Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want these updates as soon as we post them, follow us on Twitter.

quick weekly news

Ethereum spot ETFs could attract $15B by end of 2025

Bitwise chief investment officer Matt Hougan has declared that we may see new inflows of up to $15B by the end of 2025, caused by Ethereum ETF approvals. He based his research on an analysis of available data, including a comparison of ETH market cap to Bitcoin’s, the global crypto ETP market, Grayscale’s Ethereum Trust (ETHE) conversion, and spot Bitcoin ETFs’ “carry trade”.

He found that in regions where both ETFs have already been approved, Bitcoin ETPs account for approximately 78%, while Ethereum ETPs represent around 22% of the total assets under management. Considering his prediction that Bitcoin ETFs will rise from $56B to nearly $100B as “these ETFs mature” and subtracting ~$3B for conversion, he expects to see a net flow of $15B into Ethereum ETFs by the end of 2025.

Bitcoin Mayer Multiple hits lows that last accompanied $30K BTC price

Popular investment analyst On-Chain College stated that Bitcoin’s recent 17% correction puts the first cryptocurrency at a Mayer Multiple level of 1.05, not seen since October 2023. The analyst strongly suggests this may be one of the indicators of potential recovery in Bitcoin’s price and even reaching new highs.

Quote: “A healthy reset of sentiment to shift back bearish while being at twice the price.”

Furthermore, the analyst added that for Bitcoin/USD to reach its peak, achieved in March 2021 at 2.4 level, the Bitcoin price would need to be nearly $140,000. However, this indicator doesn’t always correspond to BTC price floors. In mid-2022, the indicator bottomed at around 0.47, but recovery occurred only four months later.

Blast token rallies 40% after $2B airdrop debut

$BLAST – the native token of the top 3 by TVL Ethereum L2 network with native Ethereum yield – experienced a surge with an impressive 40% gain right after the token airdrop and release on June 16th, 2024. This comes in contrast to other recently launched top-tier projects, such as zkSync ($ZK) or LayerZero ($ZRO), whose tokens have fallen 46% and 43% from launch, respectively.

However, the airdrop attracted some criticism from crypto market commentators on X, as the FDV of the project at release was a few times lower than the community was expecting to see, thereby making the airdrop less valuable than anticipated. Arthur Cheong, the co-founder of crypto investment firm DeFiance Capital, said BLAST’s launch at the $2 billion FDV was a surprise for him, suggesting that the times when projects launch at $20B valuation are probably over.

It is also important to note a recent article by investment analyst Cobie which claimed that “high FDVs and low Initial MCs” do not allow space for retail investors to make upside gains.

Crypto losses to deep fakes could reach $25B in 2024

Crypto exchange Bitget stated that deepfake tricks and scams are set to cause over $25 billion in losses in 2024, which is 245% more than last year’s losses, with $6.3B lost in the first quarter of 2024. This is a 217% increase compared to Q1 2023, according to Bitget Research. Bitget has also added that this trend is expected to continue in 2025, so we could see losses of $10B per quarter in 2025.

The regions with the most deepfakes detected in the first quarter of 2024 are China, Germany, Ukraine, the United States, Vietnam, and the United Kingdom.

Bollinger Bands indicator

Bollinger Bands is one of the most popular trading indicators for recognizing market momentum in technical analysis. It’s primarily used to determine if a market is oversold or overbought and helps traders analyze whether a market is trending or range-bound.

Trading strategies:

🔸 Trading the range: Create an easy-to-use range by marking upper and lower edges. When scalping, trade within this range, buying or selling accordingly as the price touches the lower or upper lines.

🔸 Trading breakouts: Spot potential squeeze breakouts after prolonged range-bound periods using the Bollinger Bands indicator and leverage them to your advantage.

💡Pro tip: Signals given by Bollinger Bands are stronger when using longer time frames, as the SMA 100 is more robust than the SMA 20 due to its extended period.

Want to master Bollinger Bands and implement them in your trading strategy? Explore our comprehensive article to dive deeper into this powerful indicator! 📈

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

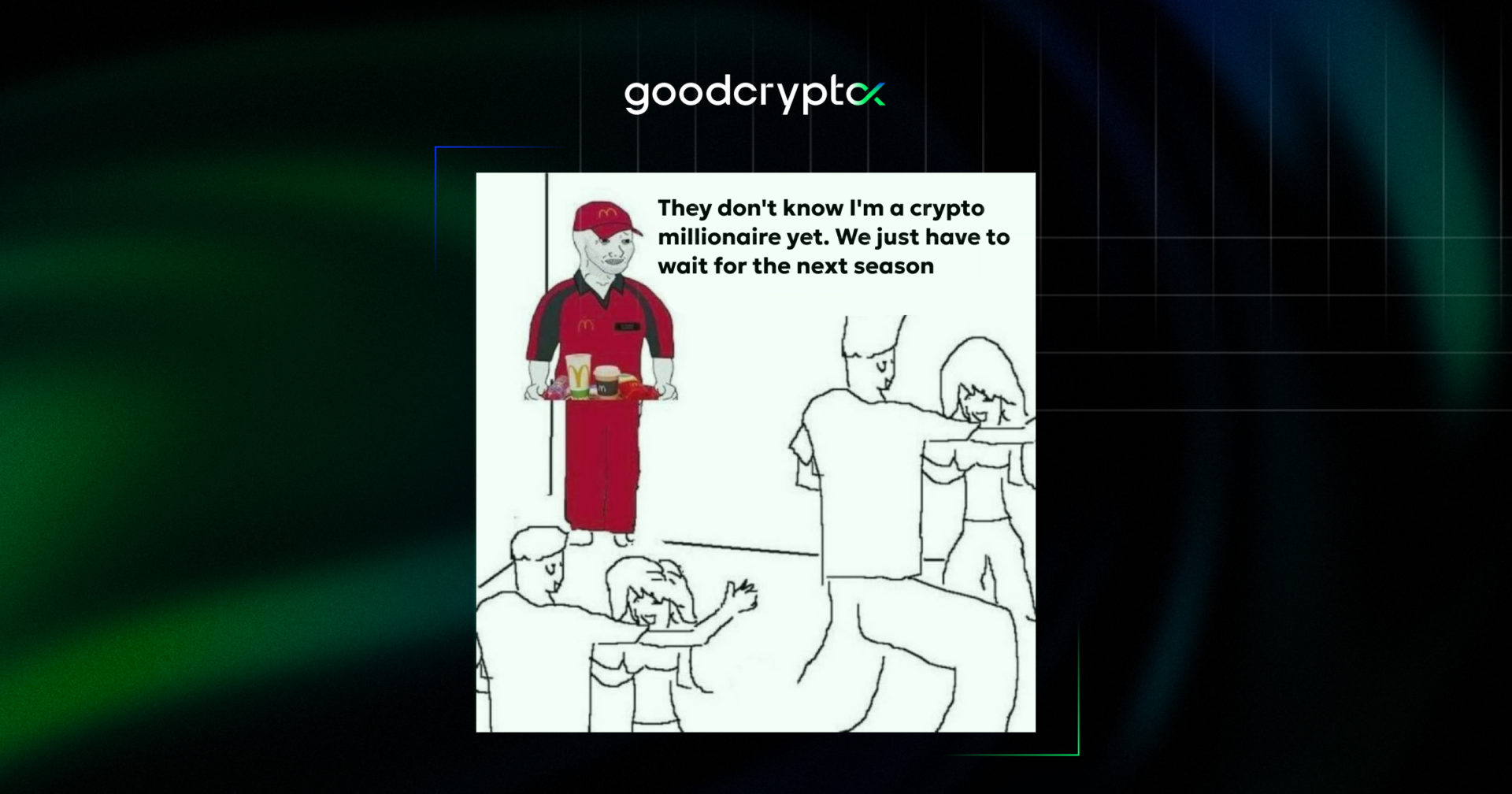

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!