Hey traders!

This week in the crypto market feels like a hangover from the previous one, full of pain and disbelief. But despite the red charts, the news wasn’t all that bad. Let’s recap the most notable updates in this digest:

quick weekly news

Solana ETFs see record inflows despite market slump

Amid the crypto market slump, one important piece of news has gone almost unnoticed by the crypto community – the launch of the Solana ETF. The first spot products were introduced just a week ago, and despite the falling market, they recorded inflows, while Bitcoin and Ethereum ETFs experienced $2.6B net outflows.

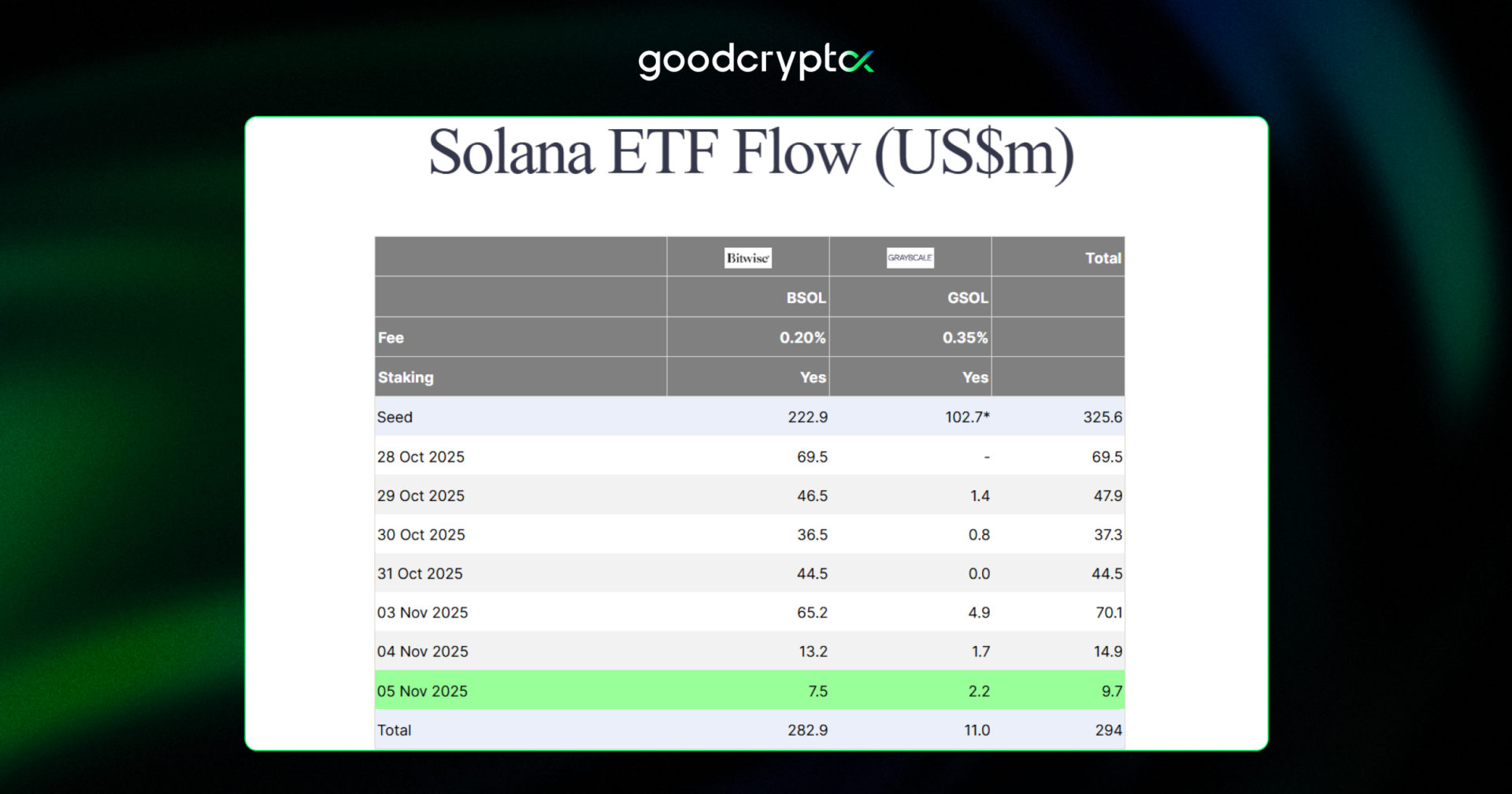

According to FarSide Investors, weekly Solana ETF inflows reached $294M, with $325M coming in before the ETF’s official launch (marked as “Seed” in their table). While these numbers are smaller than those of ETH or BTC ETFs, Solana still became the first altcoin ETF to record positive inflows within its first week.

Most notably, all these inflows occurred amid a sharp market decline, with Bitcoin down nearly 7% and Solana down about 17%. The main reason for the strong $SOL ETF performance could be the approval of the $SOL ETF with staking rights, as its high staking APR of around 7% makes it an attractive investment tool for traditional finance investors.

‘Ethereum is scaling’ – ETH maxis cheer as TPS hits record 24K with Lighter

But Solana wasn’t the only one with good news this week, Ethereum proved it still has fire in its belly as its ecosystem hit a new TPS record of 24,192. The news was shared by Anthony Sassano, founder of The Daily Gwei and well-known crypto influencer.

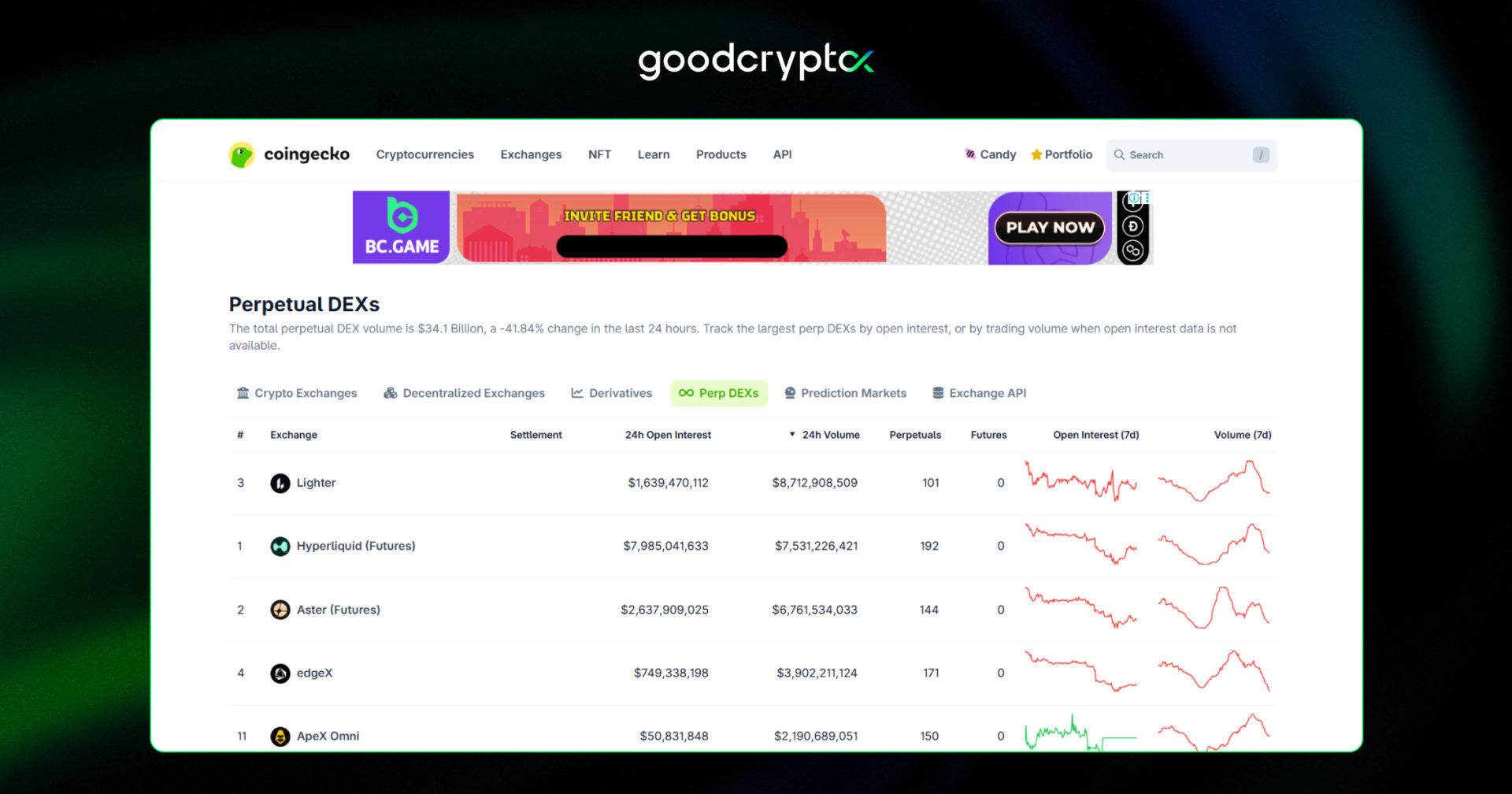

The main driver behind Ethereum’s record-breaking TPS was the high-performance perpetual DEX Lighter, which has recently made waves in the perp DEX market thanks to its low fees and rumored large token airdrop, similar to Hyperliquid. As of November 2025, Lighter has become the largest perpetual DEX by 24-hour trading volume.

As Bankless podcast host Ryan Sean Adams noted, thanks to Lighter, Ethereum’s TPS has increased over 20x in the past 30 days, all because the Lighter team “took the time to use the latest zk L2 tech in an appchain people actually want.”

CZ pardon was considered with ‘utmost seriousness,’ White House says

Another hot topic this week was the discussion around CZ’s recent pardon by U.S. President Donald Trump. A few days ago, Trump was asked about the pardon during an interview with CBS, to which he replied, “I don’t know who he is.”

The president clarified that he had never met Changpeng Zhao and had “no idea who he is,” adding that he only knew CZ was a “victim of a witch hunt” by the Biden administration. This statement came shortly after rumors surfaced about a potential connection between Binance’s rapid adoption of $USD1, a stablecoin from Liberty Financial, a Trump-linked organization. The move reportedly boosted awareness and adoption of the coin, leading some in the crypto community to speculate that it was meant as a favor to prompt CZ’s pardon. However, the Binance CEO denied these allegations.

A few days later, White House Press Secretary Karoline Leavitt commented on Trump’s CBS interview, explaining that his remarks meant the president “does not have a personal relationship with this individual.” She also noted that CZ’s pardon underwent a formal review process before being signed by President Trump.

Coinbase exec criticizes banks’ pushback against crypto charter application

Speaking of major crypto companies, the final news of the week concerns Coinbase. The Independent Community Bankers of America (ICBA) has officially opposed Coinbase’s application for a National Trust Company Charter in the U.S.

According to the ICBA, the application fails to meet statutory chartering standards and could set a dangerous precedent for the structure of the U.S. banking system. In its letter to Coinbase, the organization cited “untested” elements of crypto custody and expressed concern that Coinbase’s trust arm might “struggle to achieve and maintain profitability during crypto bear markets.”

Paul Grewal, Coinbase’s Chief Legal Officer, responded by saying that the company’s innovation and mission to bridge the gap between crypto and traditional finance are seen as threats to the banking industry. He stated, “It’s another case of bank lobbyists trying to dig regulatory moats to protect their own interests.”

Momentum Indicator (MOM) trading strategies

The Momentum Indicator measures the speed and strength of a price movement by comparing the current price to a past price. It helps identify whether momentum is increasing or decreasing, allowing traders to spot potential entry and exit points. Typically, traders apply two main strategies with the MOM indicator:

🔸 Zero Line Crossover: This strategy identifies bullish momentum when the MOM crosses above the zero line and bearish momentum when it crosses below, with trend and period adjustments helping to filter out false signals.

🔸 Divergence Trading + EMA: This approach combines MOM divergences with the 200-period EMA, using bullish divergences above the EMA and bearish divergences below it to detect potential reversals or trend continuations.

Want to learn more about MOM trading strategies? Check out our comprehensive MOM Indicator review.

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the goodcryptoX app!