Hello there! 👋

This week has brought us some controversial news, adding both bullish and bearish sentiment to the current state of the crypto market. Let’s recap the most notable of them 👇

quick weekly news

Ohio lawmaker introduces Bitcoin reserve bill allowing state to buy BTC

On December 17th, Ohio House Republican leader Derek Merrin introduced HB 703, proposing to grant the state treasurer the authority, but not the requirement, to purchase Bitcoin. In a post on Twitter, he stated that the “US dollar is being rapidly devalued,” and therefore, the Ohio State Treasurer should have the flexibility to invest in $BTC as part of a “proper asset allocation.”

“Ohio must embrace technology and protect tax dollars from eroding,” he added.

Derek Merrin hopes HB 703 will serve as a regulatory framework in Ohio’s next legislative session, as the current one concludes in less than two weeks, on December 31st. Given this timeline, there won’t be much opportunity for the Ohio House to review the proposal. It is highly likely that the legislation will need to be reintroduced and reviewed during the 136th General Assembly, which begins on January 6th.

It’s worth noting that this is not the first time Derek Merrin has demonstrated his commitment as a pro-crypto politician. He has received a high “A” score for crypto adoption from Stand With Crypto, a Coinbase-supported advocacy organization, and he even refers to himself as a “strong defender of crypto” on LinkedIn. Given similar statements from officials in Texas and Pennsylvania, it’s not surprising that he would propose the idea of a Bitcoin strategic reserve for the Ohio State Treasuryю

FED will slow down rate cuts next year

This week brought some negative news for the crypto market as well. On December 18th, Jerome Powell, during the last Federal Reserve meeting, stated that despite a 0.25 bps rate cut this time, there will likely be a slowdown in rate cuts in 2025.

The primary reason behind this decision is inflation, which, according to Powell, is “steadily” receding but still at a pace “slower than hoped.” For this reason, he emphasized the need for caution in reducing rates next year. The Fed also updated its “dot plot” for 2025, indicating there will only be two rate cuts (50 bps) instead of the initially projected three (75 bps).

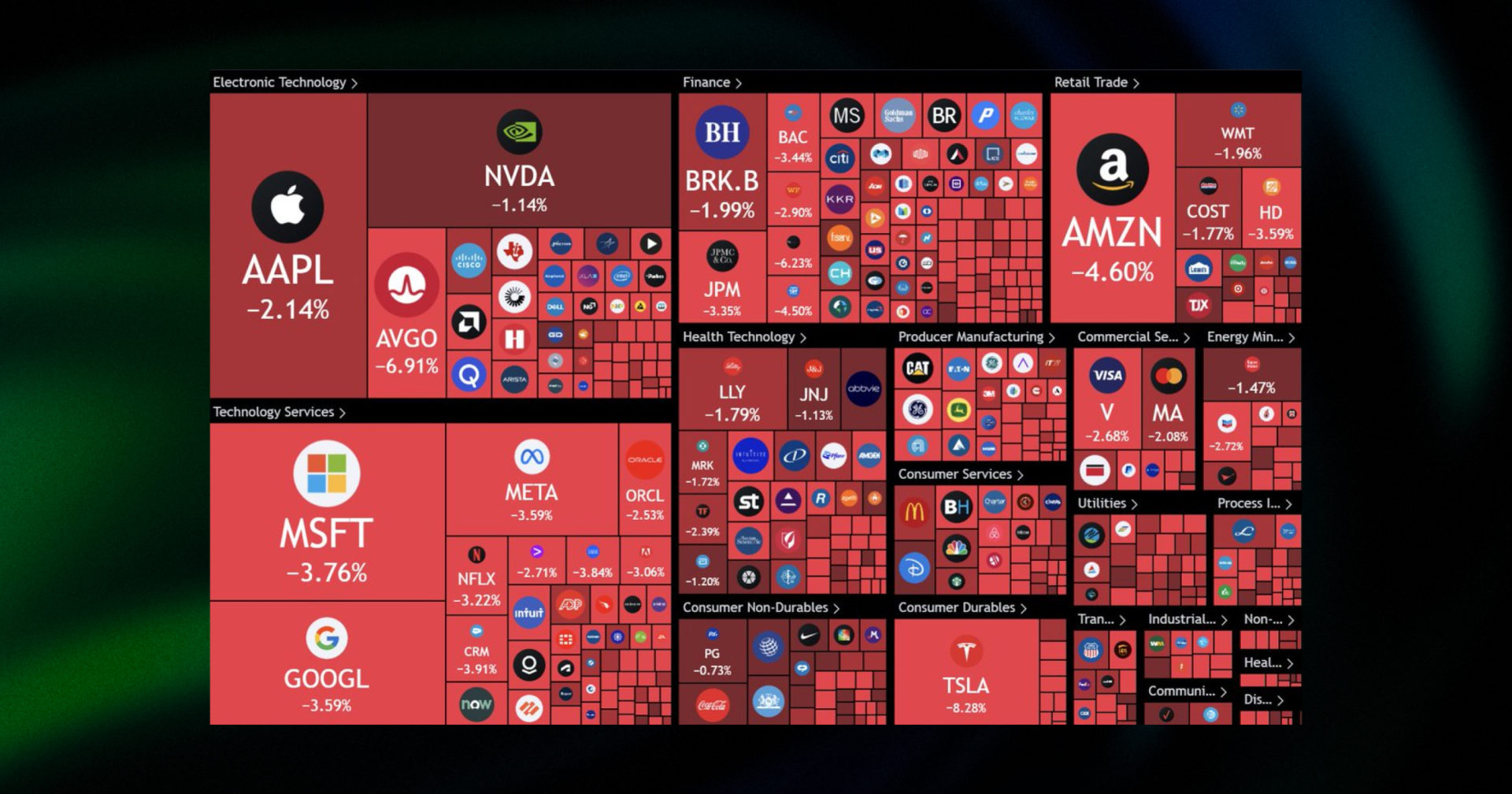

This news has had a significant impact on the market for “high-risk” assets, including the US stock market, resulting in a $1.5T wipeout.

Source: WatcherGuru

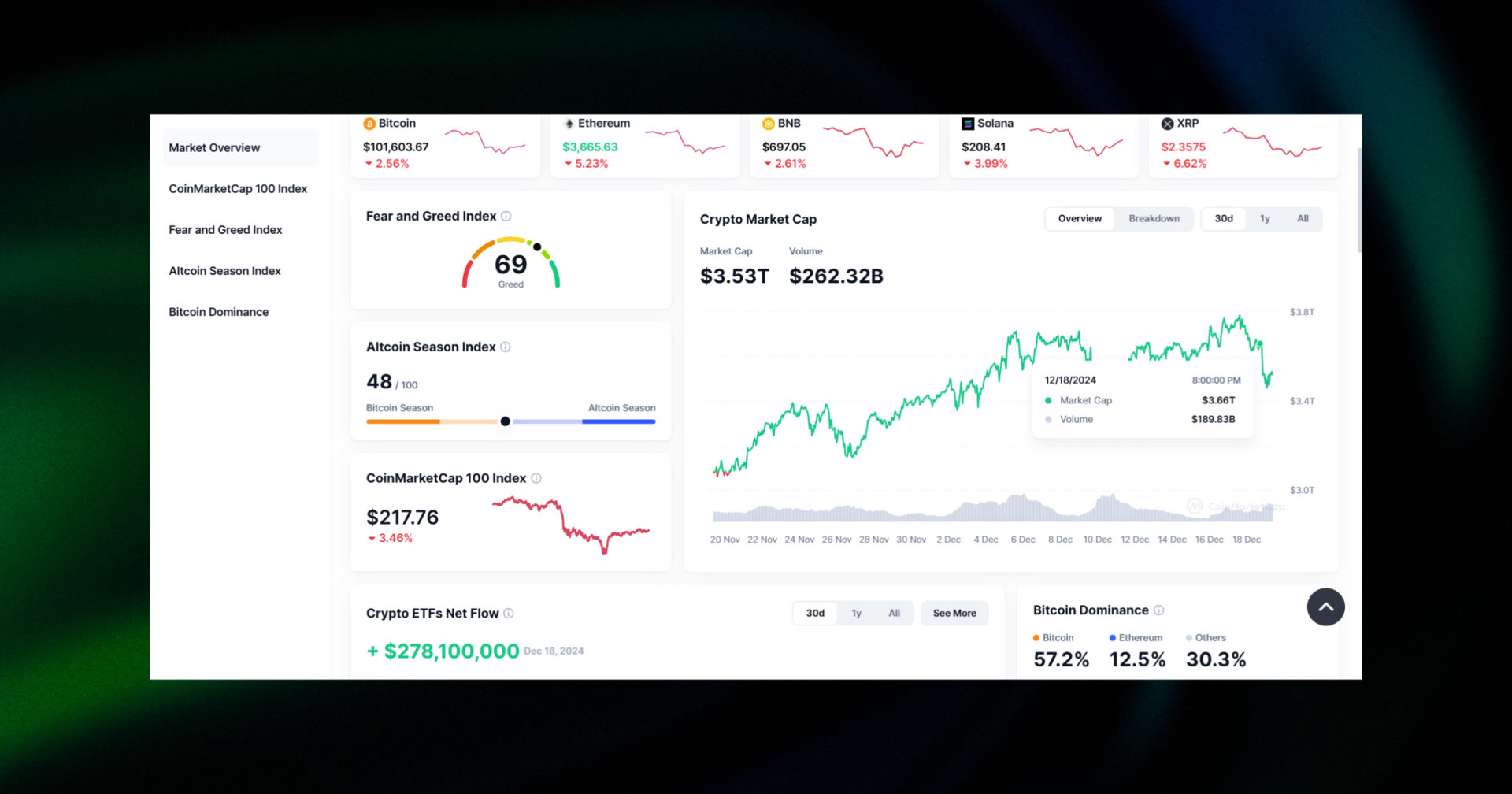

Meanwhile, the crypto market also experienced a dip, with losses amounting to around $200B at the time. Bitcoin briefly dropped below $99K before recovering to the $101K mark, while Ethereum fell below $3,700 and is now trading near that level. In addition to the more conservative outlook on rate cuts, Jerome Powell addressed Bitcoin and the idea of creating a Strategic Bitcoin Reserve, stating that it is currently “illegal” by law to purchase $BTC and that the Fed does not intend to advocate for changing this law.

Source: CoinMarketCap

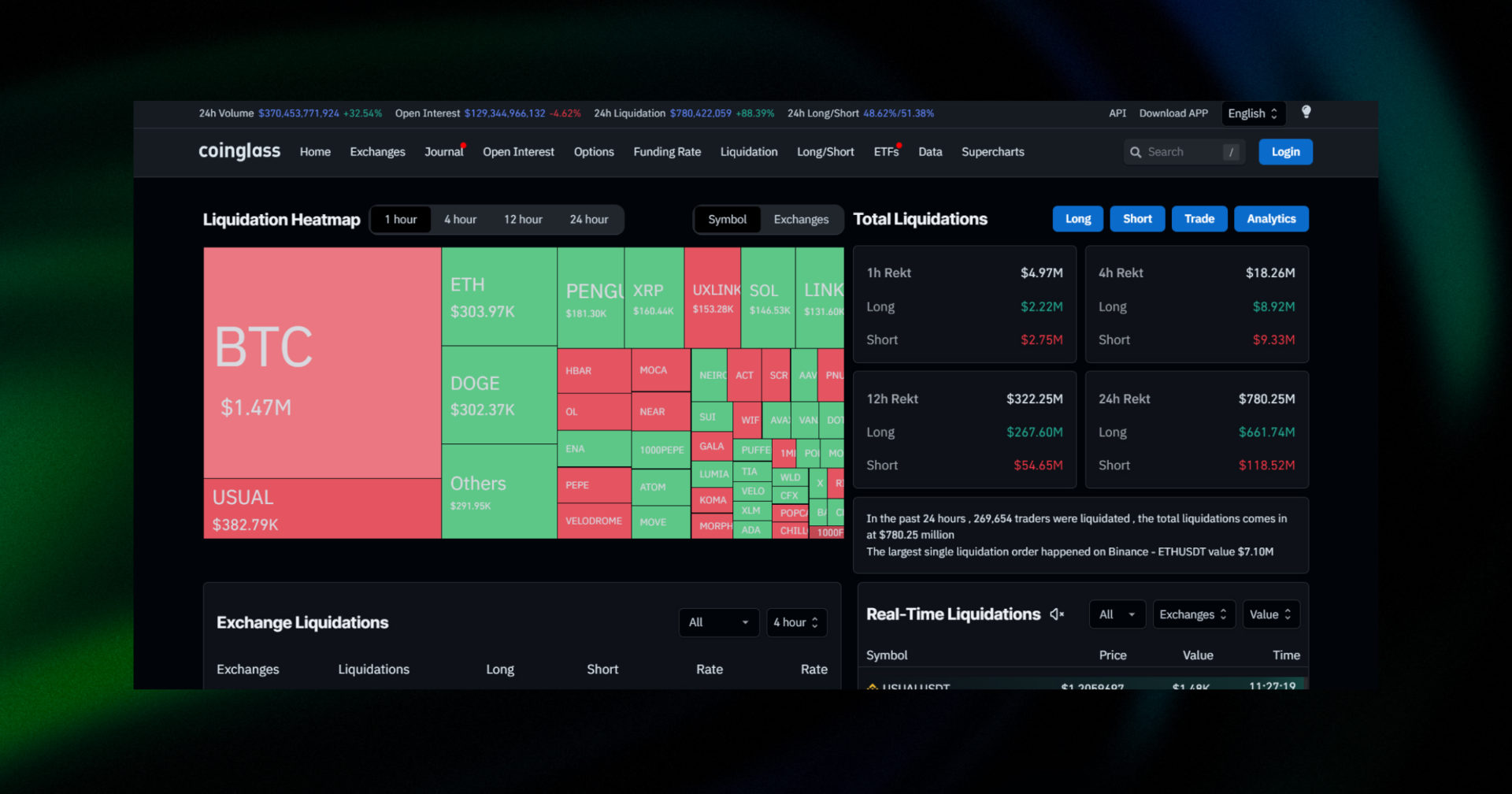

Following the swift moves on the market, around $780M has been liquidated within the last 24 hours, according to CoinGlass, where longs have a majority of liquidations ($661.74M/$780M).

Source: CoinGlass

Trump’s inauguration may trigger crypto sell-off, says Arthur Hayes

Continuing the narrative of this week’s crypto market correction, Arthur Hayes suggested in the “Trump Truth” essay that Donald Trump’s inauguration may trigger a sell-off rather than a pump, as investors might realize the gap between Trump’s statements and the potential of his actual actions.

“The market believes that Trump and his people can immediately achieve economic and political miracles,” Hayes wrote but then highlighted that changes in U.S. policies regarding crypto will take much more time and effort than retail investors anticipate. For this reason, Hayes predicts the market will “wake up” as soon as Trump assumes the role of U.S. president, potentially causing a significant sell-off before the crypto market enters a “crack-up boom phase” later in 2025.

Given this outlook, Hayes suggests that his investment fund, Maelstrom, plans to act ahead of such a sell-off by trimming some of its positions before the inauguration. The strategy aims to repurchase crypto tokens at lower prices during the first half of 2025.

Binance.US charts 2025 comeback, CEO Norman Reed reflects on challenges and plans for growth

According to a recent post by Decrypt, Binance.US interim CEO Norman Reed stated that the company plans to enable USD services in early 2025. However, no specific date has been set. Reed emphasized, “It is not a matter of if, but when,” suggesting that USD services will eventually return to Binance.US.

To provide context, in 2023, Binance was charged by the SEC for operating unregistered exchanges, broker-dealers, and clearing agencies. Meanwhile, its subsidiary, Binance.US, was accused of misrepresenting trading controls and oversight on its platform, according to the Securities and Exchange Commission.

These charges ultimately led Binance CEO CZ to step down and pay a $50M fine, while the company paid $4.3B as part of a settlement. Binance.US, on the other hand, was forced to operate under restricted banking access. As a result, Binance.US wasn’t closed completely, but it discontinued USD services in the U.S. and has since “survived” over 17 months of SEC scrutiny, responding to multiple depositions and hundreds of document requests to demonstrate that there was no wrongdoing on the exchange’s part.

Now, in a recent interview with Decrypt, Norman Reed claimed that USD deposits would resume, despite a conflicting statement from Richard Teng, the new CEO of Binance, who recently said Binance.US is not yet ready to re-enter the U.S. market. “Whether we re-enter the U.S. market, I think that’s a premature discussion,” Teng said in a Bloomberg interview.

GoodCrypto paper trading review

Paper trading on GoodCrypto is finally live, thanks to our recent integration with Bitget exchange!

If you’re eager to get started but unsure how to enable this feature, we’ve prepared a comprehensive video review to guide you through:

🔸 How to enable paper trading on GoodCrypto and acquire test assets;

🔸 Which trading tools our app supports for paper trading;

🔸 How to fix the “insufficient balance” error in your GoodCrypto account.

Check out our detailed guide and start enjoying paper trading on GoodCrypto now! 👇

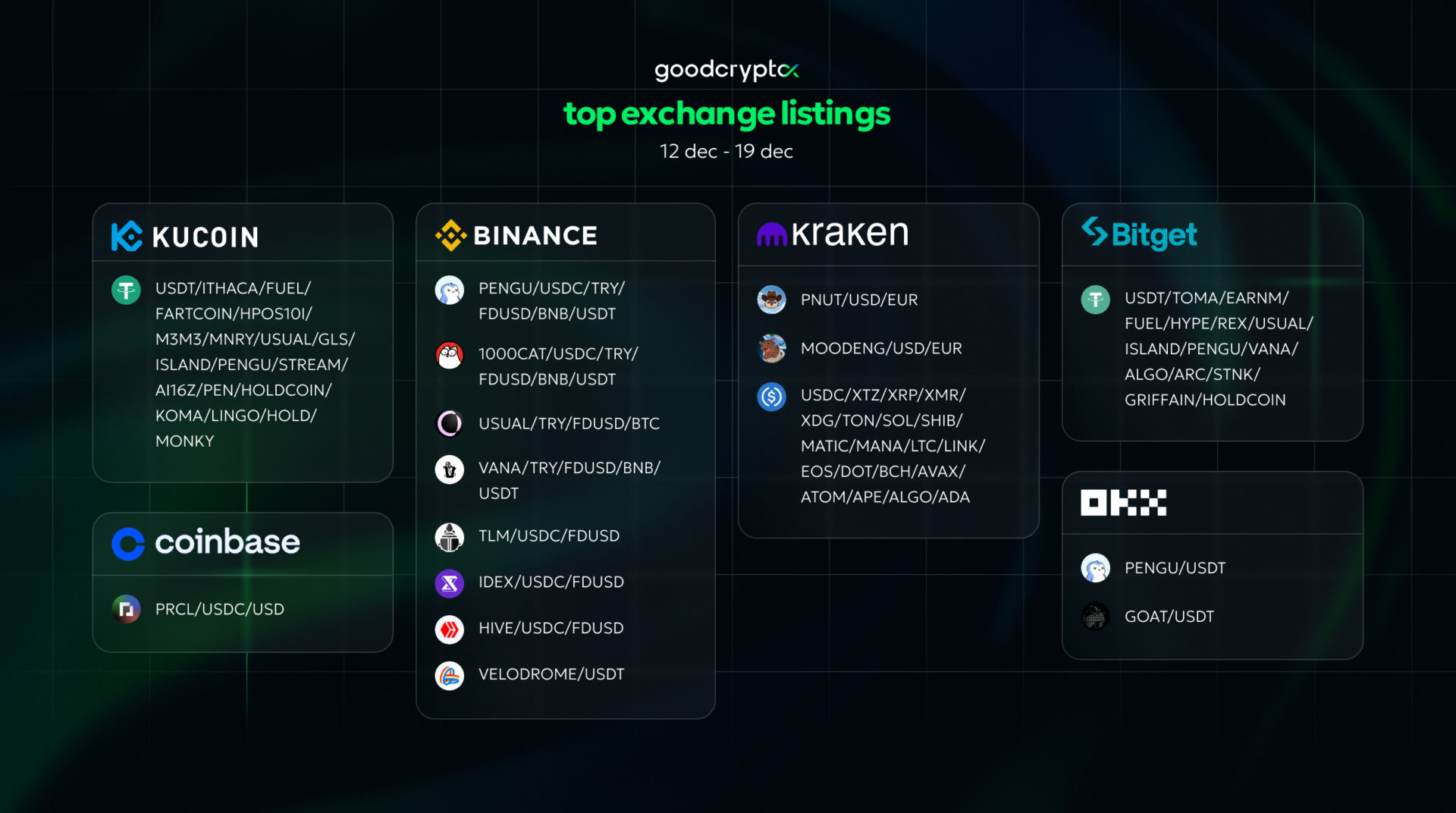

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

In honor of yesterday’s dip 😅

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!