Two months since we launched GOOD.

If Month 1 was about getting everything live — the token, the revshare system, the dashboards — then Month 2 was about what comes next: expanding the ecosystem and building the future of GOOD and goodcryptoX.

This month, the market gave us a stress test right out of the gate. A flash crash on October 10 wiped out half the market — and with it, half the open bots in goodcryptoX. The month ended with a liquidity dry-up, likely tied to the U.S. government‑shutdown standoff. It wasn’t an easy environment to trade — and that showed in a slight drop in activity inside the app. But it was also the kind of month that tests whether the system we built actually works.

And it did.

Despite the market slump, most of our core metrics grew: more holders, more tokens in revenue share, more wallets compounding. The flywheel did its job — turning real trading activity across the market into platform revenue, and ultimately into GOOD token demand, even as overall volumes softened.

What follows is a snapshot of how our ecosystem performed in Month 2.

If you’re new — or if you missed the first update — we recommend reading State of GOOD — Month 1 for a deeper dive into how the GOOD token economy works, how we think about the product, why we’ve avoided paid market makers, and how the GOOD flywheel is designed to compound over time.

revenue sharing

We continue to distribute 50% of all DEX trading revenue to wallets holding ≥10,000 GOOD.

No staking. No lockups. Just hold and earn.

Month 2 revshare snapshot:

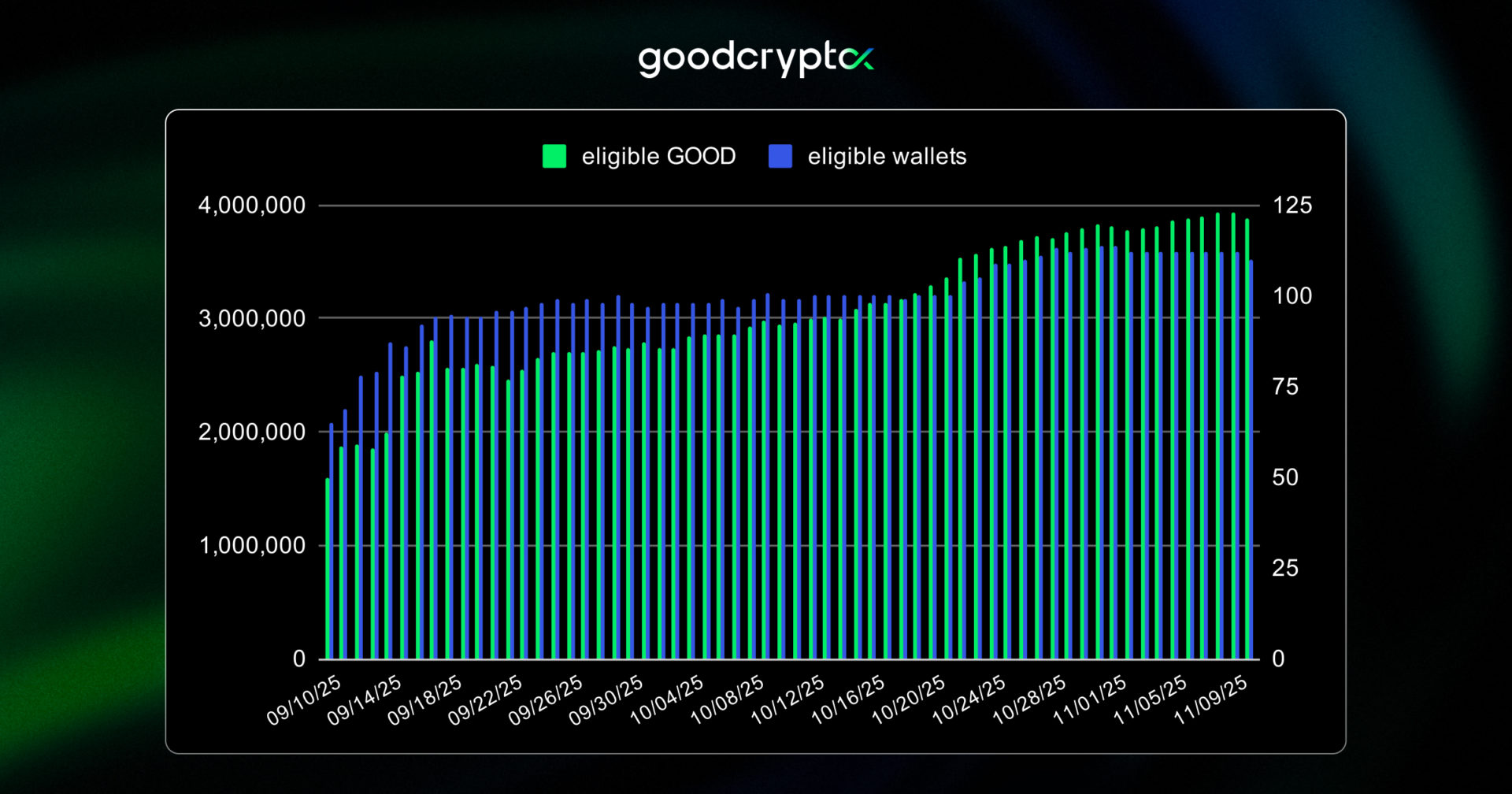

- Eligible wallets: 100 → 112

- Tokens participating: 2.9M → 3.9M GOOD

(Live: Revshare Dashboard)

It’s just 12 new wallets in absolute terms — but that’s a 12% month-over-month increase, which is strong growth by any measure, especially during a quiet market stretch. What’s even more important: the number of tokens participating grew by 33% — a clear sign of growing conviction among existing holders.

Meanwhile, over 90% of all eligible wallets kept auto-compounding. That alone added another ~50,000 GOOD of buy pressure — same as Month 1, despite softer trading activity.

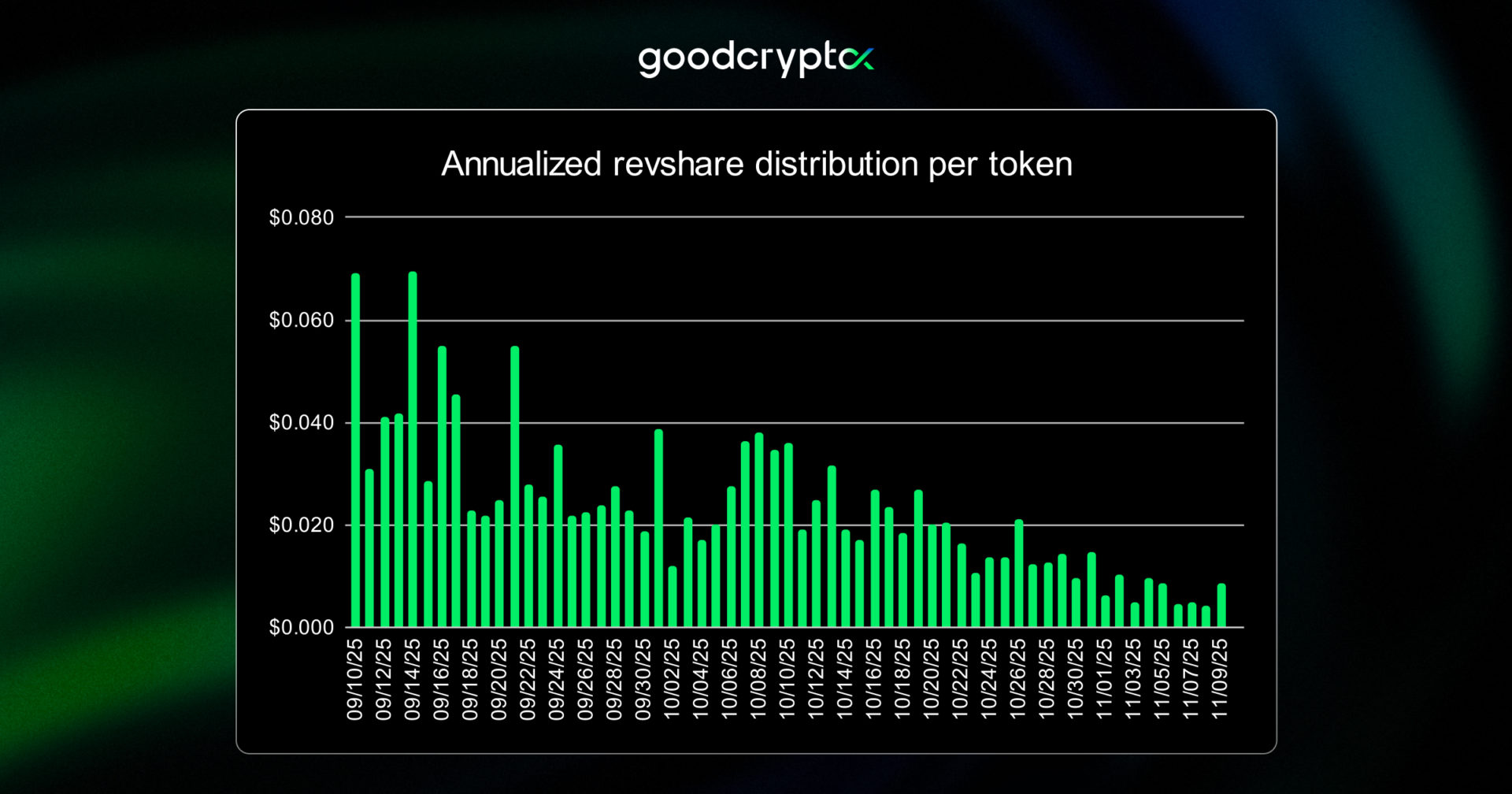

As volume slowed and the pool of revshare-eligible tokens grew, the average yield per token came down — as expected.

(Live: Revshare Dashboard)

In Month 1, the program offered yields north of 30% — which we described at the time as a reflection of what the market was demanding for holding GOOD.

In Month 2, yields stabilized around 15% — a sign that more holders are comfortable with the long-term potential of the token, even with a lower short-term return.

That’s encouraging.

It shows belief — not just in the system working, but in it working over time.

And what excites us even more: the total number of GOOD holders is now approaching 1,000 wallets.

Only 112 are currently participating in revshare — but that doesn’t mean the rest are passive.

Many are already on their way: steadily accumulating, compounding, or waiting to cross the 10,000 GOOD threshold.

trading rewards & airdrop

Revenue sharing rewards conviction.

Trading rewards drive usage.

Together they keep the flywheel spinning.

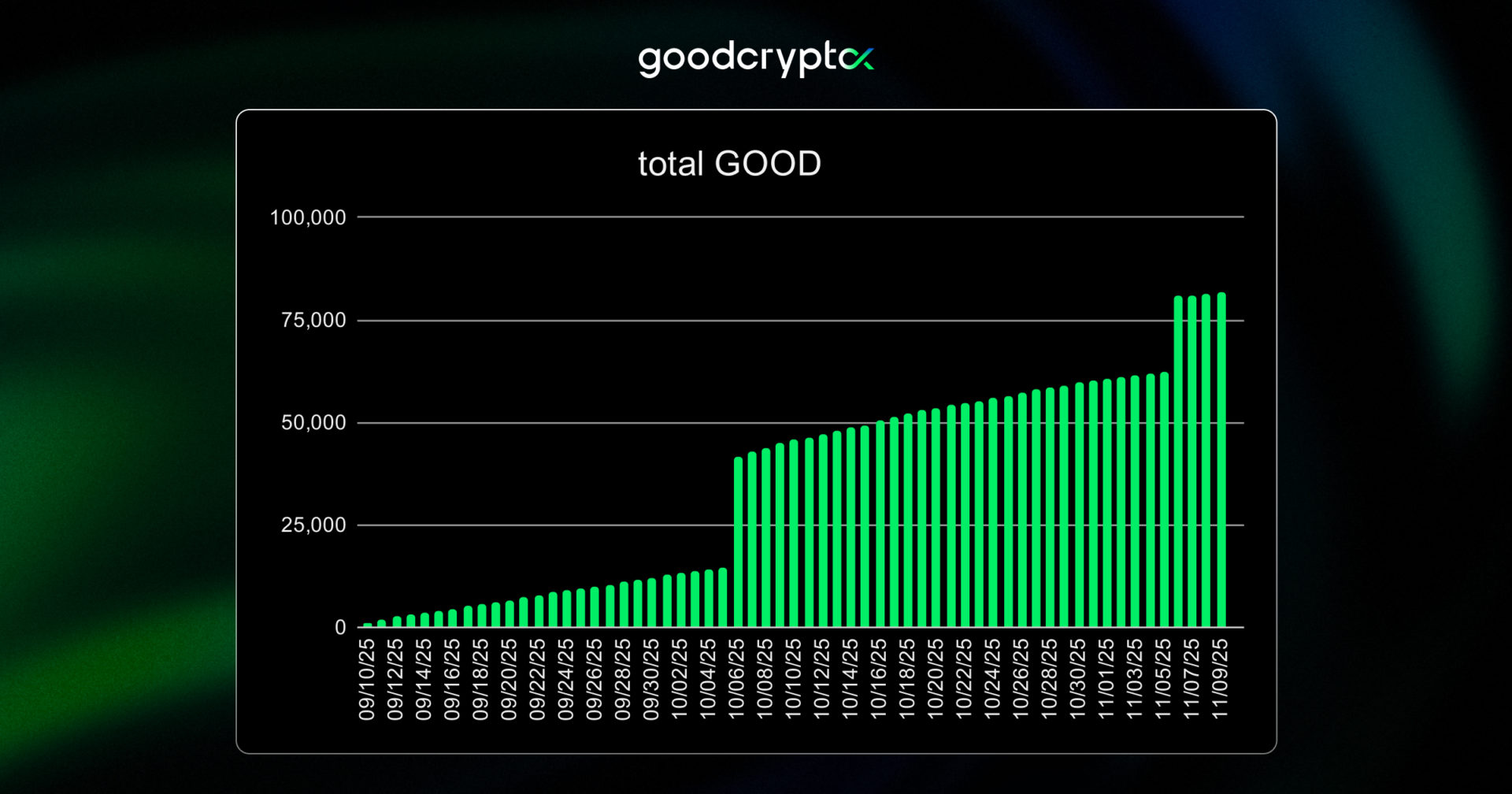

Every week we distribute trading rewards across all users.

Roughly 200 wallets received GOOD each week in October.

Unclaimed rewards held by CEX traders — those who still haven’t created a Solana wallet — grew from 40 000 to over 60 000 GOOD. That means 100 + active app users will find a nice surprise once they create their Solana wallet in the app.

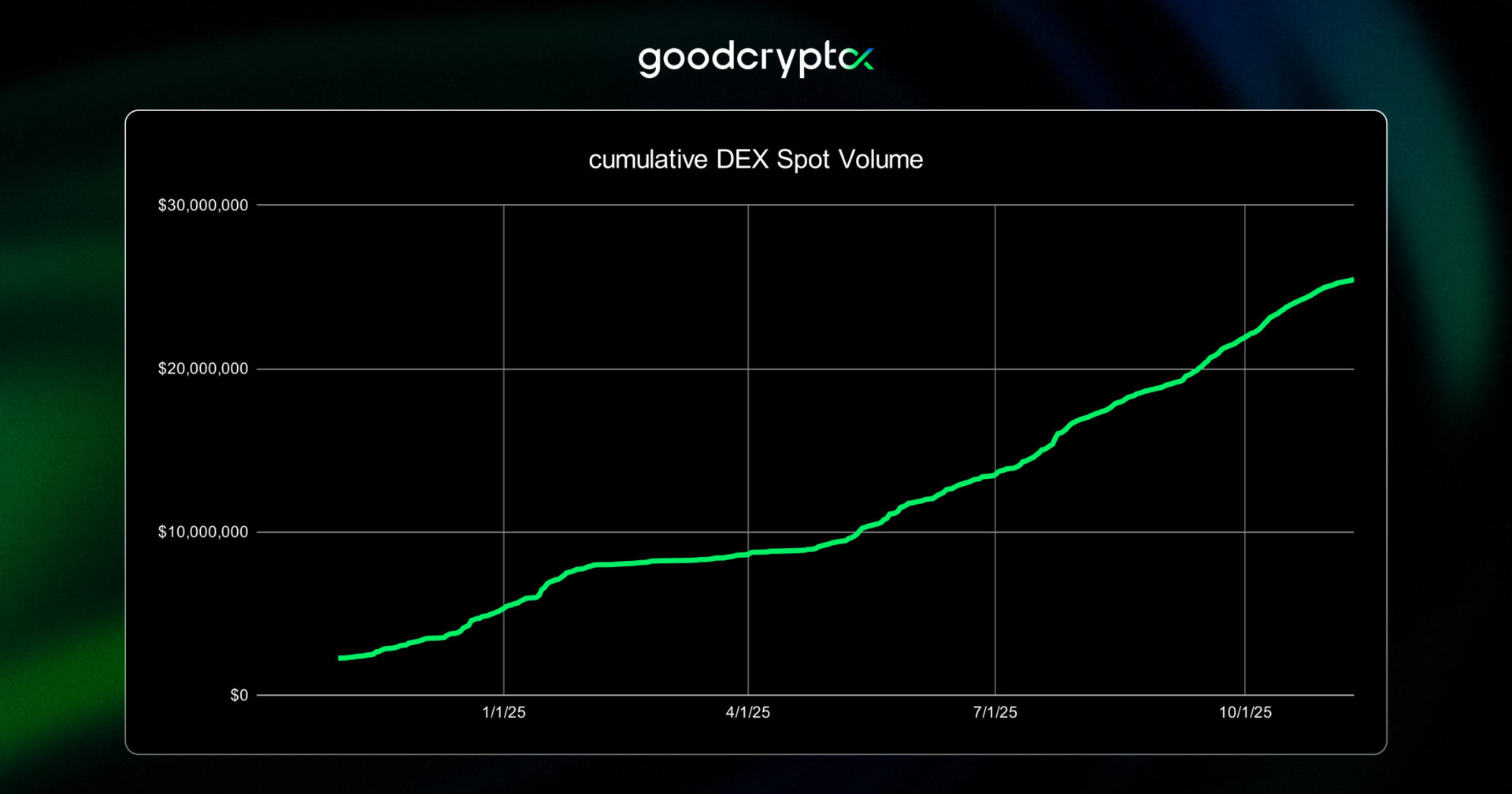

Our cumulative DEX spot volume passed $25M, up from $22M last month. The curve remains steep: the first $10M in volume took 14 months; the next $10M took 4. We’re on pace for the next milestone — and with Hyperliquid launching, volume should accelerate further.

(Live: Volume Dashboard)

Airdrop Two is tied to that $100 M volume target, so every trade pushes us closer.

DEX fee discounts — now for DEX futures

With the upcoming app v 2.4.0 release that brings Perp DEX support, we’re revamping how DEX trading fee discounts work.

So far, discounts applied only to DEX spot trades. From now on, they’ll also apply to DEX futures — starting with Hyperliquid.

If you already have, say, 30 % off on DEX spot, you’ll get the same 30 % off on Hyperliquid from day one.

We’re also expanding how DEX fee discounts based on traded volume are earned.

Until now, only DEX spot volume counted toward your tier.

Going forward, DEX futures and even CEX volume will count too — with different weights.

This way, active CEX traders start their DEX journey with meaningful discounts, while all your activity feeds into one loyalty path. For users, it’s fairer. For the ecosystem, it’s smarter — because the more volume migrates to DEX side, the more revenue flows into revshare and burns.

🔥 burns — the deflation engine keeps running

Every day we burn 10 % of DEX revenue.

Every month we burn another 10 % from CEX rebates, subscriptions, and NFT sales.

So far, 80 000 + GOOD have been burned —including 18 000 GOOD in the latest monthly burn event.

(Live: Burn Dashboard)

At current pace, that’s roughly a 0.5% annual deflation rate vs total supply — and multiple times higher relative to circulating supply. And as the burns ramp up… — we are confident you’ll enjoy owning a deflationary asset in an inflationary environment.

the product — ready for lift‑off

Last month we said: foundation first, moon next.

This month we got lift‑off ready.

Hyperliquid integration is in the final testing phase and about to go live.

It’s one of our biggest product releases since launch — the moment where DEX futures join the GOOD economy.

Once live, every Hyperliquid trade will generate fees that flow straight into revshare and burns.

And we’ll be the first platform to offer no‑code bots for Hyperliquid — Grid, DCA, Infinity Trailing — available from day one. Same as TradingView webhooks, multiple take-profits with SL following, Trailing Stop-Losses and a lot more.

We believe that on‑chain trading is the future. This release brings it closer.

In parallel, we kept progressing on 💎Sniper Bot. It’s not ready for prime time yet, but it’s next in line once Hyperliquid is out.

Beyond that, our upcoming focus will be on bringing the Grid bot to spot DEXs (will need to implement true limit orders on DEXs first). Then – TradingView Strategy bot for CEXs and DEXs.

Each unlocks new capability — and each one adds torque to the flywheel.

outro

Month 2 wasn’t easy for the markets, but it was an important one for GOOD.

We proved that the system holds, even when the market doesn’t.

More holders, more tokens in revshare, more burns, more resilience.

And now we’re standing right before the next chapter — the launch of Hyperliquid.

Once it’s live, DEX futures volume joins the loop: more revenue → more revshare → more burns → more value.

We built the foundation. We tested the flywheel. Now it’s time to accelerate.

stay GOOD