- 1. Overview

- 1.1. Psychology as foundation

- 2. Portfolio management

- 2.1. What is portfolio management?

- 2.2. Cryptocurrency portfolio management: useful tips and recommendations

- 2.2.1. Understanding the cryptocurrency environment

- 2.2.2. Good Crypto tips

- 2.3. Money management trading strategy

- 2.3.1 Dollar-Cost Averaging

- 2.3.2. Example of cryptocurrency portfolio management: Diversification

- 2.4. Good Crypto – the best crypto portfolio tracker

- 3. Financial risk management

- 3.1. What is risk management?

- 3.2. Trading risk management

- 4. Trading psychology checklist

- 4.1. Keep in mind the One Percent Rule

- 5. Summing up

- 6. Other benefits Good Crypto can bring you

The road to successful cryptocurrency portfolio management is not without bumps. Although cryptocurrency markets provide great potential to make financial profits, the chance to lose money is still significant. Before exposing your hard-earned money, you need to have a plan that protects your portfolio value. Then, you can take the next step into developing a strategy to consistently make profits. Limiting your losses will create the foundation for achieving your goals.

In short: your first question to solve is “how do I avoid making losses?”,

then you can solve “how do I make profits?”.

Good Crypto provides you with all the tools you need to create a profitable cryptocurrency portfolio management system.

Overview

It’s important to recognize that there are different ways to be involved with the cryptocurrency markets and generate wealth.

- The HODLer: when you invest and accumulate over time, without planning to sell immediately.

– We categorize this as Passive Investing. - The trader: when you open positions to make a certain amount of profit, and sell back into the asset you want to accumulate. For example USD or BTC.

– We categorize this as Active Investing or Trading. - The validator: when you are a participant in a cryptocurrency network, such as a miner or a staker. You are then rewarded for confirming transactions and increasing the network stability. This part is not what we will cover in this article.

Psychology as foundation

The only certainty in investing and trading is uncertainty.

This is vital to acknowledge for anyone who wants to start investing and especially trading. Professional advice always starts with the famous saying “don’t invest what you are not willing to lose”. Psychology is what it all comes down to. If you are invested too much, you will start to become emotional, and being emotional will affect your decisions. When you are emotional, knowledge will become obsolete.

It’s nearly impossible for human beings to be fully detached from money. Holding us in its grip almost like a religion, money is what the markets are all about. Being detached from exactly the reason you are attracted to a market for, seems like a hard contradiction to overcome. Money is triggering feelings of greed, fear, and attachment.

The most influential writer when it comes to market and trading psychology is without a doubt, Mark Douglas. His book Trading In The Zone has inspired thousands of traders to date, and it became the foundation for anyone that wants to become mentally prepared to become a trader.

The teachings from Mark Douglas will be woven into this article, especially when we will look at Active Investing and trading.

Other great books on investing and trading psychology covering our biases and how they affect our financial decisions are Thinking, Fast and Slow by Nobel laureate Daniel Kahneman and a less well-known but equally great The Little Book of Behavioral Investing by James Montier.

Knowing that trading psychology is the foundation, how do you continue?

It takes trading money management and a protection mechanism to allow you to stay focused and stress-free. You can’t expect to be 100% correct in everything you do in the markets, because nobody can. You’ll need to create a system that allows for mistakes to happen and keep these mistakes at a limited cost.

Cryptocurrencies are highly volatile. If you become aware that you are oversensitive to this, then reduce your investment immediately and act accordingly to those feelings.

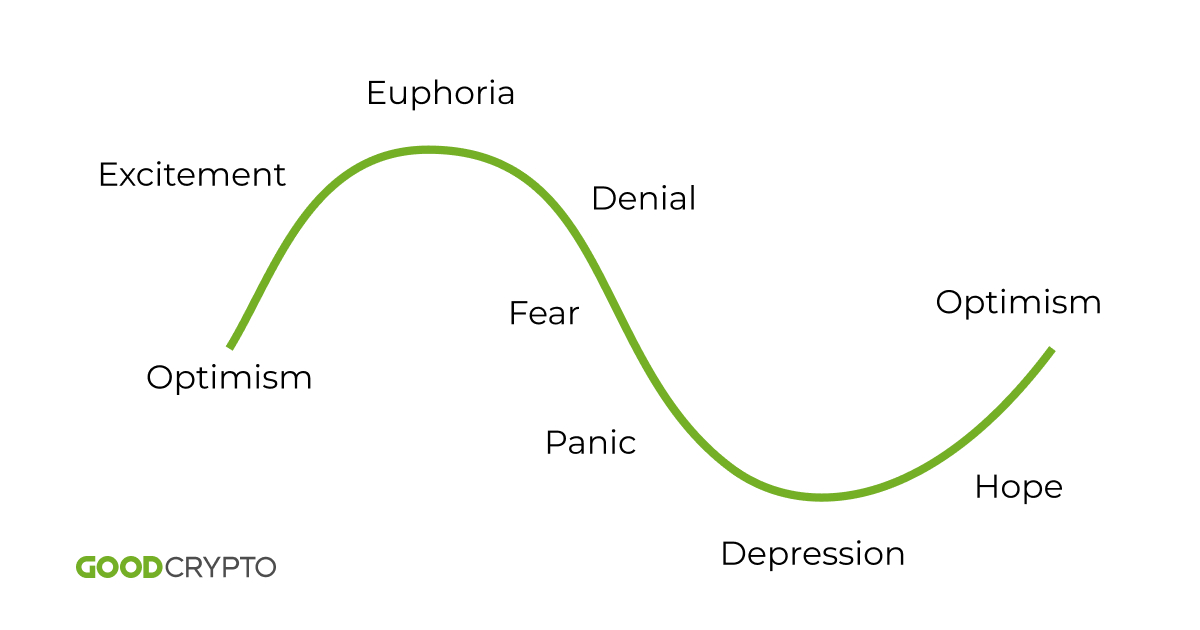

One of the most famous depictions of how trading psychology is driving the markets. Optimism drives a market up, peaking into euphoria, coming down in anxiety and anger, and so forth.

Portfolio management

What is portfolio management?

Before exposing your hard-earned money to the volatility of the cryptocurrency markets, you need to determine how much capital you’re feeling comfortable investing with. It’s advised to only invest about 10% to 20% of your capital. However, this is purely up to you to decide. The less you invest, the less you will feel attached to whatever outcome it may bring.

Once you decide how much you are willing to invest, you need a proper plan – an advanced portfolio management strategy.

How much time and energy are you willing to invest in cryptocurrency portfolio management? Do you desire to create a passive and less time-consuming crypto portfolio, or are you prepared to take on greater risk and potentially earn more by trading smaller market movements? Your advanced portfolio management strategy will depend on the answers to these questions.

You can also combine both, and create an active trading strategy that will accumulate profits into a passive portfolio. Either way, you need to create a plan. Let’s take a look.

- First, the size of the initial investment is decided based on your total capital

- Second, the investment plan is created. Passive, active, or both

- Third, detailed passive and active plans are developed

Cryptocurrency portfolio management: useful tips and recommendations

Understanding the cryptocurrency environment

The cryptocurrency market unique and takes some time to understand before starting with cryptocurrency portfolio management.

Bitcoin is the mother of all cryptocurrencies and it gave birth to the very first blockchain in 2008. It’s the oldest, most robust, and secure network in existence. Bitcoin is the reason why all other cryptocurrencies exist. To understand more about how Bitcoin works, and why its social and economic impact is so large, read The Bitcoin Standard: The Decentralized Alternative to Central Banking, written by Saifedean Ammous.

There’s no other cryptocurrency that can ever replace the position Bitcoin has in the world because Bitcoin is not controlled by anyone, it’s very decentralized, and it cannot be hacked. New and alternative cryptocurrencies can solve issues of speed and scalability, but they will never replace Bitcoin because they will often act as a company, or simply lack the degree of decentralization and security. New cryptocurrencies are part of the whole ecosystem and aim to solve technological, social, or economical issues. Every useful altcoin can thrive along with Bitcoin.

The whitepaper of Bitcoin written by the anonymous creator(s) Satoshi Nakamoto in 2008 described a digital cash-like currency. However, due to its massive growth and adoption, it became a store of value. This is why Bitcoin is also called Digital Gold.

This short introduction is important to understand because it means that the main asset people want to accumulate is Bitcoin. Traders are speculating on alternative coins and tokens, or altcoins because they want more BTC. This knowledge creates the foundation of professional cryptocurrency portfolio management in cryptocurrencies.

The importance of BTC can be compared with the importance of USD. Let’s explain. The US Dollar is the most traded currency in the world. The largest volume of trading stocks and bonds is to be found in the US Dollar. The US Dollar is also the most important currency for lending and global trade. This means that the changing value of the Dollar influences the value of everything that is traded with it.

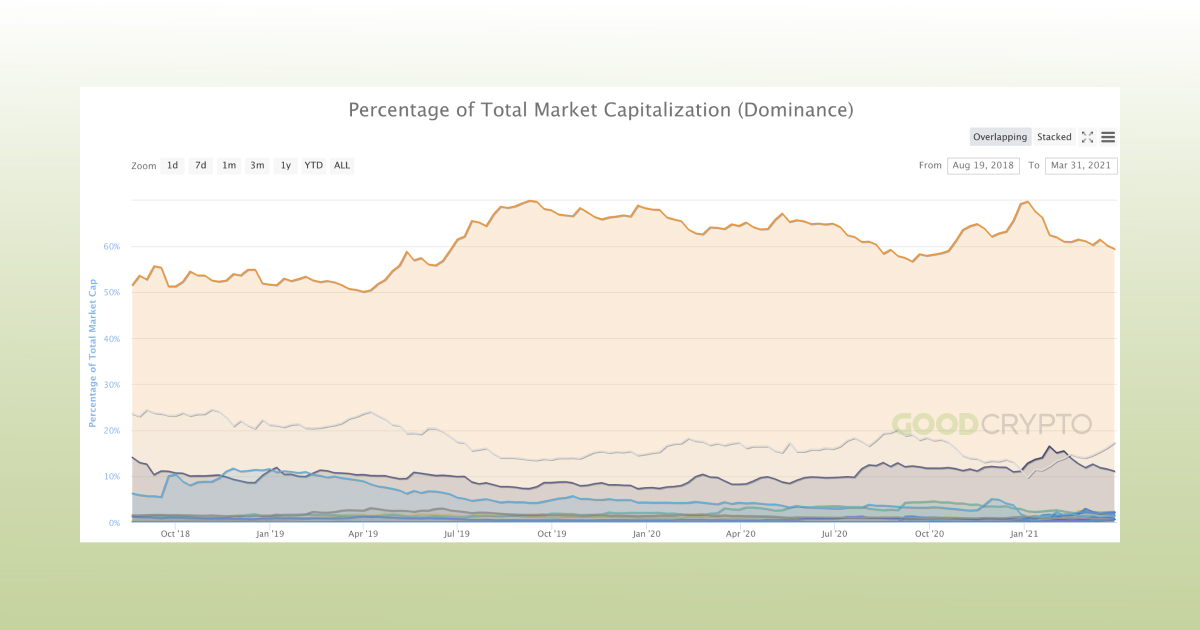

Bitcoin is the main currency with which altcoins are being traded, and therefore every altcoin will depend a lot on the value of Bitcoin. When the Bitcoin value goes up, the altcoins will also rise. When Bitcoin goes down, then the whole cryptocurrency market will go down in value. Lately, more and more volume is being traded with USD pairs, but the same dynamic stays. Bitcoin is the leader of all cryptocurrencies. It is critical to understand this when starting with cryptocurrency portfolio management.

An overview of the market dominance of Bitcoin compared to altcoins, source coinmarketcap.com

The Good Crypto app allows you to compare different markets with each other. In the right menu tap “vs” and add a market. This example points out the correlation of Bitcoin price movements with other major altcoins. This knowledge is crucial for cryptocurrency trading portfolio management.

Good Crypto tips

Listing out our tips for successful cryptocurrency portfolio management. Most of these will be explored in the rest of this article.

- Understand and answer to the question: “what is portfolio management?”

- Create a portfolio management strategy and stick to it to avoid becoming emotional

- Always keep a significant amount of value of your holdings in BTC (or USDT if you trade against the Dollar)

- Diversify

- When trading, always consider what Bitcoin is doing (strong moves are moving the entire crypto market)

- When trading, always use a Stop Loss that prevents your potential loss on any position not to exceed 1% of your total portfolio. Always follow the One-percent Rule

- Define your trade setup before making the trad

- Be patient

- Constantly learn more about trading

- Look for tools that can simplify and automate your trading actions

Money management trading strategy

Dollar-Cost Averaging

Reducing your risk and creating a long-term savings portfolio needs dollar-cost averaging. This is the key to creating a safe position in the market. This is money management trading done right!

Let’s analyze some facts using the for-bitcoin.com/calculator website. If you would have saved $10 and bought BTC with it every week since January 1, 2016, you would have spent $2,470 by now and own 1.4653BTC, worth $80,657.11. That means your investment 00 would have been extremely profitable.

You can play around with the calculator and see other statistics, for example having spent a total amount of nearly $2,000.00 by saving $50 per month since January 1st, 2018, you would now own a little over $12,000.00 worth of BTC. That’s the power of dollar-cost averaging and it should be considered in every crypto money management portfolio.

It’s worth getting into more detail about why this crypto money management strategy is so good.

Imagine buying $200 when bitcoin is worth $50,000. If the price drops to $25,000 your investment is worth $100.

But if you split up the entry, and you would buy $100 at $50,000 and you invest the other $100 at $25,000 then your Dollar cost averaging entry is $37,500. This means that your total investment of $200 is worth $200 at $37,500 instead of $50,000 when having invested everything at once. It is a trading money management knowledge that simply cannot be ignored!

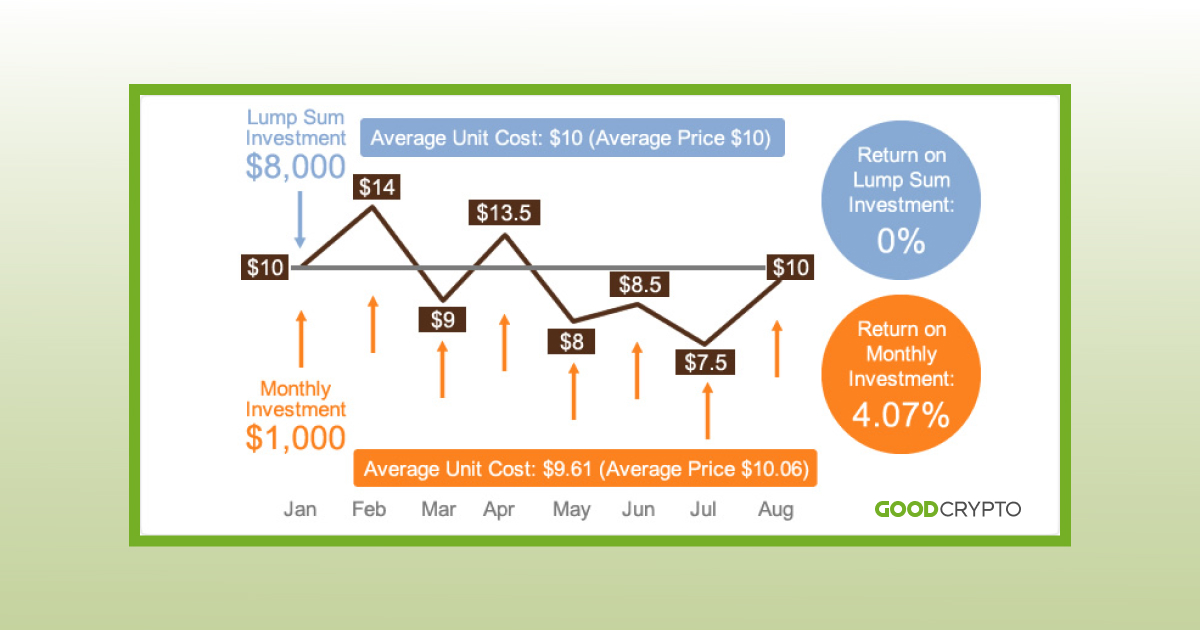

This example shows a lump sum investment made at $10 will always need the price to be above $10 to be profitable. However, if the entries of the position would be made by the Dollar cost averaging system over a longer period, the Dollar cost averaging entry is eventually lower, $9.61, allowing profits to be made easier.

To conclude: when Dollar cost averaging you are less likely to be psychologically in fear when the market turns down, you simply add to your position and use the opportunity to lower your average price of entry.

Example of cryptocurrency portfolio management: Diversification

When creating a passive portfolio, you want to make sure to use diversification as part of your money management trading. Using Good Crypto as your cryptocurrency portfolio tracker will make it easier.

Knowing that Bitcoin is the leading cryptocurrency asset, in most cases you’d want to hold the largest part of your portfolio in BTC. It’s the most secure way to construct your crypto portfolio and it also has proven to be very profitable over time.

It’s prudent to have at least 50% to 80% of your passive cryptocurrency portfolio in BTC. The rest could be dedicated to altcoins, preferably those that are part of the growing ecosystem, for example, Ethereum, Binance Smart Chain, or Polkadot.

When investing in altcoins, you need to do good research – DYOR – Do You Own Research is one of the most common abbreviations you’d encounter in crypto and for a good reason. That way you maximize the chances that your investment will grow as the underlying project develops and minimize the risk of losing your entire investment on a rug pull by a scam project. Your best bet would be to go with projects that have the following:

- a strong foothold in the market,

- track record of product development milestones delivered

- a big established network

- an active and strong community of supporters who believe in the project

A small part of your portfolio could be dedicated to smaller projects which you see perform well and you expect to have a high return, but that also hold more risk. High risk, high (potential) return. This part of your portfolio ideally should constitute no more than 5% to 10% of your total assets. This part of the portfolio could potentially include other risky things like yield farming, and initial fundraisers.

Let’s create an example of a balanced portfolio that would have limited risk but also the potential to become the best cryptocurrency portfolio for the long term:

- 50% Bitcoin

- 15% Ethereum

- 25% in other altcoins such as DOT, UNI, LUNA, SOL, BNB, etc

- 10% for yield farming, small projects, or fundraises

Let’s create an example of a balanced portfolio that would have limited risk but also the potential to become the best cryptocurrency portfolio for the long term:

- 50% Bitcoin

- 15% Ethereum

- 25% in other altcoins such as DOT, UNI, LUNA, SOL, BNB, etc

- 10% for yield farming, small projects, or fundraises

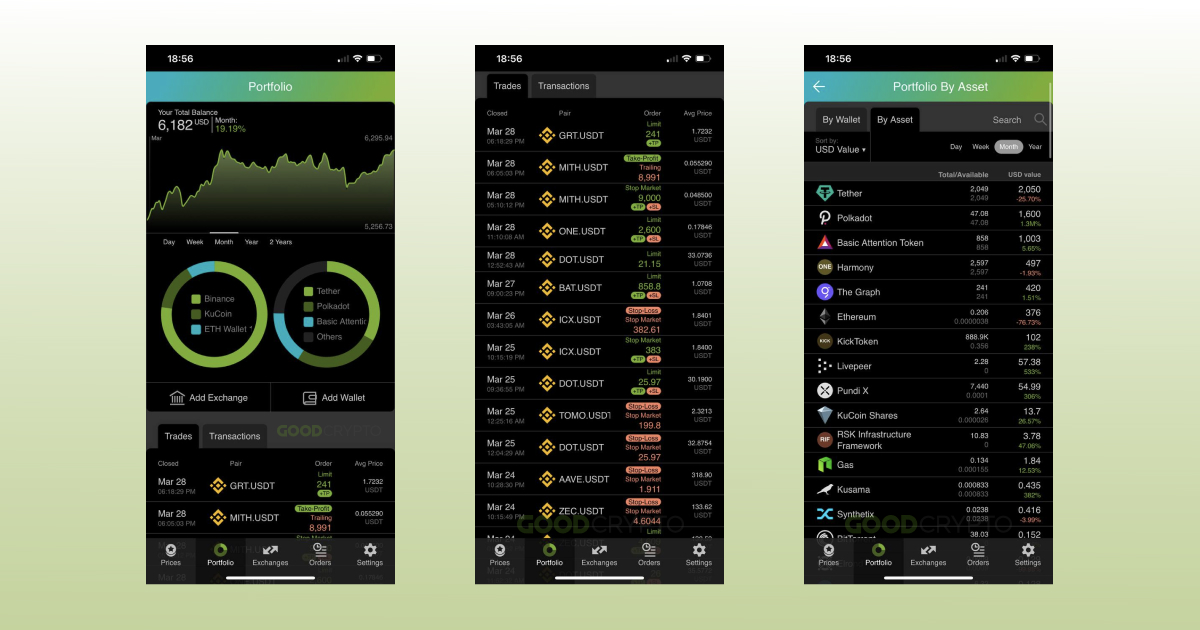

Good Crypto – the best crypto portfolio tracker

The investment portfolio we have described above is a more passive way to interact with the market. Still, it’s very important to keep track of market movements and see what is happening. Analyzing your portfolio is easy with the Good Crypto app. Anywhere you go, at any time of the day, you can follow the movements of your investments. Good Crypto as a crypto portfolio tracker and cryptocurrency trading app connects all your exchange accounts and wallets and creates a beautiful aggregated overview. Every single trade made is shown, every holding and its change in value being recorded as you trade and/or accumulate. There’s no other application on the market that allows you to trade and connect with as many exchanges as Good Crypto does (30), and having a built-in portfolio overview in the same place as you trade is unique. Therefore, Good Crypto now can be considered as the best iOS and Android app for cryptocurrency portfolio management.

The best cryptocurrency portfolio can be created only when you understand the market and know the main rules of portfolio and money management. However, tools like Good Crypto can significantly facilitate your progress and organize the overall process of portfolio management.

Read more cryptocurrency portfolio management programs’ reviews in our blog.

Financial risk management

What is risk management?

Risk management definition: In trading and investing, risk management creates an environment that is less stressful by protecting your value in case of unexpected events or wrong decisions. Risk management is the foundation of a healthy and profitable portfolio.

After having looked into the passive kind of investing, let’s explore active trading. An active portfolio can take as much time and attention as you want, and often has an addictive effect. This is where the psychological aspect plays out clearly.

Most often, cryptocurrency investors both invest passively and trade actively. It’s advised to keep the active trading portfolio smaller in size than the passive one. For example trading with an amount no larger than 30% of your investment is a good rule of thumb. That being said, some people simply don’t want to hold cryptocurrencies for long periods of time at all because of their volatility, and will trade with 100% of their investment, converting it into USD every time they want to “cash-out”. When doing this, you must create a consistently profitable system that has proven itself over time. Most cryptocurrency traders are either trading to maximize their Bitcoin holdings or to maximize the amount of USD or other fiat currency.

Trades can take any length of time, even up to several weeks. Usually, a position does not last longer than a week or several days, and some swing traders or intraday traders simply trade during one day and close their positions at the end of the same day.

Especially when trading with leverage, the risk of loss is significant. Leveraged trading means that you borrow money to trade with, but it includes being responsible for the losses which are made. If you own $1000 and you borrow $9000, that means you can open a $10,000 position and reap the rewards if you profit, but it also means you will more easily liquidate your account when the market moves against you.

“Trading the markets is making a bet, either the price goes up or it goes down.”

Financial risk management is based on this essential piece of knowledge. If the market is uncertain, how can you create a system that creates a certain profit?

According to Mark Douglas, there are a few significant things to remember.

– Anything can happen

– You do not need to know what is going to happen to make money

– There’s a random distribution between wins and losses at any given set of variables that define an edge

– An edge is nothing more than an indication of a higher probability of one thing happening over the other

– Every moment is unique

Trading risk management

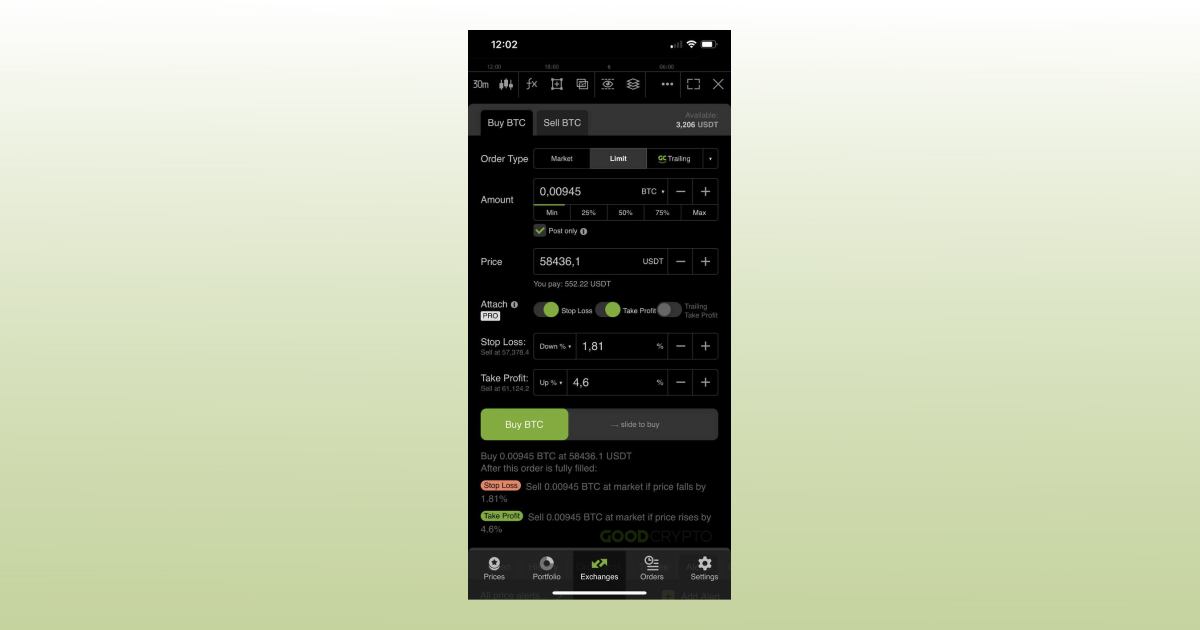

When creating a trade, your exit plan needs to be made before entering. This means that you have a point of entry determined, a point of taking profit, and a point of exiting the position if it turns out to be a bad trade.

In practice this means you have created a Buy order, a Take Profit order and a Stop Loss order on paper before you open a position. Good Crypto provides you programmable trades, which means that you can create all these orders, which will be connected, at once. By contrast with crypto exchanges and other crypto trading apps, in Good Crypto, this happens without freezing your account balance, opening up the possibility to utilize your portfolio to the full extent and program as many trades as you want to. Therefore, Good Crypto also serves as trading risk management software helping you to set up your position properly and manage the risk.

An example of placing an order in Good Crypto, with Stop Loss and Take Profit orders attached. You can enter either a fixed price value or %.

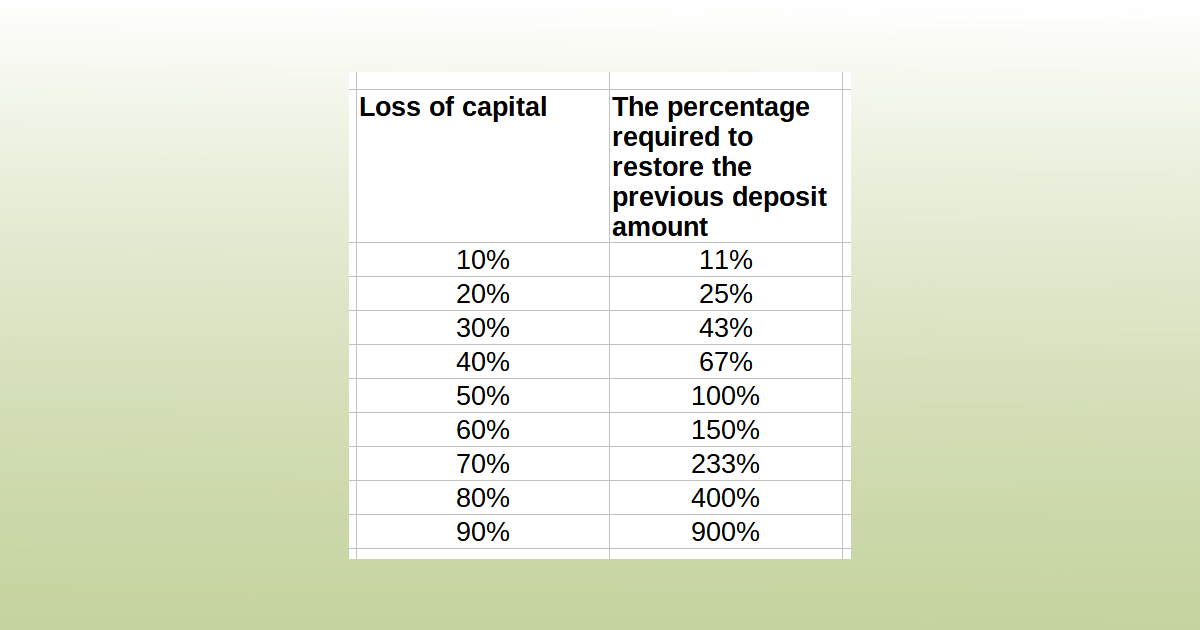

Using a Stop Loss in cryptocurrencies is extra important because of the volatility. A Stop Loss will make sure your trade ends at for example a 10% loss and not a 50% loss. When a loss is made, it takes a bigger win to eventually make back what is lost. This means that you need to know when to leave a trade in time and take the loss if you have to. Seeing your value go down by 50% means the win to make up for it is required to be 100%. This is important to understand because it will prepare you for when a trade goes not in your favor.

This is why a trading strategy should always include a Stop Loss! This leads to the explanation of the Risk and Reward ratio and main risk management rules.

Trading psychology checklist

- Check your trading psychology.

Are you feeling FOMO? Fear of missing out is emotion-based trading, and will cost you money sooner rather than later. - Have you decided on a trade setup?

Along with your Buy order, did you decide where to place your Stop Loss order and where to Take Profit? MAs, Bollinger Bands, Ichimoku Clouds, and other indicators may help you decide on that. - What is the R:R (risk reward ratio) of the trade?

Remember, you need to be sure that when you risk 1 dollar, you know the size of your potential profit. - What is your position size?

This should make sure you do not risk more than 1% of your portfolio when the trade goes bad. In numbers: if you have $1000 to trade with, you should never risk $100 or more on a single trade! You only want to risk $10 which is 1%, or less on any given trade or position.

Remember the formula: Position size = (Risk % x Trading capital) / Stop Loss %

Keep in mind the One Percent Rule

When creating a possible trade setup, you need to know and accept what your risk is. Of course, you hope for the best outcome. But what happens if the trade goes against you? This is what Mark Douglas means by accepting every outcome – you need to be prepared. Not a single trader in the world is always correct. What distinguishes a good trader from a bad one is how he manages risk.

The risk reward ratio, also written as R:R, is a way to measure your potential loss compared to your potential win. If you risk 1 dollar, and you can potentially earn 3, then your R:R is 1:3.

The one percent rule adds to this. This general rule in trading is often not respected but is key to becoming a profitable trader. Even if you are right only 50% of the time you make a trade, if you have a setup with a risk reward ratio of 1:3 that is earning 3 each time you win, and only risking 1 on your losing trades, then you will be profitable.

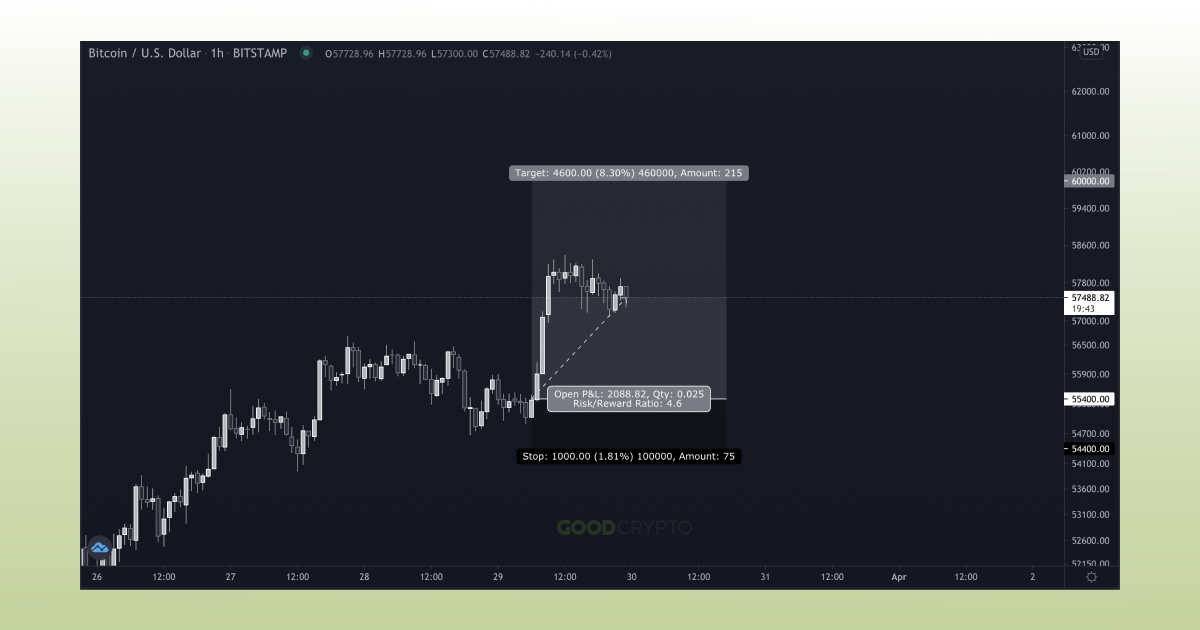

When you have determined where you want to enter a trade, where you take profit, and where you place a stop loss, you can calculate your R:R. TradingView does this automatically. Let’s look at the example below.

An example of a trade based on R:R. This trade shows an R:R of 1:4.6, with a Buy order made at $55,400, a Stop Loss order at $54,000, and a Take Profit order at $60,000.

Wait, then what does the 1% rule mean?

The 1% rule means that when your Stop Loss order hits, you have not lost more than 1% of your total trading portfolio. In numbers: if you have $1000 to trade with, you don’t want to risk $100! You only want to risk $10 which is 1%, or less.

Position size = (Risk % x Trading capital) / Stop Loss %

Once your trade setup is made, you can calculate how big your position size has to be for it to respect not losing more than 1% once your Stop Loss order is hit.

To follow the example made above, the calculation would be (the 1.81% is the distance of the entry to the Stop Loss order in the example above):

(1% x 1000) / 1.81% = $552.5

You enter the trade in the example above with $552.5, if your Stop Loss hits then you have risked only $10 which is 1% of your trading portfolio. However, if you win, you have made $46.

It’s important to create a trade setup first, and only then you will calculate your R:R.

Good Crypto shows for every trade setup what your % of profit or loss will be. This information can be used to calculate your position size with the formula above and this way you limit the potential loss to 1%.

Summing up

Cryptocurrency markets have a great potential to make profits. But in every market and with every investment, there is a risk of loss. Being prepared to make the wrong decision is important to give you peace of mind, and protect your wallet. After having read this article you can get started with creating a plan that can foresee when the market moves against you, both in your long-term strategy and your short-term trades.

Dollar-cost averaging, and risk reward trading that does not risk more than 1% of your portfolio are both long-term and short-term solutions to help you on your way to making profits.

Other benefits Good Crypto can bring you

Good Crypto offers you both a professional trading terminal to program every trade which is needed in a setup and an aggregated portfolio overview. But it doesn’t end there.

- Track your portfolio performance in real time

- Automatically have your trades and balances updated

- Connect and trade on over 30 exchanges, all in one application

- Track your blockchain wallets and enable alerts for transactions

- Have an easy to understand overview of all your holdings combined with a clear distribution by assets, exchanges, and wallets

- Follow the cryptocurrency market, over 15,000 trading pairs, and discover new currencies based on their performance and market cap

- See the live order books and trade history for all these pairs

- Schedule a market summary notification that gives you a 24h recap at the time of your choosing

- Receive alerts for sudden movements of the top currencies, DeFi hyped projects, newly listed currencies, and (soon) advanced alerts based on technical indicators

- Trade on top of 30 exchanges with advanced order types and automation

- Denomination in over 40 fiat currencies to track performance in your native currency

- Futures and leverage trading possible on the most liquid markets like BitMEX, ByBit, FTX, Binance, and KuCoin Futures

Not convinced yet?

Find Good Crypto on both the iOS App Store and the Android Play Store and discover the most advanced cryptocurrency application on the market for free!

Do you have questions?

Connect with the public chat room in Telegram and ask anything, 24/7.