As the popularity of the cryptocurrency market continues to grow, investors and traders are turning to innovative tools like algo strategies, particularly grid bots, to help them automate their trading routine. Why so? These bots use unique trading strategies for periods when the market is sideways and there is no opportunity to make a profit on massive trend movements. The bot creates a grid with buy and sell orders at equal intervals, that is used to make a profit from any market volatility in a given range, while the price moves through the grid.

Grids are autonomous bots that can operate either in a market with a minimum amplitude of the price movements or execute trades with a lightning-fast speed if volatility is high enough. It all depends on an asset selected for trading by you, your strategy and your trading objectives.

In this short article, we’ll take a closer look at how crypto grid bots work in practice. We’ll examine our recent user case on a futures market, see what the obvious advantages of this algo and why bots are quickly becoming a must-have tool for any cryptocurrency investor or a regular trader.

A Bit About The Grid Bot Basics

Many traders, regardless of their skill level, rely on market volatility to make profits. However, truly successful traders are distinguished from most others by their ability to find the right entry and exit points in difficult and unstable conditions, such as a stagnant market.

During this phase, the risks of making a loss are extremely high. There is no accurate and clear structure to rely on, and at any moment, the market can break a trend not in our favor. However, the advent of tools such as automated trading bots has dramatically changed the course of things. These tools multiply the chances of stable trading for any market participant. Using the Grid bot, any trader has an opportunity to gain maximum profit even from the slightest market movements, thanks to the specific grid algorithm strategy.

Ways To Make Your Grid Trading Strategy More Profitable

- Define market movement priority: To launch any Grid Bot and start earning money, it is important to define the priority of the market movement in the timeframe you are interested in, whether it will go up or down.

- Choose the right bot for the market condition: For an anticipated uptrend, the best choice would be a Long Grid Bot with an initial grid of buy orders, whereas for a downtrend, it would be better to use a Short Grid Bot with sell orders grid at the start. During a flat market, a Neutral Grid is best suited to work in the range, which will buy cheaper and sell higher, steadily gaining profit even from the low volatility market movements.

- Set an order size (buy/sell) amount and a number of levels manually: An order size of each level and their number can be set manually, according to your risk strategy, deposit and trading objectives.

- Take advantage of Grid’s principle: Grid’s principle can be used to capitalize on movement in a given range. For example, one can take advantage of Grid’s principle as soon as Bitcoin starts to show its first activity after the holidays.

By following these tips and utilizing the Grid Bot strategy, traders can utilize their capital more efficiently and increase their chances of making a profit on the cryptocurrency market.

This is exactly what we did, taking advantage of Grid’s principle to capitalize on movement in a given range as soon as Bitcoin started to show its first activity after the holidays.

Our Insane Grid Bot Case Study: BTC/USDT

As you may remember from our earlier posts in our series on grid bot trading, this is exactly what we looked at – the case of trading in a flat market and providing tips on achieving decent profits with minimal effort using such bots.

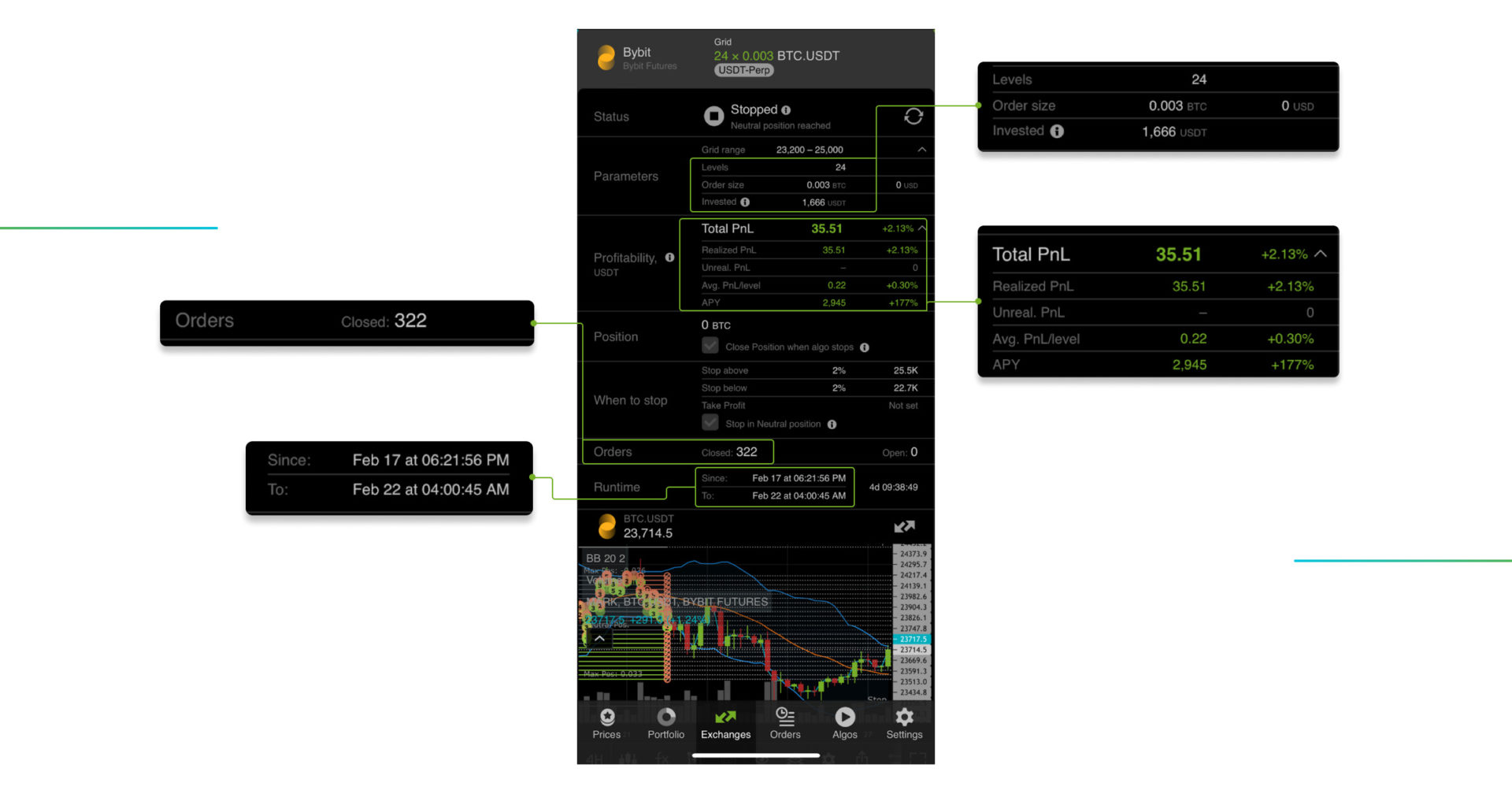

This time, we will show an awesome case of how we used the ByBit futures grid bot to trade BTC.USDT with x10 leverage and achieved impressive results with a mind-blowing ROI in just over 4 days of trading.

Well, let’s dive in and explore the details of this trade.

After the New Year’s stagnation, more volatility came into the market, and we decided to take the most advantage of it. On this occasion, the choice fell on a classic BTC.USDT pair on the Bybit exchange.

We set a range of 24 levels (between 23200-25000 USDT) in Neutral mode with a size of 0.003 BTC per level, with equivalent to 166 USDT of the total funds loaded in the bot (1660 USDT with x10 leverage).

- An important point to note is that we set a Stop Loss of 2% of the movement in case of a sharp price squeeze with the exit out of the range.

- The second important criterion was a Take Profit, we wanted to exit the market when the Neutral point is reached. We set the T/P tick approximately after a few days of running, while the bot was in the upper part of the range, to close the trade when it would return to the initial price level where it was launched (close Neutral)

During the bot’s run time, it performed 322 orders just in 4d and 10h. This brought us a solid PnL gain of 21.3% to the body of the investment of 166 USDT, with the equivalent to 35.51 USDT of net profit. (the fees are already excluded)

Let’s Sum Up

The Grid bot opens up an opportunity to generate profits in the ranging market with minimal effort on your part. You just need to choose the range you are interested in, the number of levels, and the order size, and then the bot executes orders moving from level to level of the grid. Moreover, the Grid will never be affected by emotions or fear, which makes it indispensable even in the most difficult market conditions.

By automating the trading process with Grid bots from GoodCrypto, traders can take advantage of any market movements around the clock, exploit their capital more efficiently, mitigate risks, and gain solid profits even when it is difficult to make trades manually. All this can be done without the need for constant monitoring.

Doesn’t that sound amazing? It’s even easier in practice – just run your Grid bot in a couple of clicks and profits will not be long in coming! Explore the greatest wonders of trading with GoodCrypto PRO features and use the top trading tools available in the market.