Happy New Year, fam! 🎉

During the holidays, the market stayed mostly flat, with only minor moves throughout the period. However, the news cycle was anything but quiet. Here’s a quick recap:

quick weekly news

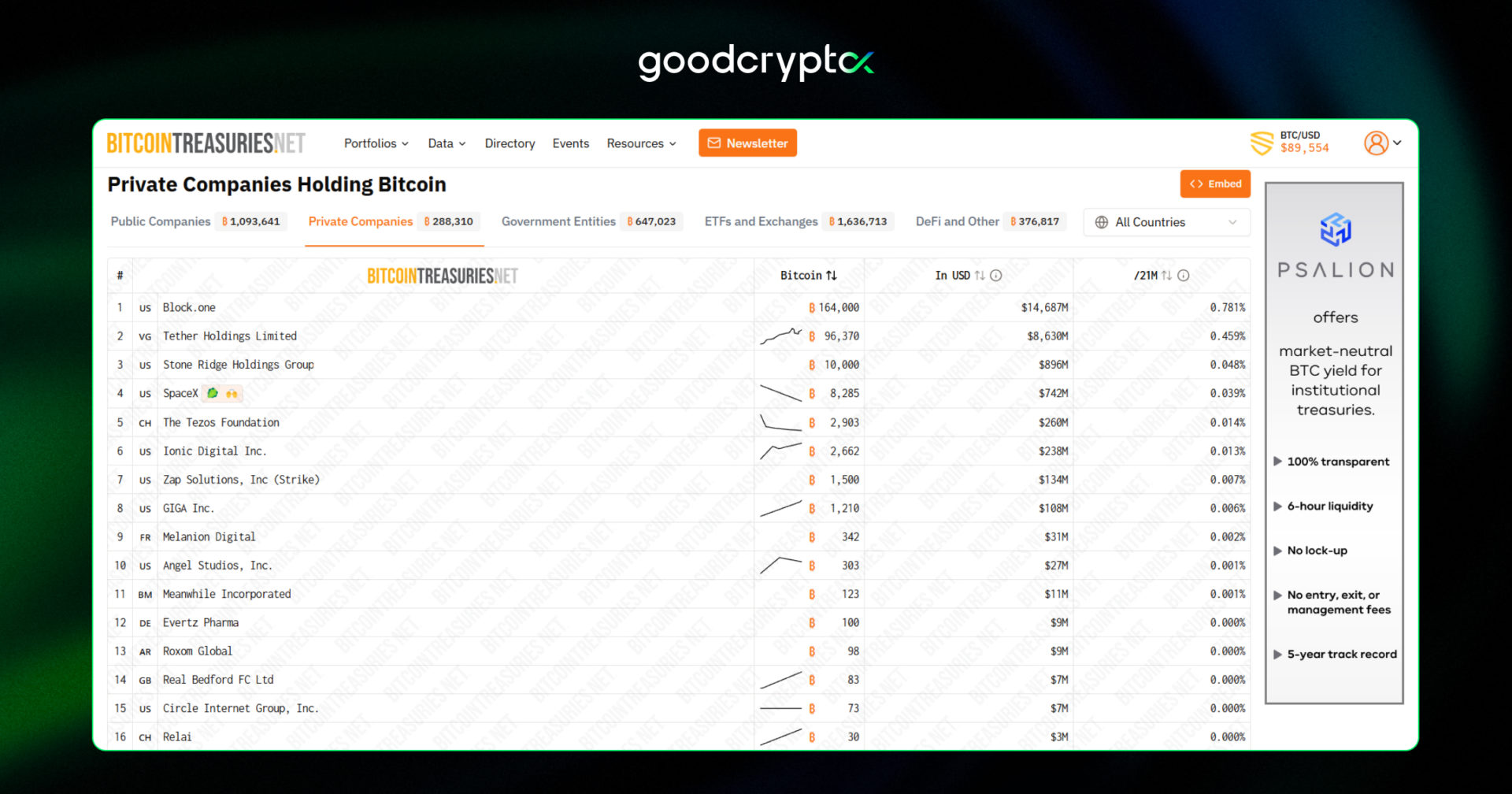

Tether adds nearly $800M in Bitcoin, bringing holdings above 96,000 BTC

This week, Tether showed how to enter 2026 the right way by purchasing almost $800M worth of Bitcoin. The news was announced by Tether’s CEO on Twitter on December 31, 2025.

According to CoinDesk, the purchase is part of Tether’s strategy to allocate up to 15% of its Q4 profits toward Bitcoin acquisitions. This move has made Tether the second-largest private company and stablecoin issuer to hold BTC.

As reported by the media, such purchases allow Tether to diversify its reserves, which are currently heavily concentrated in short-term U.S. Treasuries and repos. However, given Bitcoin’s volatility, it remains unclear whether this allocation will strengthen the overall quality rating of Tether’s reserves.

To recap, in 2025, Tether faced scrutiny over its 1:1 USD backing, as a relatively large portion of its reserves was held in higher-risk assets, including Bitcoin, during a period of sharp BTC price declines. This ultimately led S&P to downgrade USDT’s stability assessment to “Weak.”

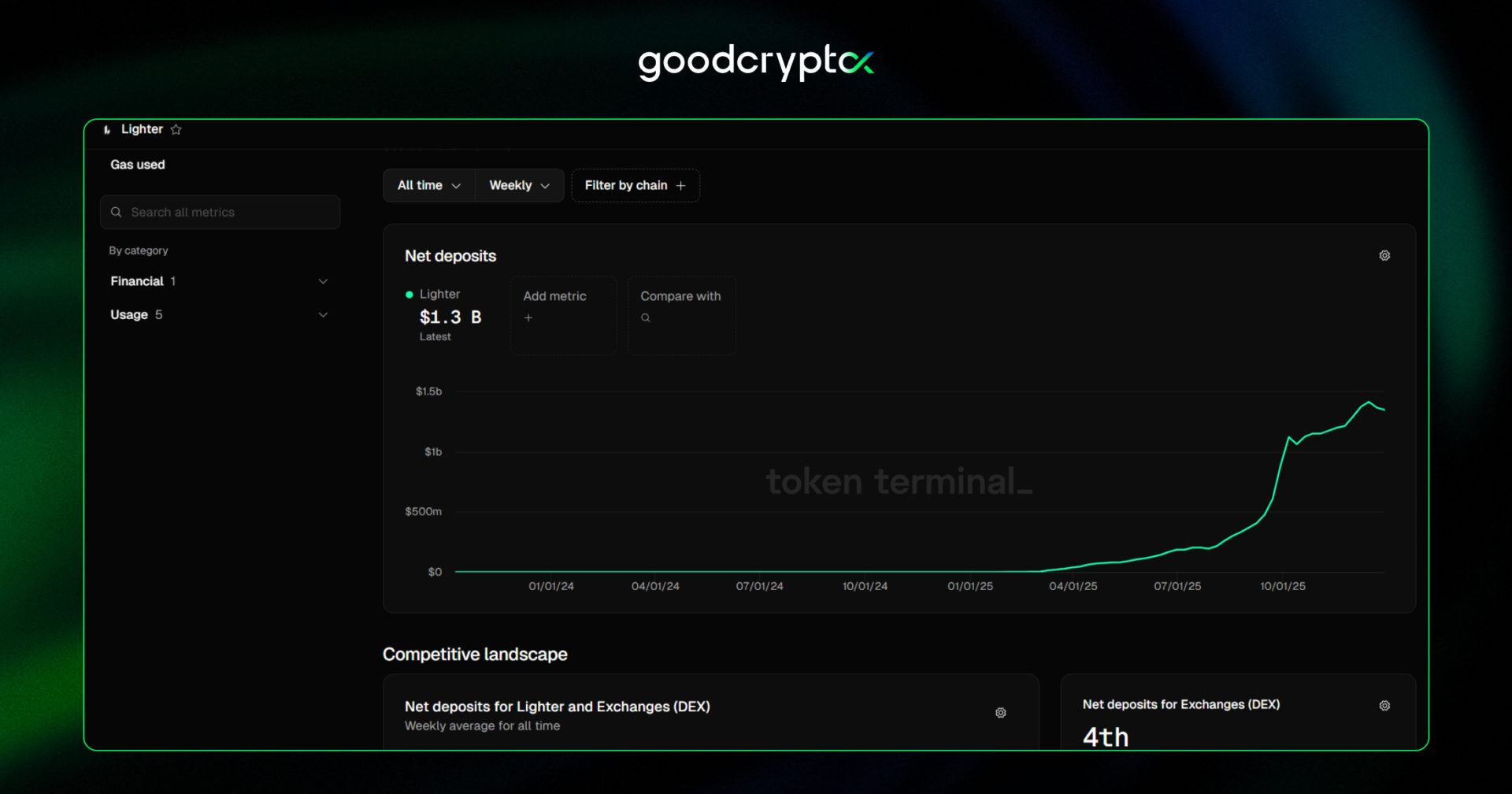

Lighter conducts ~$700M airdrop. $250M withdrawn in the first hour

Another New Year surprise for crypto traders arrived just a day before New Year – on December 30, 2025. On that day, perp DEX and ZK L2 chain Lighter unexpectedly launched the $LIT airdrop for point holders, converting 1 point into 20 tokens at an implied ~$2.8B FDV. With $LIT currently trading near $2.7 per token, the total airdrop value exceeded $680M.

According to Lighter’s announcement on X, 25% of the total token supply was allocated to the $LIT airdrop, with no vesting for recipients. Additionally, Lighter confirmed future buybacks and token burns funded by a portion of protocol profits, though the exact percentage has not been disclosed.

As is common with most airdrops, users began withdrawing funds shortly after distribution, resulting in over $250M in outflows within the first 24 hours. Despite this, the protocol still maintains approximately $1.3B in net deposits, according to TokenTerminal.

Trump Media to distribute new digital tokens to DJT shareholders

Another token distribution update comes from the U.S.: Trump Media and Technology Group (DJT), the parent company of Truth Social, reportedly plans to launch a new digital token for shareholders through a partnership with Crypto.com.

According to CoinDesk, the token will be issued on the Cronos blockchain, developed by Crypto.com, and distributed to shareholders at a 1:1 token-to-share ratio. Media reports indicate that the token’s main utility will be to provide benefits or discounts across Trump Media products, including Truth Social, the Truth+ streaming service, and Truth Predict.

Trump-related companies have been actively entering the crypto space throughout 2025. For example, World Liberty Finance, founded by Trump family members and once promoted on Trump’s Twitter, launched its own stablecoin, $USD1, which currently has a market capitalization of over $3.2B.

This move aligns with Trump’s broader vision of turning the U.S. into a Bitcoin superpower, promoting a crypto-friendly environment, and positioning the country as a hub for crypto activity.

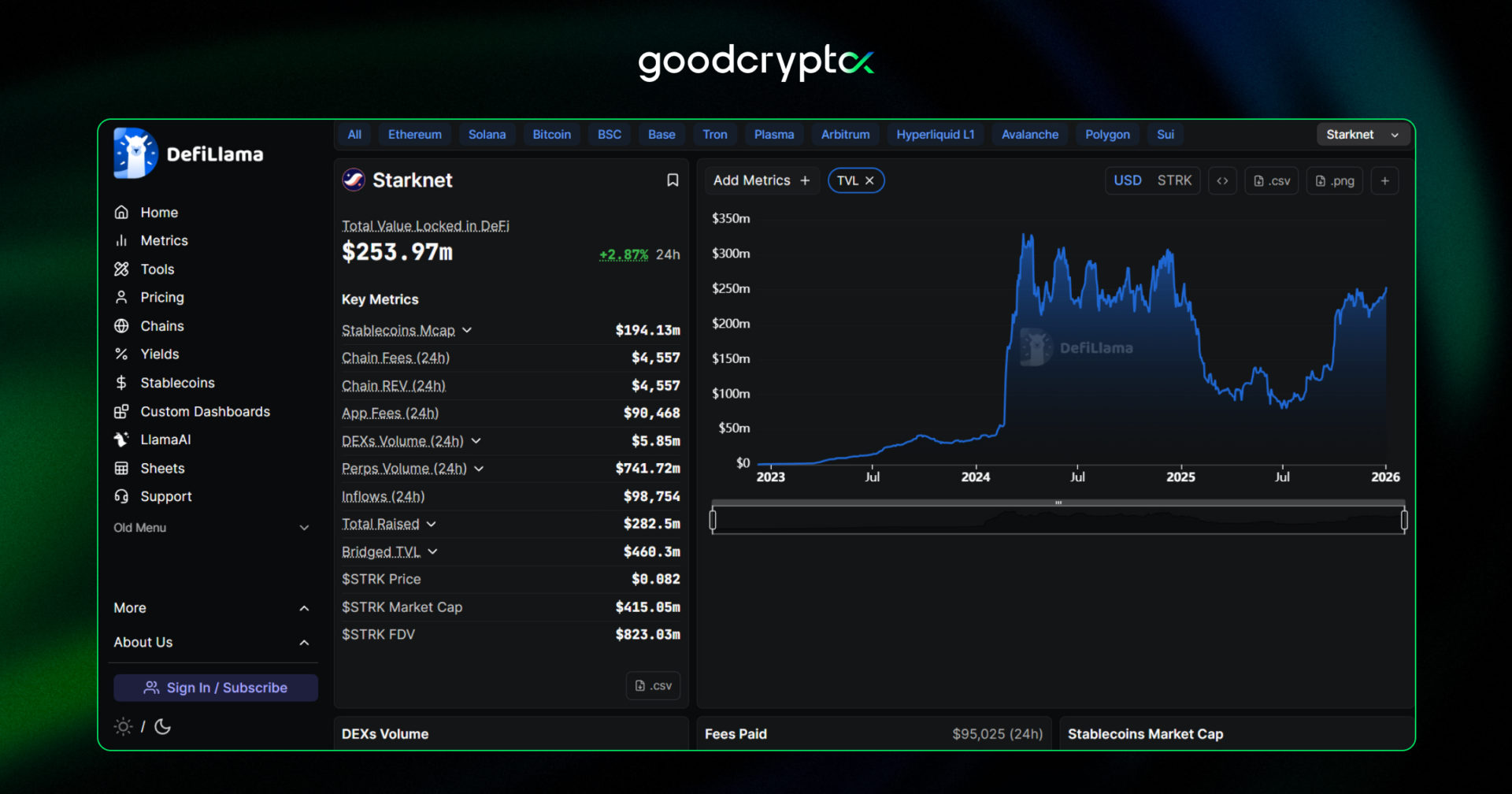

Bitwise files for 11 ‘strategy’ ETFs, tracking tokens including AAVE, ZEC, TAO

Finally, the market got a boost this week with Bitwise filing for 11 new ETFs, including several altcoins not previously mentioned. According to the announcement, each ETF would allow up to 60% of a fund’s assets to be invested directly in the underlying tokens, with the remainder allocated to exchange-traded products and potentially derivatives such as futures and swaps.

The ETFs cover $AAVE, $CC, $ZEC, $UNI, $HYPE, $SUI, $STRK, $TRX, $TAO, $NEAR, and $ENA. Notably, among the more established coins are several “young” tokens launched in the 2022–2025 cycle, including $HYPE, $SUI, $TAO, and the newest, $CC.

Most of these tokens and their associated protocols are currently performing well. $STRK is the exception, having fallen 96.5%, with protocol revenues remaining low, despite some recent rebounds in core metrics.

Momentum Indicator (MOM) guide

📚 The Momentum Indicator measures the speed and strength of price movements by comparing current prices to past levels. It helps traders spot momentum shifts and identify potential entry or exit points. The indicator is commonly used through two main strategies:

🔸 Zero Line Crossover: Track momentum via zero-line crossovers. When the MOM moves above zero, it signals bullish momentum, and when it drops below zero – bearish momentum.

🔸 Divergence Trading + EMA: Combine MOM divergences with the 200 EMA to identify trend reversals or continuations – bullish signals above the EMA, bearish signals below.

Want to dive deeper into MOM trading strategies? Check out our in-depth Momentum Indicator review.

Receive an instant notification when a new coin is listed with goodcryptoX PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the goodcryptoX app!