Hey there! 👋

This week has brought us some remarkable news and events, shaping the crypto industry. Let’s recall some of the most interesting ones in our weekly digest. If you would like to receive more updates on the crypto market, follow us on Twitter.

quick weekly news

Ethereum ETFs post $133M of outflows on the second day of launch

The recently approved eight Ethereum exchange-traded funds (ETFs) have caused a net inflow of over $133M on the second day of their launch. This has completely reversed the first day’s inflow of over $26M, which had caused a massive dip from $3,336 to the seven-day lows of around $3,170.

Source: Fairside investors

According to the table of Ethereum ETF flows by Fairside Investors, the most outflows were from Grayscale’s ETHE ETF, which for two consecutive days brought outflows of over $484M on the launch day and $326.9M on July 24th, 2024.

It’s important to note that this outflow wasn’t coincidental: ETHE was launched by Grayscale back in 2017, allowing institutional investors to purchase $ETH. However, upon converting ETHE to a full-fledged ETF, Grayscale had imposed a six-month lockup period on all investments. After July 22nd, 2024, these limitations were removed, enabling a large portion of investors to sell their assets sooner.

Meanwhile, the BlackRock iShares Ethereum ETF is leading overall Ethereum ETF inflows, attracting over $266M of funds on the first day and $17.4M on the second day of launch. The second-highest inflows during these two days were for Bitwise, with an impressive $204M inflow on the first day and a significantly lower $29.6M inflow on the second.

Hashdex files S-1 for ETF to hold Bitcoin, Ether and potentially others

On July 24, 2024, the digital asset manager Hashdex filed an S-1 application for its Crypto Index US ETF. Currently, the Index will consist of Bitcoin and Ethereum only, but more assets could be included in the future. Quote:

“If any crypto asset other than bitcoin and ether becomes eligible for inclusion in the Index, the Sponsor will transition to a sample replication strategy, with only bitcoin and ether in the same proportions determined by the Index,”

The other cryptocurrencies which may be added to Hashdex’s Index might be Litecoin, Chainlink, Uniswap, Filecoin, Bitcoin Cash, and Stellar, as they are already listed in the Nasdaq Crypto Index Settlement Price. The proportions of crypto in the Index will be determined according to market caps of listed coins. For example, if Hashdex’s Index were listed today, it would have approximately 76.3% Bitcoin and 23.7% Ethereum ratio.

Bitcoin mainnet receives first-ever verified ZK-proof

At 11:22 pm UTC on July 24 the BitcoinOS, Bitcoin rollup protocol, have successfully verified the first ZK proof on the Bitcoin’s mainnet. Previously, on Bitcoin was available only Optimistic rollup technology, as Zero-Knowledge wasn’t available on the Bitcoin network because of its complexity.

BitcoinOS is powered by the ZK Succinct Non-Interactive Argument of Knowledge, or zk-SNARK that will enable creation of the “near-trustless bridges” bridges between Bitcoin’s L1 and L2 networks. This is achievement will also unlock the offering new levels of functionality such as building DAOs, DeFi, etc. on Bitcoin and scalability without requiring any changes on network’s base layer for Bitcoin’s future L2 networks.

Edan Yago, co-founder of BOS, said the development of ZK technology on Bitcoin “represents an era where Bitcoin is no longer just digital gold. Quote:

“It is also an operating system and a platform on which the entire world of decentralized applications can be built. […] This marks a chapter where Ethereum, Solana and all of the other layer-1 projects are no longer safe from competition by Bitcoin.”

Nigeria to train 1,000 youths on AI, blockchain every year

Recently, the Nigerian government launched an initiative to train 1,000 Nigerians annually on various cutting-edge technologies such as AI and blockchain, as it expects these industries to “overtake the world economy”.

To start the training program, the government partnered with tech company Gluwa, while Nigerian Vice President Kashim Shettima announced financial grants of over 150,000 Nigerian naira (approximately $90) to incentivize the development of a home-grown fintech industry. Quote:

“We are adopting this initiative across the nation to create a network of tech hubs that will power Nigeria’s economic growth for decades to come.”

Earlier in July, the NITDA in Nigeria also revealed plans to establish several research centers specialized in AI, Internet of Things, and blockchain across the country’s six geopolitical zones. What do you think on Nigerian’s rush toward innovations and new technologies? 🤔

How to Read AWO (Avesome Oscillator) Indicator?

Awesome Oscillator (AWO) is is a momentum indicator that helps traders find reversal signals for the current trend. It is mostly used to measure market momentum and determine trend directions.

How to read AWO indicator:

The indicator’s bars can oscillate above or below the zero value, depending on whether the fast SMA is above or below the slow SMA.

🔸 Positive AWO Zone: If the bars are placed above the Zero value, the AO zone will be positive, signallying of the bullish momentum.

🔸 Negative AWO Zone: If the bars are placed below the Zero value, the AO zone will be neagtive, signallying of the bearish momentum.

Want to learn more about the Awesome Oscialltor? Discover our full Awesome Oscillator review and start implementing this powerful tool in your trading strategy! 📈

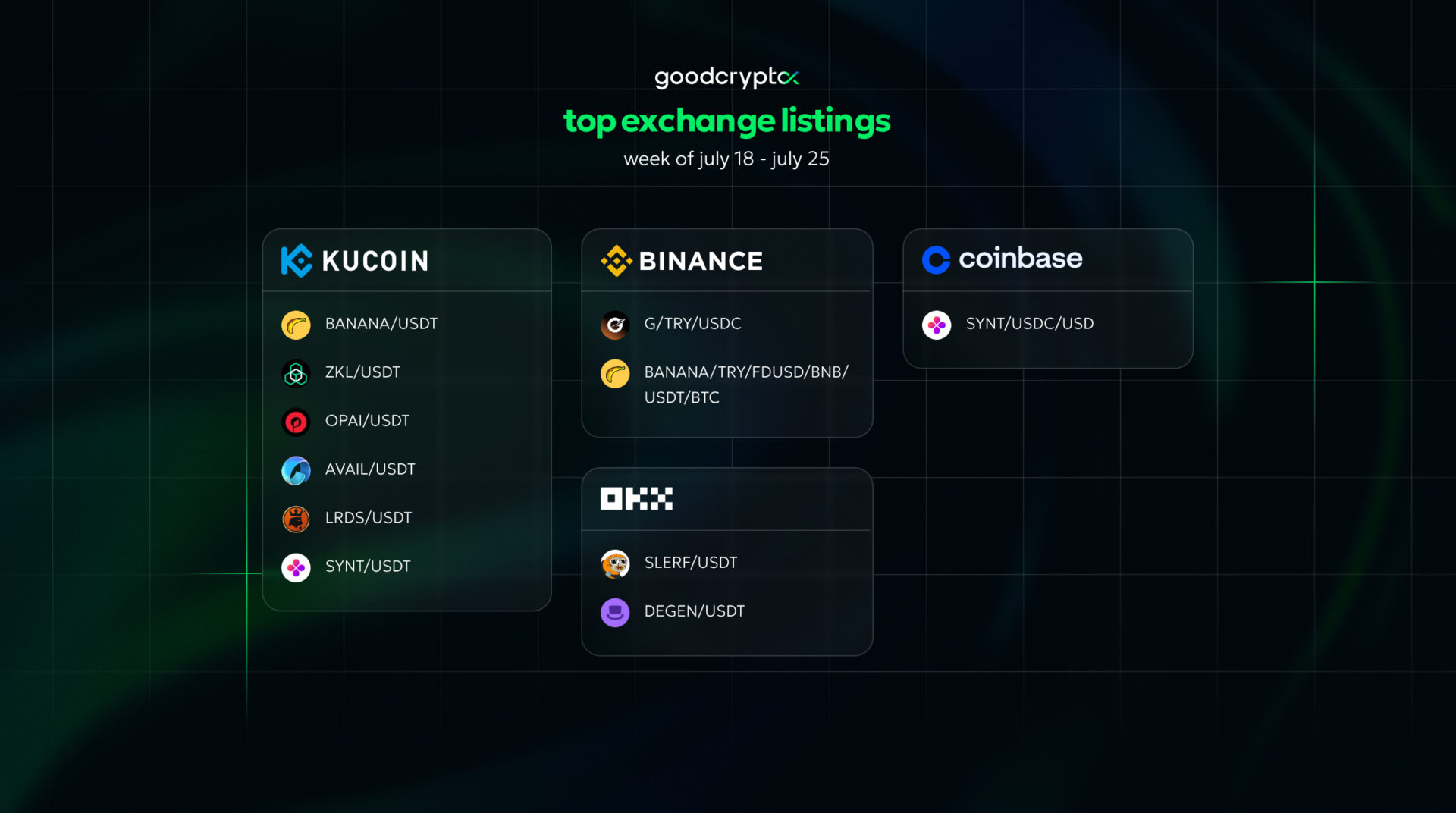

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!