Hey fam!

This week hinted at a potential market turnaround, but the signal remains unclear as headlines brought both positive developments and setbacks. Let’s review them:

quick weekly news

Daily crypto liquidations nearly triple as leverage overheats

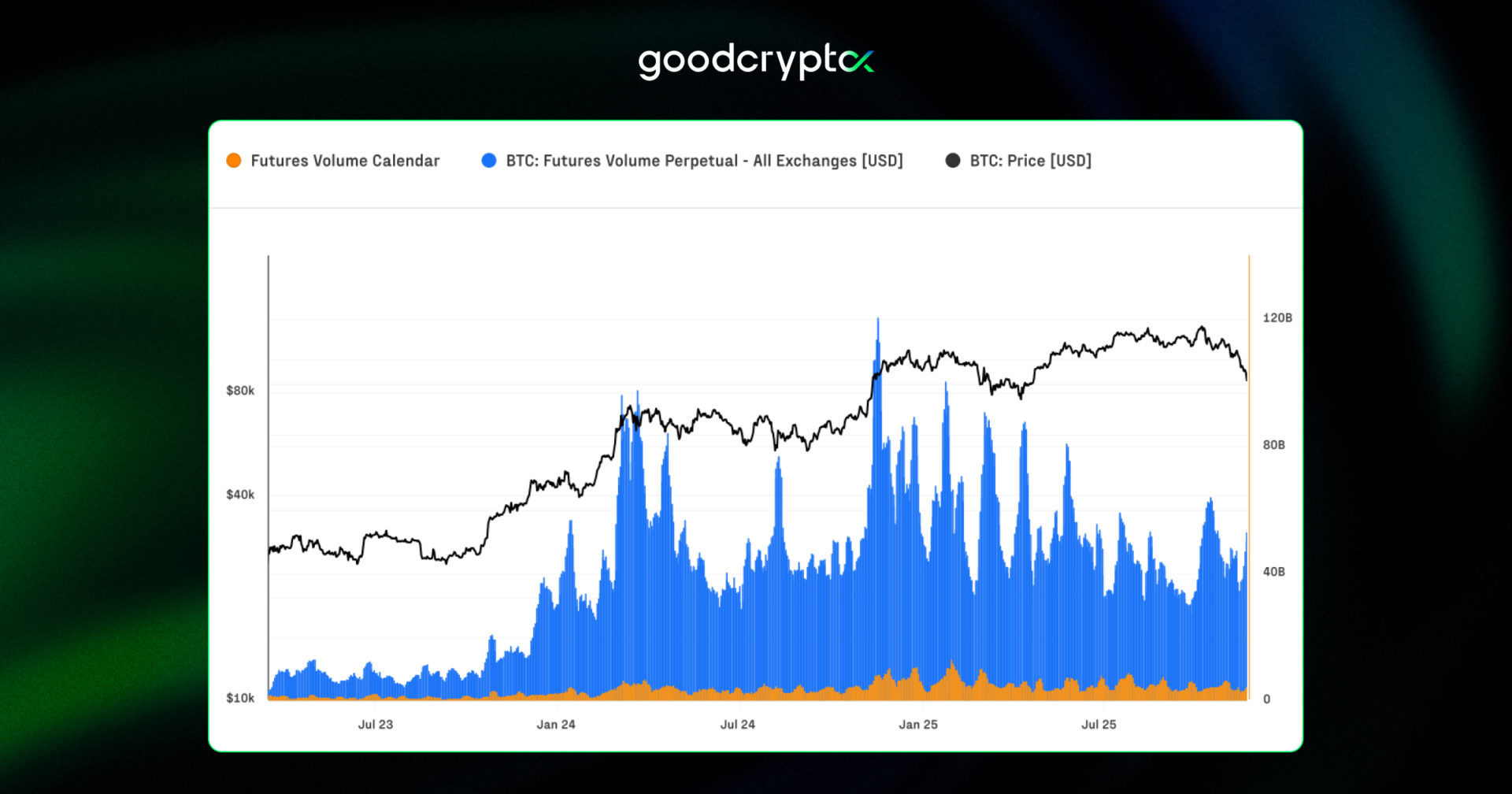

Let’s kick off this digest with a structural shift inside the derivatives market, as new data from Glassnode shows daily crypto liquidations have nearly tripled this cycle. Average daily futures wipeouts have jumped to roughly $68M on the long side and $45M on shorts, reflecting a much more heavily leveraged market than in previous cycles. The trend was highlighted by the October 10th “Early Black Friday” reset, when over $640M per hour in long positions were wiped out as Bitcoin plunged from $121K to $102K.

Source: Glassnode

Despite extreme leverage in derivatives, spot market activity is also expanding. Bitcoin’s daily spot volume has doubled versus the prior cycle, now ranging between $8B and $22B, with dip-buying clearly visible during the October crash. Since US spot ETFs launched in early 2024, price discovery has increasingly shifted to the cash market, while leverage has concentrated in futures. This dynamic has helped lift Bitcoin’s market dominance from 38.7% in late 2022 to 58.3% today, with realized capitalization climbing to a record $1.1T.

On the capital side, the scale of institutional participation continues to grow. Monthly inflows into Bitcoin now range between $40B and $190B, with more than $732B added since the 2022 bottom, more than all previous cycles combined. Around 6.7M $BTC is now held by ETFs, corporate treasuries, and institutional vehicles, with ETFs alone absorbing 1.5M $BTC since early 2024, while balances on centralized exchanges keep declining.

Beyond trading, the report also highlights Bitcoin’s evolution into a major settlement rail. Over the past 90 days, the network processed $6.9T in value, surpassing volumes handled by Visa and Mastercard over the same period. Taken together, the data paints a picture of a more institutionally anchored market structure, one where leverage-driven volatility is rising, but is increasingly underpinned by deep spot liquidity, large-scale capital flows, and real economic settlement use.

Strategy’s Bitcoin buying collapsed, company braces for bear market

Talking about institutions, Strategy has sharply slowed its buying pace in 2025. Data from CryptoQuant shows monthly purchases collapsing from 134K $BTC at the November 2024 peak to just 9.1K $BTC in November 2025, with only 135 BTC added so far this month.

Source: CryptoQuant

Despite the slowdown, Strategy still remains the largest corporate holder of Bitcoin. The company added 8,178 $BTC in mid-November, worth roughly $835M, lifting total holdings to almost 650K $BTC worth about $58.7B at current prices. However, speculation around crypto treasury firms has intensified as the broader proxy trade tied to corporate Bitcoin exposure continues to unwind alongside market weakness.

On the balance sheet side, Strategy is actively fortifying its financial position. Management has stated that BTC sales would only be considered if the company’s stock drops below net asset value or if access to financing tightens. The firm has also built a $1.4B cash reserve to cover dividends and debt servicing, targeting a 24-month liquidity buffer to weather extended market stress.

Source: Strategy

At the same time, new risks are emerging from the traditional finance side. Index provider MSCI is proposing a rule that would exclude companies with more than 50% of balance sheet assets in crypto from major stock indexes. Such a change could materially reduce passive inflows into Strategy stock.

Crypto M&A deals hit an all-time high in 2025, blowing past $8.6B

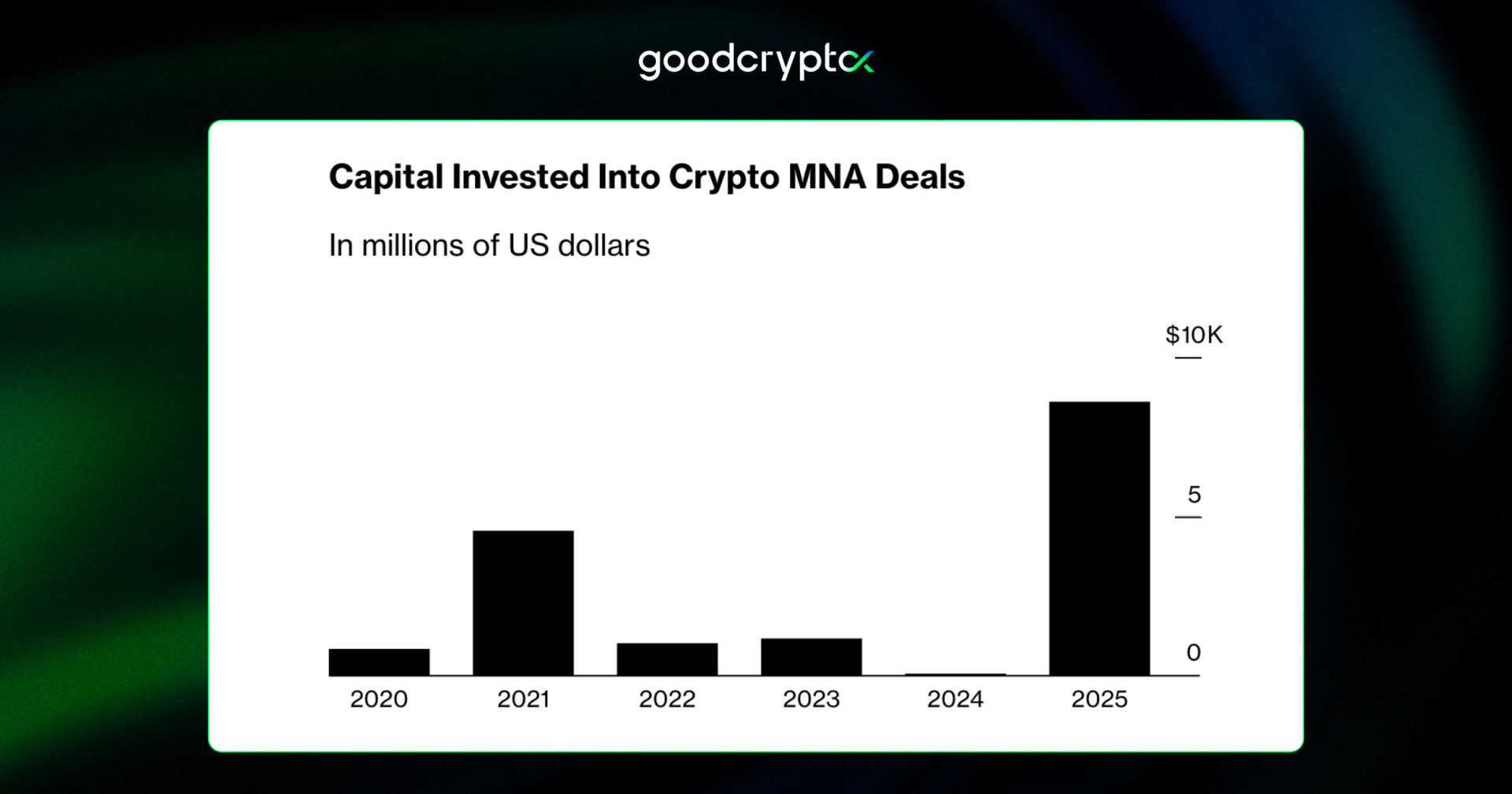

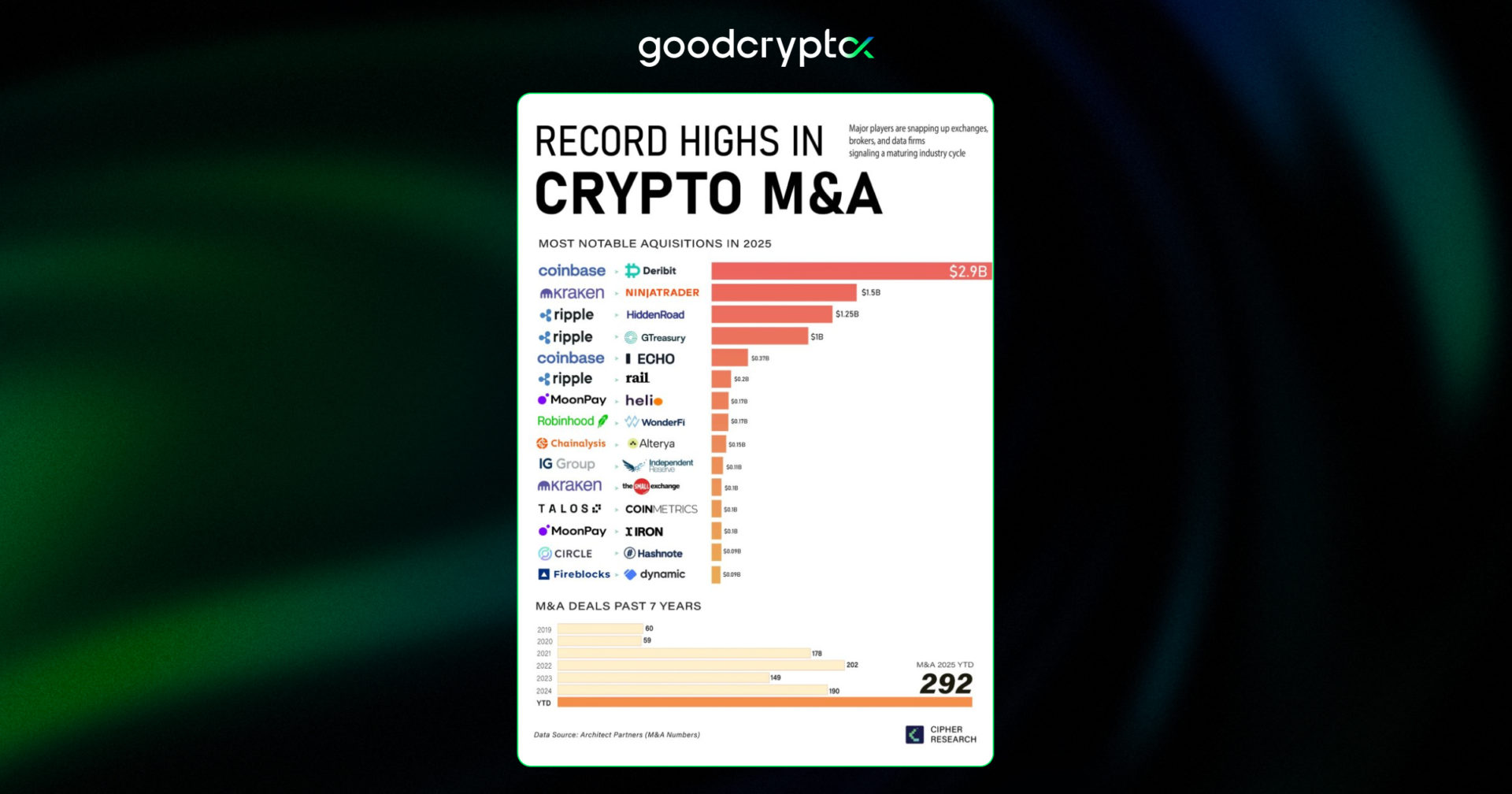

Speaking of some positive news, there is a major structural signal from the industry side, as crypto M&A activity hit an ATH in 2025, topping $8.6B across 133 deals. According to Bloomberg, citing Pitchbook, this year’s deal value alone exceeded the combined total of the previous four years, highlighting how aggressively crypto companies are consolidating despite volatile market conditions.

Source: Bloomberg

Coinbase led the acquisition spree with six major deals, including the landmark $2.9B purchase of Deribit, one of the largest derivatives platforms in crypto. Coinbase also acquired Spindl, Echo, Vector.Fun, Liquifi, and the Roam browser team, signaling a broad strategy focused on infrastructure, token tooling, and onchain distribution rather than just trading volume.

M&A expansion was also aggressive across other major crypto incumbents. Ripple completed four large acquisitions in 2025, including the $1.25B purchase of Hidden Road and a $1B deal for GTreasury to strengthen its institutional and treasury stack. Kraken followed closely with five acquisitions, expanding into futures, proprietary trading, US derivatives via Small Exchange, and tokenized equities through Backed Finance AG.

Source: Voronoi

This record wave of consolidation reflects long-term confidence in crypto infrastructure, even during a cyclical slowdown. With easing monetary policy expectations, a shifting US regulatory stance, and institutions positioning for the next growth phase, 2025 is shaping up as a strategic reset year where dominant platforms are using M&A to lock in market share ahead of the next liquidity expansion.

Polymarket is opening US app to waitlisted users after CFTC green light

Let’s wrap up our digest with some news from the prediction-market sector, as Polymarket has officially begun reopening to US users. Following regulatory clearance, the platform is rolling out access to waitlisted users first, starting with sports event contracts, with broader market categories planned next as the relaunch scales.

The green light came after the Commodity Futures Trading Commission (CFTC) issued a no-action letter to a derivatives exchange and clearinghouse acquired by Polymarket, effectively clearing the regulatory path for its return to the US market. If fully reopened, Polymarket’s valuation could reach up to $10B, underscoring the scale of demand for regulated onchain prediction markets.

Competition in the sector is intensifying. Rival platform Kalshi recently closed a $1B funding round at an $11B valuation, keeping it neck-and-neck with Polymarket. Both platforms saw explosive growth in 2024, and remain the largest prediction platforms till now.

The broader ecosystem is also heating up. Coinbase is reportedly building a prediction-market platform backed by Kalshi, while Trump Media and Technology Group plans to integrate prediction markets into Truth Social. Together, these moves point to prediction markets becoming a mainstream onchain financial primitive in the US once again.

the MACD indicator review

📊 The MACD (Moving Average Convergence Divergence) is a trend-following momentum indicator that highlights shifts in trend direction through moving average crossovers and histogram changes. It helps traders spot potential entries, exits, and reversals with precision.

Why MACD matters:

- Catch trend reversals: Spot bullish and bearish crossovers early;

- Time entries & exits: Use histogram momentum to refine trade timing;

- Confirm divergence: Detect hidden weakness or strength before price reacts.

🔥 Master the MACD indicator with a comprehensive guide from goodcryptoX.

Receive an instant notification when a new coin is listed with goodcryptoX PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the goodcryptoX app!