Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

To enable cryptocurrency payments for cloud services, Google partners with Coinbase

A new agreement between Google and Coinbase will enable a specific group of clients to pay for their cloud services using cryptocurrencies like Bitcoin and Ether. It will go into effect at the start of next year.

The internet giant is to investigate utilizing Coinbase Prime, a custodial service for holding and trading bitcoins, according to CNBC on October 11.

Coinbase responded by announcing that it will switch specific applications for data storage from Amazon Web Services to Google Cloud.

Amit Zavery, vice president, general manager, and head of the platform at Google Cloud stated that initially, only a small number of clients already active in Web3 would be able to make bitcoin payments using the Coinbase Commerce connection. However, Zavery said that more of its clients would eventually have access to the service.

Together, FTX and Visa will enable crypto payments in 40 countries

Cryptocurrency spending might get a lot simpler. One of the biggest cryptocurrency exchanges in the world, FTX, has teamed up with payments giant Visa to introduce debit cards across 40 countries. With this change, FTX users would be able to pay for products and services with “zero fee” debit cards. Additionally, according to the corporate website, card ownership is cost-free.

In response to the announcement, the FTX token, the native cryptocurrency of the FTX trading platform, increased by 7% and hit a high of $25.62. However, at roughly $80, the token’s all-time high is still some distance away.

The advancement would put Mastercard’s recent cryptocurrency ventures to shame for Visa. Chief financial officer Vasant Prabhu commented about the anticipated 2022 crypto bear market, “Even though values have fallen, there is still sustained interest in crypto.”

Hard-fork of BNB Smart Chain in response to $100M exploit

According to a post on GitHub, Binance’s smart contract-enabled blockchain, BNB Smart Chain, will experience a hard fork as a patch for the vulnerability that drained the platform of an estimated $100 million on October 6.

In order to reenable the cross-chain, the article described the release for the mainnet and testnet as a “temporary urgent patch to mitigate the cross-chain infrastructure between Beacon Chain and Smart Chain.”

The Moran hard fork, which is scheduled to happen on October 12 at 8:00 am UTC, will take place at block height 22,107,423. The iavl hash check vulnerability will be fixed, and block header in sequence checks will be added.

Regular users are unaffected by the fork, but node operators must take specific actions, such as shutting the physical node if it is still functioning and replacing it with a fresh binary.

The issuer of the Tether stablecoin freezes 8.2M USDT on Ethereum

Whale Alert, a cryptocurrency monitoring service, has discovered several transactions that suggest Tether froze three USDT addresses on October 10.

The frozen addresses include 3.4 million USDT, 1.95 million USDT, and 2.9 million USDT, according to Etherscan’s transaction records. The addresses hold $8.2 million worth of USDT stablecoin and can no longer transfer money.

A Tether spokesman informed Cointelegraph that “Tether works closely with law enforcement worldwide to assist in investigations, and has to date assisted in freezing over 360 million in assets, 101 million of which have either been reissued or are scheduled to be reissued.”

The spokesman said that Tether regularly communicates with important law enforcement officials, and the business responds with reasonable requests from law enforcement agents to freeze privately owned wallets. However, the representative said, “We do not freeze wallets of exchanges or services.“

The company said it would not comment on the specifics of the new freezes, adding: “Tether cannot comment on any sort of collaboration with law enforcement agencies in adherence with its compliance policies and regulatory obligations.”

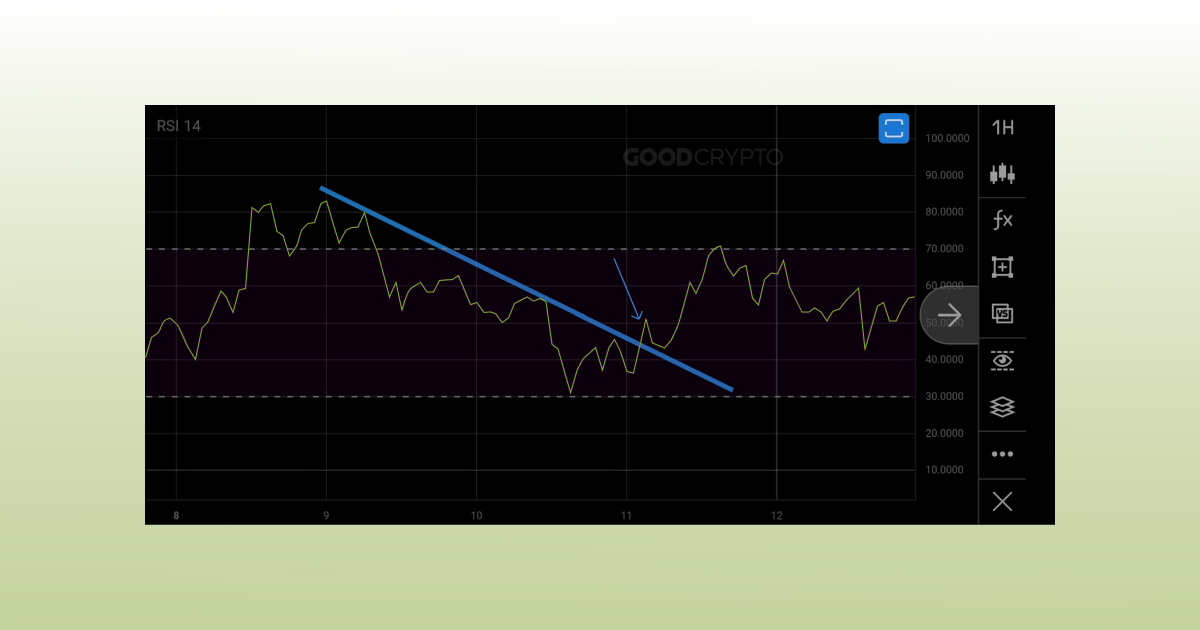

RSI indicator breakout

To examine a market trend, you may draw trendlines using the Relative Strength Indicator (RSI) indicator. A trendline is a straight line with two or more intersections. The more touchpoints the trendline has, the stronger it is. An RSI indicator breakout occurs when the RSI crosses a specific trendline.

This image demonstrates how the RSI emerged from a downward trend, rechallenged the trendline, and then continued to move upward.

Find more about the Relative Strength Indicator and how to read and use it while making a trading decision in this Ultimate Guide.

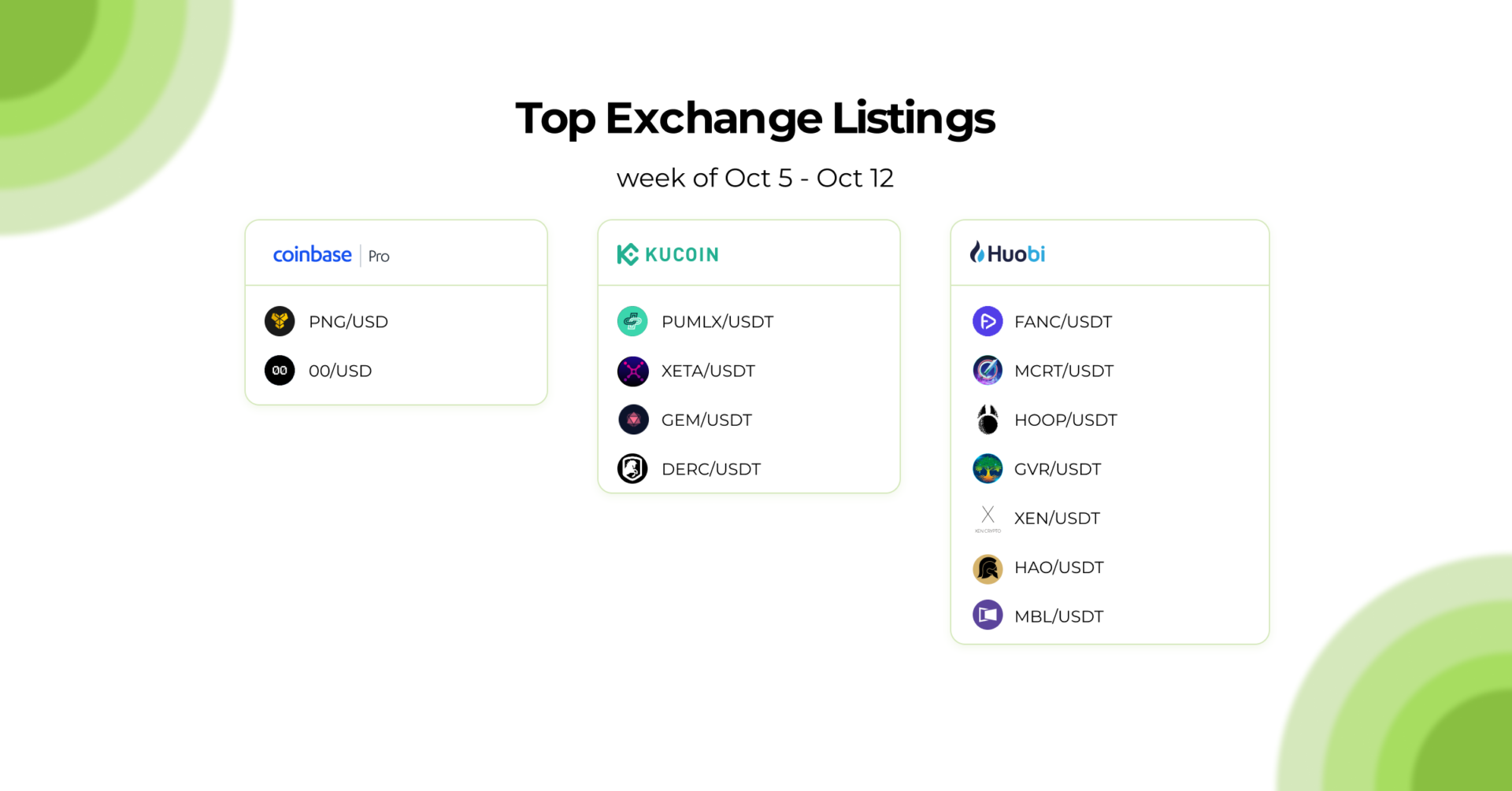

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!