Hey there!

The crypto market continues its post–New Year rally, driven by positive headlines despite rising global political tensions. Here’s a recap of this week’s key events that may have influenced the market:

quick weekly news

December core consumer prices rose at a 2.6% annual rate

Let’s begin this digest with the latest bullish news. On January 13, 2026, the U.S. Bureau of Labor Statistics released the CPI report for December 2025. Analysts expected seasonally adjusted inflation to rise by 0.3%, from 2.4% to 2.7% year over year.

However, the market was surprised to see a smaller inflation increase of just 0.2%, bringing annual inflation to 2.6% annually, excluding volatile food and energy prices. One possible reason for this misjudgment may have been an overestimation of the impact of tariffs on inflation.

While tariffs were expected to drive the current price surge, the Trump administration, following the “Liberation Day” announcement, introduced numerous tariff exemptions for specific goods and sectors. As a result, although tariffs of 20-30% were announced on average, the weighted average rate turned out to be only 15.8%.

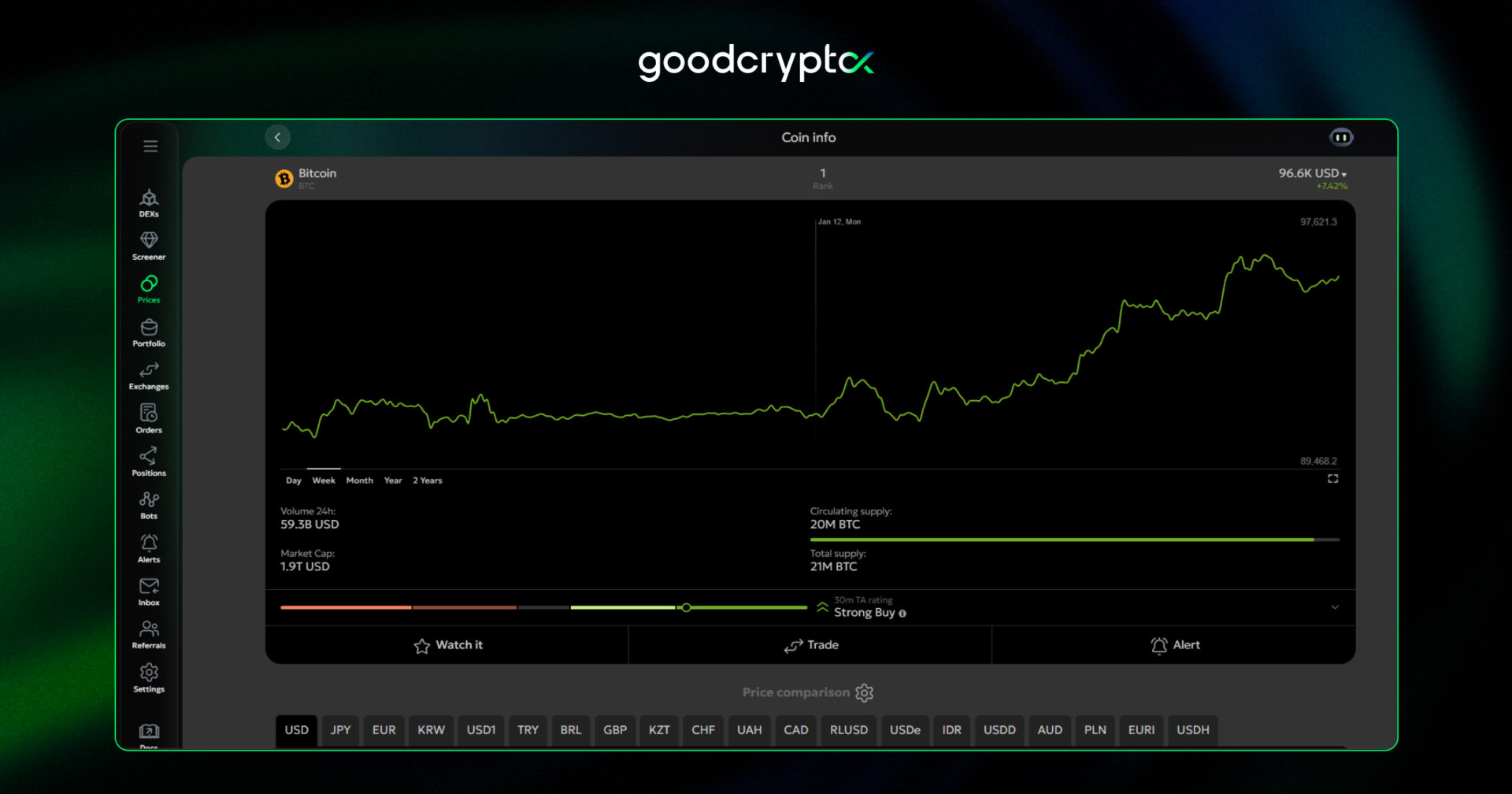

Amid the positive CPI data, market sentiment turned cautiously optimistic. Bitcoin rose by approximately 4% within a day after the CPI release and has continued to climb despite ongoing political tensions.

Bitcoin at risk of dropping under $96,000 as U.S.-Iran rhetoric pressures risk assets

Talking about the rising global political tensions, the focus this week has been on the Iranian protests and the brutal suppression of demonstrators in Iran. To briefly recap, for almost half a month, the Iranian people have been holding protests across the country due to rapid economic deterioration.

The protests peaked this week, and the Iranian government reportedly allowed the military to use guns against protesters, which heightened tensions among pro-democratic leaders worldwide, including in the United States. The growing instability in Iran, coupled with the increasing chances of new strikes from the U.S. or Israel, has added pressure to the markets. Despite sanctions, Iranian oil remains an important component of the global economy, and traditionally, any turbulence in the global economy also impacts the crypto market.

However, in the latest Trump press conference on January 15, he softened his rhetoric, stating that the government “stopped killing Iranian protesters.” While this does not entirely rule out military intervention, the probability of such an outcome has decreased.

Zcash price soars after SEC scraps investigation into privacy coin

Another notable development has emerged with Zcash’s $ZEC – a token we mentioned in our previous digest. Last week, the entire development team of the protocol resigned, causing a significant selloff in the market, despite the team stating that the Zcash protocol itself would not be affected.

This week, the news about Zcash was bullish. The Securities and Exchange Commission reportedly dropped an investigation into the organization. This investigation had been initiated by the previous SEC administration under Gary Gensler. On August 31, 2023, the Zcash Foundation received a subpoena from the SEC in connection with an inquiry designated “In the Matter of Certain Crypto Asset Offerings (SF-04569).”

Privacy protocols like Zcash are often used to avoid sanctions and regulations, which was a focus for the previous SEC team. However, with Paul Atkins entering office as the new chairman, several investigations against Web3 companies have been dropped, with Ripple being the most prominent example.

Amid this news, Zcash token $ZEC rose over 5% in the last 24 hours, finishing the week with a 13% price gain:

Senator Lummis says crypto market structure bill hearing may get postponed

The last major news of the week comes from the U.S. Senate. The Senate Banking Committee has delayed the markup of a bipartisan crypto market structure bill. The reason for the postponement has not been disclosed.

Despite the delay, the committee confirmed that talks with industry, regulators, and law enforcement are ongoing. Interestingly, one of the key crypto players in the U.S., Coinbase, does not support the current version of the bill. According to Brian Armstrong, CEO of Coinbase, the legislation grants “too much power to the SEC,” imposes a “de facto ban on tokenized equities,” enforces “DeFi prohibitions,” and includes amendments that could further restrict companies’ ability to pay “rewards” on users’ stablecoin holdings.

The crypto market structure bill is among the first bills simultaneously introduced by both major U.S. parties. It aims to establish clear regulatory rules for crypto in the United States, define jurisdiction between the Securities and Exchange Commission and the Commodity Futures Trading Commission, and create a federal framework for overseeing digital-asset markets.

Supertrend indicator: a definitive guide

The Supertrend indicator is a trend-following trading tool that helps traders identify clear buy and sell signals based on price direction and volatility. Through its signals, it helps users set precise entry and exit points on the chart.

🤔 How you should use it:

- Catch trend reversals: Go long when the Supertrend line flips green, or short when it turns red, making it a simple way to ride strong moves early.

- Set smart stop losses: Use the Supertrend line as a dynamic stop loss that follows the price and protects your downside;

- Confirm with other Indicators: Combine with EMA, RSI, or MACD to filter out false signals and improve entry accuracy.

📖 Ready to level up your crypto trading? Read the full Supertrend Indicator guide by goodcryptoX and make your trading strategy more efficient!

Receive an instant notification when a new coin is listed with goodcryptoX PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the goodcryptoX app!