Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

Huobi Korea aims to break away from its parent firm and alter its name

The cryptocurrency exchange Huobi Korea is getting ready to buy its shares from Huobi Global and alter its name, according to a Jan. 9 report from the South Korean news site New1. Co-founder of Huobi Global, Leon Li, owns around 72% of the stock of Huobi Korea. Li’s stake in the Korean business would be acquired by Cho Kook-bong, chairman of Huobi Korea. According to News1, Cho owns a significant regional cryptocurrency mining business.

Huobi has recently faced a variety of problems. According to reports, it let off 20% of its workers on January 6, following a $60 million loss that week.

For weeks, there had been rumors that Huobi Global was having issues. It was one of the initial partners for the city of Busan in its endeavor to establish itself as “the blockchain city of South Korea.” Still, it was eliminated along with the other four worldwide partners in the latter part of last year. In October, Li sold Justin Sun a part of Huobi Global.

Over $5B in liquid cryptocurrency and cash has been recovered by FTX

The failing cryptocurrency exchange has “recovered $5 billion in cash and liquid cryptocurrencies,” claims FTX attorney Andy Dietderich. However, the entire client deficit is “still unclear,” and the exchange is currently “working to rebuild transaction history.” On Wednesday, Dietderich told a bankruptcy judge in Delaware that the business intended to sell non-strategic investments worth $4.6 billion.

Binance and Voyager, first approval for a US transaction amid national security inquiries

Voyager Digital, a bankrupt cryptocurrency lender, has gained preliminary court permission for its plan to sell $1.02 billion worth of assets to Binance.US. The decision was made amid a national security investigation against Binance.US that Voyager is attempting to accelerate.

According to a Jan. 11 Reuters report, Judge Michael Wiles of the United States Bankruptcy Court for the Southern District of New York authorized Voyager to enter into the asset purchase agreement and request creditor approval on Jan. 10. However, the sale won’t be final until a subsequent court hearing.

During the court hearing, Joshua Sussberg, an attorney for Voyager, stated that the company has been responding to inquiries from the Committee on Foreign Investment in the United States (CFIUS) and will address any issues CFIUS may have that may cause it to reject the acquisition.

“We are coordinating with Binance and their attorneys to not only deal with that inquiry, but to voluntarily submit an application to move this process along,” added Sussberg.

CFIUS is an interagency organization that assesses foreign investments in or acquisitions of American businesses for potential threats to national security. Suppose CFIUS finds that there are legitimate national security concerns about the agreement. In that case, it has the authority to reject or reverse the transaction or instruct all parties to make changes to ease the problems.

The Voyager Official Committee of Unsecured Creditors, a group representing creditors without security interests in Voyager, supported the transaction in its current form, noting that it would result in more significant recoveries for creditors than if Voyager liquidated its holdings itself, as would happen if CFIUS blocks the transaction.

In a second round of layoffs, Coinbase plans to reduce its employment by another 20%

On January 10, Coinbase CEO Brian Armstrong declared that the exchange would eliminate 950 positions to slash operational expenses by about 25% amid the continuing crypto winter.

Although Armstrong highlighted that Coinbase is “well capitalized” and that cryptocurrency “isn’t going anywhere,” the company must continue with layoffs to maintain “appropriate operational efficiency.” Coinbase will discontinue specific initiatives with a “lower probability of success” as part of a personnel reduction, the CEO said, without mentioning which projects will be done so.

Regarding the opportunity presented by the loss of FTX and the rising regulatory clarity, Armstrong said, “In fact, I believe recent events will ultimately end up benefiting Coinbase greatly.” Added:

“But it will take time for these changes to come to fruition, and we need to ensure we have the appropriate operational efficiency to weather downturns in the crypto market and capture opportunities that may emerge.”

The company’s 8-K form filing with the US Securities and Exchange Commission, which is attached to Coinbase’s blog release, indicates that Coinbase’s audited financial statements for 2022 are not yet available.

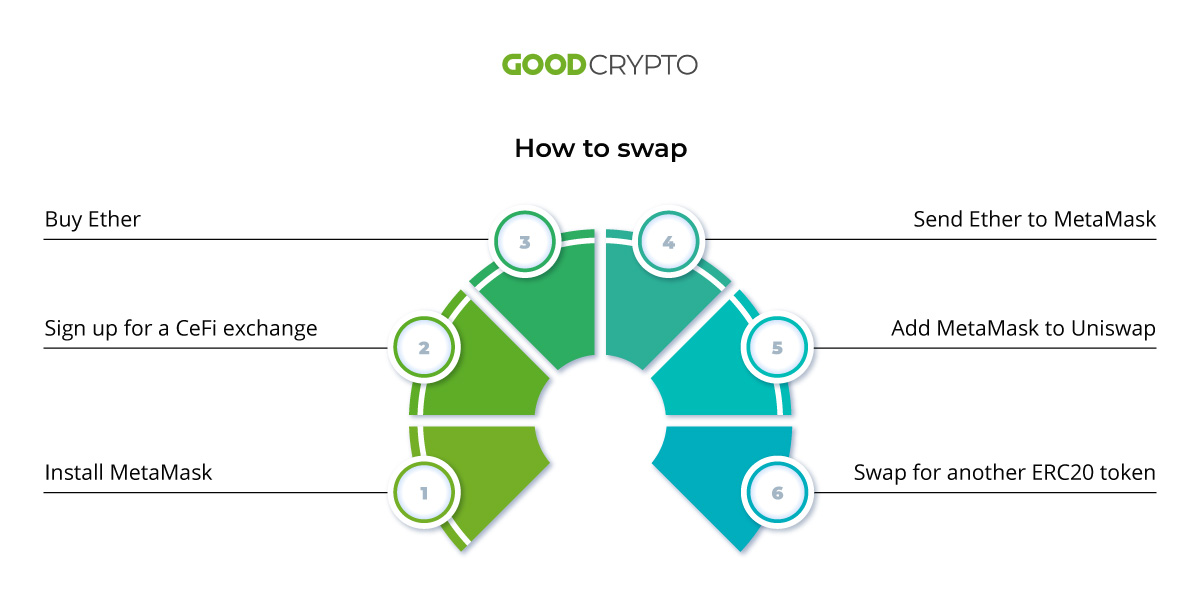

How to swap?

For a swap to happen, you must have the input token to sell and the output token to buy in exchange. So you’ll need those tokens, such as Dai and WBTC, and an ERC20 wallet like MetaMask.

It’s obviously not rocket science, but it’s still more complex than Coinbase, where practically anybody can purchase bitcoin with a few simple clicks.

Find all about Privacy, Security, Wallet, and more in the Ultimate Guide in the crypto world.

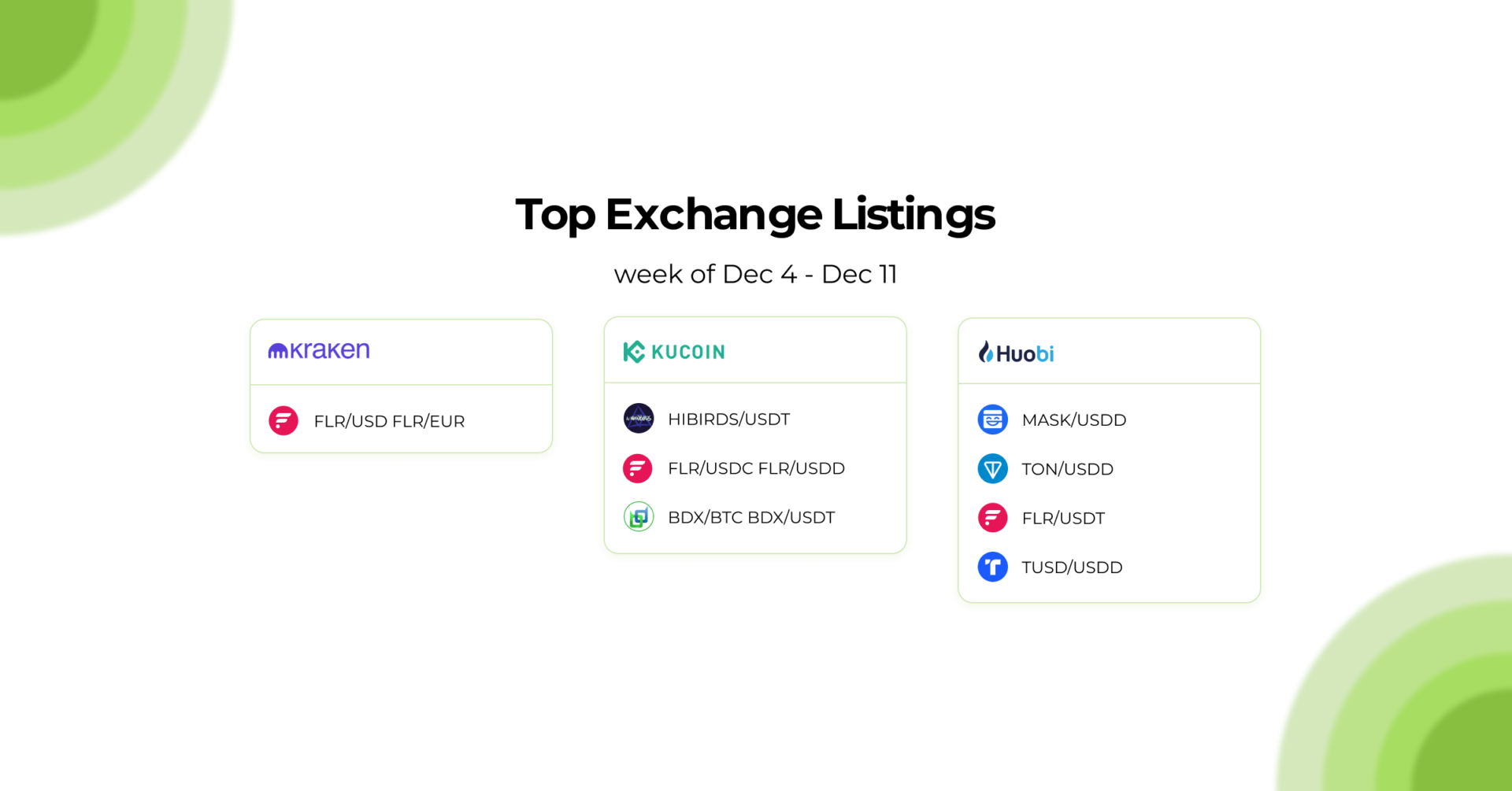

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!