Hi there, and Merry Christmas, everyone! 🎄

Today, we’ve prepared a roundup of the latest and hottest crypto events that occurred this week. Let’s recap them together to stay up to date with the blockchain industry 👇

quick weekly news

Japan PM not ready to talk about Bitcoin national reserve

On December 26th, local Japanese media reported on recent statements by the Japanese Prime Minister, who questioned the decision of “the US and some other countries” to introduce Bitcoin as a strategic funding reserve.

This follows earlier remarks by Senator Satoshi Hamada of the Party to Protect the People, who suggested that Japan should consider adopting a similar approach to the US and other Western countries that are reviewing their policies on crypto and Bitcoin and asked current government members their opinions on this. He stated, “I believe that Japan should follow the example of the United States and other countries and consider converting part of its foreign exchange reserves into cryptocurrencies such as Bitcoin.”

In response, the government noted that they are in the “early stages” of discussing the potential introduction of Bitcoin reserves. They emphasized that “crypto assets do not fall under foreign exchange, etc.” and that the current reserves are intended to stabilize foreign currency-denominated assets and bond markets. This means that even if the government were to support the creation of Bitcoin reserves, changes to the existing legal framework would be required.

Adding to the rather “cold” stance from the Japanese Prime Minister on Bitcoin, it seems the government recognizes the volatility of crypto assets, including Bitcoin, and the potential risks related to purchasing or holding cryptocurrencies.

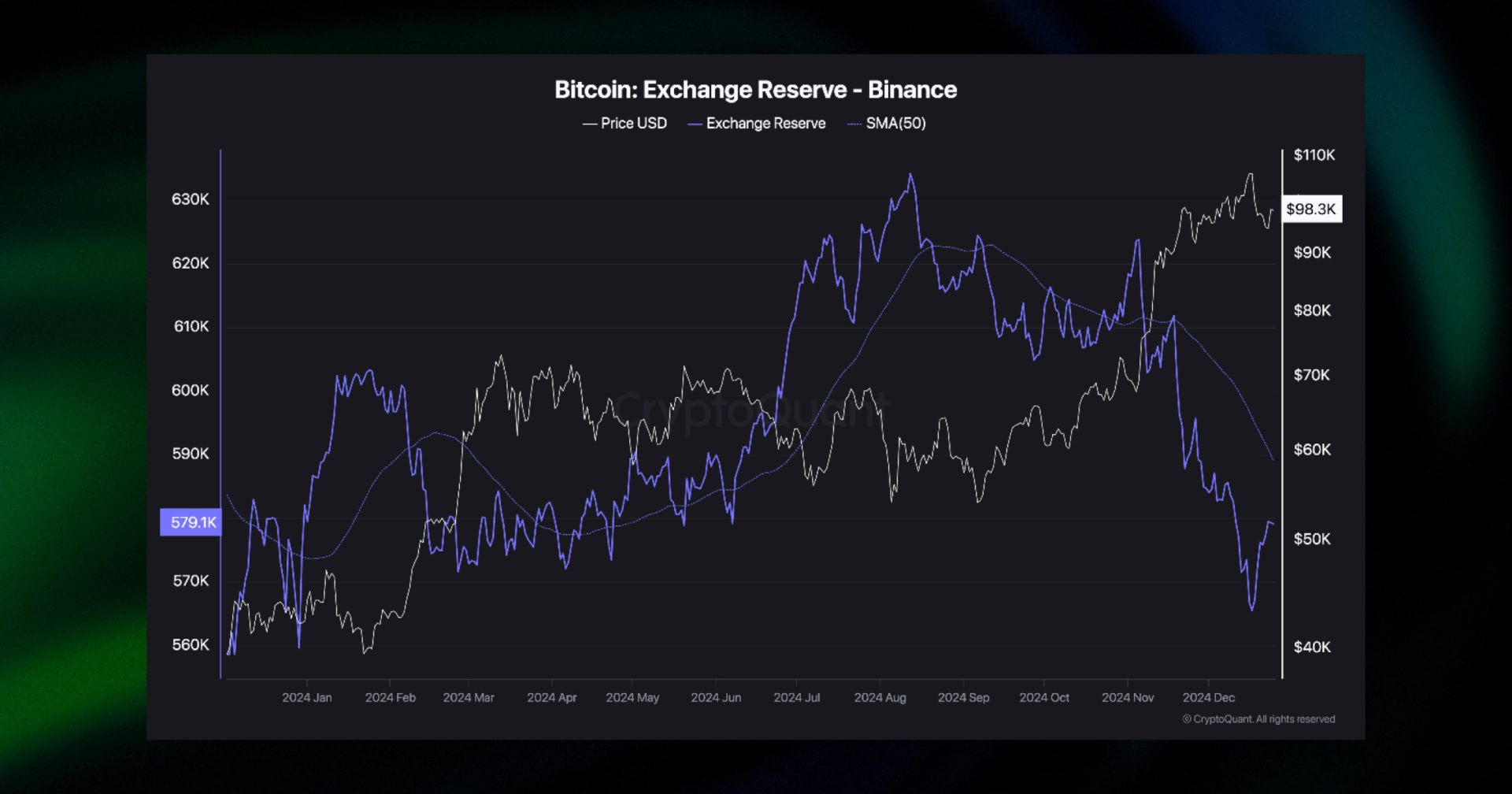

Binance Bitcoin reserves hit January levels — months before BTC jumped 90%

Talking about volatility, CryptoQuant analyst Darkfrost recently reported that Binance’s Bitcoin reserves have fallen to record-low levels of approximately 570K Bitcoins, a level last seen in January 2024, two months before the surge in March. A decreasing Bitcoin supply among exchanges is usually an indicator that investors are opting to withdraw their holdings from exchanges rather than keeping them there for short-term selling.

This suggests growing confidence in Bitcoin’s long-term prospects, which, in turn, indicates a more robust environment for Bitcoin to potentially surge even higher. What’s more, the achievement of record-low exchange supply coincided with $BTC reaching a new ATH of $108K.

Notably, considering the previous experience in March 2024, when BTC supply hit record lows and two months later $BTC surged by an impressive 90%, this data suggests Bitcoin could achieve nearly $180K in the mid-term. Nevertheless, even without considering the specific numbers, the increasing number of withdrawals from exchanges remains a positive sign for the market.

six Bitcoin mutual funds to debut in Israel next week

According to CoinDesk, the Israeli media outlet Calcalist reported that six mutual funds are set to be released on the market. As the report states, the Israel Securities Authority (ISA) has already given final approval for these products, on the condition that all six funds debut simultaneously on December 31st.

These funds will be offered by Migdal Capital Markets, More, Ayalon, Phoenix Investment, Meitav, and IBI, with management fees ranging from 0.25% to 1.5%. Meanwhile, one of the funds will aim to outperform Bitcoin by actively managing its assets.

This approval comes almost a year after the US SEC approved Bitcoin ETFs in the United States. The US remains a major point of reference for its partners regarding monetary strategies and policies, as it continues to be the largest economy in the world.

“The investment houses have been pleading for more than a year for ETFs to be approved and started submitting prospectuses for Bitcoin funds in the middle of the year. But the regulator marches to its own tune. It has to check the details,” an unidentified senior executive analyst told Calcalist.

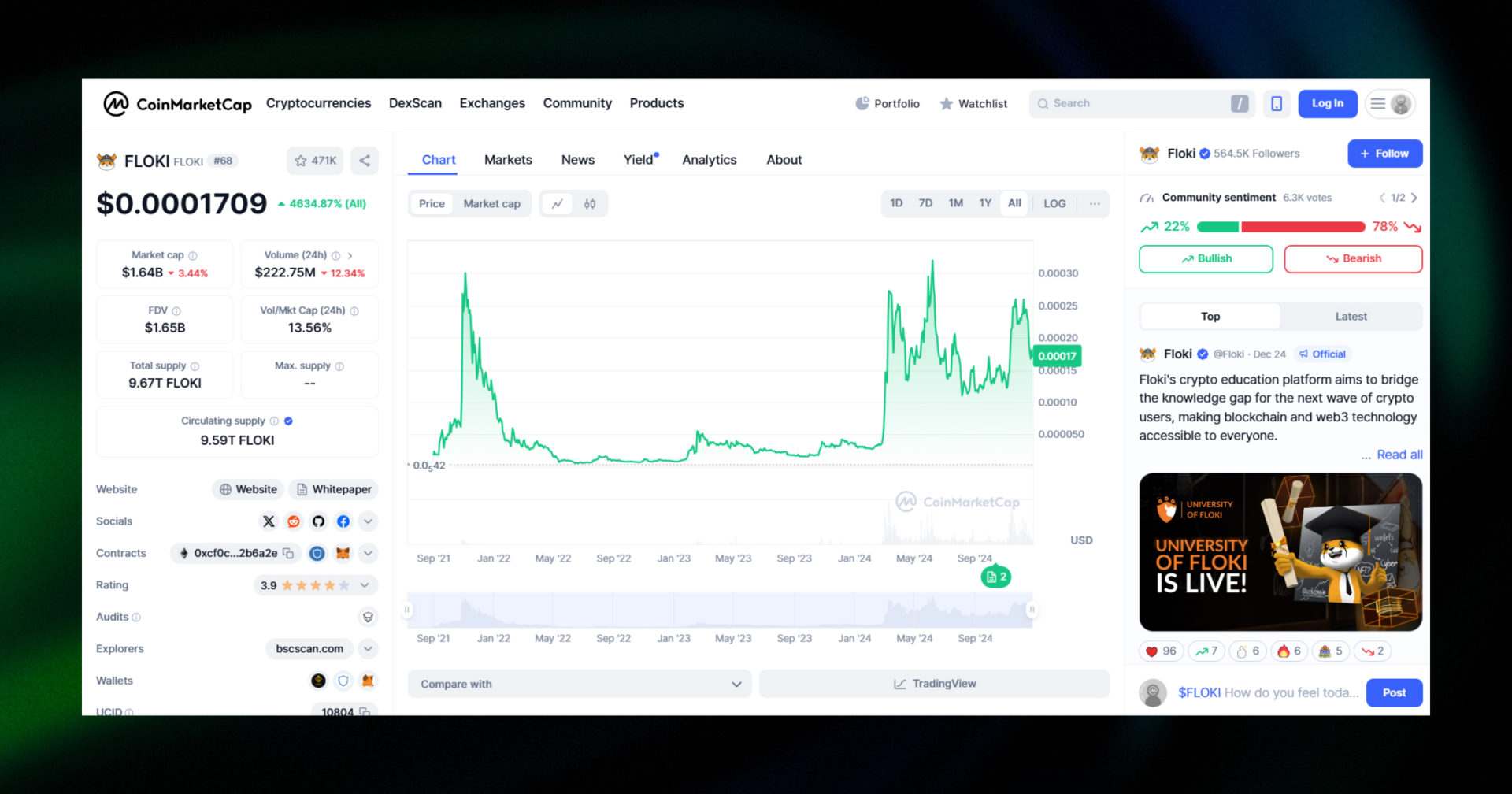

Floki on course for Europe ETP

Recently, CoinDesk reported that one of the unnamed Floki developers stated that Floki Inu is working with an unidentified asset manager to provide liquidity for a European ETP. This development follows last month’s Commodity Futures Trading Commission (CFTC) meeting, where Floki was classified as a utility token alongside $ETH and $AVAX. The estimated launch date for this event is early 2025, meaning that if successful, Floki would become the second memecoin after $DOGE to have an institutional product in Europe.

“We’ve been actively working with a respected Asset Manager and an ETP Issuer to launch a Floki ETP (Exchange-Traded Product) for quite a while now, and after months of due diligence and painstaking effort, we’ve been told that the Floki ETP is on track to go live in early Q1, 2025,” said the developer.

To recap, $FLOKI is the native token of the Floki NFT metaverse, which allows holders to vote on major updates within the ecosystem. However, it is also considered by many users as a memecoin due to its concept and design, inspired by Elon Musk and his Shiba Inu dog. Launched in 2021, the coin has grown by over 4600%, according to CoinMarketCap, and is now the 68th largest cryptocurrency in the industry.

Source: CoinMarketCap

reviewing test sniper bot case #1

Gems 💎 sniper bot is one of the most powerful features recently added to goodcryptoX. It allows you to automatically snipe new coins that match your criteria across multiple unique metrics such as liquidity, experienced buyers, buying/selling pressure, and more. The test mode has already been running live for a while, giving some of our users the opportunity to try it out and achieve up to 144% ROI within a single month!

Check out our sniper trading case #1 to discover 👇

🔸 New setup ideas for your bot;

🔸 The most common mistakes you might encounter during the setup;

🔸 And most importantly, the correlation between changes in key metrics and the bot’s profitability.

Read our case and start trading on-chain like a pro with our 💎 Gems sniper bot! 💪

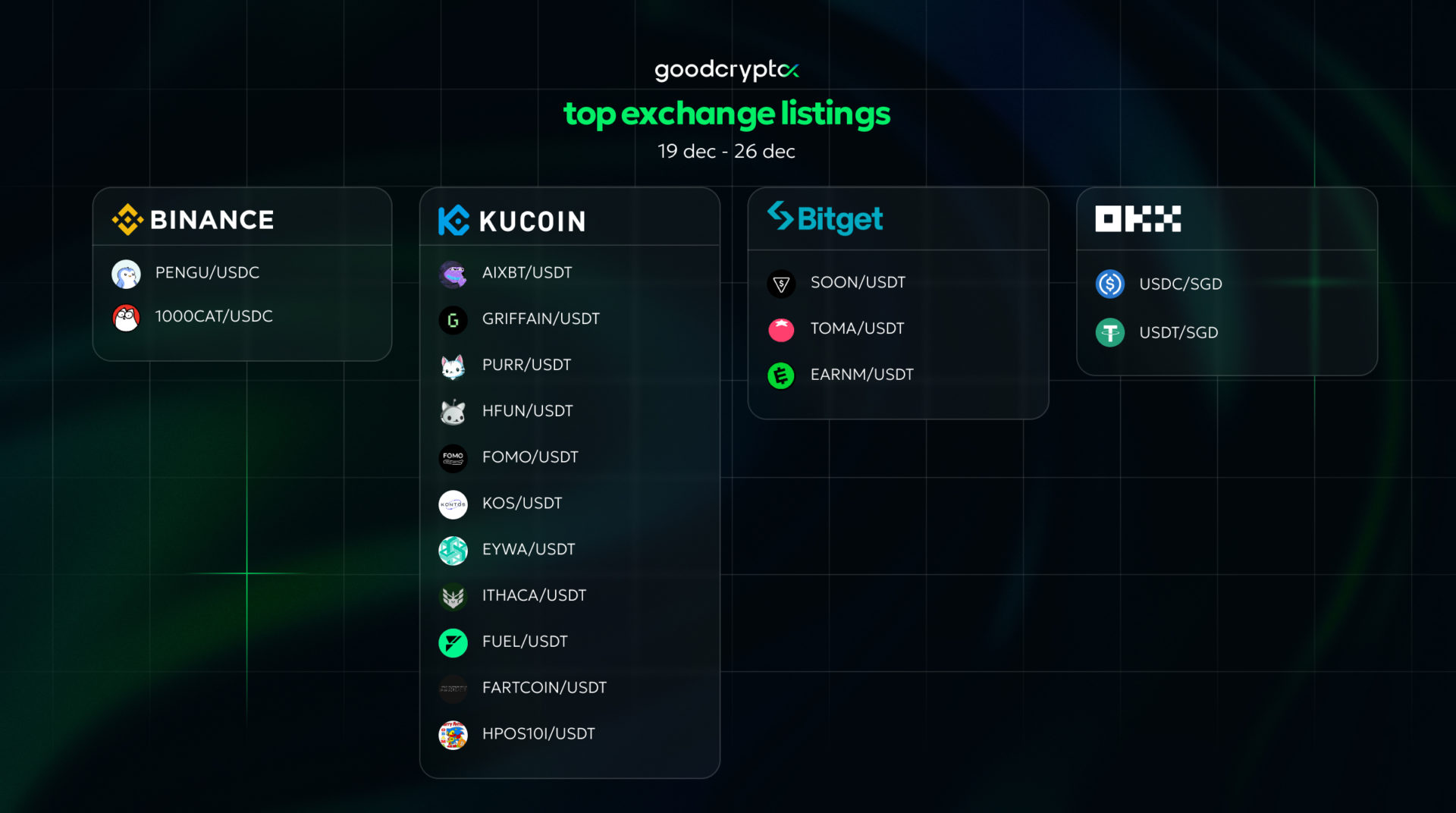

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!