Hey there! 👋

The market continued to decline, but there’s still hope as some positive headlines emerged this week:

quick weekly news

Fed leaves rates unchanged

Let’s begin this digest with some macroeconomy news in the U.S. – the Fed interest rate meeting. This week, the Fed decided to leave the rate at the same level as before, in the 3.50%-3.75% range. According to the Investing.com website, it was quite a forecasted turn of events, but the market had already priced it in.

The decision on the interest rate comes despite the rising pressure from Donald Trump on Fed Chairman Jerome Powell and because of the potential impact of tariffs on inflation. As Jerome said in the press conference, the key indicators suggest that economic activity has been expanding at a solid pace. Meanwhile, the inflation rate remains “somewhat elevated.”

Hence, to support the Fed’s goals to establish maximum employment and inflation at the rate of 2 percent over the longer run, the Committee made a decision to leave the interest rate at the same level. 10 out of 12 voted to support this decision, with 2 out of 12 voting for a 0.25% rate cut.

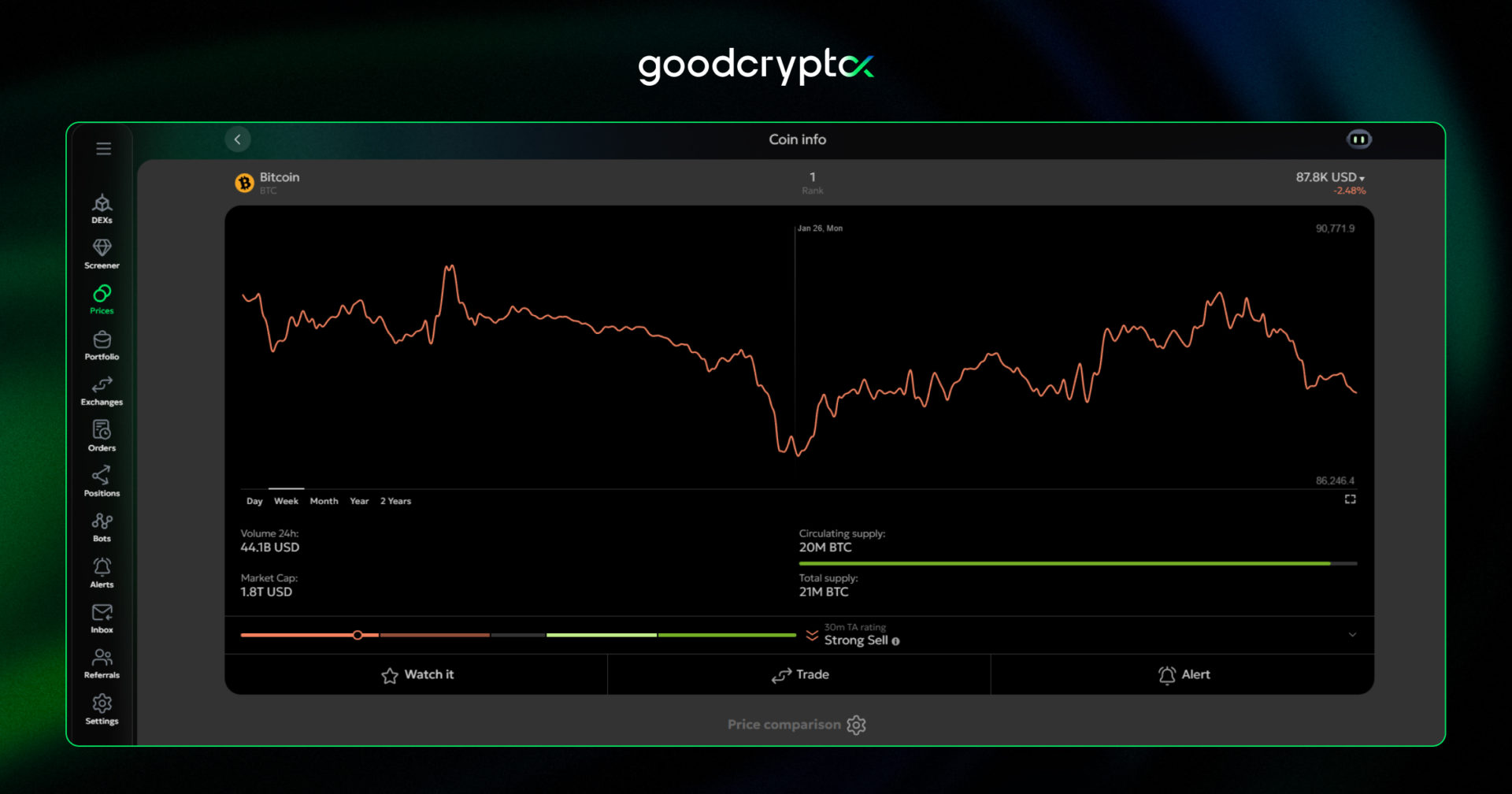

For the crypto market, the Fed interest rate meeting didn’t have much impact – Bitcoin slightly bounced up, as it often happens during pre-announcement timeframes, and then returned to approximately the same price zone.

HYPE token surges as silver futures volume soars on Hyperliquid exchange

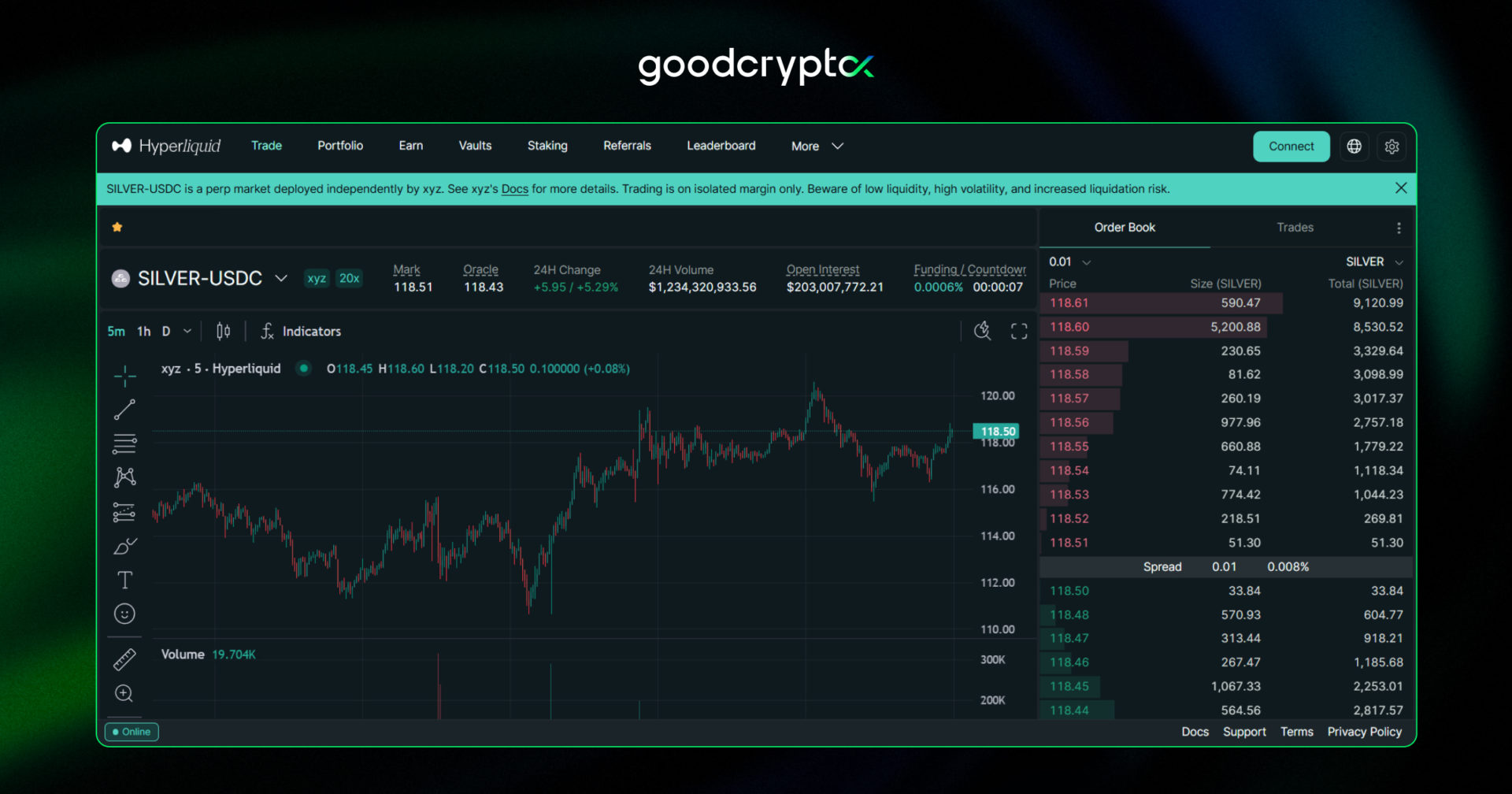

Hyperliquid has seen a massive increase in silver futures volume shortly after the launch of the HIP-3 markets by XYZ. According to the app, the 24-hour trading volume of SILVER-USDC has reached over $1.2B, with almost $200M in open interest.

This accounts for approximately 11% of the total Hyperliquid 24-hour trading volume, according to data from DeFiLlama. The platform splits the revenue generated from HIP-3 markets launched by other creators on a 50/50 basis, which means the massive revenue surge benefits not only creator XYZ but also Hyperliquid itself.

On top of that, the Hyperliquid CEO has recently announced that the platform has become “the most liquid venue for crypto price discovery in the world,” surpassing leading centralized exchanges such as Binance.

Amidst such bullish news on the protocol, the $HYPE token has seen a massive 50% price surge, most likely driven by rising interest among crypto investors and potentially cascade liquidations of $HYPE yield farmers.

Gemini launches Zcash credit card that pays ZEC rewards

This week, the market was surprised by the launch of a Gemini Zcash-themed branded crypto credit card. According to the website, the metal card will allow users to receive cashback of up to 4% on every transaction with no annual fee, paid in $ZEC coins:

- 4% for gas, EV & transit;

- 3% for dining;

- 2% for groceries;

- 1% on other transactions.

It is a continuation of the series of crypto-themed cards, with previous tokens being Bitcoin, Ethereum, and XRP. Most likely, the exchange announced the Zcash credit cards amid the rising hype around the token in recent months.

Moreover, the launch of the Zcash credit card was featured by the Gemini CEO, who stated that “privacy is normal and a precondition to your freedom and self-sovereignty.” According to Decrypt, $ZEC is now a top-10 option for crypto rewards picked by Gemini cardholders.

Fidelity to enter stablecoin market with Ethereum-Based ‘Digital Dollar’

Talking about crypto adoption, Fidelity Asset Manager announced plans to launch its own stablecoin, “Digital Dollar” ($FIDD). The firm aims to back it with the operational standards of Fidelity Digital Assets, leveraging Fidelity’s longstanding asset management expertise.

The stablecoin will be based on Ethereum and will provide investors with a stable digital dollar, combining features of digital assets and blockchain technologies. $FIDD will also allow users to buy or sell FIDD for $1 on the Fidelity Digital Assets, Fidelity Crypto, and Fidelity Crypto for Wealth Managers platforms.

Fidelity is among the leading asset management firms, highly engaged in crypto investments. It was among the first funds to launch Bitcoin, Ethereum, and Solana ETFs, along with industry giants such as BlackRock and Grayscale. Now it aims to tap into the $300B+ stablecoin industry with its token, seeking to take the lead ahead of major asset managers in the U.S.

how to use trading bots

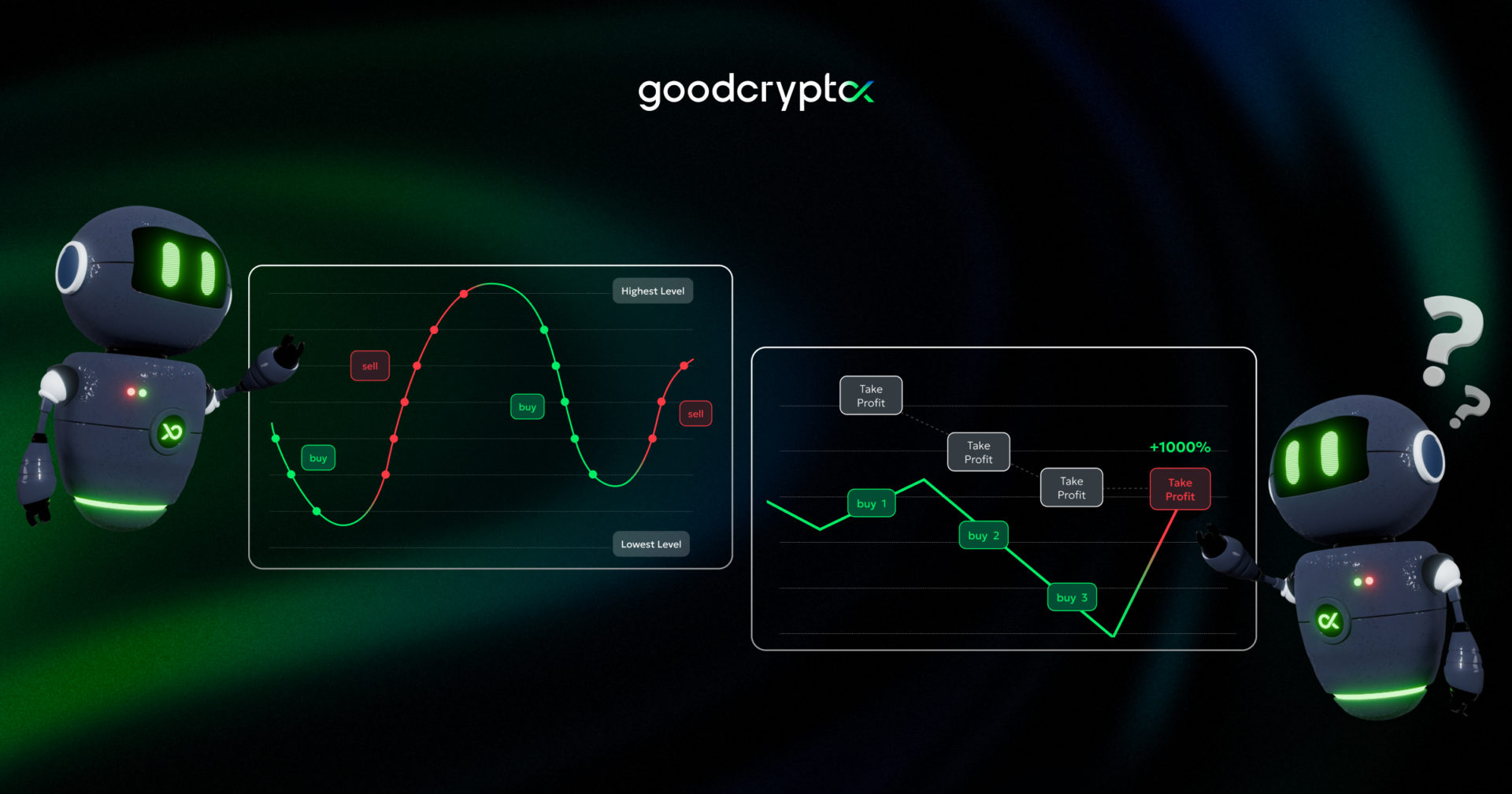

🤖 Crypto trading bots aren’t magic money printers, they are tools. The best results come from knowing which bot fits which market and setting it up with precision. From automating range trading to capitalizing on trends, here are the fundamentals that turn bots from gimmicks into profit machines:

- Arbitrage opportunities: use arbitrage bots to instantly buy low and sell high across exchanges;

- Range trading made easy: deploy grid bots to buy/sell at predefined levels in sideways markets;

- Trend riding: apply DCA bots to scale into positions and average down entries during sustained moves.

📖 Want to make automation bots work for you while you mind your business? Check out the full guide from goodcryptoX!

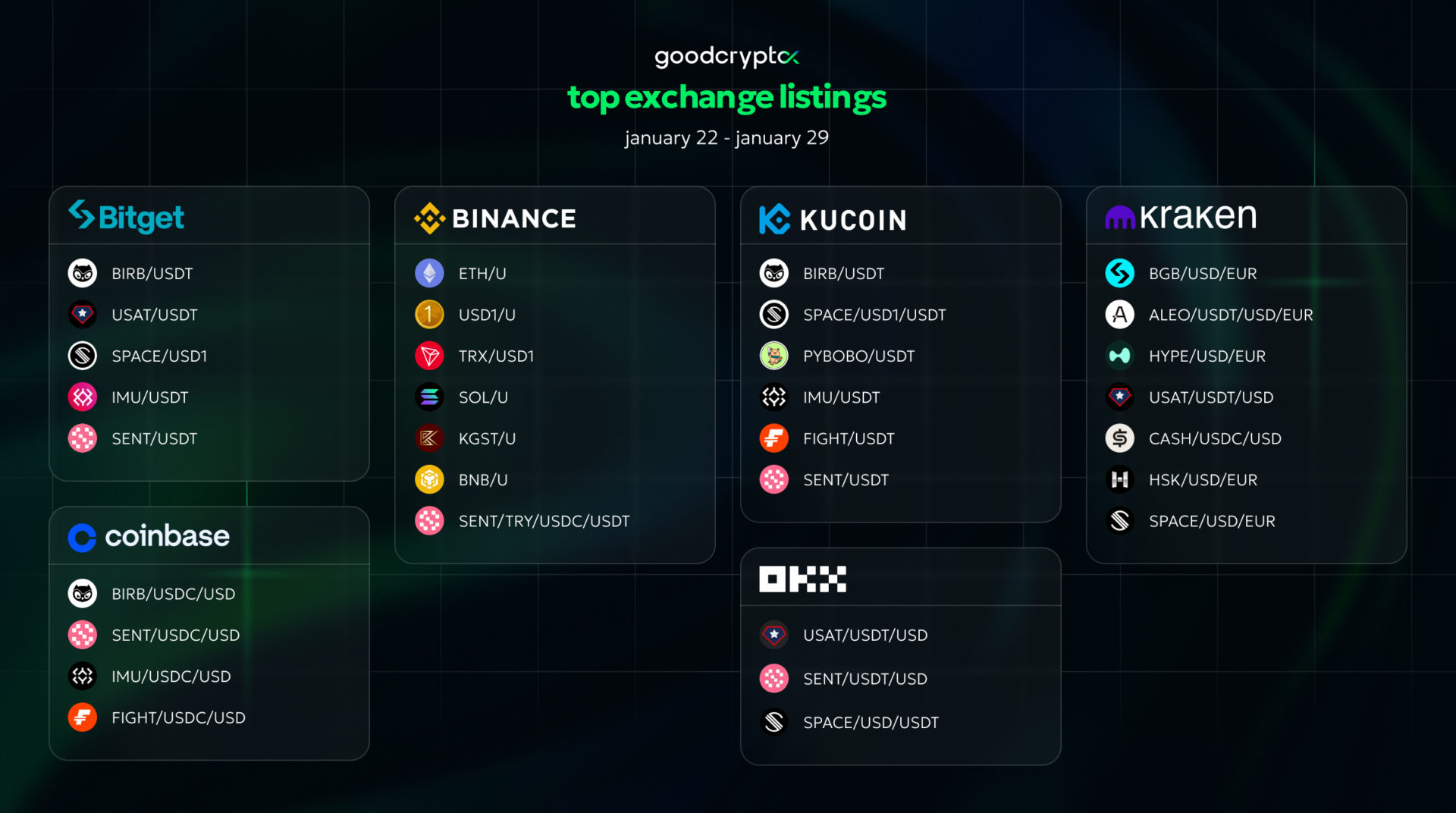

Receive an instant notification when a new coin is listed with goodcryptoX PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the goodcryptoX app!