Hey, there! 👋

Over the past week, several notable crypto events have occurred that are set to further shape the Web3 industry. Let’s explore the shiniest ones to stay up to date in the ever-evolving crypto market 👇

quick weekly news

less than 1% of Microsoft shareholders voted in favor of investing in Bitcoin

On November 11th, 2024, Microsoft conducted a vote regarding a proposal released a few days earlier to buy and hold Bitcoin.

According to the Microsoft Investor Relations report, only 28.234M Microsoft shareholders voted in favor of purchasing and holding $BTC, while 5.148B voted against the decision. This means only about 0.5% of the voters supported the initiative. As a result, during the shareholder meeting, Microsoft issued its verdict, stating: “Bitcoin is a more volatile asset at the moment than corporate bonds, so companies should not risk shareholder value by holding too much of it.”

Nevertheless, despite the overwhelming vote against purchasing $BTC and its classification as “too volatile,” the company described Bitcoin as one of the best hedges against inflation. Microsoft noted that corporate bond yields are “less than the true inflation rate.” Thus, it emphasized the importance of “not ignoring Bitcoin,” warning that dismissing the asset entirely might harm shareholder value. The company suggested that shareholders should evaluate whether investing in $BTC is worthwhile for each specific company while advocating for holding at least 1% of assets in Bitcoin.

Notably, Microsoft isn’t the first large corporation to receive a proposal to invest in Bitcoin. For instance, Amazon recently faced a proposal from its shareholders, led by the National Center for Public Policy Research, to allocate 5% of its holdings to $BTC. Meanwhile, Tesla already holds a significant amount of Bitcoin in its reserves, making it the fourth-largest U.S. company by total $BTC holdings value.

Vancouver votes to make the city “Bitcoin-friendly”

However, the adoption of Bitcoin isn’t limited to the corporate level, as the Vancouver city council has voted to explore ways to incorporate Bitcoin into its financial system.

According to the motion, Vancouver aims to begin accepting taxes and fees in Bitcoin and convert a portion of its financial reserves into Bitcoin as a hedge against inflation and currency volatility. This proposal draws inspiration from a previously passed Bitcoin legislation bill in Pennsylvania. The report also notes that ten other U.S. states are reportedly exploring similar legislation to enable adding Bitcoin to their strategic reserves, as is the incoming federal administration in Washington, D.C., on a national level.

That said, the positive outcome of the vote does not immediately make Vancouver “Bitcoin-friendly.” The city must establish numerous rules and regulations before it can start accepting fees or taxes in Bitcoin. Additionally, a robust investment strategy is required to begin forming its strategic Bitcoin reserves. Furthermore, despite the vote’s approval, opposition still exists, specifically from Green Councilor members, due to concerns about Bitcoin’s energy-intensive Proof of Work mechanism, which could potentially raise environmental issues.

MicroStrategy’s Nasdaq debut could trigger $2.1 Billion ETF buying spree

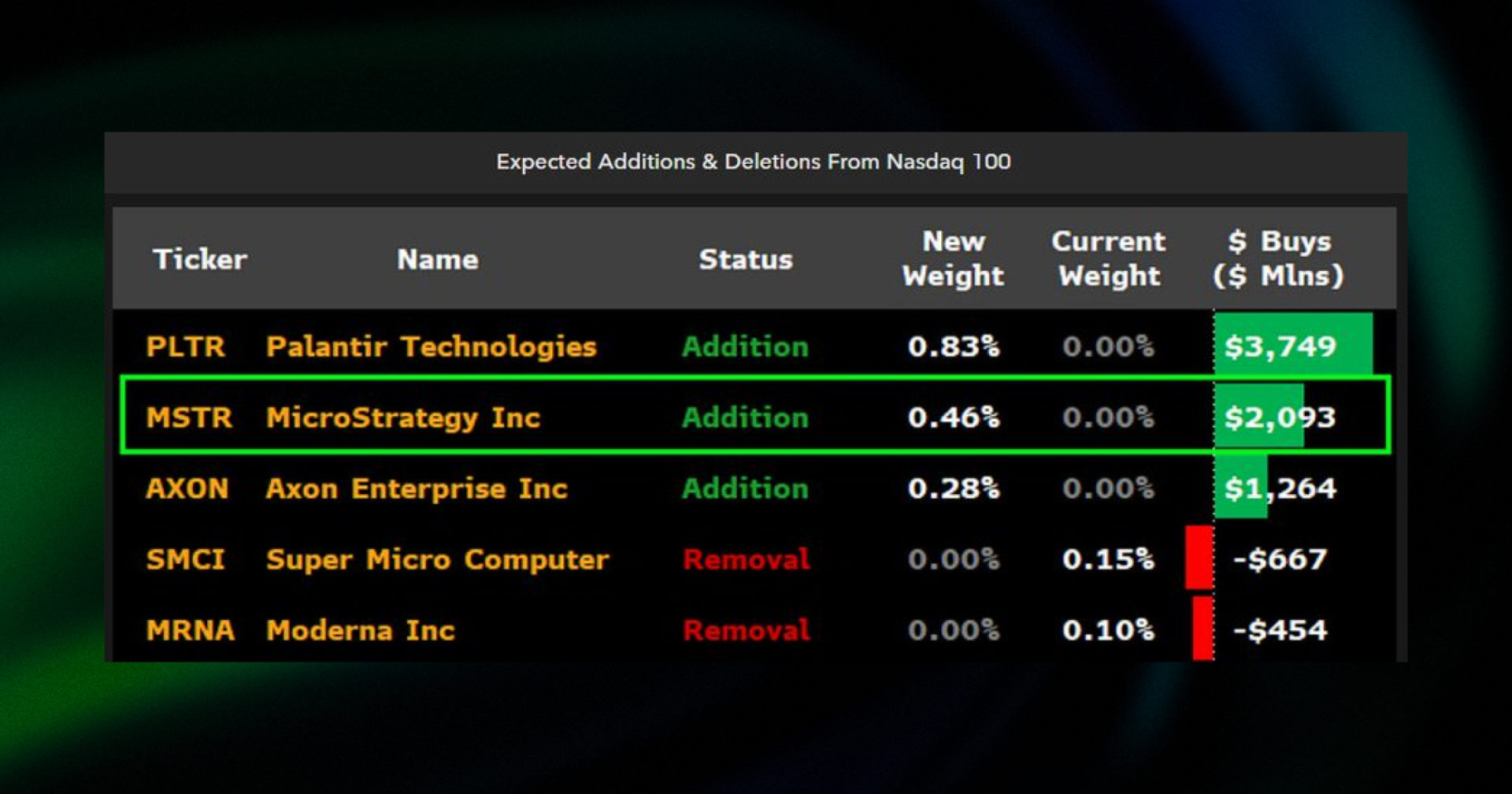

On December 10th, 2024, Bloomberg’s senior ETF analyst Eric Balchunas stated on Twitter that $MSTR (an abbreviation of MicroStrategy’s stock) is likely to be added to the Nasdaq-100 (QQQ) on December 23, 2024.

The Nasdaq-100 is a group of the 100 largest non-financial companies listed on the Nasdaq exchange. It serves as a key indicator of market trends for specific sectors such as technology, consumer services, and more. This index significantly influences U.S. investors, shaping market sentiment and investment flows across various sectors of the economy.

The potential inclusion of MicroStrategy in the Nasdaq-100 could draw increased investor attention toward crypto-related companies and MicroStrategy itself. According to research by James Seyffart, a crypto analyst at Bloomberg, this development could bring over $2B in inflows to $MSTR stock. However, as there have been no official statements from Nasdaq or MicroStrategy regarding the inclusion of $MSTR in QQQ, the development remains uncertain. It is currently regarded as the “best estimate of what will happen” rather than a confirmed decision.

Source: Eric Balchunas

scammers are using Telegram verification bots to inject crypto-stealing malware

On December 10th, 2024, the security firm Scam Sniffer released a Twitter post describing how scammers are combining social engineering with fake Telegram verification bots to inject crypto-stealing malware into users’ PCs.

According to the company, scammers have started orchestrating a complex scheme by creating fake profiles of crypto influencers and inviting X users to join their crypto community groups for “alpha” insights. However, when users click the link and attempt to join the channel, they are required to complete a “captcha” bot verification, which injects malicious PowerShell code into their clipboard.

Through this method, scammers have been able to steal users’ private keys and, as a result, the funds stored in their wallets. In light of these developments, we strongly endorse Scam Sniffer’s tips to avoid falling victim: beware of suspicious profiles, avoid unknown commands, stay calm during time-sensitive verifications, and diligently review what you are signing when verifying your Telegram account.

Source: Scam Sniffer

Stay Safe! 🤞

DCA bot usecases

The DCA trading bot is one of the most powerful tools in a bull market, allowing you to capitalize on market volatility. When the market moves against you, it increases your chances of turning a profit by averaging down your entry price.

💡 DCA Bot Use Cases

🔸 Setting multiple TPs: Imagine you’ve already gained some profit on your position and hold an asset you want to sell but aren’t sure about the best timing. Set up our bot as a multiple Take Profit tool to exit the market in parts at levels you define for the bot.

🔸 Accumulating long-term holdings: Building long-term holdings can be challenging due to frequent market reversals, often leaving you in a dilemma: “Is this the dip or not?” To solve this problem, set up our DCA crypto bot, which will automatically average down your entry price and capitalize on potential market dips.

Want to explore more DCA bot use cases? Check out our comprehensive DCA bot review 👇

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!