👋 Hey there!

A new week brings another round of major events shaping the crypto industry! Let’s dive into the most notable highlights in this crypto digest! 👇

quick weekly news

Elizabeth Warren pledges to work with Trump to end debanking of crypto firms

After years of the so-called operation “Choke Point 2.0” appeared during the Biden administration, it seems that Democratic representatives have finally joined Republicans in opposing such an initiative. Hence, on February 5th, 2025, during the Senate Banking Committee hearing on debanking, Senator Elizabeth Warren highlighted complaints from multiple top crypto companies alleging debanking.

In that meeting, she also asked Nathan McCauley, Anchorage Digital co-founder and CEO, whether he had encountered such issues over the past few years. Additionally, she questioned Brookings Institution’s Aaron Klein on how Consumer Financial Protection Bureau (CFPB) could stop “unfair debanking.”

In response, McCauley explained the situation within the digital asset industry and provided evidence that U.S. government officials had engaged in a concerted effort to debank crypto firms, colloquially referred to as “Operation Choke Point 2.0.” He claimed that “dozens of crypto leaders” have faced such challenges and suggested that “regulators pressured banks to cut off services to the crypto industry.”

As a result, Elizabeth Warren acknowledged that “debanking is a real problem” and pledged to take action. “This shouldn’t be happening, and we need to figure out why and who is responsible,” she said.

White House crypto czar David Sacks pushes for a “Golden Age” for digital assets

On Tuesday, February 4th, 2025, the newly appointed White House AI and crypto czar, David Sacks, announced collaborations with lawmakers on potential regulations for digital assets, aiming to establish the U.S. as a leader in the digital asset industry.

According to his interview with CNBC, Congress will form a joint working group to develop robust crypto regulations. “They are very committed to moving legislation through the House and the Senate this year to provide a clear regulatory framework that the digital assets ecosystem needs to sustain innovation in the United States,” he said.

Stablecoins also received special attention, as most stablecoins in the market are currently USD-backed. Encouraging the healthy growth of the stablecoin industry could reinforce the U.S. dollar’s dominance worldwide. Currently, the largest stablecoin issuer, Tether, with its $USDT stablecoin, is ironically not based in the U.S., and it seems the crypto czar is looking to change that.

Furthermore, David Sacks announced that existing regulatory frameworks will be revised and better adapted for digital assets, aiming to prevent capital from flowing out of the U.S. to more crypto-friendly countries like Switzerland or Singapore. “I look forward to working with each of you in creating a golden age in digital assets,” Sacks said

Law firm demands Pump.fun remove over 200 memecoins using its IP

However, not everyone in the U.S. is trying to adopt crypto or understand its technology. The law firm Burwick Law, which previously sued Pump.fun over allegations of investor harm, is now demanding that Pump.fun remove over 200 memecoins that use its name, logo, employees’ names, and even its plaintiffs’ names. According to an announcement on Twitter, Burwick Law stated that it “confirmed that PumpFun has the technical capability to remove these tokens and has chosen not to act, despite the clear financial and legal risks posed to the public.”

For context, these coins emerged after Burwick Law announced its lawsuit against Pump.fun over alleged investor harm. On one hand, this concern seems reasonable, as many users suffered losses on this memecoin launchpad. On the other hand, Pump.fun does not bear direct responsibility for what happens with tokens created on its platform. Burwick Law’s lack of understanding of blockchain technology appears to have led to the rise of memecoins mocking the firm, with users creating tokens using its logo and giving them offensive names like “Dog Shit Going Nowhere ($DOGSHIT2),” among others, to troll the company.

As a result, Burwick Law has issued questionable demands to Pump.fun, insisting that these specific tokens be removed as they are not associated with the firm. However, the bigger question remains: What role does Pump.fun truly plays in the launch of these memecoins, and how can it even delete an existing token contract address?

Bitcoin reserve may end up a ‘potent political weapon’ — Arthur Hayes

On February 6th, 2025, the Maelstrom Fund chief investment officer and founder of the BitMEX exchange released an essay titled “The Gene”, addressing the often-overlooked downsides of potential Bitcoin strategic reserves. He argues that a Bitcoin strategic reserve in the U.S. could be a “net negative” for the industry, as it may be used more as a political tool than a financial asset. Additionally, there is a significant risk that a Bitcoin reserve could be dissolved if the Democrats win the 2028 U.S. election and reinstate their aggressive policies toward crypto, potentially resulting in the liquidation of the Bitcoin strategic reserve.

“Broadly speaking, many misguided crypto folks wish for the U.S. government to print dollars and purchase Bitcoin as part of a national stockpile. I believe these folks are asking for the wrong things,” he said.

The core argument is that in case of creating a large Bitcoin reserve “There would be 1 million Bitcoin just sitting there, ready to be sold,” and it would take only “a signature on a piece of paper” for them to be liquidated. Even if such an event never occurs, the mere possibility would create massive selling pressure on the entire crypto market, particularly Bitcoin. He further suggests that if U.S. President Donald Trump fails to curb inflation, end wars, and stabilize the food supply by 2026, the Democrats could gain political momentum, reclaim a House majority, and potentially “punish” crypto investors who supported the “Orange Man.”

The most concerning aspect of these claims may be Trump’s recent announcements of trade wars with Canada, China, Mexico, and potentially the EU, which are expected to drive prices higher and fuel inflation. While the proposed trade measures involving Canada and Mexico have yet to be implemented, Monday’s market downturn – marking the largest liquidation of funds since the FTX collapse – suggests that this is a highly sensitive issue for crypto investors, even without factoring in the potential return of the Democrats to the White House.

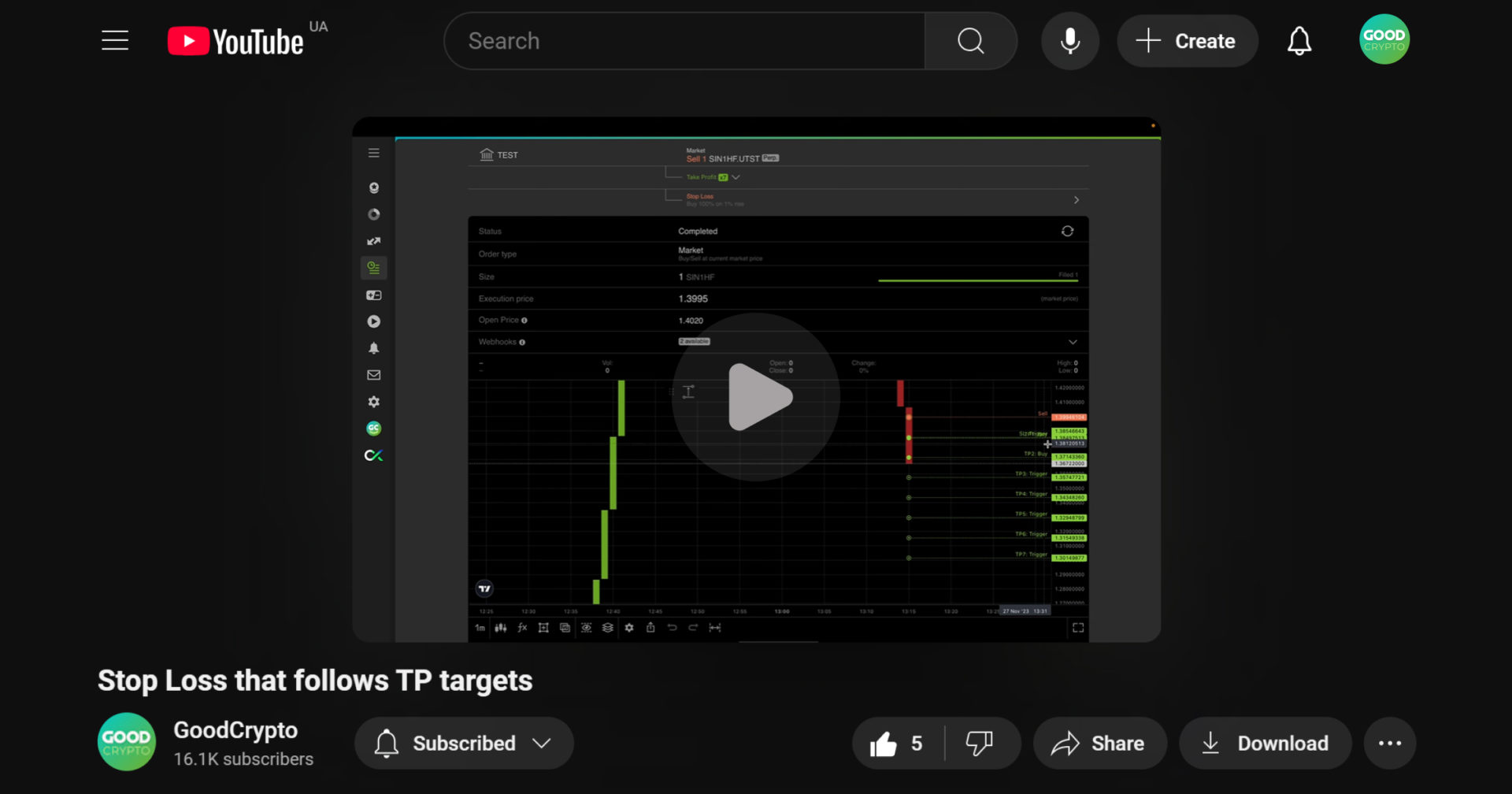

SL that follows TP targets

📈 The Stop Loss auto pull-up feature that lets you dynamically adjust your SL as Take Profit targets are hit. By following your TP levels, the bot reduces potential losses while securing achieved profits, giving you tighter risk control.

This tutorial will help you answer the following questions 👇

🔸 How does Stop Loss follow TP targets?

🔸 How to set up break-even and follow-TP strategies?

🔸 What are the advantages of using this feature in volatile markets?

Check out our in-depth video guide and master the art of strategic risk management with GoodCrypto! 💪

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!