Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

Algofi announces closure of lending protocol on Algorand blockchain

Algofi, the borrowing and lending protocol built on the decentralized finance blockchain, has announced its upcoming shutdown. On July 11, the developers expressed their unwavering belief in Algorand’s technology and consensus algorithm. Due to several events, the Algofi platform will be phased out and placed in withdrawal-only mode.

Effective September 1, collateral factors for ALGO, vALGO, STBL, USD Coin, goBTC, and goETH markets on both Algofi V1 and V2 will be reduced from approximately 80% to 0% by early December. The current Liquidity Mining programs will also be halted, with no future proposals being enacted. At the time of publication, the Algofi protocol had $25 million in total value locked, a significant decline from its peak of $135 million in February.

In related news, the U.S. Securities and Exchange Commission (SEC) charged cryptocurrency exchange Bittrex with operating an unregistered exchange in the U.S. Algorand was among the six tokens classified as securities by the SEC.

Additionally, cryptocurrency exchange eToro recently suspended trading of ALGO, MANA, MATIC, and DASH for its U.S. customers. This decision was attributed to the rapidly evolving regulatory landscape.

Rodeo Finance was exploited for $1.53 Million: code vulnerability in Arbitrum-based DeFi protocol leads to loss

Rodeo Finance, a decentralized finance (DeFi) protocol based on Arbitrum, fell victim to an exploit on July 11, resulting in a loss of $1.53 million. The exploit took advantage of a code vulnerability in Rodeo Finance’s Oracle, leading to the theft of over 810 Ether.

Blockchain analytics firm PeckShield shared data revealing that the attacker transferred the stolen funds from Arbitrum to Ethereum and converted 285 ETH into unshETH. The attacker then deposited the ETH onto Eth2 staking. To obfuscate the transaction’s trace, the stolen ETH was routed through the popular mixer service Tornado Cash, commonly used by exploiters as an exit route.

The exploit leveraged manipulation of time-weighted average price oracles, which DeFi protocols employ to calculate average asset prices over specific timeframes and mitigate market volatility. However, this mechanism presents a vulnerability that allows attackers to manipulate the oracles, artificially skewing the calculated average prices of assets. This manipulation grants them an advantage during transactions and enables them to exploit the protocol.

Axelar partners with Microsoft to bridge public and private blockchains

Axelar and Microsoft have announced a partnership to bridge public and private blockchains. Axelar will join Microsoft’s Azure marketplace as part of the collaboration, becoming the first cross-chain protocol to be listed on the platform.

This partnership will enable Axelar to reach thousands of companies using Azure’s cloud service. Developers will have access to tools through AxelarJS SDK and general message passing, allowing them to integrate functionality independently of blockchains and databases.

The collaboration will also explore integrating public and private blockchains to support AI applications, establishing trust and ensuring data integrity. Axelar supports 43 blockchains and raised $35 million in Series B funding last year.

Coinbase Wallet introduces instant messaging feature using Ethereum identities

Coinbase Wallet has announced a new feature that allows users to send instant messages to each other using their Ethereum identities. In a recent blog post, Coinbase revealed that the feature relies on the Extensible Message Transport Protocol (XMTP), a messaging system that enables communication through blockchain addresses. The decentralized social media network Lens also utilizes XMTP.

According to Coinbase, select wallet users can now send messages to other users’ cb.id, .eth, or Lens usernames. The feature will be initially rolled out to users who scan a QR code from the blog post or own Lens profiles, with wider access planned. Messages are end-to-end encrypted to ensure privacy, and users can block unwanted addresses from sending messages.

Currently, popular chat apps used by crypto users, such as Twitter, Discord, and Telegram, do not provide options for verifying Web3 identities.

In addition to reducing centralization, Coinbase highlights that using XMTP for messaging enables chat histories to be transferred even if the company stops offering its wallet service or ceases to exist. Users can access their chat histories through other XMTP apps like Lenster or OrbApp. Coinbase emphasized the seamless transfer of chats, allowing users to focus on connection.

Momentum Oscillator trading strategy: zero line crossover

The Zero Line crossover is a straightforward and popular trading strategy using the Momentum Indicator.

- When the Momentum Indicator crosses above the Zero Line, it suggests upward momentum and is seen as a bullish signal.

- Conversely, when the Momentum Indicator crosses below the Zero Line, it indicates downward momentum and is considered a bearish signal.

This strategy capitalizes on the fact that the Zero Line represents the price of an asset N periods ago, and any price increase or decrease causes the Momentum Oscillator to cross the Zero Line accordingly.

However, not all crossover points are reliable signals for entering or exiting trades. To enhance accuracy, consider increasing the period length of the Momentum Indicator, analyzing the broader market trend, or incorporating price patterns.

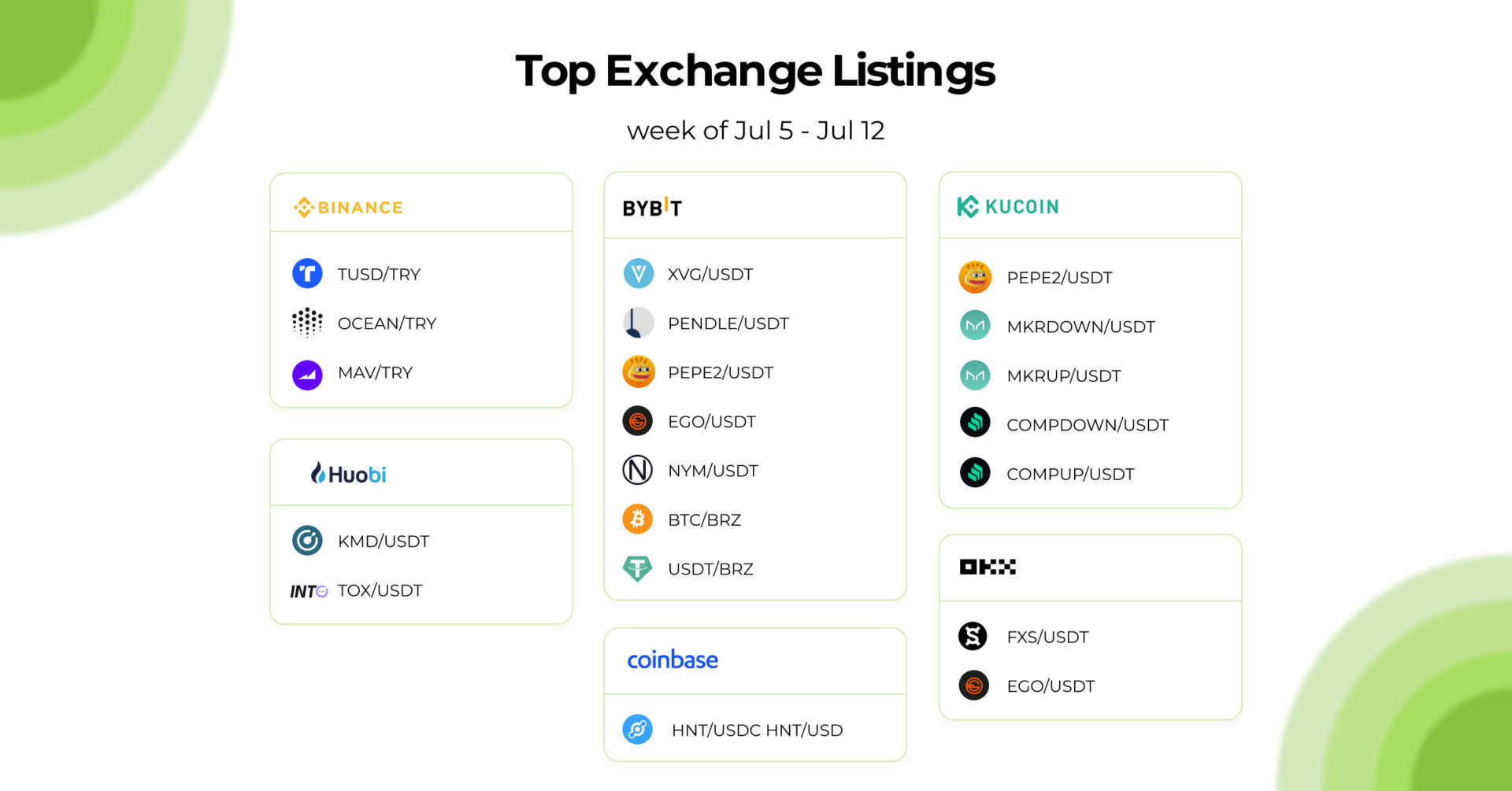

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!