Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

Days after SBF bail, Alameda wallets become active, and the community considers foul play

Just a few days after the former CEO Sam Bankman Fried was freed on a $250 million bail, it was discovered that the cryptocurrency wallets linked to the now-defunct trading business Alameda Research — sister FTX’s company — were sending money out.

The community was interested in the movement of money from Alameda wallets, but they were more interested in how these dollars were transferred. It was discovered that the Alameda wallet was exchanging ERC20 token bits for ETH/USDT and that the ETH and USDT were subsequently routed through instant exchanges and mixers.

ZachXBT, an on-chain expert, saw that the Alameda wallet ultimately exchanged the cash for Bitcoin utilizing decentralized exchanges like FixedFloat and ChangeNow. Unfortunately, hackers and exploiters frequently use these platforms to conceal their transaction paths.

Many others hypothesized that the way these monies are transferred appears exploitative. Still, considering that Bankman-Fried is now known to have a criminal record, many people also thought it may be an inside job to remove whatever money was still in those wallets.

Others questioned why he was permitted access to the internet and the bail restrictions. Adding, “Why did his bail condition include no computer/internet access?“

Galaxy Digital purchases Argo Blockchain’s top mining plant for $65 million

On December 28, Argo Blockchain CEO Peter Wall announced an agreement to sell the Helios facility for $65 million to Mike Novogratz’s cryptocurrency investment company Galaxy Digital. Argo has already begun cashing its mined Bitcoin to lower the loan to Galaxy.

Argo will also get a fresh $35 million equipment financing loan from Galaxy to reduce the ailing miner’s debt. “We’ve used the proceeds of that sale in a new Galaxy loan to pay off the debt that we owed to NYDIG and a tiny bit to another secured lender,” Wall said.

The new deals are intended to lower Argo’s overall debt by $41 million, increase liquidity, and enhance the operational structure, all of which will enable the company to continue its mining activities, according to the CEO.

Wall stated that under pressure from high energy expenses combined with the low Bitcoin price, the agreement was the “only viable path forward” during the bear market.

Kraken has left Japan for the second time, citing a “weak crypto market”

In a blog post published on December 28, Kraken stated that as part of efforts to “prioritize resources” and investments, the company has chosen to stop operating in Japan and deregister with the Financial Services Agency by January 31, 2023. It said:

“Current market conditions in Japan, in combination with a weak crypto market globally, mean the resources needed to further grow our business in Japan aren’t justified at this time.”

“As a result, Kraken will no longer service clients in Japan through Payward Asia,” it continued.

Users can move their cryptocurrency assets to an external wallet or convert them to Japanese yen before transferring them to a local bank account. In addition to the method that will soon be disclosed, withdrawal restrictions will be eliminated in January, and users will be able to collect staked Ether.

On January 9, deposits will be blocked, but trading features will still be available.

In recent months, Kraken seems to have prioritized cost reduction.

On Nov. 30, Kraken said that, in light of challenging market conditions, it had taken one of its “hardest decisions” to reduce its worldwide staff by about 1,100 workers, or 30% of its personnel.

According to reports, 400 million Twitter users’ data is for sale on the darknet

On December 24, the cybercrime intelligence company Hudson Rock raised the alleged “credible threat” of selling a private database holding the contact information of 400 million Twitter users accounts.

“The private database contains devastating amounts of information including emails and phone numbers of high profile users such as AOC, Kevin O’Leary, Vitalik Buterin & more,” according to Hudson Rock, who continued by saying:

“In the post, the threat actor claims the data was obtained in early 2022 due to a vulnerability in Twitter, as well as attempting to extort Elon Musk to buy the data or face GDPR lawsuits.”

DeFiYield, a Web3 security company, examined the 1,000 accounts provided by the hacker as a sample and confirmed that the information is “real.” Additionally, it spoke with the hacker via Telegram, noting that they eagerly await a purchase there.

If confirmed, the hack might pose a severe risk to cryptocurrency Twitter users, especially those who use aliases.

The risks of having such information released online include focused phishing campaigns via text and email, account takeover assaults via SIM swaps, and the doxing of personal data.

Ichimoku Analysis

This SOL/BTC chart illustration demonstrates a recently created collection of bullish indications, and a Buy was validated. The price is above the cloud, the cloud is green, the Tenkan Sen (Blue) and Kijun Sen (Red) are bullish, the Chikou Span (Purple) is above the price and the cloud, and we definitely made support for the Kijun Sen as we can see from the price’s recent bounce directly above the line. You can set a stop loss order beneath the cloud at 0.00020000 or under the Kujun Sen, a previous support level.

A long trade may be initiated since all five signs are bullish. With the help of this article, you should use the Ichimoku Cloud indication and recognize when it is telling you to buy or sell.

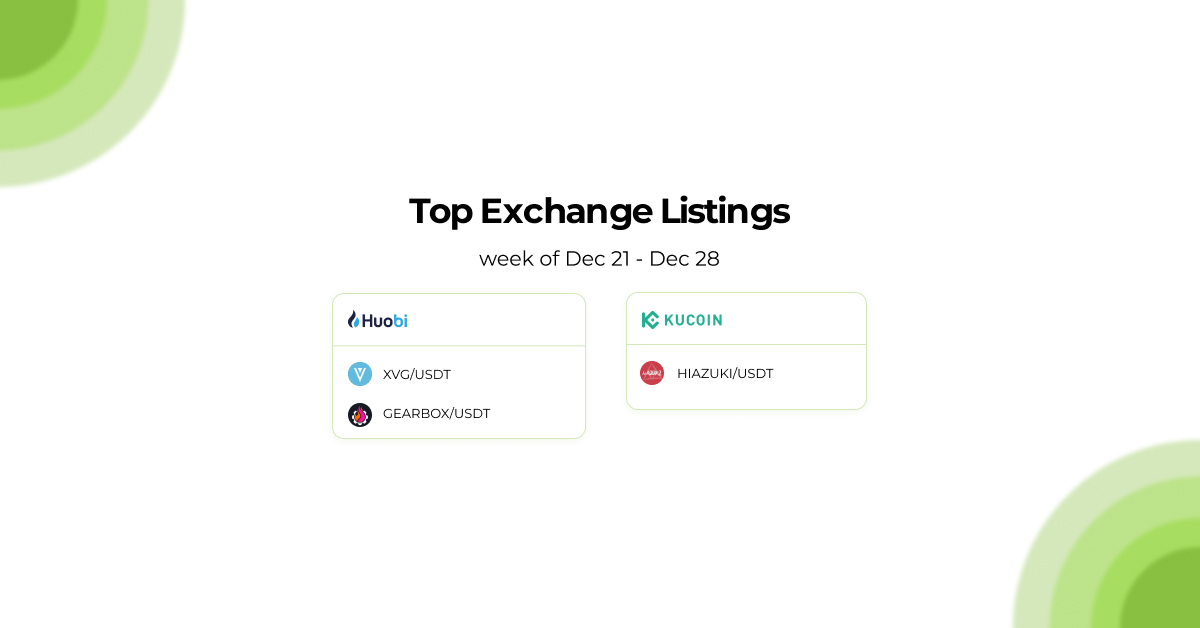

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!