Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

Coinbase receives NFA approval for U.S. crypto futures offering

Coinbase, a prominent cryptocurrency exchange, has secured approval from the National Futures Association (NFA) to provide eligible United States customers access to crypto futures investments. The company announced this development on August 16, revealing its official authorization to operate as a Futures Commission Merchant (FCM) platform.

This regulatory endorsement empowers Coinbase to introduce futures contracts for Bitcoin and Ether via its derivatives exchange, regulated by the Commodity Futures Trading Commission (CFTC).

In a statement, Coinbase highlighted the significance of this achievement in affirming its dedication to running a regulated and compliant business. The exchange aims to maintain its reputation as a trusted and secure platform catering to crypto-native needs.

Although the new futures trading service will not be instantly accessible in the U.S., Coinbase encourages users to join a waitlist for early access, as indicated on their cryptocurrency futures webpage.

Coinbase underscored that the global crypto derivatives market contributes to 75% of the total crypto trading volume worldwide. The company added that trading with margin gives customers leverage and easier entry to the crypto market than traditional spot trading.

Binance Connect to cease operations: a shift in Focus amid the evolving crypto landscape

Binance Connect, the regulated crypto buy-and-sell division of Binance, will cease operations on August 16, confirmed by a Binance spokesperson in correspondence with Cointelegraph on August 15.

Simultaneously, BNB Chain-based decentralized exchange Biswap announced on Twitter that Binance had decided to deactivate Binance Connect on August 15 due to its service provider discontinuing card payment support. The Binance representative remarked:

“At Binance, we periodically review our products and services to ensure that our resources continue to be focused on core efforts that align with our long-term strategy. In the last six years, Binance has grown from being an exchange to a global blockchain ecosystem with multiple business lines. We consistently adapt and modify our business approach in response to changing market and user needs.“

Binance Connect was initially launched on March 7, 2022, under Bifinity. It served as a conduit for fiat-to-crypto payments, linking crypto entities with traditional finance channels. The platform supported 50 cryptocurrencies and fiat methods like Visa and Mastercard.

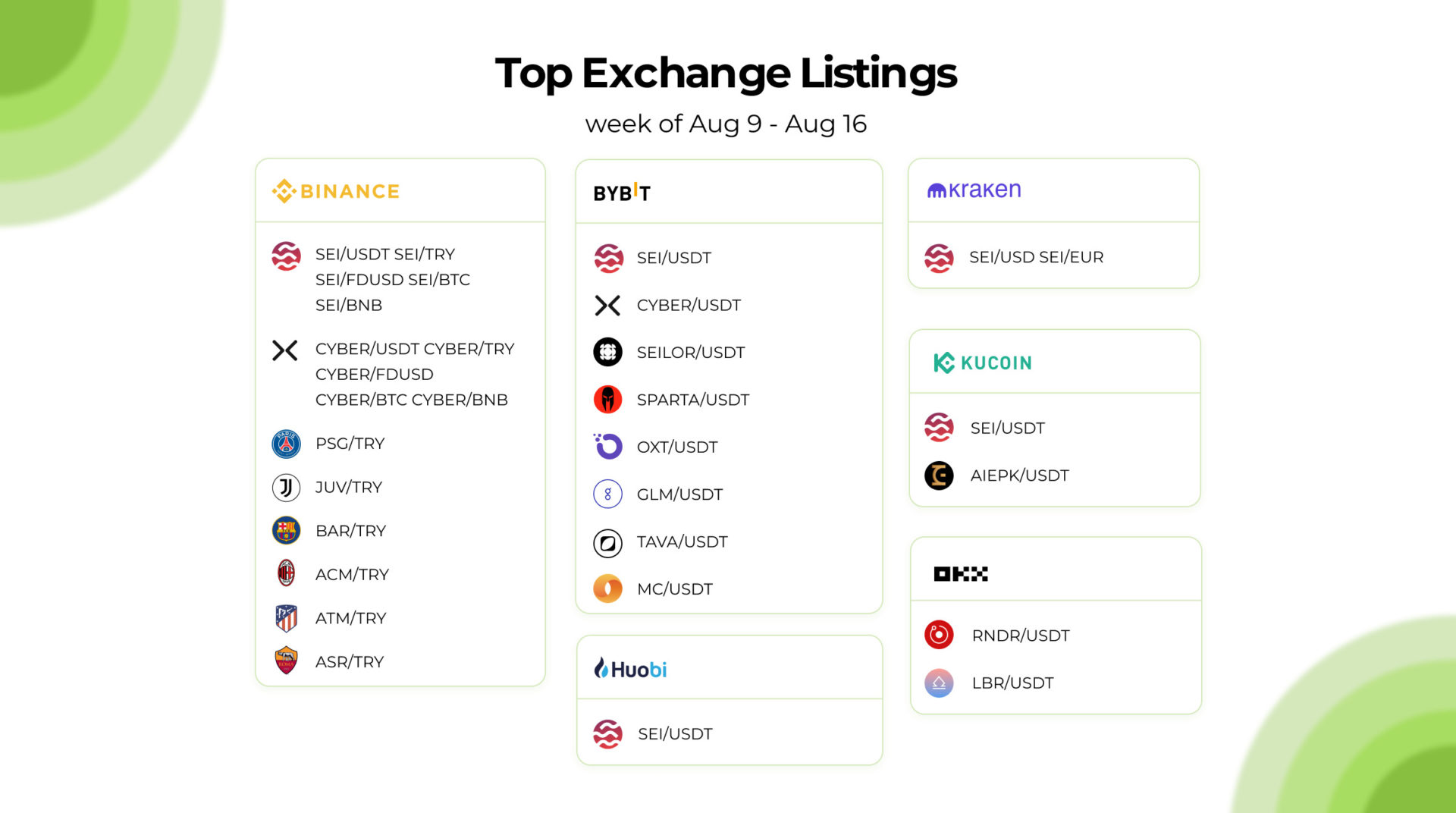

Sei Network achieves $1.8 billion valuation on debut token listing

Layer 1 trading blockchain, Sei Network, has rapidly gained a fully diluted valuation of $1.8 billion on its first day of token listing. The native Sei (SEI) token was jointly listed on prominent exchanges like Binance, Bybit, and Bitget on August 15. With a dynamic start at $0.064, the token surged to $0.48 on Binance before stabilizing at $0.18 during publication. The Sei token boasts a total supply of 10 billion SEI, with an initial supply of 1.8 billion SEI.

Additionally, Sei launched the beta phase of its mainnet on the same day. Developers highlight that the blockchain processed over 400 million transactions and created 7.5 million test wallets during its alpha phase. Sei’s network excels in transaction speed, finalizing within 0.5 seconds and accommodating up to 20,000 transactions simultaneously. Sei uses the Cosmos software development kit to enhance decentralized exchanges (DEXs) with its advanced matching engine and order front-run prevention tools.

Jeff Feng, co-founder of Sei Labs, emphasized the need for scalable and efficient Web 3 infrastructure. He noted that 30 Sei applications will launch by year-end, including DEX SushiSwap’s plan to introduce a perpetual futures exchange on the Sei protocol.

Key executives depart Silvergate amid winding down

Silvergate CEO Alan Lane and two other top executives are stepping down as the once crypto-friendly bank goes through a winding-down process. Lane and the chief legal officer, John Bonino, are leaving on August 15, while the chief financial officer, Antonio Martino, will depart on September 30.

In a filing with the Securities and Exchange Commission on August 15, Silvergate Capital, the bank’s parent company, stated that these departures are part of a previously disclosed plan to wind down operations and voluntarily liquidate Silvergate Bank.

Although the departing executives won’t be entitled to further compensation per their employment agreements, they will receive severance benefits.

These departures coincide with a surge in proposed lawsuits involving the bank, with Silvergate and Lane facing allegations about their involvement in the alleged misconduct of crypto exchange FTX. The Texas-based Word of God Church also filed a lawsuit against the bank, accusing it of using church deposits for participation in FTX’s “fraudulent” scheme. This legal scenario has raised concerns about Silvergate’s due diligence practices on its crypto clients.

Understanding of ATR trading strategies

When considering stop loss and take profit orders, a key question emerges: “Where should I place them?”

Static SP/TP orders aren’t effective due to varying currency pair volatility. For instance, a 20-pip Stop Loss might suit a less volatile EUR/USD pair, but it could lead to premature stop-outs or missed profits in the highly dynamic cryptocurrency market.

The same applies to different time frames. Consider BTC price movements in 15-minute and daily time frames. The average candle size (RMA) in 15 minutes is 53.43, whereas, on the daily scale, it jumps to 667.79. This demonstrates the need for larger stop losses on higher time frames to accommodate the greater price fluctuations typical of longer horizons.

This article aims to provide insights into the Average True Range (ATR) Indicator, including how to interpret and utilize it effectively. Additionally, it covers the advantages of ATR trading strategies and more.

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!