Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

Over $4.7M was taken in the Uniswap phishing scam involving bogus tokens

The Uniswap v3 protocol’s liquidity providers (LPs) were victims of a sophisticated phishing campaign that saw attackers steal at least $4.7 million worth of ether (ETH).

One of the first to sound the alarm about the assault was MetaMask security researcher Harry Denley. On Monday, he informed his 13,000 Twitter followers that 73,399 addresses had received fraudulent ERC-20 tokens intended to steal their assets.

According to a tweet from Binance CEO Changpeng “CZ” Zhao, the hack cost at least $4.7 million in ETH. However, word on the crypto street is that losses could be far more significant.

A “large LP” with around 16,140 ETH, worth $17.5 million, may have also been phished, according to prominent cryptocurrency Twitter user 0xSisyphus on Monday.

Voyager cannot promise that every customer will receive their cryptocurrency

In response to Voyager Digital’s bankruptcy filing on Tuesday, the crypto loan company stated that its recovery plan was intended to protect client assets. However, the project did not specifically say that it would be able to refund all comparable money to concerned users.

Concerning the 15,250 Bitcoin (BTC) and 350 million USD Coin (USDC) loan that Three Arrows Capital defaulted on, Voyager stated on Monday that it has around $1.3 billion in impacted customers’ cash in addition to $650 million in “claims against Three Arrows Capital.” Users may get a combination of Voyager tokens, cryptocurrencies, “common shares in the newly reorganized company,” and money from any proceedings with Three Arrows Capital, or 3AC, according to Voyager’s planned recovery plan – subject to court permission.

The financing company stated, “The exact numbers will depend on what happens in the restructuring process and the recovery of 3AC assets.” “The plan is subject to change, negotiation with customers, and ultimately a vote […] We put together a restructuring plan that would preserve customer assets and provide the best opportunity to maximize value.”

Projects from Terra gather to move to the Polygon environment

By switching to Polygon, more than 48 distinct cryptocurrency projects originally reliant on the defunct Terra ecosystem have seen a revival.

In a tweet on Saturday, Ryan Wyatt, CEO of Polygon Studios, expressed his joy at his network’s ability to integrate so many projects into the ecosystem. In addition, he suggested that Terra Developer Fund, a multimillion dollar initiative by Polygon, has been successful in luring talent that was unpredictably cast into uncertainty when Terra failed in May.

For a new crypto startup fund, Multicoin Capital collects $430 million

A new venture fund with $430 million worth has been formed by renowned cryptocurrency investor Multicoin Capital, further highlighting venture capital’s rising interest in the blockchain economy despite the bear market.

The company revealed on Tuesday that Multicoin’s Venture Fund III will invest between $500,000 and $25 million in early-stage businesses in various industries with an emphasis on cryptocurrencies and blockchains. Additionally, it is prepared to invest in later-stage initiatives with a strong brand and market presence worth up to $100 million or more.

The third round of the Venture Fund will give more weight to crypto ventures that have shown “proof of physical work” or to protocols that have developed financial incentives for permissionless contributing.

Meet New GoodCrypto Feature: TA Signals 🚨

TA Signal scanner is a relatively new GoodCrypto feature that provides you with Smart TA Signals that will point you in the right direction of when to buy or sell an asset. The methodology of this tool is based on the TradingView TA summary.

Each coin has an advanced Technical Analysis rating based on 13 Moving Averages and 4 Oscillators Algorithms analyze these indicators to define when buying or selling an asset is better.

Remember that this screening tool does not provide investment or financial advice! Just get the basics and DYOR!

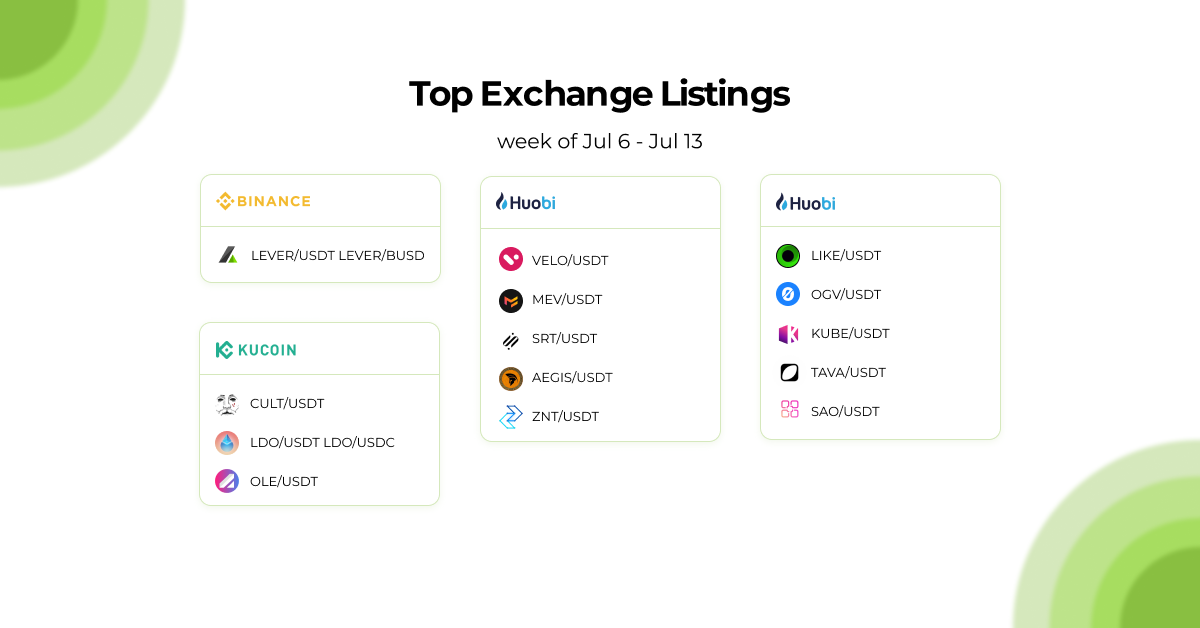

Receive an instant notification when a new coin is listed with the Good Crypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!