Despite the bright expectations of an ever-growing crypto market, the reality always proves exactly the opposite, bringing massive rekt and liquidations once traders start to believe in an “up-only” market. But is there a way to protect yourself from or even start capitalizing on such market volatility?

One of the oldest yet the most effective solutions is the DCA bot. The DCA bot is an advanced trading tool that automatically averages down your position and adjusts your take-profit target when the market moves against you, increasing your chances of turning a profit during market retracements. It allows you to avoid betting on market direction and instead expect the price won’t dip drastically without a pullback strong enough to trigger your Take Profit order.

Previously, the DCA bot was available only for trading on centralized exchanges. Now, exclusively with goodcryptoX, DCA trading is available for decentralized trading, offering you all the same features of DCA trading but with no technical limitations often imposed by centralized exchanges.

But how effective is the DCA bot for DEXs in practice? Today, we’re going to find out by reviewing a real trading case from our founder Max, who achieved over 1000% APR with a DEX DCA bot on $BORK/USDC.

We already covered this case in our YouTube channel, so if you are more friendly to video reviews, you can check it out right here 👇

This is just one of several cases shared in the “DCA Tips from GoodCrypto” Telegram channel, so if you’re looking for more case reviews like this, we highly recommend joining it.

Now let’s proceed with the case review.

$BORK DCA case review

First off, let’s start with the sweetest and most exciting part – profitability.

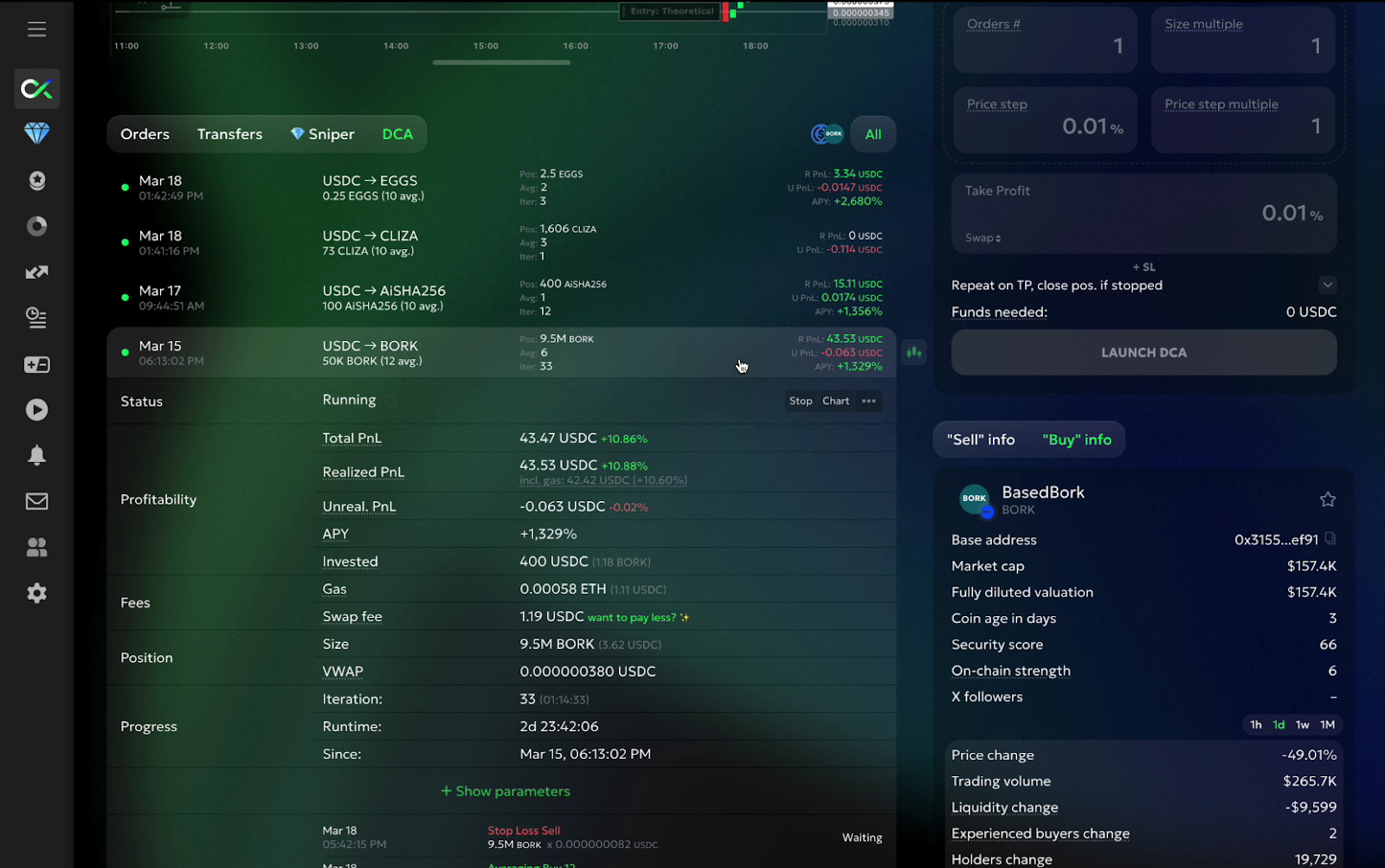

As you can see, over just three days of operation, the bot generated 43 $USDC in profit from an initial investment of 400 $USDC, resulting in a 10% ROI. When projected as an annual yield, that’s equivalent to over 1000% APR, a pretty impressive return, don’t you think so?

And the best part? It wasn’t just a case of holding a coin that happened to surge over those three days, which is extremely unlikely. On the contrary, the coin actually experienced a significant dip during that time, yet the bot still managed to generate such an incredible return.

Since most on-chain coins follow a pattern similar to $BORK, experiencing massive declines after days or months of explosive growth, this means there are plenty of opportunities to capitalize using our DEX DCA bot with the setup we’ve already proven to work.

Alright, enough bragging about the bot. Let’s move on to the actual setup and try to understand the idea behind these settings.

DCA bot settings

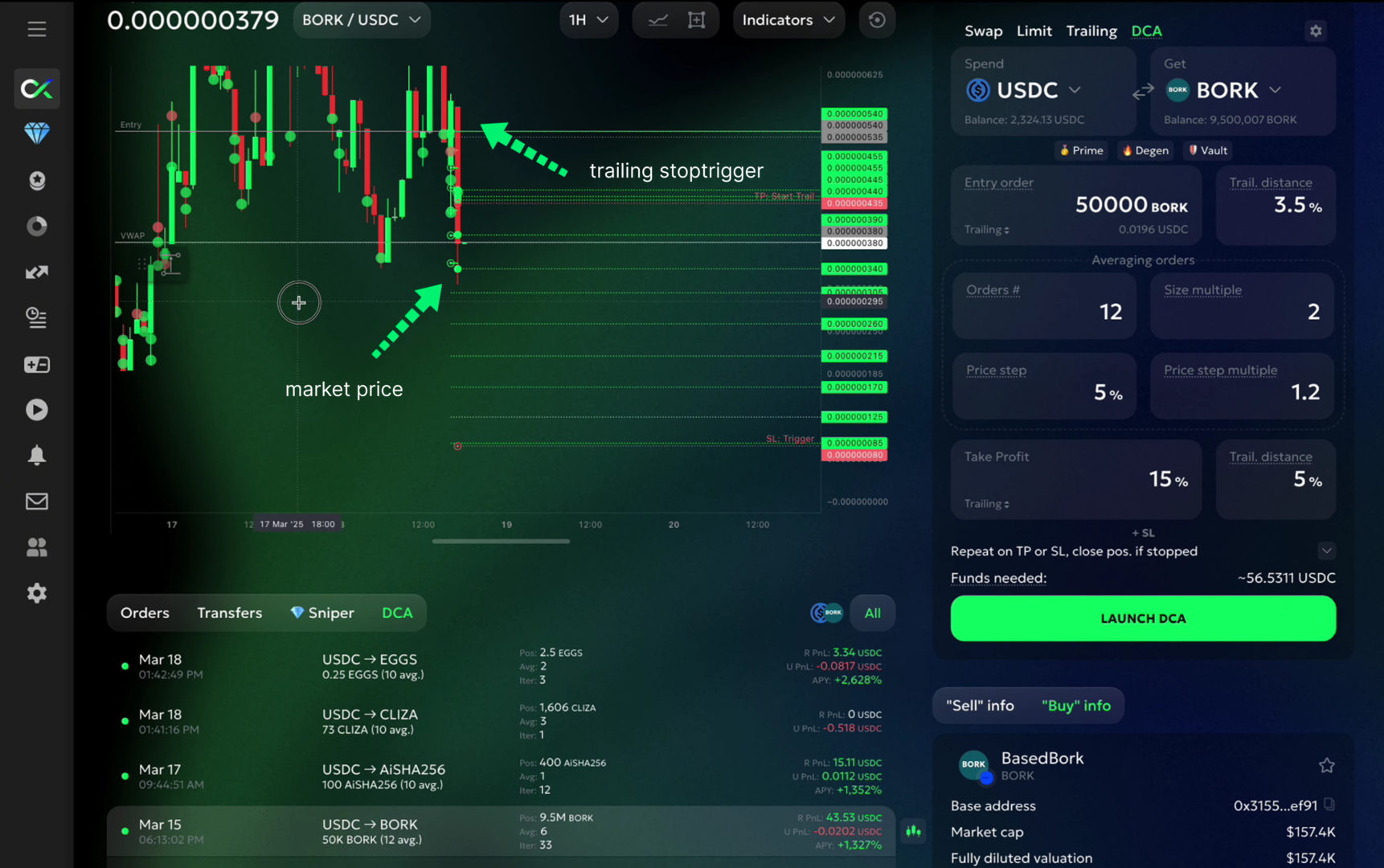

The full settings of the bot are as follows:

- Network: Base;

- Entry order: trailing;

- Trailing distance: 3.5%;

- Averaging orders number: 12;

- Size multiple of avg. orders: 2x;

- Price step of avg. orders: 5%;

- Price step multiplier of avg. orders: 1.2x;

- Take profit level: 15%;

- Take profit order: trailing;

- TP trailing distance: 5%.

Now, let’s dive into why these settings were implemented.

The first key setting that influenced the bot’s profitability was the use of trailing stop orders for both take profit and entry orders. A trailing take profit order is designed to capture additional returns if the price continues to rise after reaching the initial profit target. With a sell order placed below the current market price, it follows the price upward, maintaining a sell order just below the current price, and only closes the trade after a significant price pullback, locking in profits.

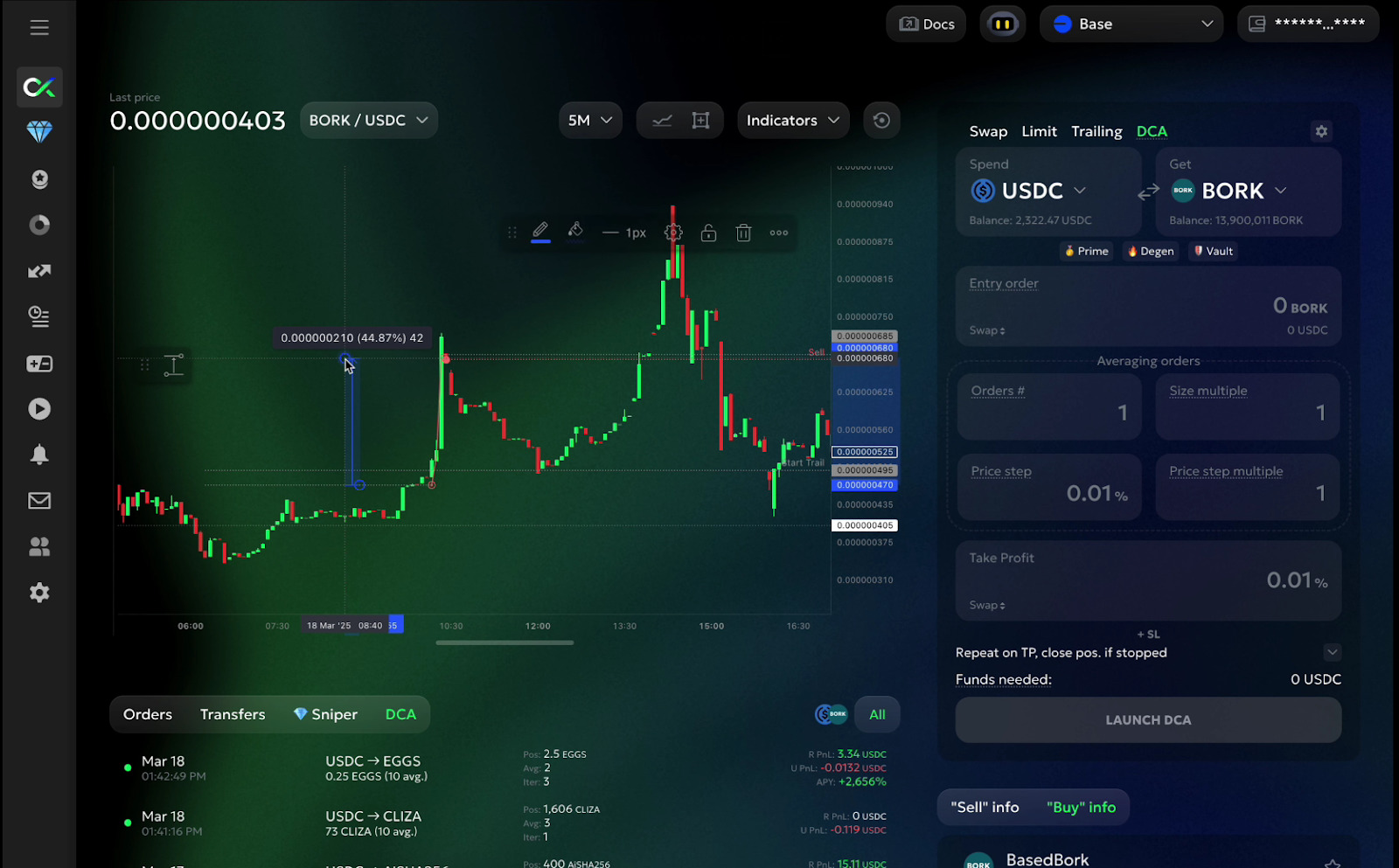

A clear example of how a trailing take profit order works can be seen in this case. In the screenshot below, you can observe how the price hit the initial take profit target, activated the trailing order, and then climbed over 40% further.

All the way up, the trailing take profit followed the price, increasing the final profit and closing the trade only after the momentum faded. In the end, Max managed to earn 18 $USDC out of the total 40 $USDC profit in a single trade!

A similar idea was behind the implementation of the trailing entry order. However, in this case, a buy order was placed above the current market price, trailing the price as it moved downward and only entering the market once it started retracing upward. By using a trailing stop entry order, Max added an extra layer of risk protection and aimed to optimize his entry price by avoiding positions during downward price movements.

Finally, there are the averaging order settings. With volatile tokens like $BORK, it’s crucial to prepare for large price fluctuations and cover a wide range of potential price drops. That’s why Max set up 12 averaging orders, starting with a 5% gap between them and using a 1.2x price step multiplier. As a result, these orders covered a range of over 80% below the initial entry price.

This setup allowed the bot to avoid hitting its stop-loss order in almost any market scenario, except a rug pull, since it’s highly unlikely for a coin to drop over 80% without at least a 15% retracement, and trigger the take profit order.

That’s all for this case!

Conclusion

DCA trading bot is one of the most popular and effective trading tools to profit from market volatility, previously available only on CEXs. However, with goodcryptoX, you can bridge this feature to the even more volatile DEX trading realm, offering multiple advantages compared to CEXs:

- Access any coin: Trade coins before they hit centralized exchanges. Similarly, if you want to trade a specific coin available on the centralized exchange you’re not registered on, you can now access it via DEXs.

- Trade any pair: Profit from the volatility of any coin against any other. Want to trade $BORK against $VIRTUAL? Do it!;

- No limits: Enjoy complete trading freedom, without the restrictions often imposed by CEXs when using DCA strategies. Trade within any price range, place any number of orders, and choose any position size – completely without limitations with the DEX DCA bot by goodcryptoX.

This $BORK DCA bot on Base is a clear example of the key advantages of DEX trading. $BORK isn’t listed on any CEX, and centralized platforms would hardly allow you to cover a 90% price drop using averaging orders. That’s why a DEX DCA bot is a must-have tool in every serious DEX trader’s arsenal.

If you’d like to explore more cases like this, check out our “DCA Tips by GoodCrypto” TG channel. We welcome new members, ideas, experiences, and questions!