👋 Hey there!

The market finally calmed down after weeks of drama and U.S.-China trade war tension. But the news didn’t stop, so catch the latest digest by GoodCrypto 👇

quick weekly news

Powell says Fed can wait on interest rate moves as tariff battle with China continues

Traditionally, let’s start with U.S. economic news. Yesterday, at the Economic Club of Chicago, Jerome Powell commented on the newly imposed tariffs on Chinese goods. He stated that the Fed would hold off on any interest rate moves for now.

His reasoning? While Trump claims tariffs are paid by the targeted country, in reality, the costs are passed on to U.S. companies, forcing them to raise prices. Even beyond finished goods, complex products like cars will become more expensive due to imported components, many of which come from affected regions.

Given the uncertainty around a potential resolution with China, the Fed is likely to wait. Interestingly, since the new tariffs haven’t yet impacted inflation, last week’s inflation data reflects a tariff-free snapshot of the economy, possibly the last one for a while.

But that outlook is fading fast. The White House is escalating tensions, confirming a massive 245% tariff on some Chinese imports. What a year to be alive!

Base scrutinized over promotion of token that briefly crashed 95%

Recently, Base blockchain posted on X: “Base for everyone” NFT collection, linking for NFT mint to Zora – an innovative NFT marketplace with its own L2 chain that auto-turns minted NFTs into tradable tokens. As the first token not directly launched by Base but closely tied to it, Zora had been eagerly anticipated by the community.

The hype was real: the token briefly surged to a $17M market cap, only to crash by over 95% shortly after – a classic crypto move 😁. The drop sparked backlash, with users accusing Base of a rug pull and insider trading.

Base responded on X with: “Base did not launch a token.”, which is technically true. Still, their promotion of Zora raised questions about the chain’s credibility. But to be fair, after the dramatic dip, the token has since rebounded to a ~$11M market cap.

Crypto traders pile $110 million into bets that Ethereum’s price could fall as low as $1,300

Meanwhile, Ethereum continues to face issues with investor confidence, as traders have placed over $110M into bearish positions on $ETH. These traders are betting that Ethereum won’t even reach $1,800 by April 2025.

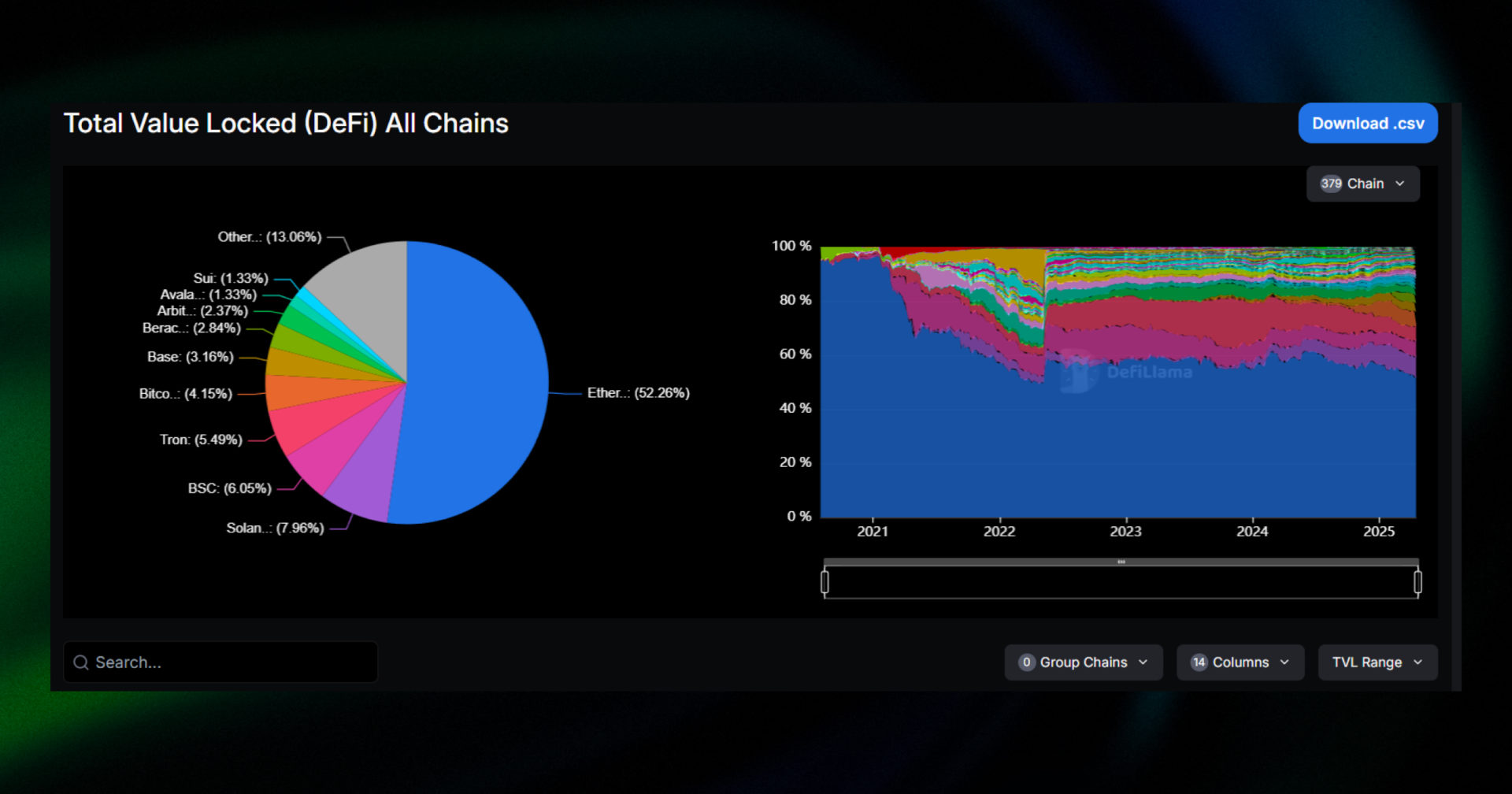

While Bitcoin showed some strength following the pause of certain tariffs on other countries, Ethereum hasn’t reacted at all, still trading in the $1,500 – $1,700 range, around the same level as during the “Black Monday” crash in U.S. stock markets. One key reason for this sluggish performance is the rise of a new competitor: Solana, which has drawn significant liquidity from Ethereum’s ecosystem.

Additionally, Ethereum Layer 2s are pulling both liquidity and user activity away from the mainnet. Many of these L2 networks have launched their own tokens, which don’t directly benefit Ethereum’s price. According to Santiment’s marketing director, Brian Quinlivan, Ethereum’s transaction fees have dropped to a 5-year low, just $0.168 per transaction.

The reason remains the same: fewer people are interacting with Ethereum’s Layer 1 and using $ETH than before. Still, it’s worth noting that despite the bearish sentiment, Ethereum maintains a strong lead in total value locked (TVL), with over $47B locked on-chain, nearly 6.5 times more than its closest competitor, Solana.

SEC’s next roundtable to discuss crypto custody with insiders

But there was also some promising news. Yesterday, the U.S. Securities and Exchange Commission (SEC) announced a roundtable discussion on crypto custody, featuring participants from Kraken, Exodus, Anchorage Digital, and other key industry players.

From the SEC side, Commissioners Hester Peirce and Caroline Crenshaw, Acting Chair Mark Uyeda, and Crypto Task Force Chief of Staff Richard Gabbert will take part. Representing the crypto industry will be executives from Kraken, Anchorage Digital Bank, Exodus, WisdomTree, Fidelity Digital Asset Services, and Fireblocks.

Hester Peirce, head of the SEC’s crypto task force, stated: “It is important for the SEC to grapple with custody issues, which are some of the most challenging as we seek to integrate crypto assets into our regulatory structure.”

RSI indicator for crypto trading by GoodCrypto

📊 The Relative Strength Index (RSI) is a go-to tool for spotting potential market reversals and timing entries or exits based on momentum shifts. It shows whether an asset is overbought or oversold, helping you avoid buying tops and selling bottoms.

How to Use the RSI:

🔸 In a ranging market, use RSI to buy low (below 30) and sell high (above 70);

🔸 In a trending market, watch for bullish or bearish divergence between RSI and price, which often signals a reversal before it happens;

🔸 Use RSI on higher timeframes (1H, 4H, Daily) for stronger, more reliable signals.

Want to read RSI like a seasoned pro and turn momentum shifts into actual trades? Unlock the full RSI strategy breakdown in our ultimate guide by GoodCrypto. 🚀

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!