👋 Hello there!

This week has been full of important news and events that will shape the future of the Web3 industry. Let’s explore the most notable highlights in this week’s crypto digest! 👇

quick weekly news

FED doesn’t cut rates, yet calls for Congress to move on crypto ’regulatory apparatus’

Starting with one of the most important pieces of news this week: yesterday’s FED monetary meeting determined the interest rate decision for the US for the next 1.5 months, until March 18th. As a result, the FED decided to keep the interest rate at 4.5%, the same as it was on December 18th, citing a “somewhat elevated” inflation rate despite the “low level” of unemployment.

Interestingly, despite no change in the interest rate decision since December 18th, the crypto market has not dipped, unlike in previous cases. This suggests that this time, the FED’s decision and outlook on future monetary policy aligned with market expectations.

To recall the previous meeting: despite a 0.25% rate cut, Jerome Powell warned about high inflation levels in the US and stated that the FED is likely to slow down future rate cuts. This caused $BTC to dip from nearly $103K to around $90K per coin.

However, what was even more positive for the crypto market in yesterday’s meeting was the FED’s shift in stance on cryptocurrencies. Previously, the FED stated “We do not allow Bitcoin purchases” and “We are not looking for a law change at the FED”. Now, they have moved to “Banks are perfectly able to handle crypto”. While the FED operates independently from the US President, it appears to be under pressure to adapt to the US government’s changing stance on crypto.

This news significantly impacted Bitcoin’s price, causing it to surge from $101.5K to $104.5K within an hour after Powell’s statement.

Source: GoodCrypto

Funds continue to actively file for new ETFs

Meanwhile, the ETF rush continues following SEC Chairman Gary Gensler’s resignation, as Bitwise files with the SEC for a spot $DOGE ETF. To recall, we previously mentioned Bitwise’s registration for a Dogecoin ETF in our last mail digest. At that time, it was only a reference to Bloomberg ETF analyst James Seyffart’s mention of Bitwise’s filing. Now, however, the news is official with the SEC, says Seyffart.

What’s even more interesting is that companies are now massively applying for 10 different leveraged crypto asset ETFs. This marks a major shift compared to summer and autumn 2024 when only the Ethereum ETF was approved – weeks after intense negotiations with the SEC.

According to Seyffart, the new ETF filings include assets such as Chainlink, Cardano, Polkadot, BNB, and even Melania Coin. Meanwhile, already SEC-recognized tokens like Solana, XRP, and Litecoin have also made an appearance in these filings.

Source: James Seyffart

“I’m starting a movement to bring back Gensler. Who’s with me?” he added, lol.

As Seyffart notes, this surge in ETF filings and the inclusion of new assets signal that issuers are testing the limits of what the SEC’s new leadership will allow. Interestingly, he expects the new crypto task force, led by Hester Peirce, to determine what will be approved and what won’t.

Gary Gensler returns to MIT

Speaking of the SEC, the former and well-known ex-head of the agency, Gary Gensler, has returned to the Massachusetts Institute of Technology (MIT) as a professor focusing on artificial intelligence, finance, financial technology, and public policy. He has also become a co-director of the FinTechAI@CSAIL initiative.

To recall, Gensler previously worked at MIT from 2018 to 2021, before being appointed as SEC Chairman by the Biden administration. During that period, he taught a course called “Blockchain and Money”, at which time he was considered more crypto-friendly, even stating that “most cryptocurrencies are not securities.”

But what’s even more interesting and controversial is that back in 2021, Gensler praised Algorand ($ALGO) as a great example of blockchain technology. However, once he became SEC Chairman, he classified ALGO as a security in multiple cases against third parties, including the SEC’s lawsuit against Binance.

What do you think made him to such dramatically change his view? 🤔

Crypto.com to delist Tether USDT and 9 other tokens in Europe on Jan. 31

Meanwhile, the Eurozone continues to adapt to cryptocurrency regulation, as another leading crypto exchange, Crypto.com, has announced the delisting of $USDT and several other assets in Europe. These assets will remain available for conversion to other currencies until the end of Q1, March 31st.

MiCA is a recently introduced EU regulatory framework designed to standardize and regulate the crypto market by addressing regulatory inconsistencies, rising fraud, and potential financial stability risks. The primary requirement MiCA imposes on crypto issuers is to clearly disclose investment risks, ensuring that consumers are better informed before investing.

According to the recent Crypto.com announcement, the assets failing to meet MiCA’s requirements include:

- $USDT

- Wrapped Bitcoin ($WBTC)

- Stablecoin Dai ($DAI)

- Pax Dollar ($PAX)

- Pax Gold ($PAXG)

- PayPal USD ($PYUSD)

- Crypto.com Staked ETH ($CDCETH)

- Crypto.com Staked SOL ($CDCSOL)

- Liquid CRO ($LCRO)

- XSGD ($XSGD)

Notably, Crypto.com is not the first exchange to delist $USDT and other assets in response to MiCA. In October 2024, Coinbase also announced the delisting of $USDT, classifying it as a noncompliant stablecoin under MiCA.

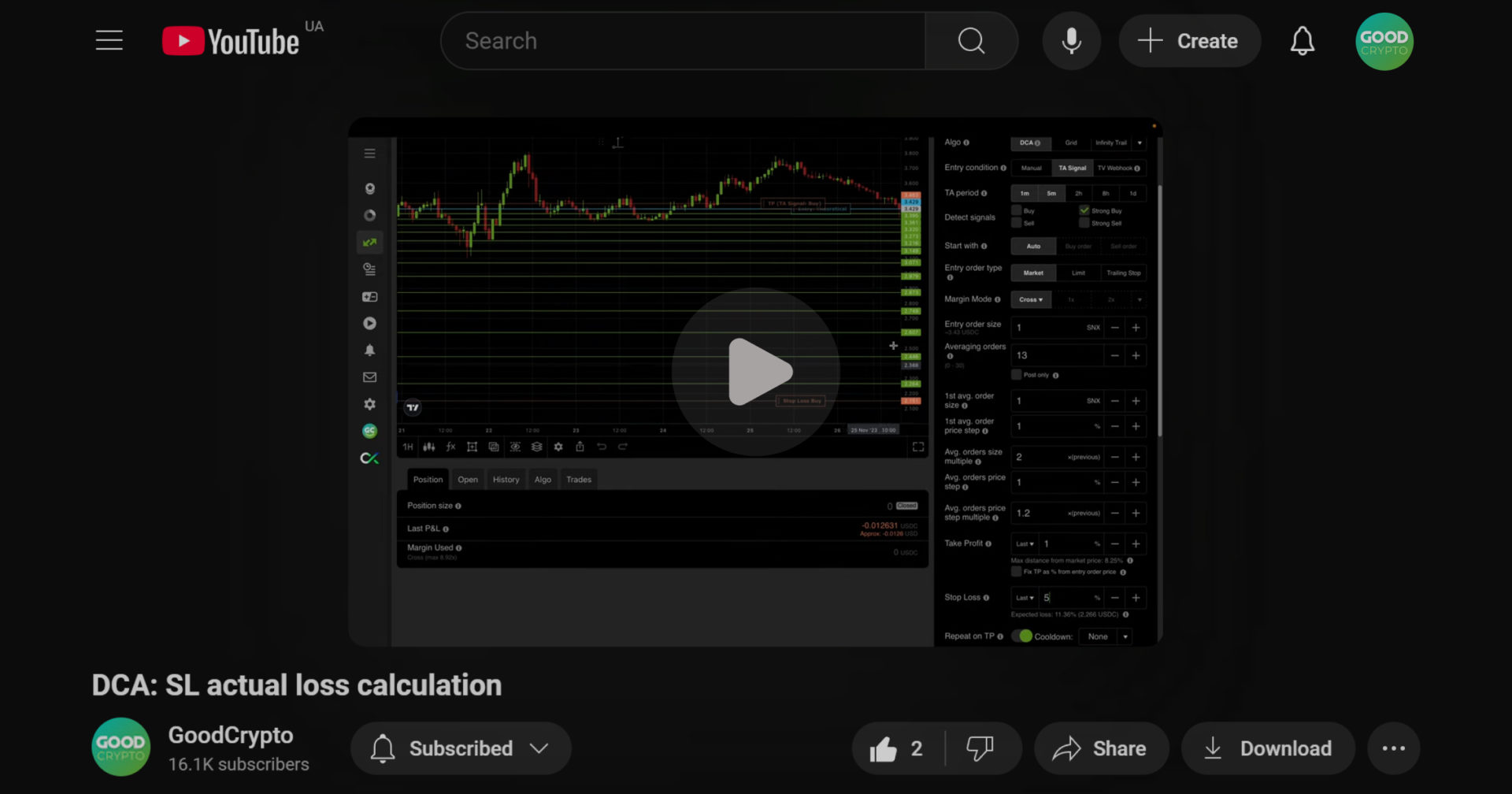

master the actual stop loss calculation in DCA!

📈 The DCA setup form has a parameter that allows you to calculate the actual loss if Stop Loss is reached accurately. Previously, SL was calculated as a percentage of the last averaging order, but now you can also see the total expected loss both as a percentage and in absolute terms.

This tutorial will help you answer the following questions 👇

🔸 How is actual Stop Loss calculated in DCA?

🔸 How does the number of averaging orders impact total loss?

🔸 How does the averaging order size “multiple” influence SL and TP probability?

Check out our in-depth video review and master the art of DCA bot performance analytics on GoodCrypto! 💪

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!