👋 Hey traders!

Finally, there’s some relief on the crypto after a few hardcore weeks in a row. Let’s explore together what drew the market up in this weekly digest by GoodCrypto 👇

quick weekly news

FED decision and policy updates

Let’s start with the main driver of crypto market growth this week – the FED meeting held yesterday. While the monetary decision was widely expected by the market days before the announcement and didn’t bring anything new, the overall rhetoric of the FED slightly softened toward the market.

Many expected a complete shift in monetary policy, from a restrictive stance to a more accommodative one, due to recently improved inflation data. However, the FED stated that it will not change its forecast on rate cuts for this year, maintaining its projection of two cuts in 2025. The main reason behind this decision is that the FED describes the overall state of the economy as strong and sees no urgent need to start cutting rates. Additionally, the unpredictability of U.S. trade wars may cause another surge in inflation in the future. However, if the unemployment rate changes dramatically, the FED will review its policy.

Moreover, the FED announced a significant reduction in its quantitative tightening policy, which aims to decrease the money supply in the economy – the monthly redemption cap on Treasury securities will be cut from $25B to $5B. This decision was interpreted by markets as a softer monetary stance moving forward.

However, there are still significant challenges in the U.S. economy, particularly in its mid-term outlook, as reflected in the FED’s revised economic forecast for 2025:

- GDP growth was revised down from 1.6 – 2.5% to 1.0 – 2.4%

- Unemployment rate revised up from 4.2 – 4.5% to 4.1 – 4.6%

- PCE Inflation forecast revised up from 2.1 – 2.9% to 2.5 – 3.4%

- Core inflation rate revised up from 2.1 – 3.2% to 2.5 – 3.5%

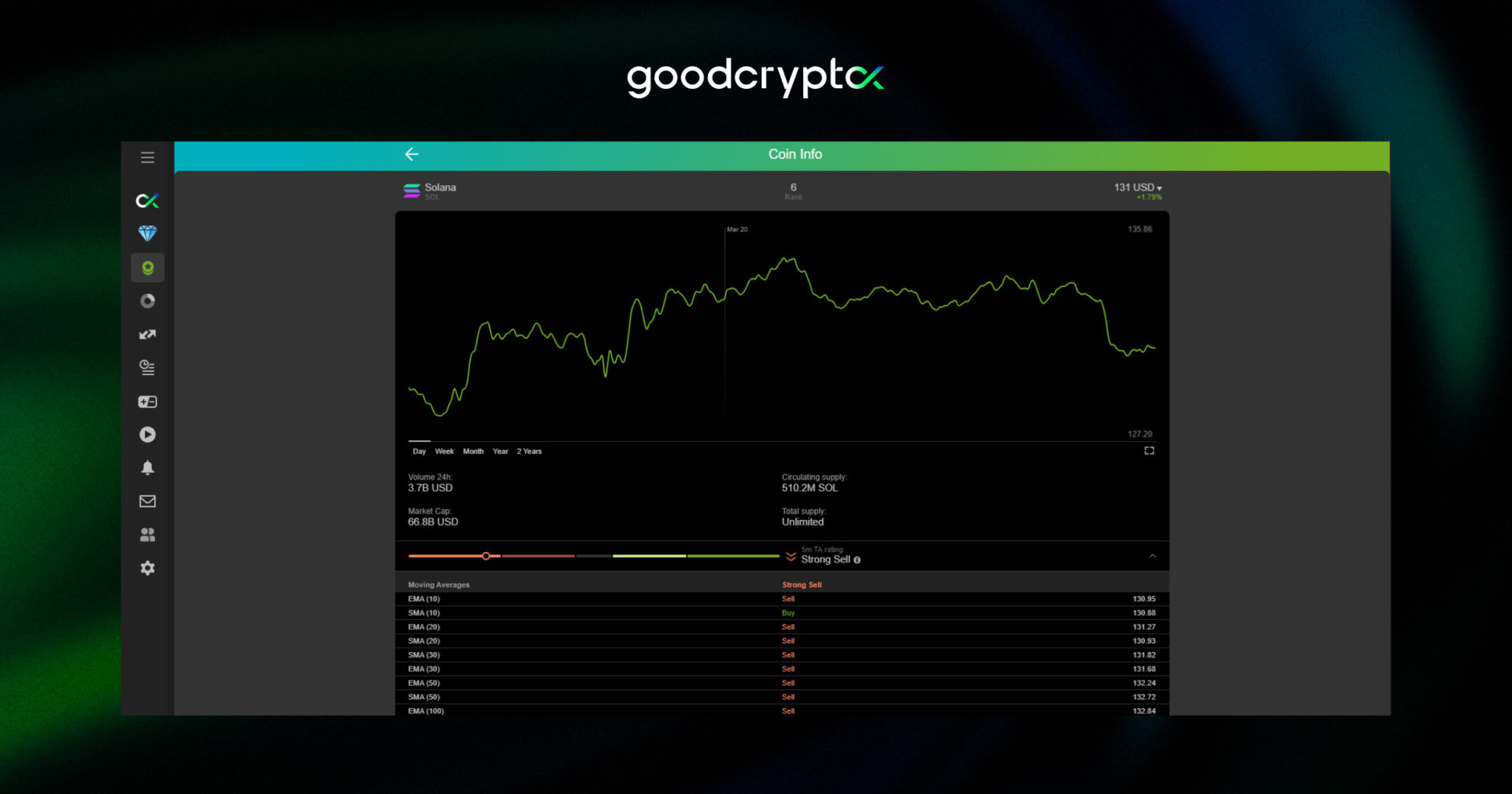

Solana futures ETF to hit markets this week

According to the filings with the Securities and Exchange Commission, the first Solana futures ETFs are set to enter the market as early as this week. The exchange-traded product will include the Volatility Shares Solana ETF (SOLZ), which will track Solana futures, and the Volatility Shares 2X Solana ETF (SOLT), which will offer double exposure.

SOLZ will have a 0.95% management fee, while SOLT will charge a 1.85% trading fee, according to the same filing. For context, JPMorgan previously forecasted approximately $3B to $6B in inflows over the next six months following the approval of a $SOL spot ETF. While this is only a futures ETF product, the listing of SOLZ and SOLT is certainly another step toward a $SOL spot ETF.

Following this news, Solana has surged nearly 6%, rising from approximately $127 per coin to almost $135 per token.

Source: GoodCrypto

83% of institutions plan to up crypto allocations in 2025: Coinbase

On March 18th, EY-Parthenon and Coinbase released a new institutional research report on companies’ plans for holding cryptocurrencies in their reserves. The survey included decision-makers from 352 firms, and a significant majority (83%) stated that they intend to increase their crypto allocations in 2025.

As Coinbase describes in its blog post, institutional investors’ confidence is largely driven by greater regulatory clarity promised by the new U.S. government, which is expected to serve as a catalyst for the growth and development of cryptocurrencies. Moreover, investors expressed confidence in existing financial instruments in the space, such as DeFi, stablecoins, and tokenization. Some of these assets offer high interest rates, making them attractive investment options.

Another majority of surveyed investors (73%) confirmed that they hold cryptocurrencies beyond Bitcoin and Ethereum, with Ripple and Solana being among the most popular choices. They also expressed interest in accessing altcoins via ETPs, with 68% stating that they would likely purchase single-asset ETPs for altcoins.

Finally, Coinbase reported that a strong majority of surveyed executives plan to allocate more than 5% of their AUM to crypto in 2025. Coinbase classified this as a clear indicator that crypto is moving beyond a niche asset class.

SEC will drop its appeal against Ripple

Ending this digest on a positive note, the SEC has taken another step toward easing tensions with the crypto space by dropping its appeal against Ripple. Previously, we discussed the pause in its lawsuit, and now, the SEC has finally dismissed it entirely.

Ripple CEO Brad Garlinghouse reacted to this news on X, saying:

“This is it – the moment we’ve been waiting for. The SEC will drop its appeal — a resounding victory for Ripple, for crypto, every way you look at it.”

The XRP lawsuit, filed back in 2020, became a symbol of Operation Choke Point 2.0, a government-backed initiative supported by the previous administration to punish and debunk the crypto industry without explicitly banning it. However, everything changed when Donald Trump took office, promising to bring in a more crypto-friendly SEC chairman.

Now, the SEC has shifted its focus away from suppressing the crypto industry in the U.S. and has taken one of its most symbolic steps toward resolving the situation.

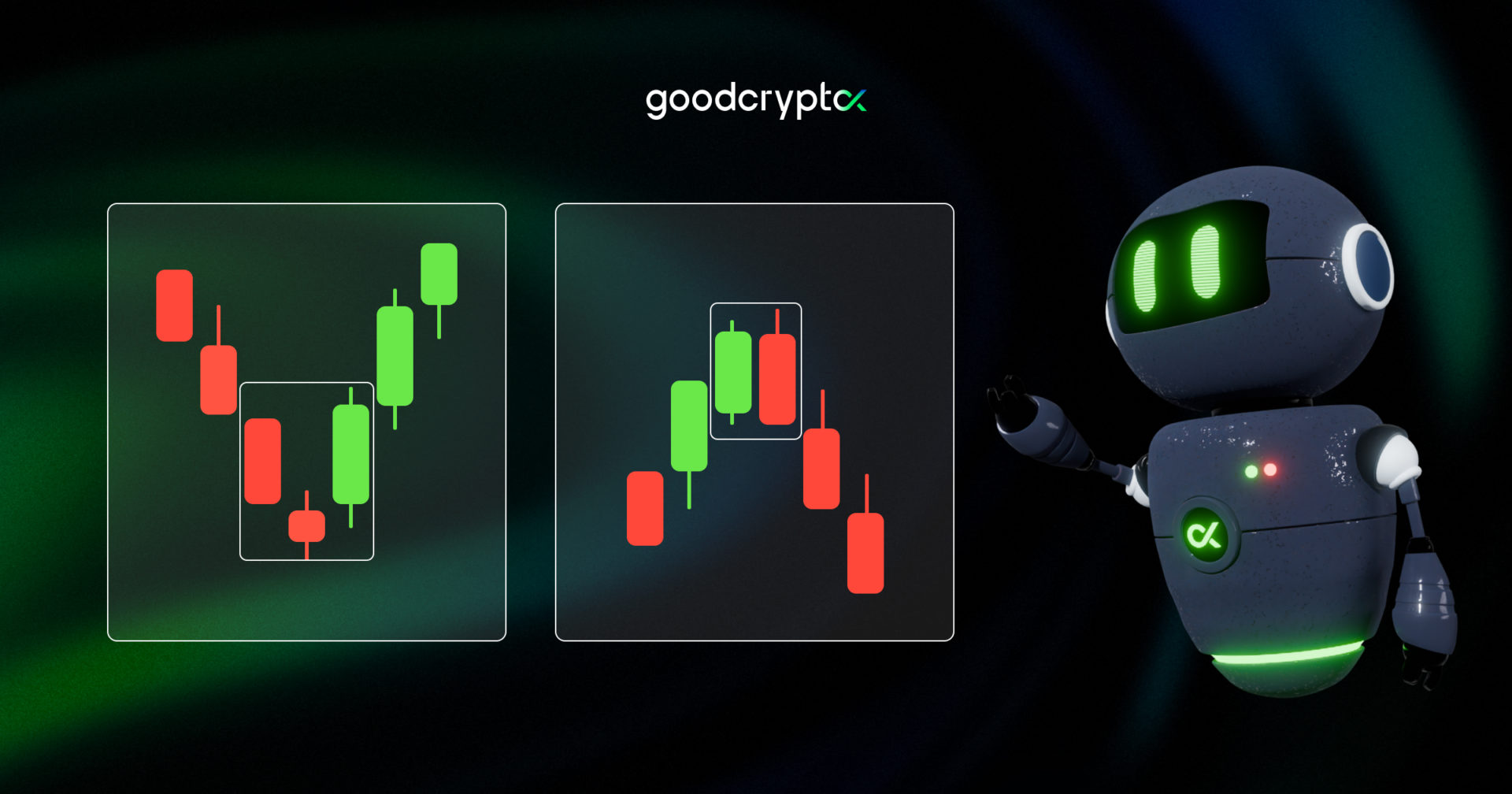

candlestick patterns explained by GoodCrypto

Candlestick patterns help you analyze market trends and make smarter trading decisions. Each candlestick shows an asset’s open, high, low, and close prices over a set time frame. While most traders use hourly or daily charts, you can also apply these patterns to shorter time frames, but be cautious with patterns during the volatility.

Types of Candlestick Patterns:

🔸 Bullish Reversal Patterns: Indicates a potential price increase after a downtrend, signaling a buying opportunity;

🔸 Bearish Reversal Patterns: Forming at the peak of an uptrend, warns that prices may drop due to buyer exhaustion;

🔸 Continuation Patterns: Confirm the current trend, often appearing during sideways price action.

Want to learn more about candlestick patterns? Check out the full candlestick patterns review and our comprehensive candlestick patterns cheat sheet by GoodCrypto 👇

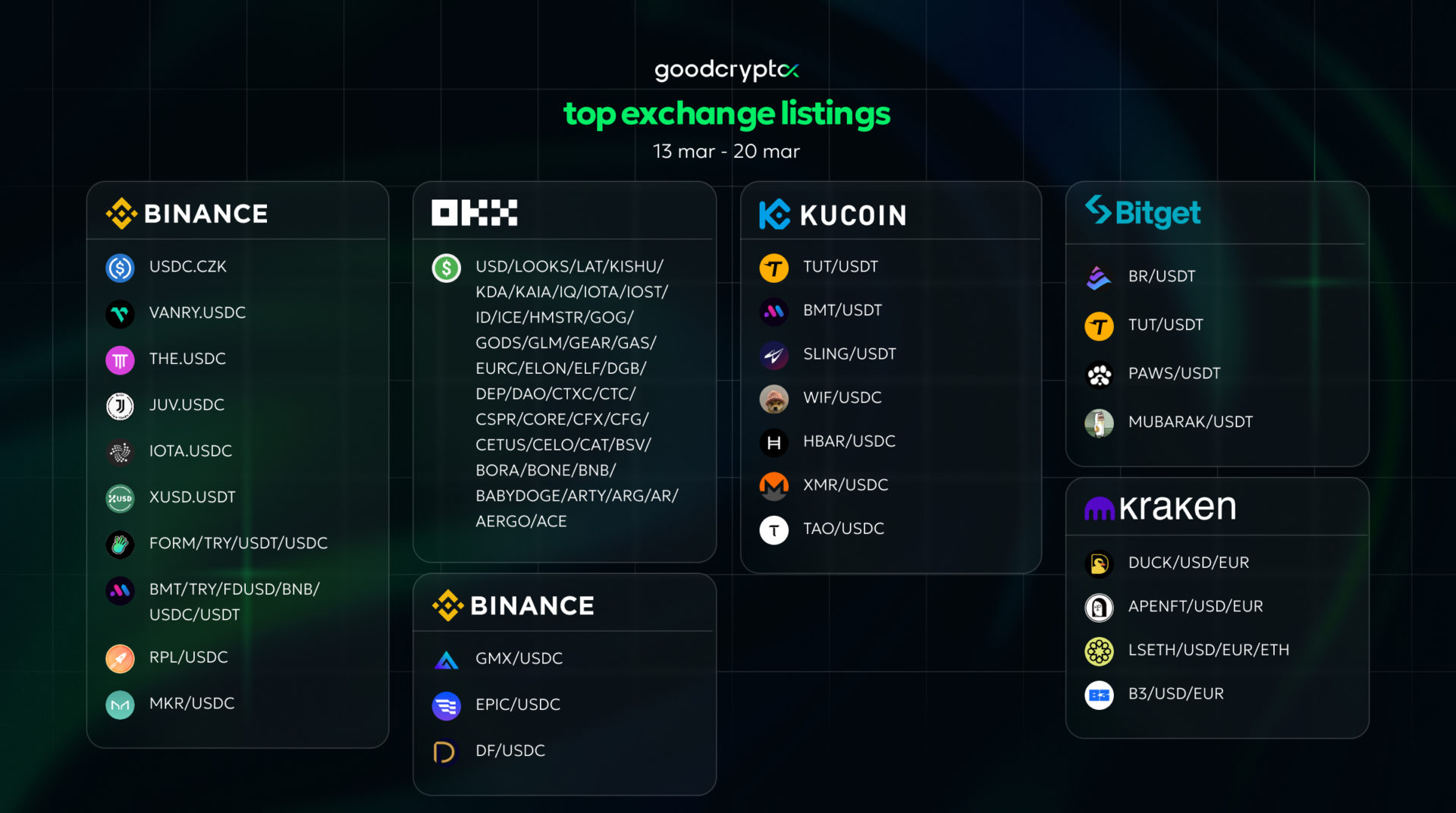

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!