Hey there! 👋

Crypto is still in the red after macro trends flipped the market a few weeks ago. Let’s unpack what happened, and whether there’s any hope for a rebound.

quick weekly news

US wraps up worst non-recession year for hiring since 2003

Once again, we start with U.S. macroeconomic news, and this time, it’s bearish. On February 11, 2026, Bloomberg reported that the United States added only 181,000 jobs in 2025.

This is the worst year for employment outside of a recession since 2003. According to the media, total job growth is just about 15K per month in 2025, which is much lower than the 49K per month forecasted by the Bureau of Statistics.

This is definitely bearish news for the U.S. economy, especially coming just a week after the announcement of Trump’s new Fed chair pick, Kevin Warsh. He is known for his conservative approach to rate cuts and inflation, so it’s unlikely that the weak job market will force him to aggressively cut rates.

On the day of the announcement, Bitcoin didn’t react much to the weak jobs report, but it adds additional sell pressure to the market.

BlackRock takes first DeFi step, lists BUIDL on Uniswap

At the same time, BlackRock keeps moving into crypto. According to CoinDesk, BlackRock’s $2.2B BUIDL Treasury Fund will soon be tradable on UniswapX.

The media reports that this will give investors one of Web3 finance’s most powerful features – access to assets “around the clock.” Pre-qualified, whitelisted investors will now be able to swap the Treasury Fund 24/7.

Following the news, Uniswap’s native token, $UNI, surged ~25% in a single day, from $3.29 to $4.33. However, as often happens with hype-driven moves, the token quickly retraced to around $3.43, leaving a total 24-hour gain of roughly 5.5%.

Binance converts its $1B safety net into 15,000 BTC

Meanwhile, Binance keeps stacking Bitcoin despite the negative market sentiment. On February 12, 2026, Binance announced on its X account that it had completed its SAFU fund asset conversion.

SAFU is Binance’s emergency reserve, designed to compensate users for losses in case of unexpected events, such as hacks. Previously composed of stablecoins, Binance recently decided to convert the funds into BTC, completing the process in multiple tranches over the past few weeks.

This week, Binance has been buying Bitcoin more aggressively than in previous weeks as the price dropped significantly. From February 5 to February 12, it purchased 11,370 BTC out of the 15,000 BTC target, nearly 75% of its total goal.

And the market panic doesn’t seem to bother Binance at all.

lawmakers slam SEC chair for easing industry policing

Finally, some controversial news on crypto adoption in the U.S. According to Decrypt, during a hearing before a House committee, House Democrats grilled SEC Chair Paul Atkins for easing oversight of the crypto industry and dropping lawsuits against several major Web3 companies.

They claimed the agency is turning a blind eye to multiple crypto scams linked to President Donald Trump, which, they argue, damages the reputation of both the crypto industry and the SEC. Rep. Stephen Lynch cited the dismissal of the lawsuit against Binance as an example. The lawsuit allegedly involved Binance facilitating the growth of the Trump-backed company World Liberty Financial through its $USD1 stablecoin.

Another Democrat pointed to the pause of the SEC’s lawsuit against crypto billionaire Justin Sun, founder of Tron. The lawsuit, filed under former SEC Chair Gary Gensler, accused Sun of offering unregistered securities and manipulating the $TRX token market via wash trading. However, after Tron acquired World Liberty Financial’s $WLFI token, the lawsuit was put on hold.

When asked whether the SEC plans to continue pursuing the Justin Sun case, Paul Atkins declined to comment.

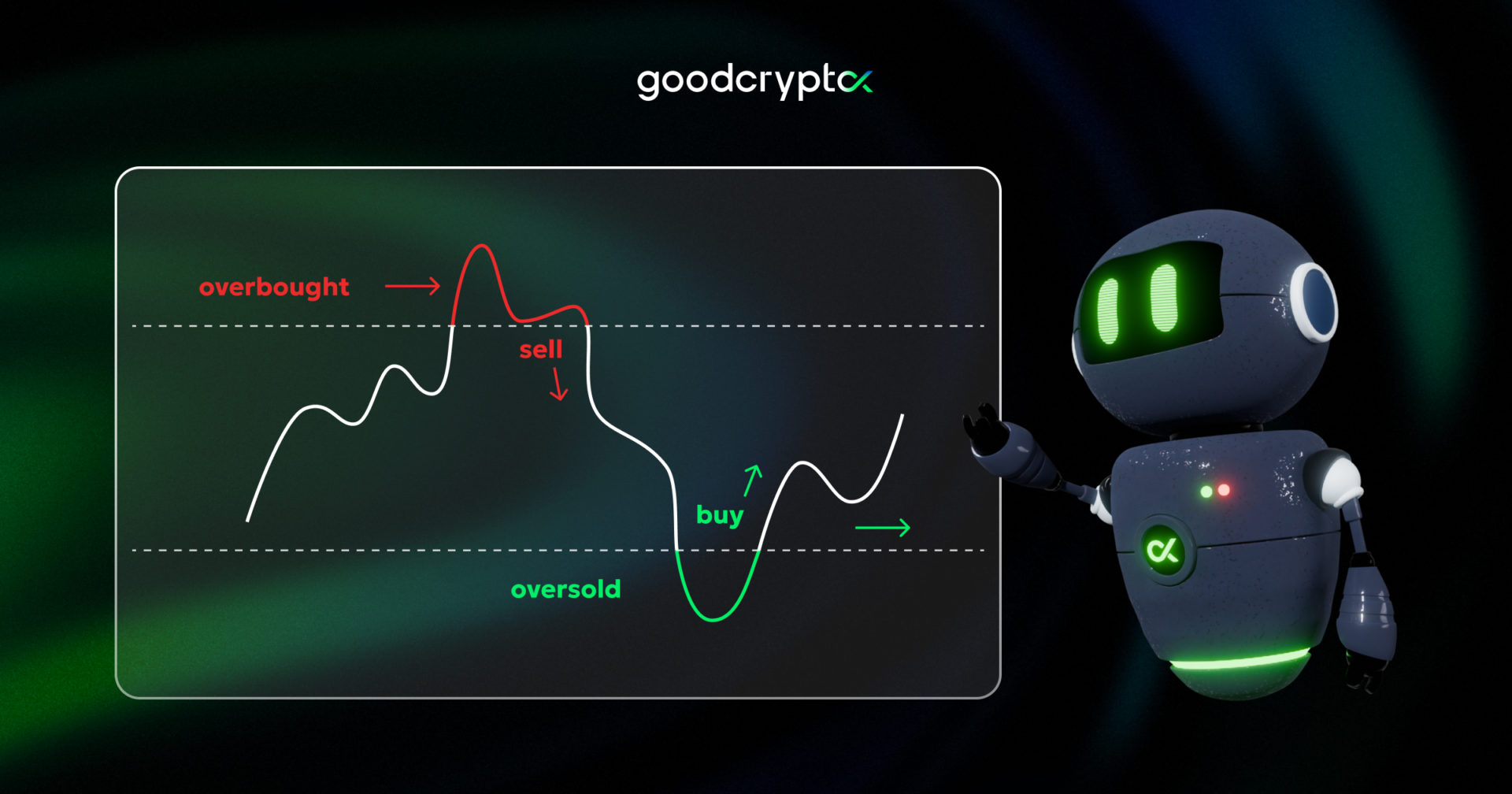

RSI indicator trading strategies

RSI is a momentum oscillator that compares recent price gains against recent price losses. It helps users identify moments when the price is overbought or oversold and is especially effective when combined with signals from other trading indicators.

RSI indicator trading strategies:

- Determining the highs and lows: When the market lacks a clear trend, the RSI indicator can help identify potential overbought and oversold ranges, allowing you to buy low and sell high.

- Finding divergences: When you notice a re-test, such as in a bottom or top formation, look for divergence in the RSI. For example, if a double top shows a bearish divergence, it may indicate a selling opportunity.

Want to learn more about this powerful tool and its trading strategies? Check out the ultimate guide to the RSI indicator by goodcryptoX! 📈

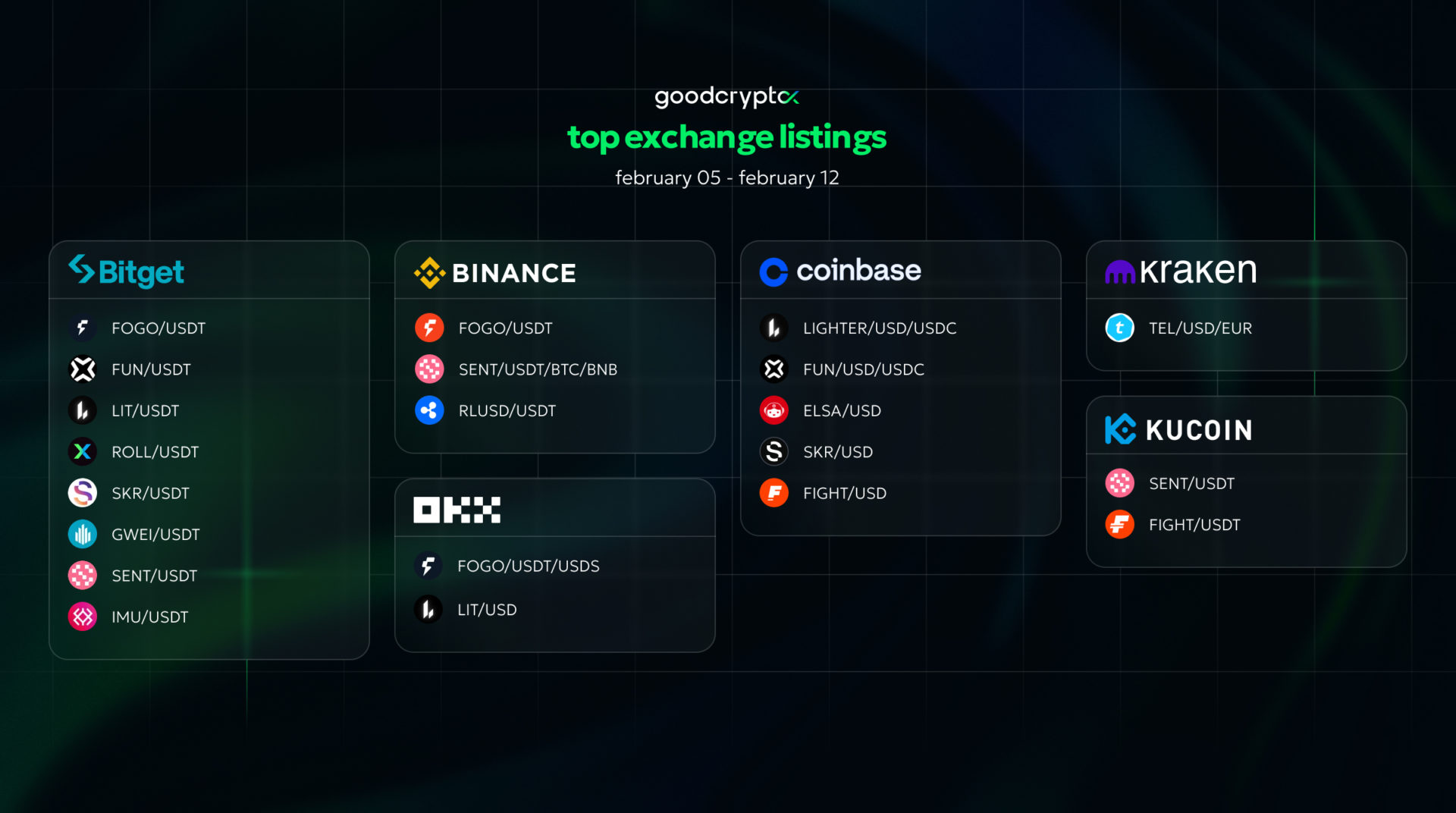

Receive an instant notification when a new coin is listed with goodcryptoX PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the goodcryptoX app!