According to the latest report we have, there are about 51 million active crypto traders worldwide. This is an absolutely staggering figure, which amounts to about 0.6% of the worldwide population! For context, there are about 25 million software developers worldwide.

We couldn’t help but think: how many of those 51 million people deploy any sort of strategies in their trading? The answer is, on the balance of probabilities, not many. Which means a lot of people would benefit tremendously from educating themselves about trading strategies and finding what works best for them or maybe picking up a good cryptocurrency trading course.

In this article, we’re going to dwell upon some of the entry-level, yet undervalued crypto day-trading strategies and show why your trade execution and adherence to rules, in most cases, matter even more than the strategy itself.

- 1. What are the most undervalued cryptocurrency trading strategies?

- 2. Simple Moving Averages

- 3. A Confluence of RSI and MACD

- 4. Dollar-Cost Averaging

- 5. Why Execution Matters Just as Much as Having the Right Strategy

What are the most undervalued cryptocurrency trading strategies?

You’ve probably done quite a bit of research into what trading strategies are typically deployed when day-trading cryptocurrencies. And thus, you probably know that there are a LOT of strategies out there. Needless to say, most of them are outright useless. So, what parameters should you apply when selecting the right strategy? Well, one thing is for sure: do not overcomplicate. Simplicity is key, and the simpler your strategy, the easier it would be to master (provided it works, of course).

Simple Moving Averages

Here’s an example of a common SMA strategy:

Timeframe: 4H

Moving Averages: 200, 12 and 26-period Exponential Moving Averages (EMA).

Whenever the price is below the 200-EMA, you should trade with a bearish bias (only take short-side trades), and vice-versa.

Whenever the 12-period EMA crosses below a 26-period EMA, this generates a sell signal and you should sell (or cover an existing long position). When the 12-period EMA crosses the 26-period EMA, you should buy (or cover an existing short position). It is also considered good practice to place your stop-loss below a previous low.

This strategy is a great, simple indicator of convergence and divergence between medium-term momentum and the short-term momentum, showing you when the price is accelerating in either direction, up- or downside.

An example of how this could be successfully executed is shown on a screenshot below:

A Confluence of RSI and MACD

The two most-used indicators – Relative Strength Index (RSI for short) and the Moving Average Convergence-Divergence indicator (MACD) can be proven very efficient when used together.

But in order to do so efficiently, you have to understand exactly how they work. Let’s see how each of them is calculated.

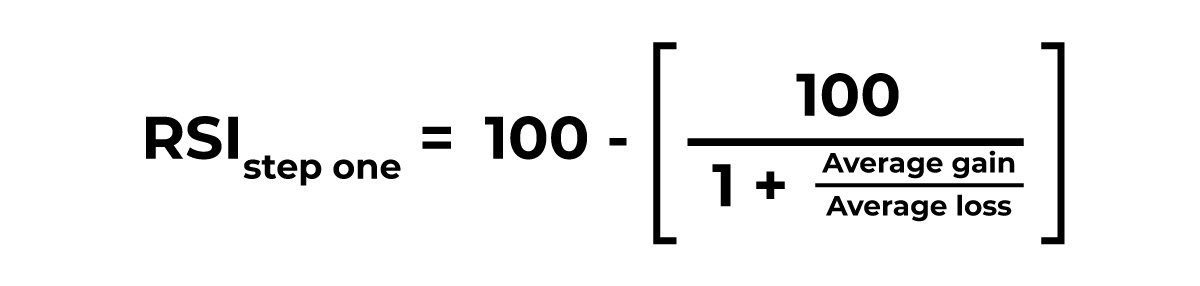

“RSI is computed with a two-part calculation that starts with the following formula: