Discover the power of MEXC with GoodCrypto! Advanced tools like bots, trailing stops, and smart TA signals and TradingView webhooks at your fingertips.

JPMorgan CEO calls Bitcoin a “pet rock,” price dips

Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want these updates as soon as we post them, follow us on Twitter.

quick weekly news

JPMorgan CEO calls Bitcoin a “pet rock,” price dips

Bitcoin faced a downturn, dropping to $42,400 after JPMorgan CEO Jamie Dimon labeled it a “pet rock” with no real purpose at the World Economic Forum. Dimon reiterated outdated criticisms, citing limited use cases such as AML, fraud, and tax avoidance, downplaying Bitcoin’s significance.

The cryptocurrency struggled to sustain support at $43,000 due to overall market liquidity issues. Despite last week’s spot Bitcoin ETF launches, Dimon expressed ambivalence towards competitors embracing Bitcoin, and he vowed not to discuss it further on CNBC. Traders cautioned about the unpredictable BTC market, emphasizing the challenge of predicting short-term movements.

Traders, on the other hand, expect Bitcoin to remain range-bound between $47,000 and $38,000 in the coming months, with increased focus on alternative cryptocurrencies.

IRS pushes pause on controversial crypto tax reporting rule

The IRS is delaying the requirement for U.S. businesses to report cryptocurrency transactions above $10,000. The IRS’s decision to delay the rule comes after concerns from businesses and crypto advocates, according to a Jan. 16 announcement from the IRS.

The IRS has not yet said when it will issue new regulations on how businesses should report cryptocurrency transactions. In the meantime, businesses are not required to report these transactions.

The decision is a positive step for the crypto industry, as it gives businesses more time to prepare for the new reporting requirements. However, it is important to note that the IRS has not abandoned the idea of requiring businesses to report cryptocurrency transactions.

ETF sell-off: Grayscale drops $376 million in BTC

According to data from blockchain analytics platform Arkham Intelligence, Grayscale Bitcoin Trust, a major holder of Bitcoin, sold off another $376 million worth of BTC (8,730 coins) on January 16th, despite Bitcoin’s price stabilizing. This outflow follows previous sales, and some analysts believe it contributes to recent price dips.

The trust’s conversion into an ETF allows investors to redeem shares for Bitcoin, which triggers selling when the GBTC price is lower than the underlying BTC value. Critics point to the 1.5% management fee as a potential reason for these outflows.

Despite the trust’s selling, other Bitcoin ETFs saw inflows of nearly $1.4 billion in the same period, indicating continued demand for Bitcoin exposure through ETFs.

Bitcoin ETF battle begins: GTBC outflows, spot ETFs rise

New Bitcoin ETFs arrived with a bang, but confusion quickly clouded the hype. Outflows from Grayscale’s giant GBTC fund, totaling $1.17 billion, nearly drowned the inflows to other spot ETFs.

The key question: will investors ditch GBTC’s high fees for cheaper, newer funds? Lower fees could fuel spot ETF growth.

Despite the GBTC drain, genuine demand for spot ETFs shines through. Social media buzz and strong inflows suggest it’s not just arbitrage. Can this demand outlast the GBTC exodus? Bitcoin bulls are cautiously optimistic, seeing it as a temporary hurdle before a potential price surge.

The GBTC vs. spot ETF battle is on, with lower fees and potential demand tilting the scales towards the newcomers. The halving adds another layer of intrigue, keeping Bitcoin bulls hopeful. The future of Bitcoin ETFs is uncertain, but the next few months promise to be fascinating.

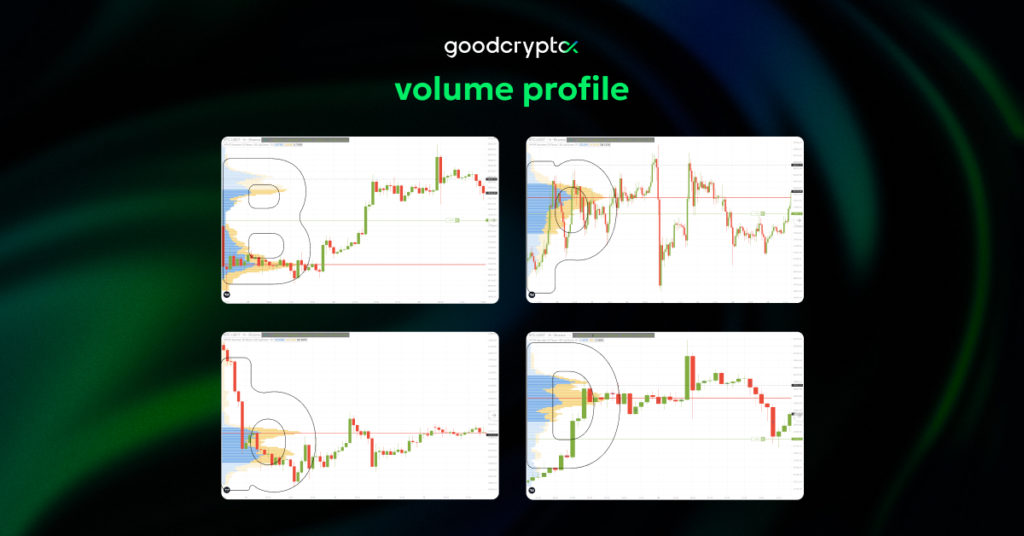

a short guide to Volume Profile shapes

The financial markets can often feel like a chaotic whirlwind, with prices dancing unpredictably and leaving traders struggling to discern the underlying forces. However, hidden within this turbulence lies a valuable source of information: volume 📊

While traditional indicators focus solely on price movements, the Volume Profile delves deeper, revealing the distribution of trading activity across different price levels.

The Volume Profile indicator comes in various shapes, offering valuable insights for traders:

- D-Shaped: Balanced market, bell-like curve. A “fair” price (POC) waits to be broken, either up or down.

- P-Shaped: Uptrend alert! Buyers dominate, pushing the price higher. New POC forms at the wider top.

- b-Shaped: Sellers in control, price drops and consolidates. Expect a bearish swing in the long run.

- B-Shaped: Double high-volume zones? Buckle up, the trend’s gonna keep on going!

✨ The market whispers secrets, but you need the right tools to hear them. Enter the Volume Profile, a chart that reveals the language of volume, showing where buyers and sellers clash and compromise.

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!

Share this post:

January 18, 2024