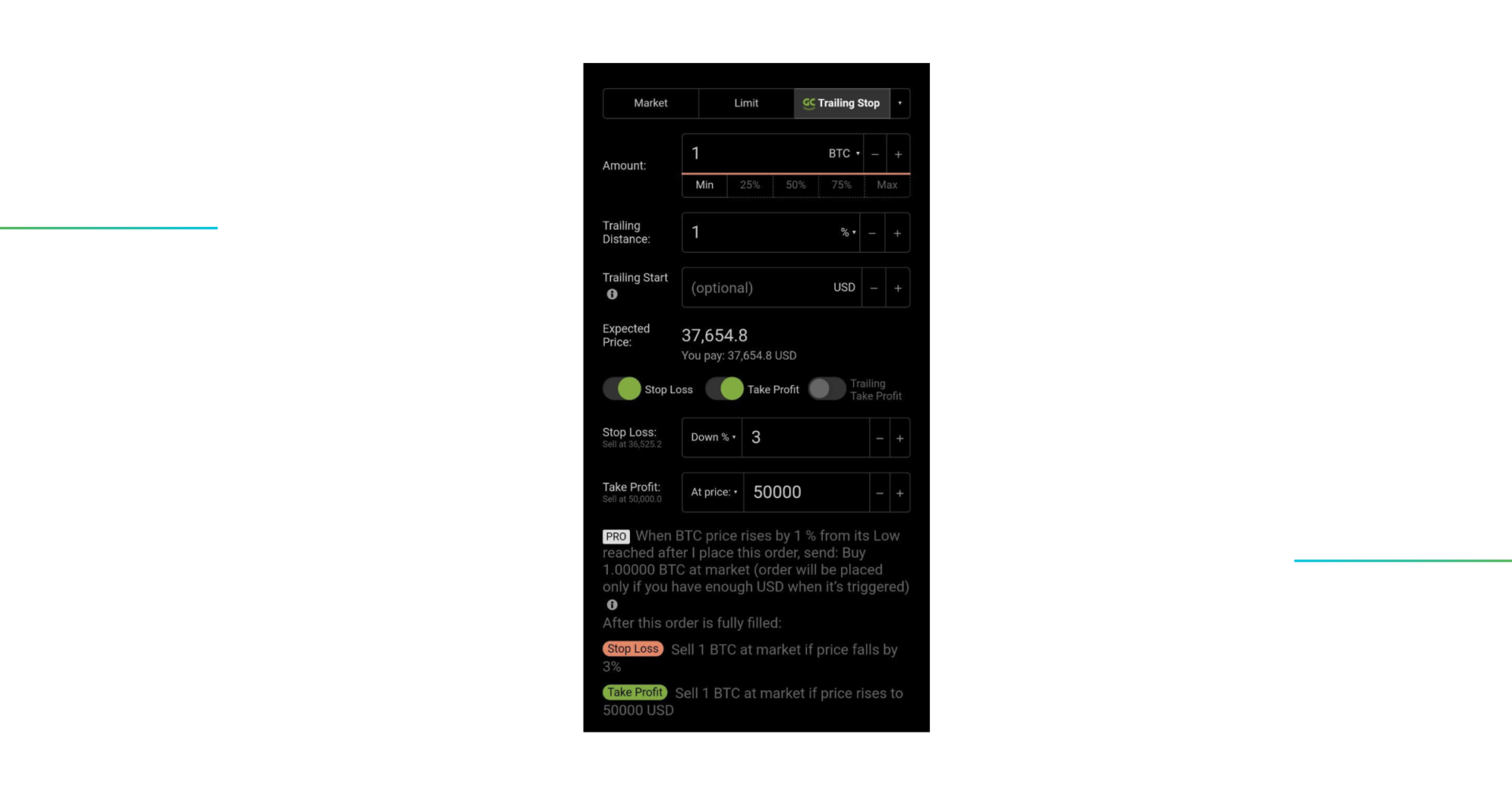

Good Crypto will soon allow you to set an alert every time the BB is touched. Your Buy and Sell Orders in Good Crypto can be programmed with a Stop Loss and a Take Profit, which are placed at the same time as the original Buy or Sell Order is placed. As mentioned earlier, you can place your Take Profit on or around the SMA line (or the opposite side of BB if you are feeling aggressive). This creates a less stressful environment to trade the range because all you will have to do is wait for the current trade to play out, then place the new one once the next range alert triggers.

Trading made easy: A Buy order with a Stop Loss and Take Profit order attached.

Bollinger Band Trading Strategy #2: Trading breakouts

Bollinger Bands are very useful to indicate if a market is volatile or not. Usually, when a market is in a range for a long time, it will contract, or squeeze, which is shown in the width of the Bollinger Bands. When the market is in a squeeze, the chance of a strong volatile move is much bigger.

This example includes the BBW, which indicates volatility, based on the width of the Bollinger Bands.

Trading the breakout of a squeeze is not always evident. It’s not ideal to simply buy when a candle has closed above the BB Band (look at the example above). Most professional traders identify a successful bullish breakout only when at least 3 candles in a row have closed above the Bollinger Band. The example shown above shows 4 strong candles closed above the Band, indicating a strong possibility of continuation.

The 20 SMA is a perfect indicator that can act as a Stop Loss, which should be placed immediately when entering the trade. Once the trade is moving in your direction, you can take profits whenever the support level of the 20 SMA is broken (meaning that the market price closes below the 20 SMA as indicated by the Sell label on the picture above), or whenever you feel like volatility has a strong peak.

To break down this trade:

- Buy when a minimum of 3 candles close above the upper Bollinger Band, around $7,000.

- Stop Loss is right below the 20 SMA, around $6,000.

- Take Profit when the 20 SMA is broken (confirmed by a candle that closed below the line), around $13,000.

Good Crypto allows you to place such trades conveniently. Both your Stop Loss and Take Profit can be attached to your Buy Order. Even better, you can attach a Trailing Take Profit, for example, 5% below the price, which represents the 20 SMA in the example above.

Bollinger Bands vs. Keltner Channels

Keltner Channels are somewhat similar to the Bollinger Bands, and some people place both indicators on top of each other. Doing this allows you to see more confirmations when making the analysis. Both indicators show volatility in a very similar way, but they use different calculations.

Keltner Channels are more steady, with lines that move slower and in a more stable manner.

Keltner Channels are also made of two elements and three lines.

- Instead of SMA, the Keltner Channels show a middle line that represents the Average True Range (ATR). The ATR is calculated by dividing the highest by the lowest price over a certain period. The most common default setting for ATR in Keltner Channels is 20 periods (candles).

- Two lines are derived by multiplying the ATR value by some factor and then adding the result to the ATR for the upper band, and subtracting it from the ATR to calculate the lower band.

When combining both the Bollinger Bands and the Keltner Channels, it’s important to have them both use the same setting.

Tapping the 3 dots that indicate the menu of an indicator, you can change the inputs or the style of the indicator. ‘Mult’ refers to the multiplication factor used in the calculation of the indicator. More information here.

When combining both the Bollinger Bands and the Keltner Channels, we can get an even better idea of when the market is in a squeeze. In the screenshot above, the green area shows the Bollinger Bands, the blue the Keltner Channels.

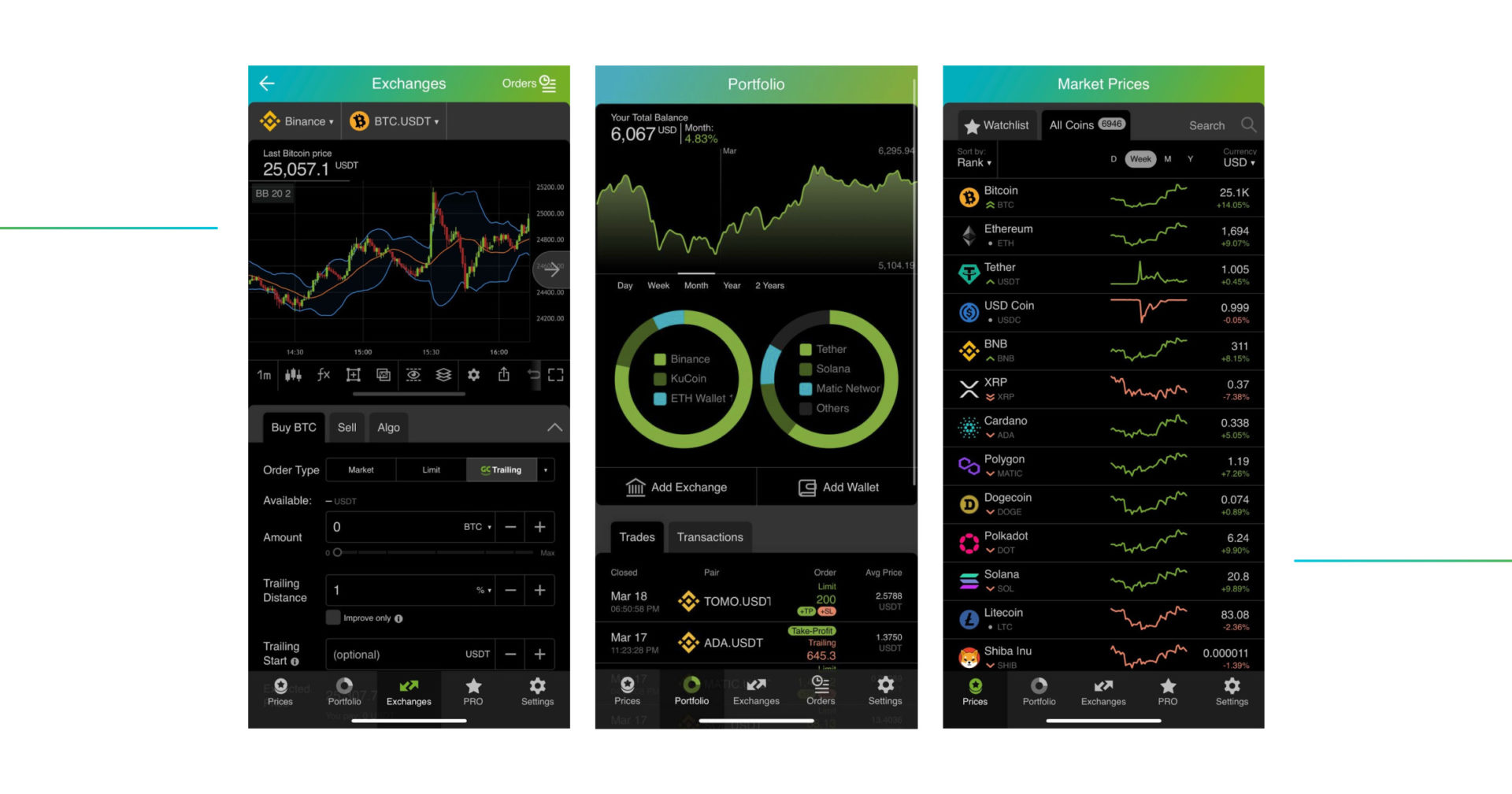

Good Crypto, the best crypto trading terminal

Good Crypto creates the easiest environment for trading by allowing you to place multiple trades at the same time. Once you have made your technical analysis, you can place not only a Buy Order but also a Stop Loss Order and a Take Profit order at the very same time. On the screenshot below, you can see all the advanced trading options. Traders can place an order and follow the trend with a Take Profit, and place a Stop Loss order simultaneously. That means, if you are trading a trend, you can make more and more profits until there is a strong correction, optimizing your profits and making you more money.

Trading in Good Crypto is possible on over 35 exchanges.

Because of the architecture of the Good Crypto application, your balance is never frozen after you send a conditional order. As a result, you can place an infinite amount of trades to test your ideas and strategies. Moreover, you can receive alerts when a certain price has been reached. This creates freedom for traders to create setups for multiple possible scenarios at the same time.

Besides the advantages for trading, Good Crypto allows you to track the whole cryptocurrency market, over 10,000 currencies and 20,000 trading pairs, all in real time.

The icing on the cake is that you can connect your exchange and/or blockchain wallet accounts to the app, and keep track of the performance of your portfolio at all times.

Not convinced yet?

Download Good Crypto for free on both the iOS App Store and the Android Play Store and discover the most advanced cryptocurrency application on the market!

Do you have questions?

Connect with the public chat room in Telegram and ask anything, 24/7.