Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

The judge in the FTX bankruptcy case dismisses the US Trustee’s request to appoint an independent examiner

According to a Feb. 15 hearing, Judge Dorsey has discretion under the law to appoint an examiner in the FTX bankruptcy case, despite some parties meeting the debt threshold with the loss of funds. The judge concluded that it would be an “unnecessary burden” on FTX’s debtors and creditors, citing CEO John Ray’s experience under similar circumstances. Judge Dorsey estimated that the cost of an examination would be in the tens of millions of dollars and likely exceed one hundred million dollars, making the appointment of an examiner not in the best interest of the creditors.

The zkEVM mainnet beta for Polygon will start in late March

Polygon’s “seamless scaling for Ethereum” system will be ready for mainnet launch next month after three and a half months of “battle testing,” according to a Feb. 14 blog post.

The system uses zk-rollup scaling technology and has been in development for three years and has achieved several milestones, including deploying over 5,000 smart contracts, 75,000 zk-proofs generated, and two third-party audits.

Security is the team’s top priority, and the technology has been subjected to various tests and audits to ensure its safety.

Zero-knowledge proofs are used to validate transaction data before bundling and confirming them on Ethereum, allowing for large amounts of data processing.

Circle dispels reports of a forthcoming SEC enforcement action

Reports that Circle had been ordered to stop selling its USD Coin (USDC) due to the stablecoin being an unregistered security were refuted by the firm’s Chief Strategy Officer and Head of Global Policy, Dante Disparte, on Feb. 14. The rumor, which originated from a now-deleted tweet by Fox Business reporter Eleanor Terrett, was swiftly denied by Disparte just 15 minutes later.

In financial circles, a Wells Notice is a formal notice sent by the US Securities and Exchange Commission (SEC) informing the recipient that the agency intends to take enforcement action against them. Circle Pay confirmed that it had not received any such notice, contrary to Terrett’s tweet.

Responding to Circle’s denial, Terrett apologized for the mistake, saying she “went with the word of several trusted sources.” In a gracious response, Disparte accepted her apology, acknowledging that “there is a lot of churn, swirl, and rumors informing the market right now.“

Terrett has since deleted her original tweet and temporarily deleted her Twitter account, which has since been restored.

Post-Paxos crackdown, Binance withdrawals, and BUSD redemptions spike

Binance, a popular cryptocurrency exchange, has seen a spike in withdrawals within the past 24 hours. This is due to recent regulatory action against Paxos and its stablecoin, Binance USD, causing investors to become anxious. According to Peckshield, there have been significant redemptions of the BUSD token, with 342 million BUSD burned in the last 24 hours.

Last Friday, the United States Securities and Exchange Commission announced a potential enforcement action against Paxos, alleging the stablecoin is an unregistered security. However, Paxos denies this claim. As a result, Binance saw 24-hour multichain token net outflows of $788.5 million, with outflows exceeding inflows by about $730 million, according to data from the blockchain intelligence platform Nansen.

This event marks the largest 24-hour net outflow for Binance since Dec. 17, when its proof-of-reserve audits were removed from auditor Mazars’ website. Despite the withdrawals, Binance assured customers that their “funds are SAFU,” meaning a Secure Asset Fund backs them for Users. Additionally, the spokesperson stated that the recent sell-off was handled with ease, with more than $1 billion withdrawn in 12 hours.

Trading approach with Ichimoku Cloud

The crucial role of adhering to the signals provided by the Ichimoku Cloud in trading cannot be overemphasized. To maximize its benefits, it is imperative to follow its guidelines rigorously. Avoid opening a trade while the price is within the cloud, and only enter a position after receiving all five Ichimoku signals in your favor. Patience is a vital aspect of trading, especially in cryptocurrency, and haste should be avoided at all costs. Then, when the signals align, you can confidently trade with increased security.

Maintaining a calm demeanor while trading can prove challenging for many traders. This is why utilizing a comprehensive and profitable system like the Ichimoku Cloud strategy is so valuable in the cryptocurrency market.

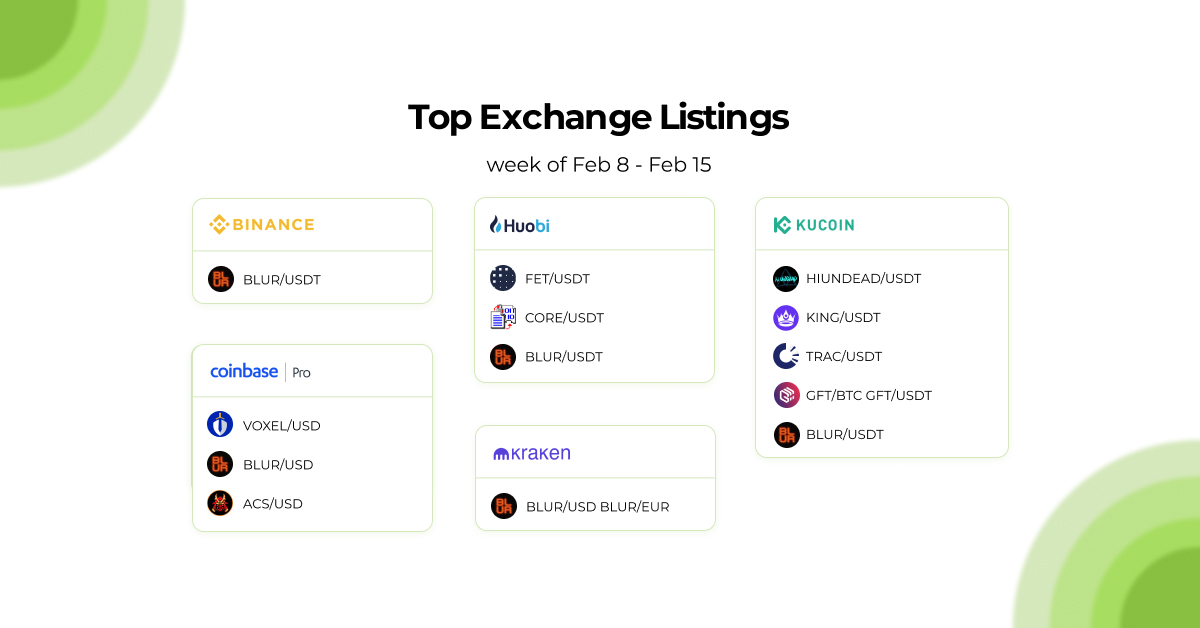

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!