Hey there!

This week was packed with some controversial news, but overall, market sentiment remained positive. Let’s dive into what happened in the crypto space over the past seven days:

quick weekly news

Fed cuts interest rate

In the middle of the week, the crypto market was influenced by positive news from the Fed’s monetary policy meeting. On December 9, 2025, the agency announced a third consecutive interest rate cut of 0.25%, bringing the range to 3.50%–3.75%.

The decision was driven by a continuing trend of a “gradually cooling labor market,” despite inflation remaining “elevated,” according to Jerome Powell. Additionally, Powell announced the start of purchases of shorter-term Treasury securities, aimed solely at “maintaining an ample supply of reserves over time, thus supporting effective control of our policy rate.”

Overall, the Fed chair described the economy’s growth as progressing at a “moderate pace,” noting that consumer spending and business investment remained solid, a positive signal for financial markets. He also shared projected GDP growth for 2025 and 2026, with real GDP expected to grow 1.7% this year and 2.3% next year. According to Powell, the current economic state has been slightly above the projections made in September.

However, Bitcoin didn’t react much to the Fed’s announcement, as the rate cut was likely already priced in.

UK financial watchdog declares sterling stablecoin payments ‘a priority’ for new year – DLNews

Another piece of bullish news came from the United Kingdom, as the government reportedly plans to initiate the adoption of dollar- and pound-backed stablecoins as a primary goal for next year.

According to DLNews, this move aims to boost the UK’s economic growth, support initiatives to digitalize financial services, enhance international trade competitiveness, and expand lending services to small businesses. The media outlet also reported that FCA Chief Executive Nikhil Rathi informed UK Prime Minister Keir Starmer that they are planning to “finalize digital asset rules and progress UK-issued sterling stablecoins.”

This initiative comes after the UK lagged behind its key allies, the US and the EU, in developing crypto policy. Previously, the government had taken a wait-and-see approach, observing whether the other markets faced crashes before deciding on a strategy. It seems that now the UK has finally committed to catching up with the US and EU in terms of crypto adoption policies.

However, the question remains: how significant was the UK’s policy lag? As DLNews notes, pound-backed stablecoins accounted for only $6M of the $308B stablecoin market, which is dominated by the US dollar. Had the government acted sooner, the situation might have looked very different.

SEC Chair Atkins Says Many Types of Crypto ICOs Are Outside Agency’s Purview

Meanwhile, SEC Chair Paul Atkins recently stated that most types of crypto ICOs do not fall under the agency’s jurisdiction. “Those sorts of things would not fall, as we would define it, into the definition of a security,” he said.

Atkins was referencing the token taxonomy disclosed earlier, noting that network tokens, digital collectibles, and digital tools should not be considered securities. As a result, ICOs conducted by projects in these areas would also be classified as non-security transactions and would not be regulated by the SEC. “ICOs transcend all four topics… Three of those areas are on the CFTC side, so we’ll let them worry about that, and we’ll focus on tokenized securities,” he added.

The only category Atkins indicated should be regulated by the SEC is tokenized assets.

GameStop Stock Falls After Bitcoin Holdings Lose Value, Firm Says It Could Sell BTC

However, this week also brought some negative news. GameStop, the large American video game retailer that became famous after the 2021 short squeeze initiated by WallStreetBets, may sell its Bitcoin holdings following the recent market dip.

A few months ago, amid the hype around Bitcoin, GameStop announced plans to start acquiring Bitcoin through the same note mechanism used by MicroStrategy, aiming to revive its stock and build an asset foundation backed by Bitcoin. However, its bet on Bitcoin has not gone as planned, which added pressure on its stock, even though the holdings still show a profit of around $19M, according to Decrypt.

Speculation arose after GameStop noted in its earnings report that it “may have to sell Bitcoin as part of treasury management operations.” This disclaimer isn’t new, as it was also included in the previous quarterly report.

Nevertheless, with the retailer’s three-month sales declining, the possibility of selling Bitcoin while the holdings are still profitable seems increasingly plausible.

Bollinger Bands indicator guide

Bollinger Bands is a price-volatility indicator designed to help you determine whether assets are overvalued or undervalued. It consists of three key components: a 20-period SMA, and two lines positioned above and below it, which represent standard deviations from that SMA.

Why use Bollinger Bands?

- Bollinger Bands give you a quick sense of market direction by showing how the price behaves relative to the SMA. The price breaks above or below the SMA, which may signal a trend continuation.

- Meanwhile, the bands also help identify potential market shifts. When the bands tighten, the market is said to be in a “squeeze,” often signaling an upcoming breakout. When the bands widen, it suggests increased market volatility.

Want to fully master Bollinger Bands? Check out our comprehensive Bollinger Bands review.

Receive an instant notification when a new coin is listed with goodcryptoX PRO plan.

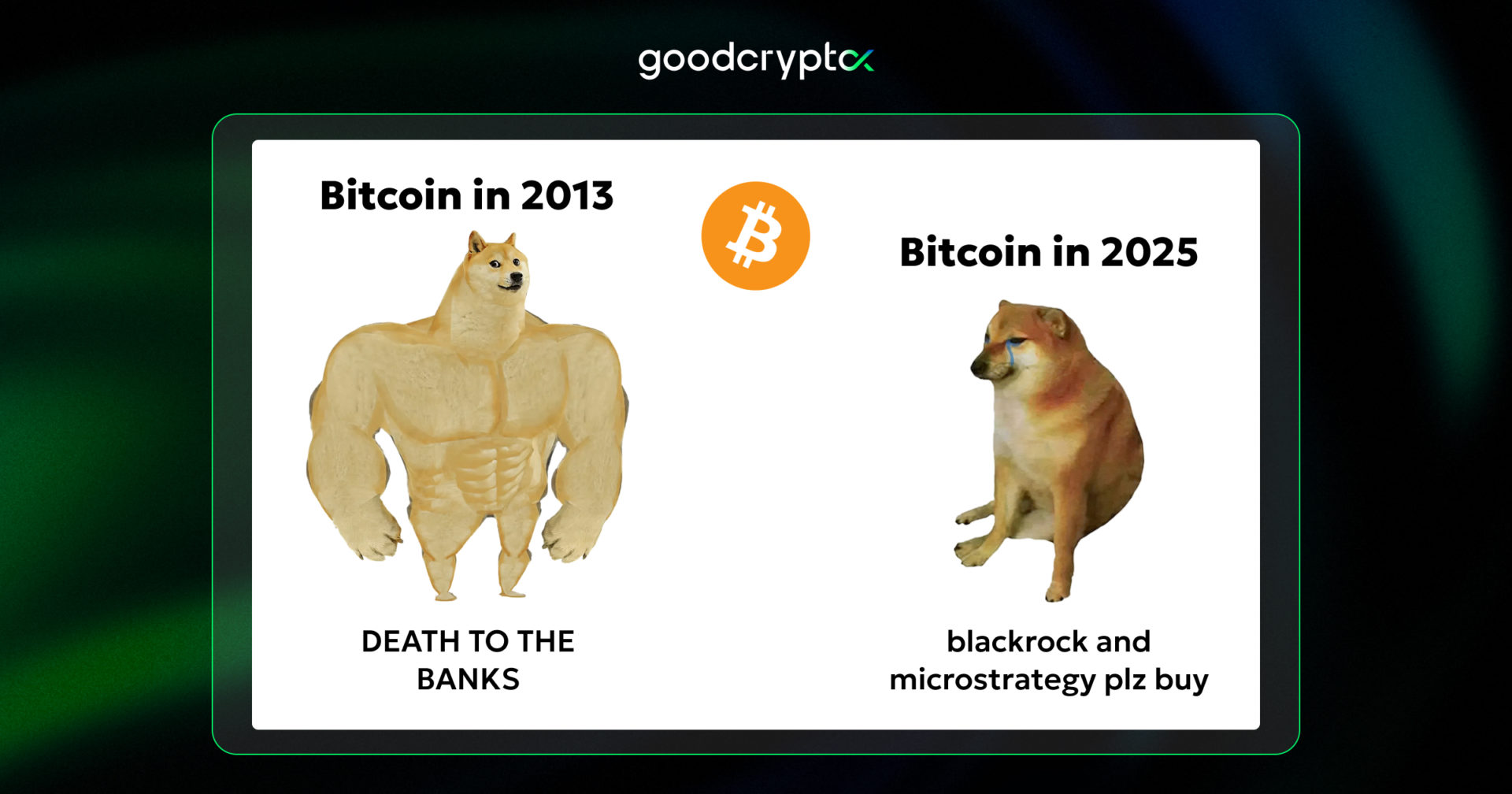

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the goodcryptoX app!