Hey there! 👋

What a week this has been! The market has been intense with numerous events, and the industry has brought us many news updates in the last seven days. Let’s recap some of them today in this weekly digest. If you’d like to receive more updates on the crypto market, follow us on Twitter.

quick weekly news

Telegram could onboard the first billion cryptocurrency users

On August 7th, 2024, during an interview with CoinTelegraph, the founder of the X10 exchange, Ruslan Fakhrutdinov, assumed that Telegram might be the key crypto app to help the industry adopt the first billion users.

He relates this with the statement that Telegram is currently one of the hottest crypto platforms with the lowest user acquisition cost among the other crypto platforms. Along with a large community of over a billion users on its platform, Telegram currently is the closest to onboarding the first billion users on-chain through its intuitive and simple-to-use mini-apps.

He added that the X10 exchange will be working closely on developing a Telegram-based mini-app in the near future targeting mainly new retail investors with its simple and intuitive setup. Although the mini-apps are not designed for more proficient traders with demands in more sophisticated indicators Telegram mini-apps still are one of the best ways to onboard new users to its exchange while “it makes sense to reserve the more complex trading platforms for the seasoned crypto audience”.

Meanwhile, Ton Foundation’s Director of Investments, Justin Hyun, stated in another CoinTelegraph interview that the platform’s goal is to onboard over 500 million users on-chain by the end of 2028, and that Telegram might become a “Trojan horse” for such massive crypto adoption. He believes that abstracting complexity away while offering Web3-specific financial incentives for users could be crucial in achieving this goal.

XRP rockets 26% as Ripple execs hail $125M penalty as “victory”

On August 7, 2024, a New York federal judge moved closer to ending a lengthy three-year lawsuit against Ripple Labs, ordering the company to pay a $125M civil penalty instead of the SEC’s demand for over $2B, while stating that Ripple was “permanently restrained and enjoined” from violating United States securities laws.

Shortly after the decision, the CEO of Ripple Labs said on X that the New York judge’s reduction of the penalty from over $2B to only $125M is “a victory for Ripple, the industry, and the rule of law.” He added, “The SEC’s headwinds against the entire XRP community are gone.”

Fred Rispoli, founder of Hodl Law and a crypto lawyer, also commented on the judges’ decision:

“Overall, a HUGE win for Ripple. Although I’m surprised by the $125M penalty, Ripple more than made that just on the price move in $XRP in the last 5 minutes.”

According to CoinMarketCap data, soon after the CEO’s announcement regarding the lawsuit’s outcome, $XRP skyrocketed over 26% in price, rising from nearly $0.50 to $0.62 per coin. As of writing this digest on August 8th, 2024, it is trading at nearly $0.605.

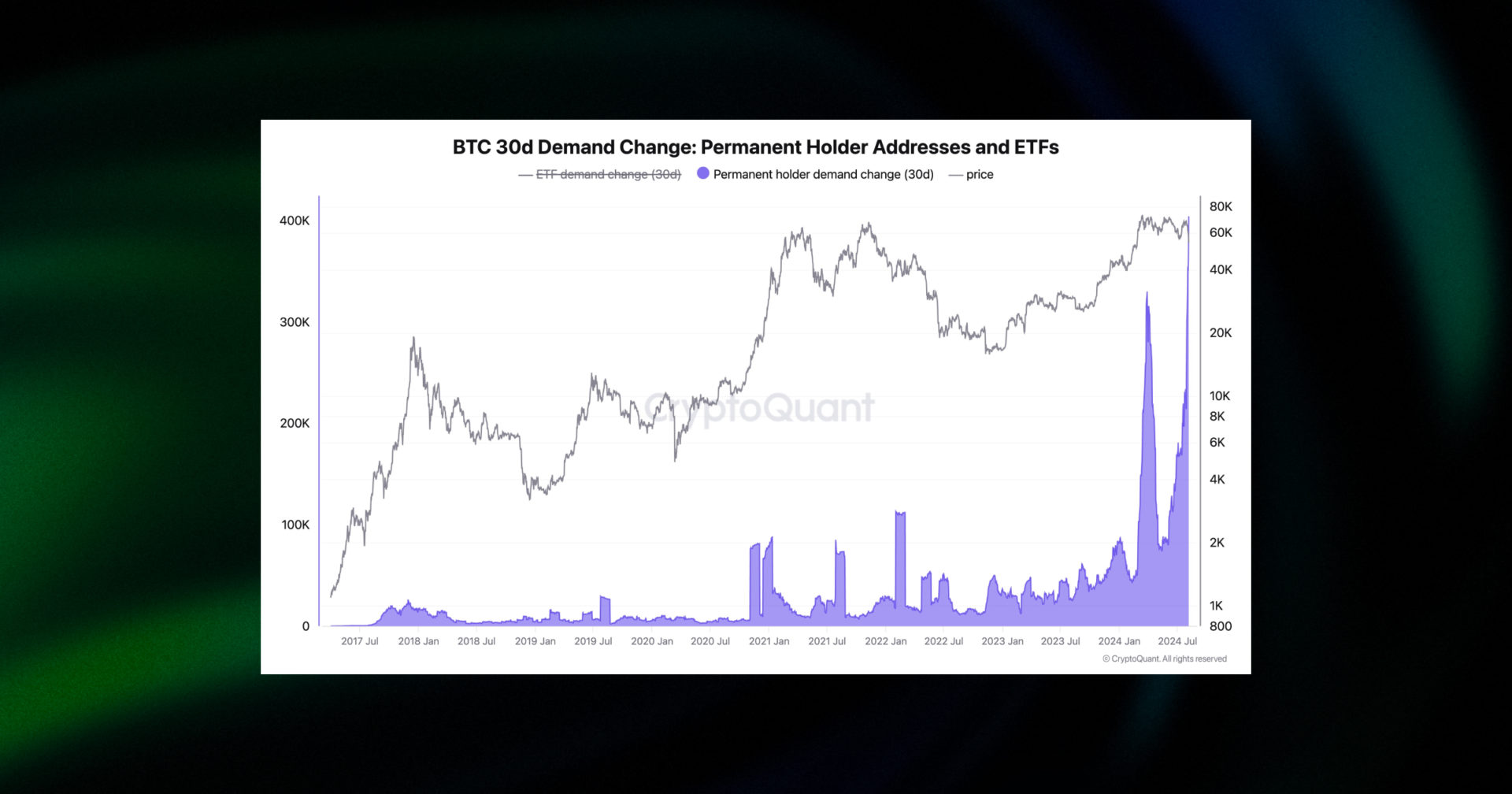

“Something is happening” – Bitcoin hodlers scooped $23B in the past 30 days

Recently, CryptoQuant founder and CEO Ki Young Ju exclaimed that “something is happening behind the scenes,” commenting on the nearly $23 billion accumulation of Bitcoin among “permanent holder addresses” within the last 30 days.

Source: “CryptoQuant”

He speculated that within a year, some large institutional investors “will announce that they’ve acquired Bitcoin in Q3 2024,” while retail investors will likely regret their decision to abstain from buying BTC back then, despite factors like “the German government selling, Mt. Gox, or whatever macroeconomic issues were going on.”

In another post on X, Ki Young Ju mentioned other factors that might influence the Bitcoin market. Among the bullish indicators, he highlighted hashrate recovery, the end of the miner capitulation period, whale accumulation, reduced old whale activity, and the absence of retail investors. Meanwhile, he also noted bearish factors like macroeconomic risks and the bearish turn of some on-chain indicators.

The crypto fund founder still believes that the bullish scenario is intact. However, he added, “If the market doesn’t recover in two weeks, I’ll reconsider.”

Crypto coalition calls for “clear rules of the road” from Biden, Harris

A crypto coalition in the United States that includes Robinhood, BitGo, OKX, Gemini, Chainalysis, Elliptic, TRM, Kaiko, and Matrixport wrote a letter to President Biden and Vice President Kamala Harris calling for “clear rules of the road” regarding crypto industry regulations.

In the same letter, they outlined that creating a sound legal framework for crypto regulations will not only better protect US consumers from bad actors but also promote the U.S. dollar and secure America’s technological edge. The coalition added that “digital assets utilizing open, public blockchains present an important opportunity to further cement American values and norms into the global financial system.”

They acknowledged that the US securities regulator’s strict enforcement approach has yielded some results, reducing the level of market manipulation, money laundering, and fraud, although some industry leaders have been involved in these activities. However, this approach is not enough: the crypto market needs a clear regulatory framework, the coalition added.

These steps are especially important for US dollar-backed stablecoins such as $USDT and $USDC, which currently occupy over 97.5% of the $164 billion global stablecoin market, according to data from CoinGecko.

Meanwhile, the crypto advocacy group The Digital Chamber recently declared that it will hand-deliver letters to every U.S. senator explaining how Bitcoin can back up reserves and provide more stability during “global economic uncertainties,” pushing the U.S. government towards further acceptance of blockchain technology.

Fibonacci Retracement Trading Strategies

Fibonacci Retracement is horizontal lines that help traders indicate potential support and resistance levels on the chart. In Fibonacci retracement, each line represents a percentage of how much of a prior move the price has retraced.

Fibonacci Retracement Trading Strategies:

🔸 Downtrend and Uptrend: Utilizing Fibonacci lines during down or up trends provides a clear view of potential support and resistance levels, allowing you to better determine your stop loss and take profit targets.

🔸 Support and Resistance: Since Fibonacci retracement shows support and resistance levels, it can also be used to identify breakouts and price bounces.

Want to learn more about Fibonacci Retracement? Discover our comprehensive Fibonacci Lines review and start implementing this indispensable tool now! 📈

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!