Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

Circle indicates a $3 billion loss from Binance stablecoin conversions

The business that issued USDC Coin (USDC) said that recent developments, including the demise of FTX and a move by rival exchange Binance, had led it to miscalculate its revenue expectations.

Last week saw the fall of FTX, despite Binance’s announcement in September that it will automatically convert USDC to its own stablecoin Binance USD (BUSD).

In its updated S-4 registration statement, submitted to the US Securities and Exchange Commission (SEC) on November 14, Circle indicated that its 2022 prediction had been miscalculated.

Before merging, acquiring another business, or making an exchange offer, corporations must complete and submit an S-4 registration statement to the SEC.

Although Circle could not determine the exact contribution Binance’s automatic conversions from USDC to BUSD made to the reduction in the supply of USDC, the company did notice that between August 17 to September 30, BUSD saw an increase of almost $3 billion.

The stablecoin issuer also said that the $13.5 billion USDC released since June 30 represents a 36% decrease from 2021.

Genesis Global suspends withdrawals due to “unprecedented market turmoil”

Genesis Global announced in a fresh tweet on Nov. 16 that it would “temporarily suspend redemptions and new loan originations in the lending business.” The company claimed, the “unprecedented market turmoil” brought on by the failure of problematic cryptocurrency exchange FTX as justification for the move. According to Genesis Global, this led to “abnormal” volumes of withdrawals that surpassed its existing liquidity.

The company also stated that the June collapse of hedge fund Three Arrows Capital had a detrimental effect on its present liquidity. The brokerage has made a $1.2 billion claim against Three Arrows Capital as part of the bankruptcy proceedings.

The firm’s liquidity levels remain unknown, although according to a prior report from Cointelegraph, Genesis Global had $175 million in money trapped on FTX. Genesis Global’s parent firm, Digital Currency Group, responded by sending a $140-million emergency stock infusion to its subsidiary to offset losses.

According to cryptocurrency exchange Gemini, Genesis Global will not be able to satisfy client redemption requests within five business days, which confirmed that Genesis Global is the lending partner for its Earn program. However, according to Gemini, “all customer funds held on the Gemini exchange are held 1:1 and available for withdrawal at any time,” and the incident has no impact on the company’s other goods and services.

The 35th-largest ETH holder right now is the FTX hacker

According to blockchain intelligence firm Elliptic, the troubled FTX exchange’s accounts were raided for more than $663 million in various crypto assets only one day after it filed for Chapter 11 bankruptcy.

Elliptic estimated that $477 million was stolen, with a significant portion of those tokens being changed into ETH. FTX itself put $186 million worth of more than a hundred distinct tokens into safe storage.

In what researchers referred to as “on-chain spoofing,” the attacker was still emptying wallets four days later, as Cointelegraph reported on Nov. 15.

Beosin, a blockchain security company, reports that as of Nov. 15, the attacker held almost $338 million in cryptocurrency after carrying out several swaps and cross-chain transactions throughout the previous day.

According to the wallet address, a massive 228,523 ETH is included, which, at the current market price, would be worth almost $288.8 million. The “FTX Accounts Drainer” account is now the 35th-largest Ethereum holder in total ETH owned.

Exchange withdrawals reached all-time highs as Bitcoin investors chose self-custody

Following the failure of the world’s second-largest cryptocurrency exchange last week, Bitcoin investors are rapidly transferring their holdings to self-custody options.

According to analytics company Glassnode, on-chain exchange flow data shows a spike in withdrawals to self-custody wallets. Glassnode said that Bitcoin exchange outflows had reached close to record levels of 106,000 BTC per month in a post on Twitter on November 13.

It was also mentioned that this has only occurred three additional times, in April 2022, November 2020, and June/July 2022. It further stated that on November 9, around 90,000 Bitcoin wallets received the asset from exchange addresses.

Outflows from an exchange often indicate that BTC is being held for the long term, which is positive. But in this case, it appears to be due to waning faith in centralized crypto exchanges.

What is liquidity? How would one locate a liquid exchange?

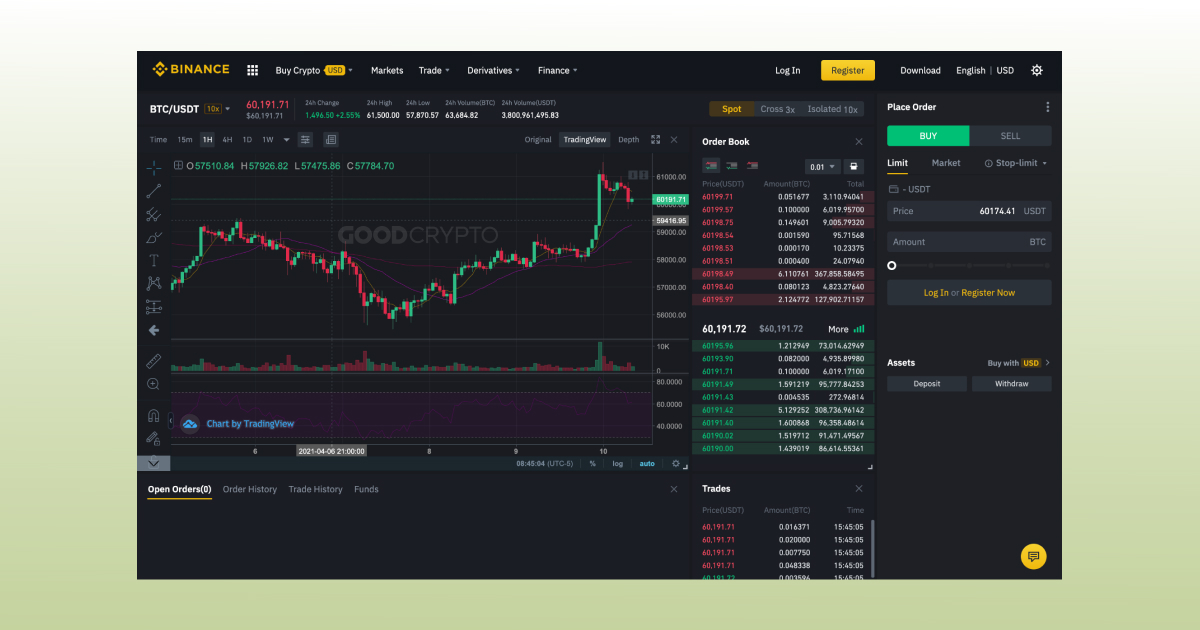

Let’s start by looking at the Binance exchange’s BTC/USDT pair.

The order book and the most recent price at which BTC was purchased or sold are displayed in the trading interface’s right area. According to the order book, there are 2.1244772 BTC available at the lowest price of $60,195.97, which is the price at which someone is willing to sell BTC.

The order book and the most recent price at which BTC was purchased or sold are displayed in the trading interface’s right area. According to the order book, there are 2.1244772 BTC available at the lowest price of $60,195.97, which is the price at which someone is willing to sell BTC.

In this instance, Binance’s BTC/USDT liquidity is strong since both the buy and sell sides have a respectable number of open orders.

The subject of liquidity comes up frequently, although it is rarely explored in detail. We’ll go through how to determine liquidity and how to locate the exchange with the maximum liquidity in this article.

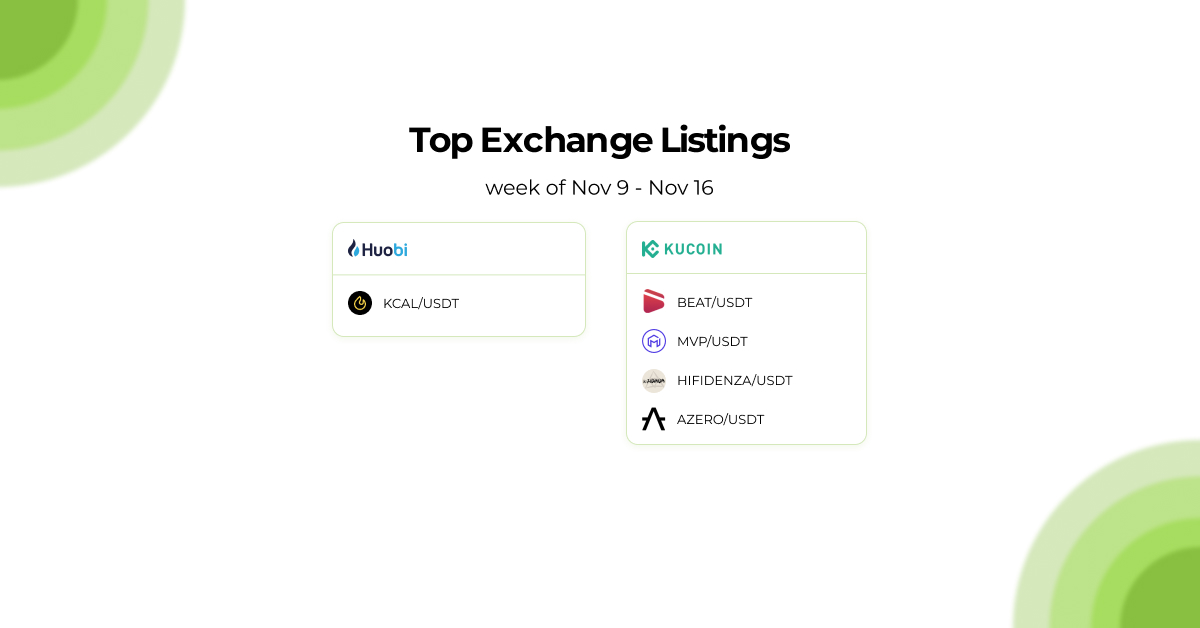

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!