from vicious to virtuous

Last month’s update was written at the depth of the drawdown.

Markets were weak, activity was subdued, and the flywheel was moving in the wrong direction. It was a classic vicious circle: lower activity, lower distributions, weaker sentiment, all reinforcing each other.

This month looks different.

Not because the market suddenly turned euphoric – it didn’t. If anything, broader conditions are still fragile, and the holiday period is historically one of the quietest times of the year. But despite that backdrop, activity on the platform picked up meaningfully. That shift matters.

When things start moving in the other direction, the same mechanics that worked against us on the way down begin to reinforce each other on the way up. That’s the flywheel, and this month, we started seeing it turn again. The vicious circle is turning into a virtuous.

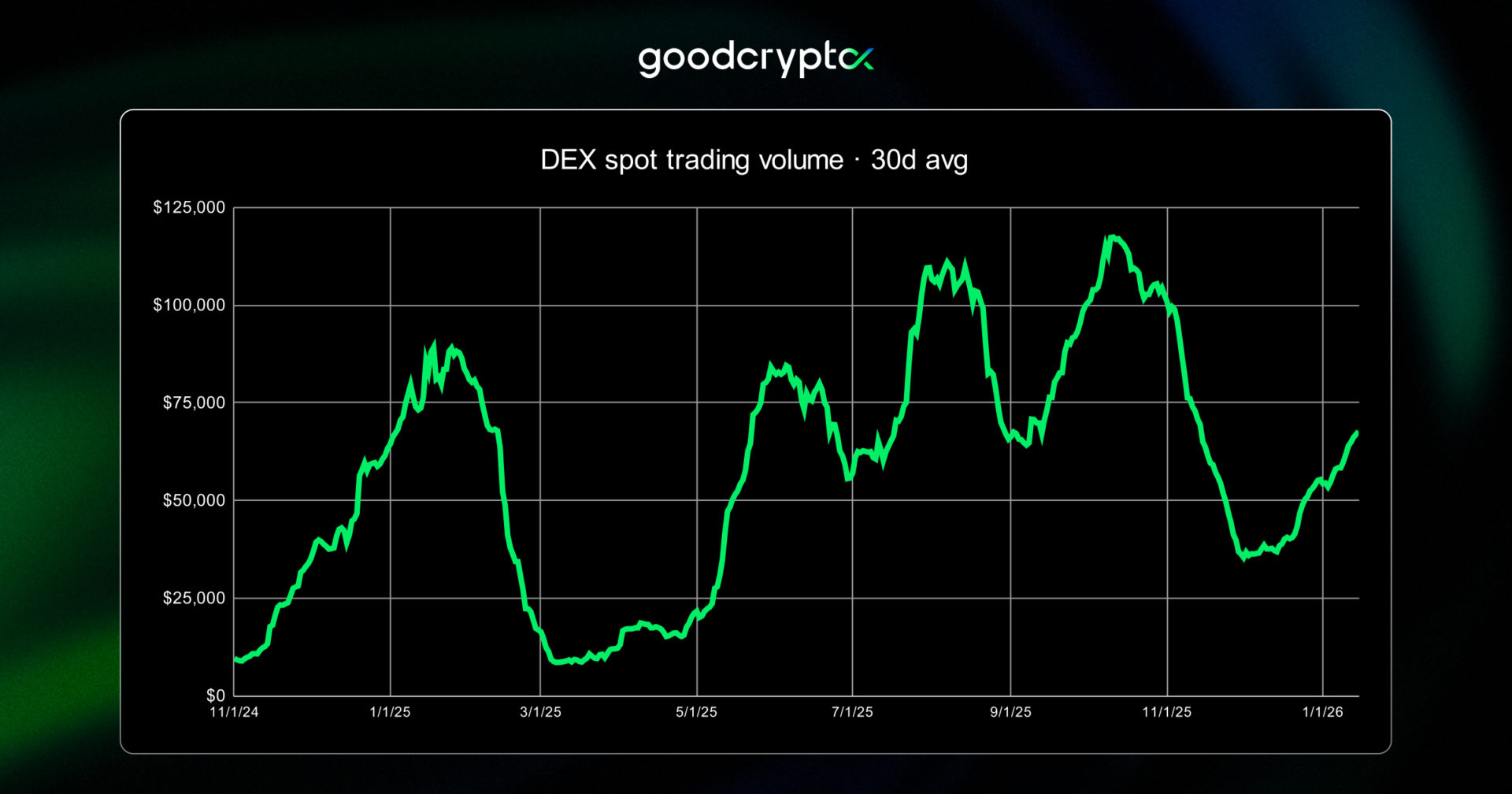

DEX volume picked up considerably during the last month, moving well off the lows. We’re not back at previous highs yet – but that’s not the point.

What matters more is how the activity returned. We’re seeing more new traders and a much broader set of coins traded daily. The traded universe expanded, and participation became more evenly distributed. That’s a much healthier signal than a single cohort coming back all at once.

The recovery is mostly taking place on Solana at the moment. Base and BNB Chain – come on, do something already 😉

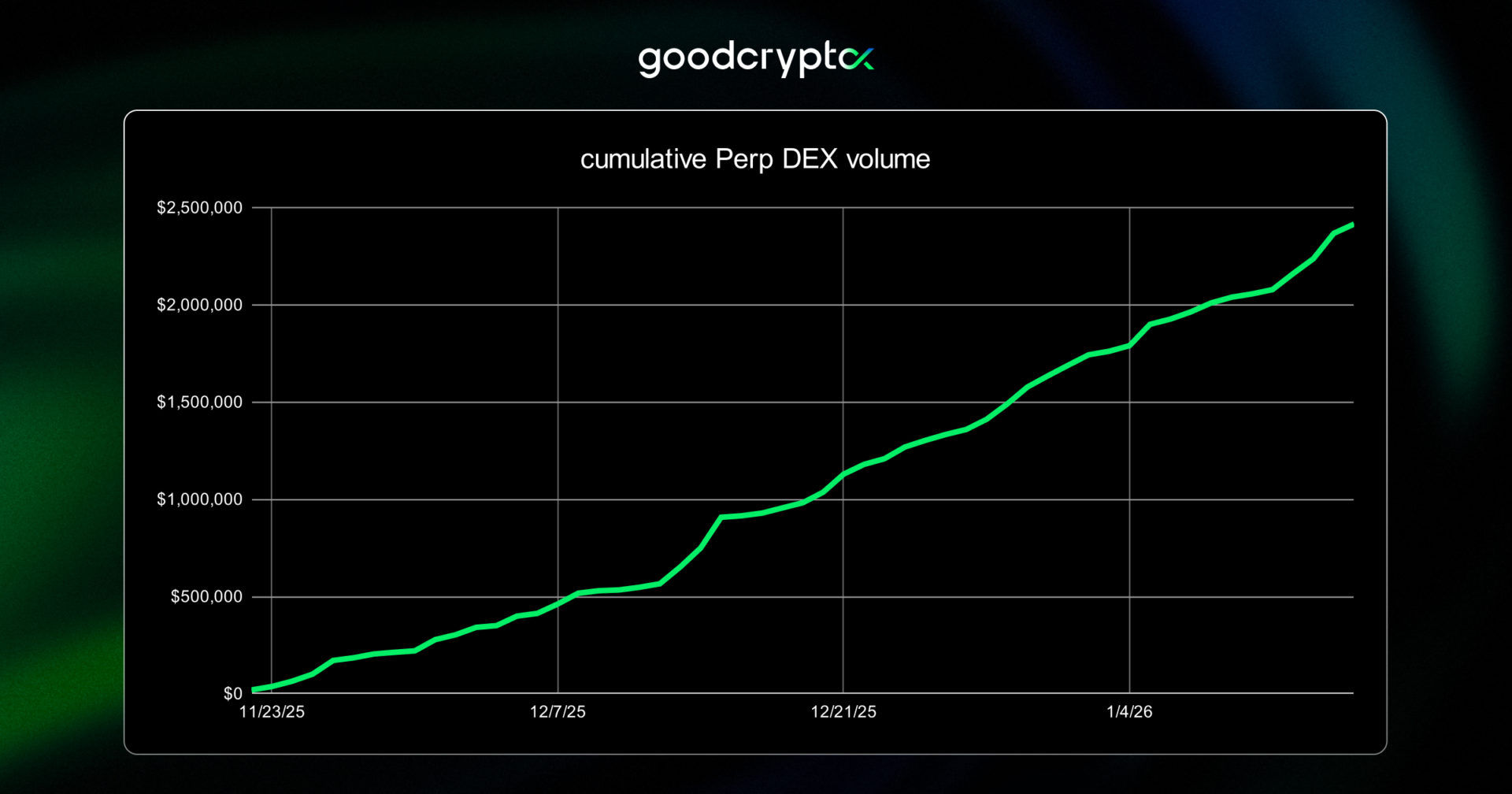

Hyperliquid continued to ramp.

As I mentioned last month, no major integration delivers results overnight. Adoption takes time. Hyperliquid is following exactly that path.

User activity and trading volume continued to grow throughout the month, even during a period when overall market participation is typically muted. That reinforces our view that the integration is gaining real traction, not just benefiting from short-term noise.

This is still early, but the direction is clear.

burn, baby, burn 🔥

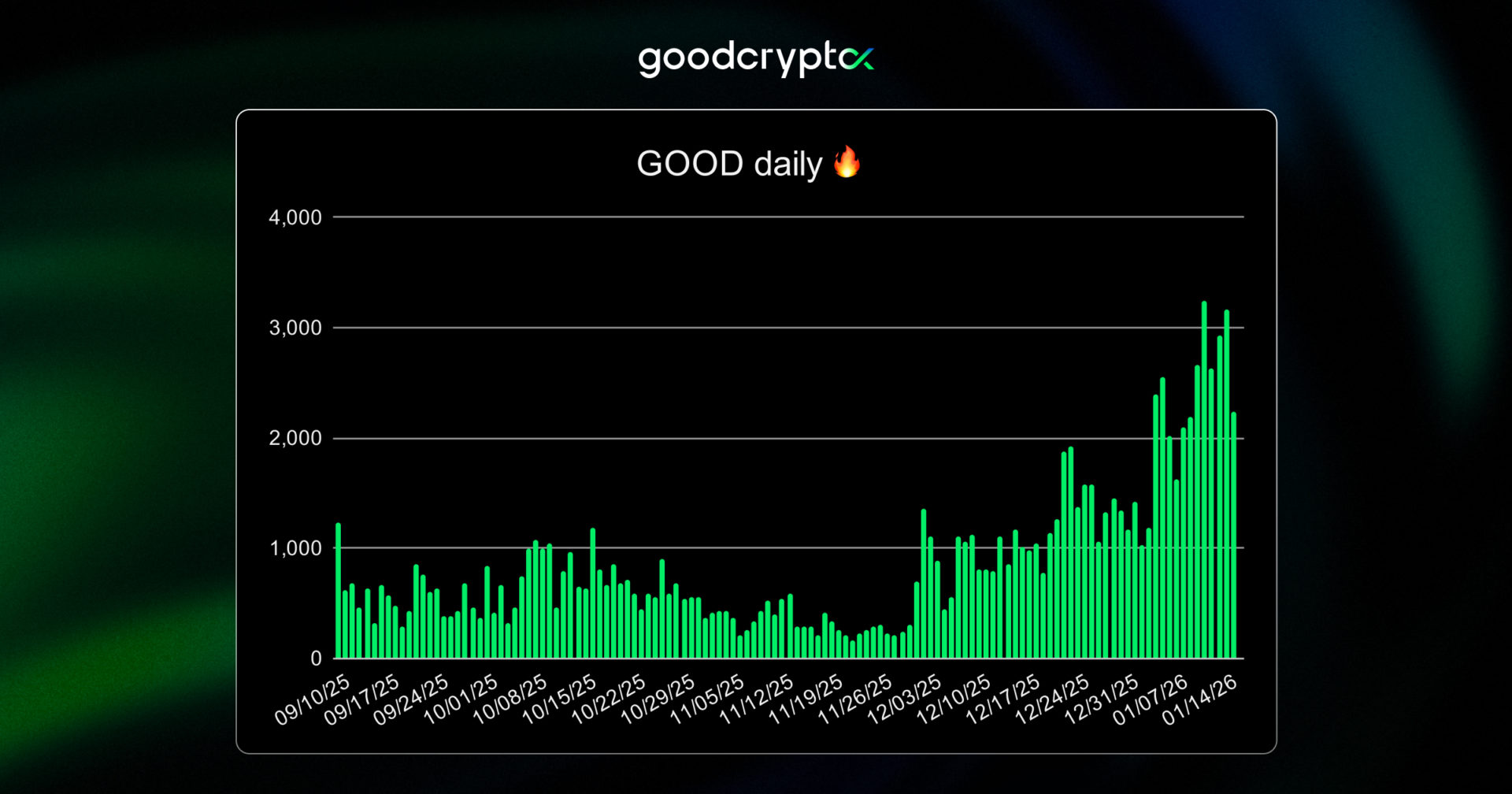

Last month, the token flywheel was working defensively. This month, it started amplifying the recovery. The most visible change is in burns.

Daily burns moved from barely reaching 1,000 tokens just a month ago to consistently exceeding 2,000 $GOOD per day, with multiple all-time highs posted.

The current daily burn record now sits well above 3,000 $GOOD.

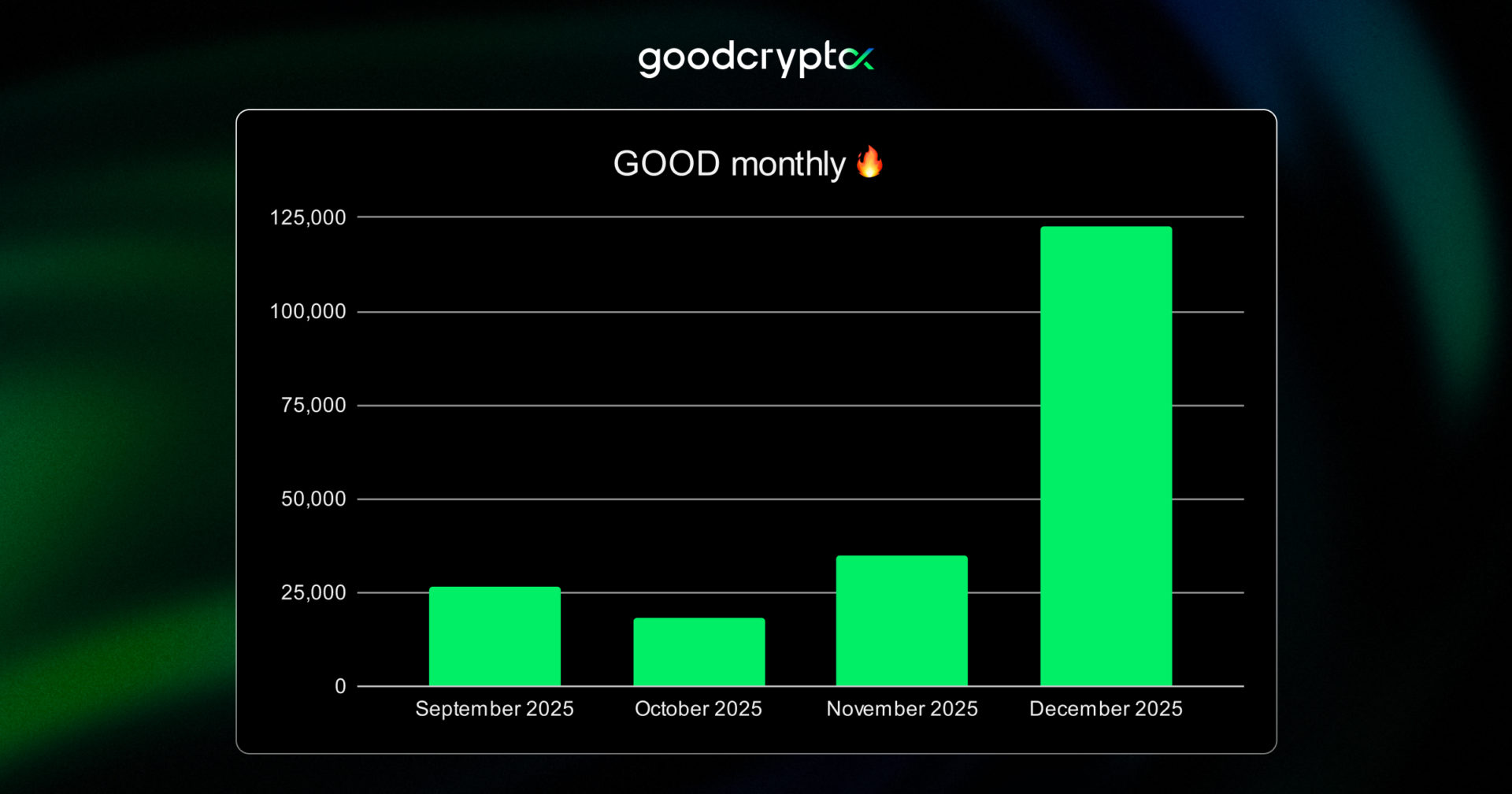

Monthly burns tell the same story.

Our fourth monthly burn – for December – was four to five times larger than any previous one.

We’re only four months into the system, and the trend is accelerating.

revshare: from defense to offense

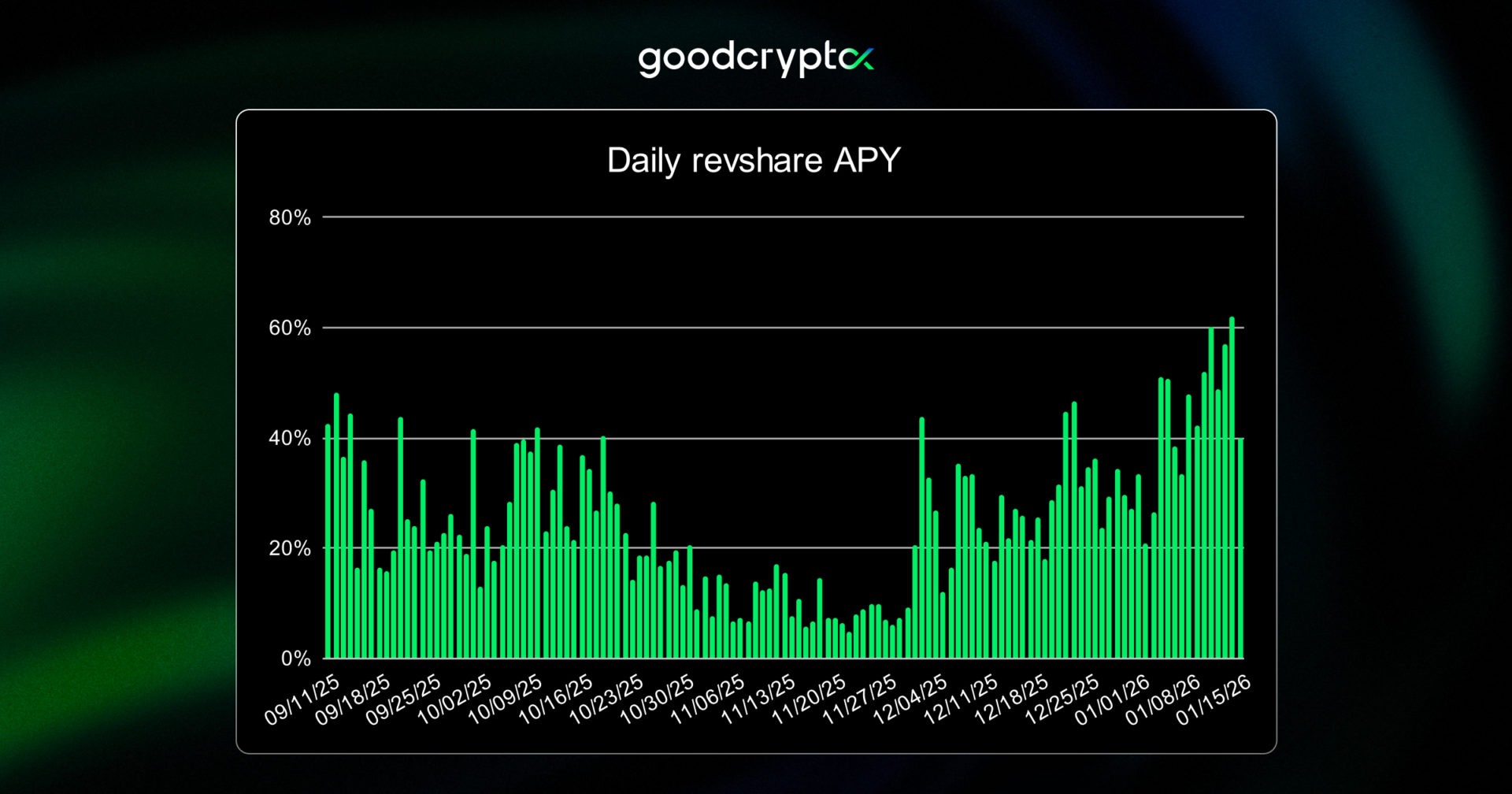

Revshare responded exactly as designed as well.

As activity picked up while the token price remained low relative to previous months, APY moved sharply higher.

- Today’s APY stands at 62%, the highest level ever recorded.

- APY has been consistently above 50% since early January.

This is not a one-day spike. It’s a trend.

Before the market downturn, when volumes were much higher, APY hovered around ~10%, which is broadly what markets tend to consider “normal” in stable conditions.

The current regime reflects a combination of recovering activity and a reset in token price. Mechanically, this is exactly how the system is meant to behave.

I’m deliberately not focusing on price commentary here. Price is certainly not the product.

However, a sustainable 50-60% yield is an extraordinary signal – however you choose to frame it.

revshare + burns = strong flywheel

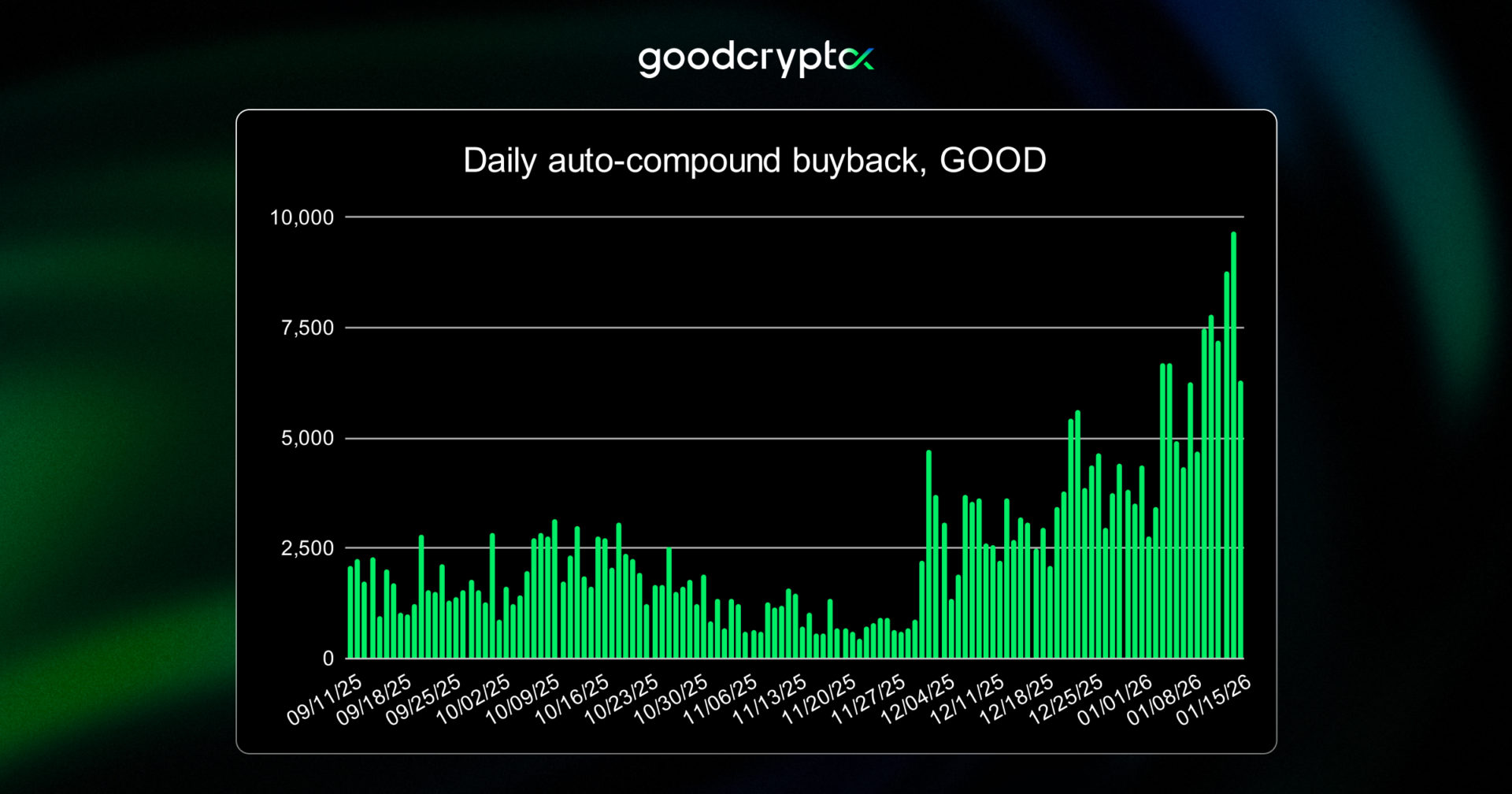

Lower price, higher APY, and rising distributions naturally fed into compounding behavior.

Most wallets receiving revshare continue to auto-compound. As a result:

- Daily buybacks via compounding grew from ~2-3k GOOD last month to a new all-time high of 9,666 $GOOD in a single day.

- More than 300,000 GOOD have now been bought back through compounding.

- Combined with burns, over 600,000 GOOD have been removed from circulation in just four months.

At the same time, participation continued to broaden:

- Eligible tokens in the revshare program grew from under 6.0M to over 7.0M in one month (~20% growth).

- Eligible wallets increased from 135 to 155 (+15%).

Double-digit month-over-month growth across these metrics has now been consistent.

subscriptions

On January 10, we increased subscription prices across plans by roughly 20-40%, depending on tier and duration.

Even after the increase, we remain highly competitive on value relative to other multi-exchange trading platforms.

From a token-economy perspective, this matters for two reasons:

- 10% of centralized exchange fees are burned, directly increasing long-term deflation.

- Higher revenue gives us more room to accelerate execution, which remains our primary bottleneck.

Speed of delivery matters. At the same time, we operate in a high-risk environment where stability and correctness are non-negotiable. Balancing the two is always the challenge.

plot twist: not everything was smooth sailing

Not everything went perfectly this month – as it never does.

The biggest miss was the delayed release of the 💎 Sniper bot. It’s close – but it’s not live yet.

Several factors contributed:

- The end-of-year period slowed execution.

- Several unexpected platform maintenance tasks showed up.

- Our team is largely based in Ukraine, where ongoing infrastructure attacks in severe winter conditions caused real disruptions.

Despite those constraints, our focus remained high. As we move past maintenance-heavy work, attention is shifting back to delivery.

💎 Sniper bot is next.

DEX Grid bot will follow.

For DEX Grid bot delivery date, we’re targeting later this winter, with the usual caveat that unknowns tend to surface once work begins.

strategic flexibility is GOOD

One final note on the token. The flywheel is already working – but that doesn’t mean it’s finished.

The token gives us strategic flexibility. As we look at integrating additional perp DEXs beyond Hyperliquid, we’re evaluating ways to align incentives even when native fee-sharing isn’t yet available. Yes, we are looking at Lighter and Aster DEXs.

One option under consideration is usage-based token mechanics – like using token burns as a trading pass. Say, burn 10k GOOD to trade $1M on a certain perp DEX via goodcryptoX.

No decision have been made yet. This is simply an illustration of how the token can (and will) be used to strengthen alignment further over time.

looking ahead

We’re still early.

The flywheel is turning, activity is returning, and the system is responding exactly as designed.

2025 delivered more institutional progress for crypto than most of the previous years combined – even if prices didn’t reflect it yet. From where we’re sitting, 2026 looks promising.

And even without macro tailwinds, our own roadmap gives us plenty to be excited about.

We already transformed the product once.

A year from now, goodcryptoX will have evolved again – into something that once again looks nothing like what came before it.

Thank you for staying with us.