Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

Due to “poor use,” Coinbase Wallet will discontinue supporting BCH, ETC, XLM, and XRP

The wallet will no longer handle Bitcoin Cash (BCH), XRP, Ethereum Classic (ETC), Stellar Lumen (XLM), and their related networks, according to a Nov. 29 announcement on Coinbase’s help sites. The crypto company justified its choice by pointing to “low usage” of the four coins.

“This does not mean your assets will be lost,” the announcement said. “Any unsupported asset that you hold will still be tied to your address(es) and accessible through your Coinbase Wallet recovery phrase.”

Not the exchange itself, but Coinbase’s app, Coinbase Wallet, is expressly mentioned in the release as delisting the tokens.

The CEO of Binance clarifies the 127K BTC transfer and references the proof-of-reserve audit

On November 28, according to a tip by Whale Alert, Binance transmitted 127,351 Bitcoin, or more than $2 billion, to an unidentified wallet. On-chain data shows that the transaction took place at 10:00 AM UTC and cost Binance just 0.000026 BTC ($0.42) in fees.

FUD, or fear, uncertainty, and doubt, was quickly sparked by the significant Bitcoin transaction, with many pointing out that Binance shifted an entire fortune’s worth of BTC in one transaction.

Later, CZ announced on Twitter that the significant transaction resulted from Binance’s PoR audit procedure. Additionally, he urged the public to remain composed and dismiss the FUD, saying:

“The auditor requires us to send a specific amount to ourselves to show we control the wallet. And the rest goes to a change address, which is a new address. In this case, the input tx is big, and so is the change.“

The CEO also referred to a tweet he had nearly four years prior, urging the cryptocurrency community to “change addresses” and “learn about blockchain transactions.“

The CEO of Binance issued another tweet in reaction to the comments that expressed increasing anxiety, saying that investors who “believe FUD all the time” are also “likely to be poor.”

Amid the current operational halt, an AAX executive exits the cryptocurrency exchange

Ben Caselin revealed the reasons for his decision to leave the company and his position at the cryptocurrency exchange in a thread on Twitter. Caselin claims that despite his attempts to advocate for the community, the ideas they came up with were rejected. As a result, the executive said his communication position had become “hollow.”

The former AAX executive also disapproves of how AAX handles the situation. According to Casein, the exchange behaviours were “without empathy” and “overly opaque.”

The former executive noted that numerous individuals, including some of his family members, had requested assistance during the withdrawal stop. Caselin said that everyone was waiting for responses to the discussion but that there was nothing he could do now.

It’s worth mentioning that Aave temporarily shut down the credit markets to ward off further assaults.

Following a vote by its governance members to temporarily freeze assets deemed to be volatile and low liquidity, the lending markets were shut down. The listed assets include Yearn Finance (YFI), Curve Finance (CRV), 0x (ZRX), Decentraland, 1inch, Basic Attention Token (BAT), Enjin (ENJ), Ampleforth (AMPL), DeFi Pulse Index (DPI), RENFIL, Maker, and xSUSHI.

The protocol also halted the following stablecoins: sUSD, USDP, LUSD, GUSD, and RAI. In addition, users that have their assets frozen and cannot deposit their funds into the protocol or take out loans against them.

The proposal states that the action will lessen the risk for Aave version 2 and encourage the eventual migration to version 3. The plan also highlighted the current lower level of risk tolerance among community members.

After weeks of uncertainty, FTX has resumed paying its employees and contractors

On Nov. 28, the newly appointed FTX CEO John Ray III made the following statement as the insolvency expert worked to guide FTX and its about 101 connected firms (FTX Debtors) through the Delaware U.S. Bankruptcy Court:

“With the Court’s approval of our First Day motions and the work being done on global cash management, I am pleased that the FTX group is resuming ordinary course cash payments of salaries and benefits to our remaining employees around the world.”

“FTX also is making cash payments to selected non-U.S. vendors and service providers where necessary to preserve business operations, subject to the limits approved by the Bankruptcy Court,” he added.

The declaration was made about ten days after the FTX debtors submitted a motion to the Delaware bankruptcy court on November 19 to pay prepetition benefits and compensation to workers and contractors. The declaration excluded payments to Caroline Ellison, Gary Wang, Nishad Singh, and former FTX CEO and founder Sam Bankman-Fried.

OKX World Cup Trading Competition With GoodCrypto Team Is Started!

We are glad to announce the start of the OKX World Cup Trading Competition!

Trade with our team of best traders to participate and share the $2,000,000 prize pool!

During the competition, trading on OKX, you can use all GoodCrypto PRO tools for FREE. Don’t miss the opportunity to boost your team’s chances to win using all OKX trading bot strategies available in Good Crypto App.

The higher your team’s PnL%, the higher your position in the leaderboard. For the best chance for our team to win, use the GoodCrypto App to its maximum capacity!

Do not forget the 1% Rule

You must be aware of and willing to accept your risk while developing a potential trading strategy. Every trader in the world is sometimes wrong. How he handles risk sets a good trader apart from a bad one.

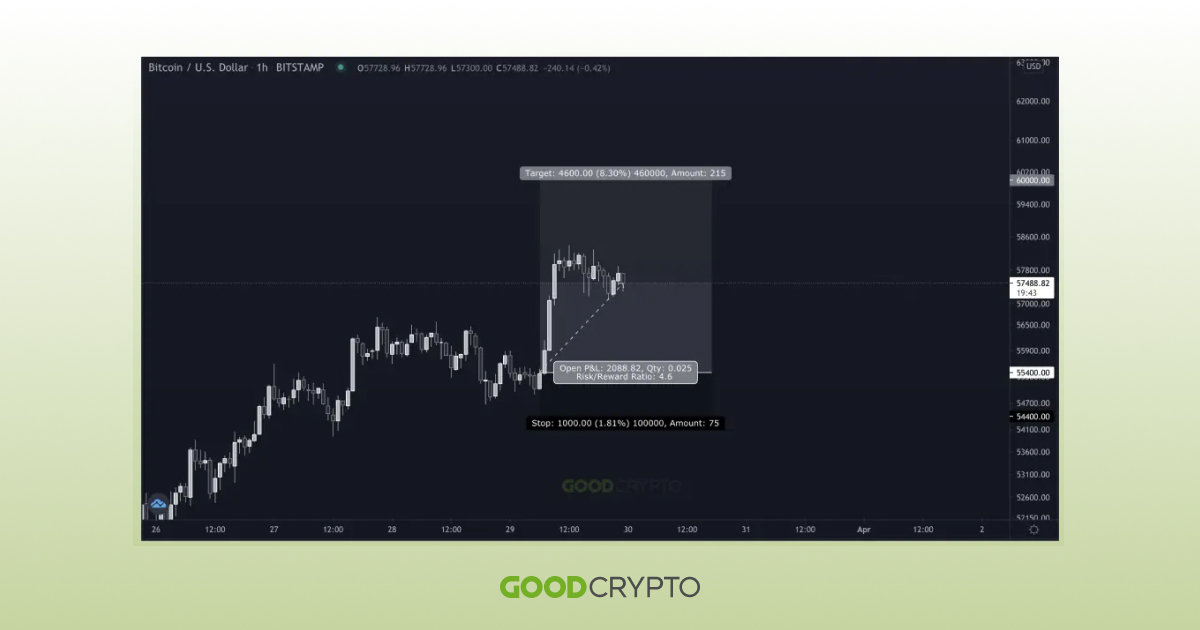

The risk-reward ratio abbreviated R:R is a means to assess your chance of winning to your chance of losing. For example, your return on risk is 1:3 if you put $1 at risk and might make $3. Suppose you have a setup with a risk-reward ratio of 1:3, which means that you gain 3 for every successful trade and only risk 1 for each unsuccessful one. In that case, you will still be profitable even if you only execute trades correctly 50% of the time.

You can figure out your R:R once you’ve decided where to begin a trade, where to take profits, and where to stop the loss. TradingView automatically does this.

An illustration of a transaction using R:R, with a Buy order placed at $55,400, a Stop Loss order set at $54,000, and a Take Profit order placed at $60,000, this trade has an R:R of 1:4.6.

Good Crypto displays your percentage of profit or loss for each transaction set. Using this data to determine your position size using the technique above, you can keep the possible loss to 1%.

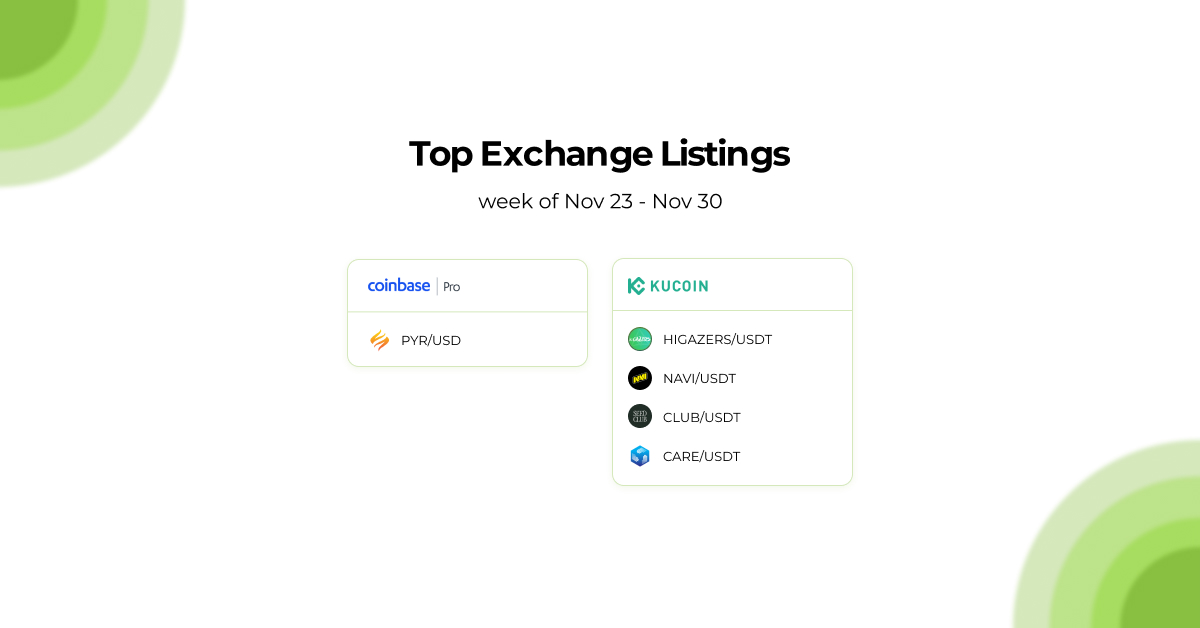

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!