Discover the power of MEXC with GoodCrypto! Advanced tools like bots, trailing stops, and smart TA signals and TradingView webhooks at your fingertips.

EU parliament nears world’s first AI law

Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want these updates as soon as we post them, follow us on Twitter.

quick weekly news

EU parliament nears world’s first AI law

The European Parliament committee has taken a historic step, greenlighting the world’s first legislation focused on artificial intelligence. This paves the way for the “AI Act,” which will establish guidelines for AI use across various industries, including banking, healthcare, and transportation.

The act aims to balance innovation with safeguards for citizens’ rights and data protection. It will oversee powerful AI models and prohibit practices like social scoring and biometric categorization. The vote follows approval by EU member states, with final approval by the full parliament expected in April.

While some businesses have expressed concerns about overly strict regulations hindering innovation, the European Commission is taking steps to support local AI development and ensure smooth implementation.

Bitcoin bulls charge towards $69,000 as crypto market nears $2 trillion

Bitcoin surged to new two-year highs on February 14th, reaching $51,000 and pushing the entire crypto market capitalization close to $2 trillion. This bullish rally follows Bitcoin’s recent recovery from a dip to $48,400 and comes as major analysts predict further price increases.

Analysts attribute the surge to several factors, including strong buyer interest, increasing institutional investments through ETFs, and the upcoming Bitcoin block subsidy halving in April. Some traders even suggest a potential price target of $69,000.

Despite concerns about overheated markets, Bitcoin’s momentum seems unstoppable, raising anticipation for the future of the cryptocurrency.

BlackRock’s Bitcoin ETF surpasses 100,000 BTC

BlackRock’s iShares Bitcoin Trust reached a milestone, holding over 100,000 BTC, just 22 days after its launch. This rapid accumulation signifies strong investor appetite for the spot Bitcoin ETF.

IBIT’s holdings have grown by over 3,700% since January, highlighting its success compared to GBTC, which has been actively selling BTC. Combined daily inflows for all spot Bitcoin ETFs reached a record $631.3 million, with IBIT attracting the largest share ($493 million).

This news coincides with Bitcoin’s surge past $51,000, its highest point since November 2021. The increasing demand and positive market sentiment suggest continued growth for Bitcoin and spot Bitcoin ETFs.

Ledger and Coinbase partner: buy crypto, store it securely

Ledger and Coinbase join forces to simplify crypto purchases and self-custody. Users can now buy crypto on Coinbase and receive it directly on their secure Ledger hardware wallet, eliminating error-prone transfers.

This partnership aims to attract new crypto users through ETFs and introduce them to the benefits of self-custody, “the true use case for crypto” according to Ledger. The integration resembles how “Skyscanner simplified booking travel,” says Ledger’s Chief Experience Officer, highlighting its user-friendly approach.

This move comes amid a new crypto cycle fueled by recent spot Bitcoin ETF launches. With more users entering the space, Ledger and Coinbase offer a seamless path to buying and securely storing crypto.

Awesome Oscillator and MACD trading strategy

🧐 Confused by Awesome Oscillator and MACD? Don’t sweat it! Though similar, they differ in key ways:

- Speed: MACD reacts faster with its EMAs, while AO uses slower SMAs, making it better for shorter timeframes.

- Price Reliance: AO uses the median price, MACD uses the closing price (considered more reliable).

Despite their differences, the AO and MACD can be a powerful duo when combined. The AO can act as a confirmation tool for the MACD’s signals, reducing the risk of false positives.

🦾 Here’s a winning strategy to leverage this synergy:

- MACD signals the trend: Wait for a bullish crossover (MACD line above Signal Line).

- AO confirms: Look for AO to enter the positive zone, solidifying the bullish momentum.

- Enter & Exit: Buy when both agree, close when AO rises above the MACD histogram to lock profits.

🔍 Want to take your trading to the next level? Our in-depth guide on the Awesome Oscillator equips you with everything you need to know about this powerful indicator.

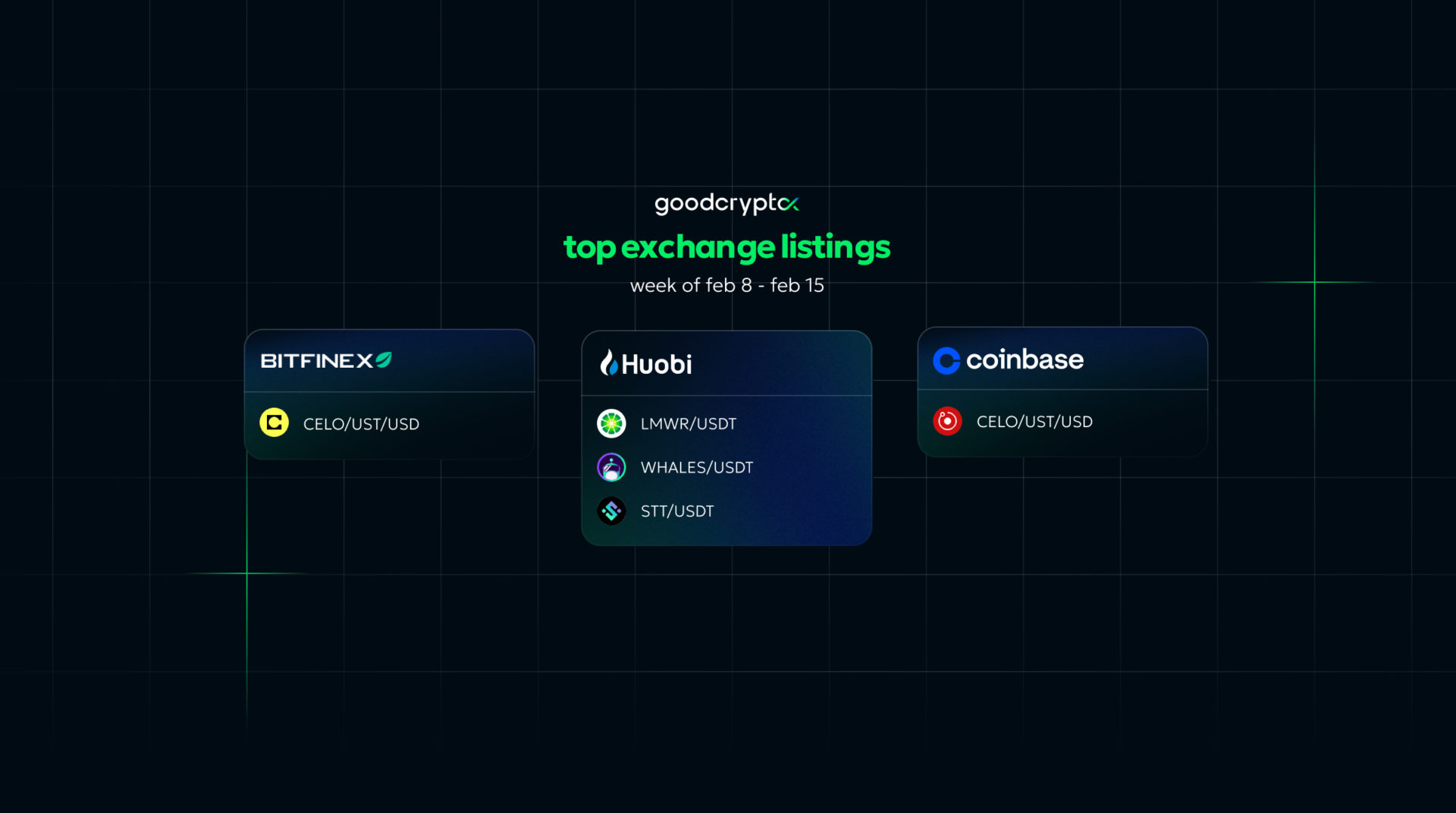

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!

Share this post:

February 15, 2024