Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

Johnny Lyu, CEO of KuCoin, announces the “Anti-FUD Fund”

The CEO of crypto exchange KuCoin claims that the company is establishing an “Anti-FUD Fund” to find “FUDers,” potentially pursue legal action against them, and instruct cryptocurrency users on how to spot false information.

The exchange’s CEO, Johnny Lyu, revealed the fund on Tuesday, only days after he published a blog post blasting Twitter user Otteroooo for disseminating false information about his company.

The first of the three components of the Anti-FUD fund, according to Lyu, is education, which would “deliver knowledge, including what is FUD and how to distinguish it” through online and offline channels.

The fund will also encourage and recognize business leaders and influencers that act responsibly, provide their audiences with reliable information, and assist their followers in avoiding FUD.

Last but not least, the fund will work to identify and perhaps prosecute anyone who “intentionally spread FUD.”

Risk of another 60% drop in Coinbase stock (COIN) by September

On July 27, the price of Coinbase (COIN) rose 4.35% to $57, following a recent 20% decline. Nevertheless, more bad news is probably on the way despite the debut of The Degen Trilogy. The first trilogy film featured at the Bored Ape Yacht Club.

Due to weak fundamentals and negative technical indicators, COIN has lost 83%+ of its value overall since making its Nasdaq debut in April 2021. Additional losses are possible.

Recap: On July 20, five days after escaping its “ascending triangle” pattern, COIN hit a price of $79 per unit. Typically, COIN’s profit objective was expected to be over $120, up more than 130% from the price on July 27.

Nevertheless, the stock’s positive turnaround ended when it reached $79 because of two consecutive pieces of bad news.

Initially, COIN’s correction started due to a broader decline in the cryptocurrency market, headed by Bitcoin (BTC). After American authorities detained a former Coinbase manager on “insider trading” charges, the downward movement gained speed.

But on July 26, when Bloomberg reported that the U.S. Securities and Exchange Commission is looking into Coinbase for offering unregistered securities, there was the greatest selloff during this slump.

Kraken is under investigation by OFAC at Treasury for breaking U.S. sanctions

According to reports, the Office of Foreign Assets Control (OFAC) of the US Treasury Department is looking into the crypto exchange Kraken for allegedly enabling customers from Iran and other nations to purchase and sell cryptocurrency, which may be in violation of US sanctions.

The New York Times reported Tuesday that the Office of Foreign Assets Control (OFAC) has been investigating Kraken’s potential sanctions violations since 2019 and may soon fine the exchange. Since 1979, the United States has placed sanctions on Iran that forbid the export of goods or services to organizations or people inside the nation. The news source claimed to have seen internal messages from 2019 that suggested Kraken CEO Jesse Powell would contemplate breaching the law if the advantages outweighed any potential consequences, albeit they did not appear to mention punishment.

Marco Santori, chief legal officer of Kraken, provided the following comment:

“Kraken does not comment on specific discussions with regulators. Kraken has robust compliance measures in place and continues to grow its compliance team to match its business growth. Kraken closely monitors compliance with sanctions laws and, as a general matter, reports to regulators even potential issues.”

Voyager declines the buyout offer for Alameda because it “harms consumers”

A proposal to purchase its digital assets from FTX and its investment arm, Alameda Ventures, was rejected by centralized cryptocurrency lender Voyager Digital Holdings because the activities “are not value-maximizing” and would “harm customers.“

Voyager’s attorneys rejected the offer made public by FTX, FTX US, and Alameda on July 22 to buy out all of Voyager’s assets and outstanding loans – except the defaulted loan to 3AC – in a rejection letter submitted to the court on July 24 as part of its ongoing bankruptcy proceedings.

The letter claims that by undermining “a coordinated, confidential, competitive bidding process,” publicizing such proposals might jeopardize any other prospective transactions. It further adds that “AlamedaFTX violated many obligations to the Debtors and the Bankruptcy Court.“

Voyager’s representatives argued that their suggested strategy to restructure the business is preferable since it would swiftly provide all of their clients’ cash and as much of their cryptocurrency as feasible.

What is DeFi in Crypto

First of all, it’s a group of engineers and entrepreneurs with libertarian viewpoints that want to replace conventional banking with innovative distributed algorithms. Decentralization will assist in removing the difficulties of trust, exorbitant fees, single points of failure, and control that plague the well-established financial sector.

Second, DeFi is the abbreviation for a vast ecosystem of decentralized applications (dApps) for borrowing/lending, financial banking, staking, trading, and much more. These applications are typically built on top of the Ethereum blockchain, but they can also occasionally be found on other blockchains like TRON or EOS.

Not to mention, it is a movement with leaders, an ideology, and a crystal-clear rationale.

Figure out what is crypto DeFi projects, explore its history, ecosystem, advantages and much more in the Ultimate Guide by Good Crypto – https://bit.ly/3vjTuKa

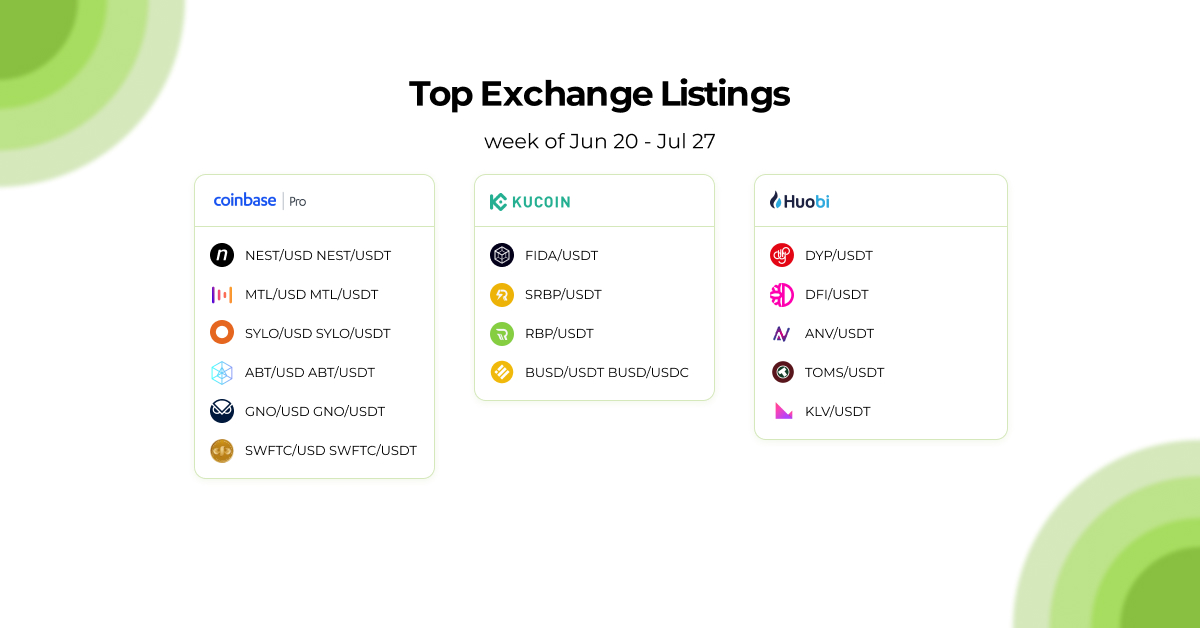

Receive an instant notification when a new coin is listed with the Good Crypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!