Another month is in the books.

Despite the doom & gloom, it was a genuinely strong month for goodcryptoX and the $GOOD ecosystem.

Not because the market suddenly turned friendly – it very much didn’t. But because, even in this environment, the system showed what it’s capable of when activity does appear. This month, we got a clear glimpse into what scaling looks like.

The month had two distinct phases.

For most of it, centralized exchanges were generally quiet. December was slow – January was slower still. Volatility stayed compressed, and nothing resembling a broad-based recovery showed up.

Against that backdrop, decentralized trading on the platform held up far better than expected.

On AMM DEXs, Solana DCAs stayed quite active, while Base and BNB Chain continued their hibernation.

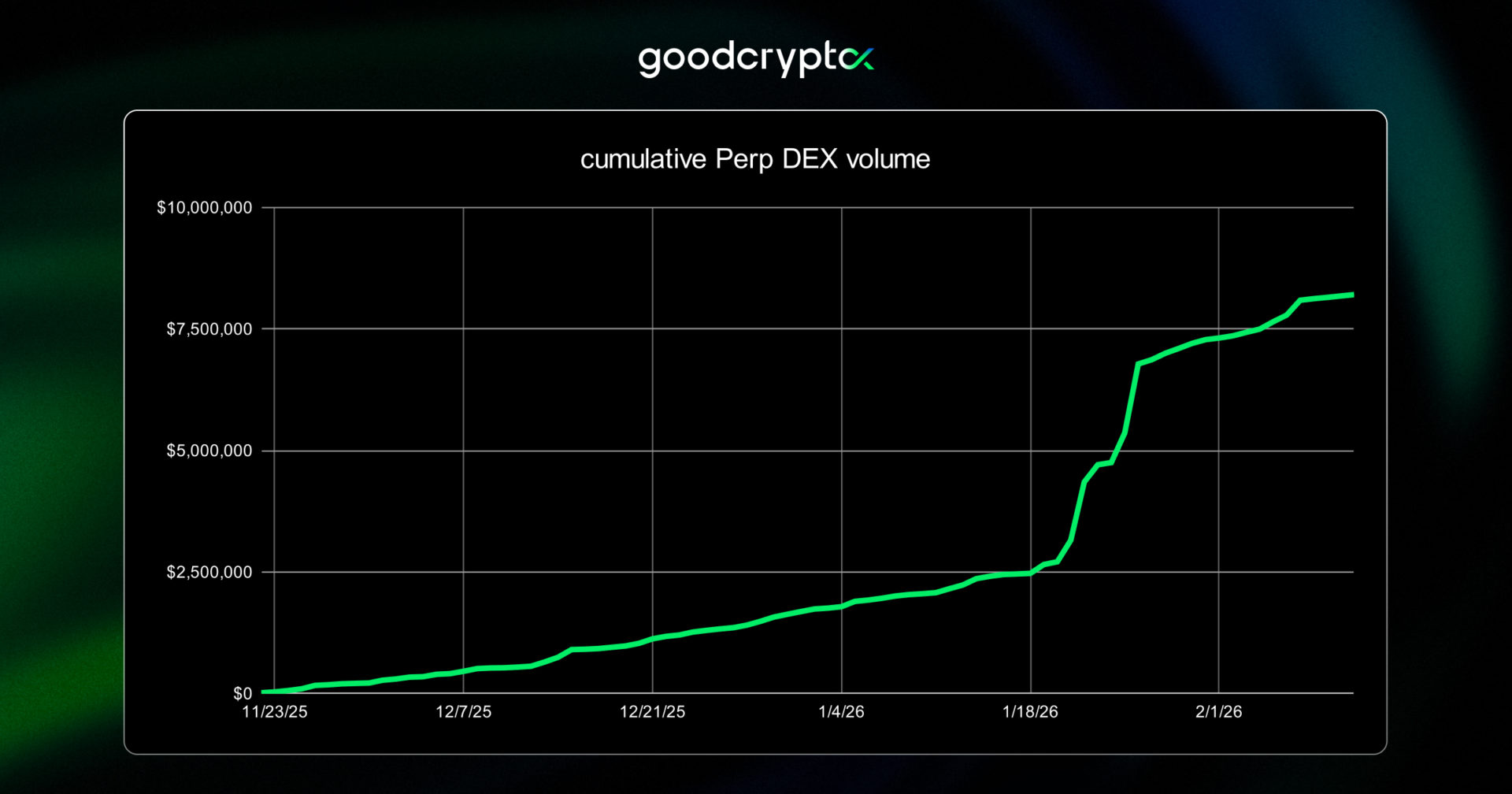

The real standout this month, though, was @HyperliquidX.

Trader growth there has been steady since launch. That didn’t change. What did change, was volume. At one point, Hyperliquid activity accelerated sharply.

For a moment, everything clicked. Volume jumped. Fees followed. Revenue sharing expanded immediately. You could see the flywheel engage in real time.

All of this happened while the broader market was anything but supportive.

This jump was enough to accelerate the $GOOD ecosystem across every measurable dimension. If you ever wanted to see our growth flywheel in motion – that was it.

Unfortunately, the market then completely lost its footing, and the carnage that followed overshadowed everything and drained most signs of life.

The quiet after the storm followed.

We don’t comment on price. But the pattern is hard to miss: when activity aligned, metrics moved fast. When macro pressure returned, it overwhelmed everything.

That doesn’t invalidate what we saw earlier in the month. If anything, it strengthens the signal.

revshare

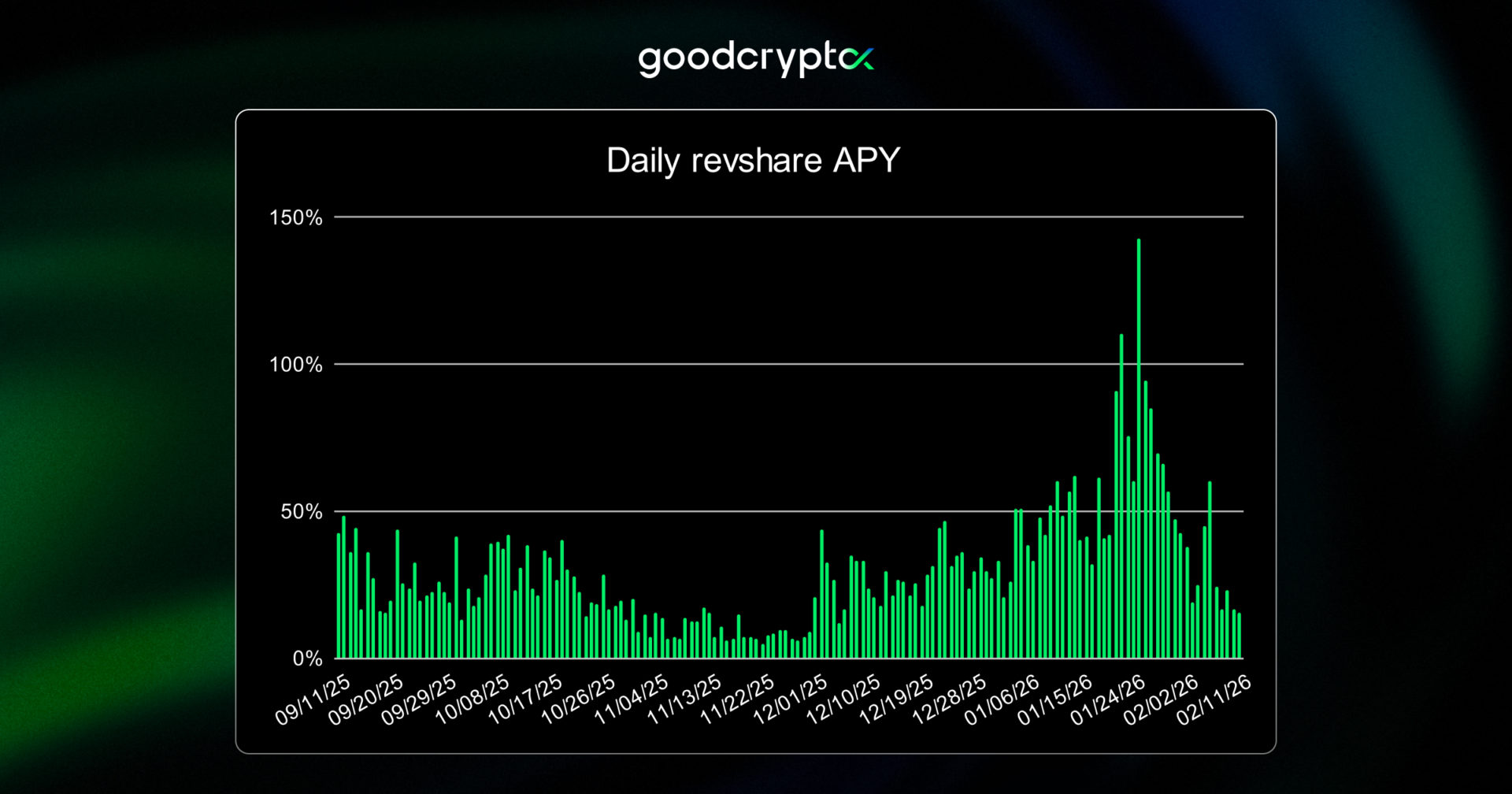

The most noticeable thing was how cleanly and sharply activity translated into token-level metrics.

As activity picked up while token price remained suppressed, yield moved sharply higher, with several days exceeding 100%. Even with the slowdown, the 30-day average APY is still north of 50%.

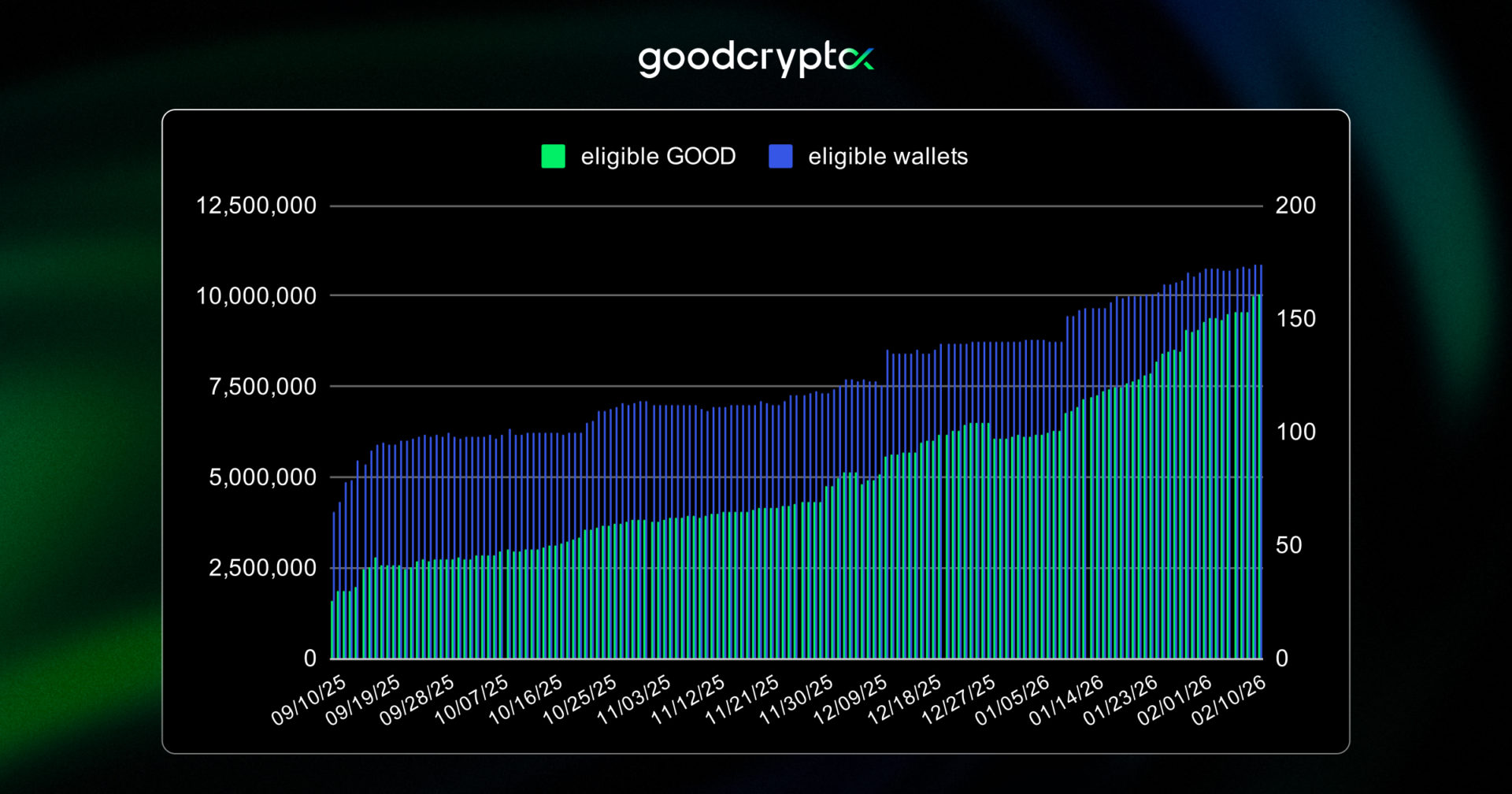

That immediately attracted new token demand, and we saw over 3M GOOD enter our revshare program. That’s roughly a 50% increase.

A large part of this inflow came from existing GOOD holders increasing their exposure, but we also expanded the program with about 30 new wallets joining. That’s 20% month-over-month growth, and an acceleration from the ~10% monthly growth we’ve seen since token launch.

Despite the huge increase in tokens participating in revshare since launch – from about 1.5M to nearly 10M – the average revshare APY over that entire period is above 30% (and up from the mid-20s just a month earlier). And it happened here, in the middle of a market drawdown.

One more number is worth calling out. During the month, for the first time, eligible tokens added to revenue sharing exceeded the total monthly token unlock. That’s a remarkable result, especially considering that the vast majority of unlocked tokens – treasury, ecosystem, marketing, liquidity – remain idle. Effective circulating supply tightened rather than expanded this month – and that’s even before taking burns into account.

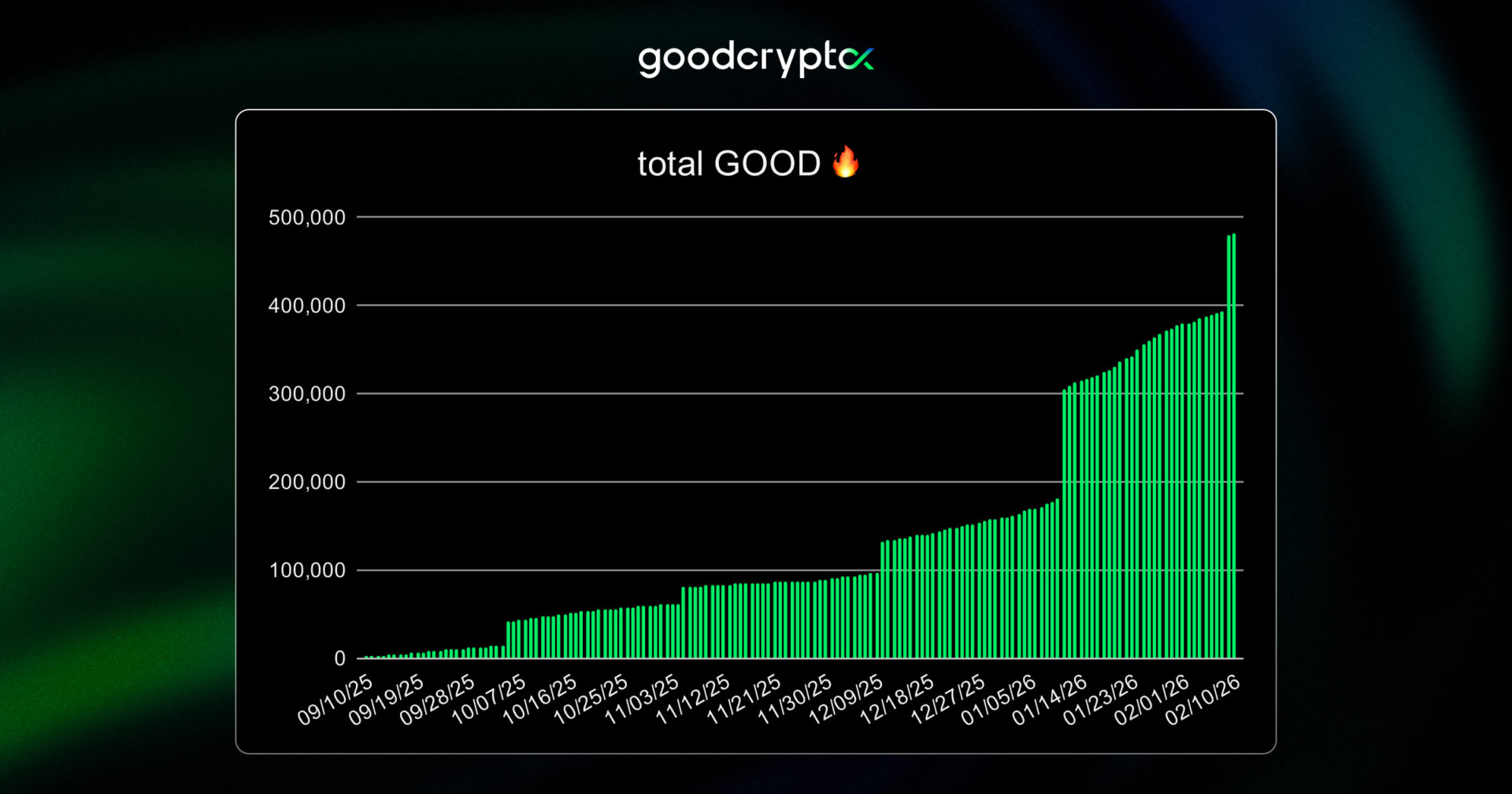

burns

Speaking of burns, roughly 200,000 tokens were removed during the month. We are closing in on 0.5M GOOD burned in total. That’s a very promising run rate, and the pace is accelerating.

product

We’re now days away from the next release. It won’t introduce 💎 Sniper yet, but it brings a full app redesign, materially improves the trading experience, and prepares the ground for what comes next. It also brings several improvements to our DCA bots that remove major pain points and take them to the next level.

💎 Sniper itself is finally built and in pre-production testing with real trading.

Real-money testing of any large new feature, besides revealing bugs, always does two things.

- First, it reveals things you simply cannot design for in advance – missing controls, edge cases, safety gaps, and structural improvements.

- Second, it uncovers new features and opportunities that were not obvious at the design stage.

We are now balancing the need to bring 💎 Sniper online as soon as possible with the desire to make it a genuinely strong first release.

I’m always very cautious around ETAs, but we are aiming to release it before the next monthly report.

Another important prerequisite before launching 💎 Sniper is revamping and enhancing the DEX Screener. The current version was created almost as an afterthought. We are significantly expanding its capabilities because, in the initial release, it will be the sole provider of entry signals for 💎 Sniper. Going forward, 💎 Sniper will be able to ingest a much wider range of entry signals.

Production testing also revealed how much work is required on safeguards. Automated buying can be extremely powerful and extremely dangerous if done irresponsibly in the DEX environment. Scam tokens, honeypots, and copycats are real risks. While we can’t eliminate them entirely, we aim to meaningfully reduce exposure.

As often happens, work on 💎 Sniper spilled over into other parts of the product. While preparing it for production, we implemented improvements that benefit existing tools – DCA bots first and foremost. True cost mode, averaging order retries, and the ability to close positions even after bots are stopped were unlocked by the same groundwork and are included in the upcoming release.

We are also days away from launching HIP-3 (equities, silver, gold, etc.) support on Hyperliquid.

looking ahead

Our near-term roadmap hasn’t changed.

💎 Sniper comes first. Native limit orders on DEXs follow. Then the DEX Grid bot.

For the mid-term, one additional idea entered the mix: prediction markets.

There are multiple possible paths – via Hyperliquid’s HIP-4, direct API integrations with Kalshi and/or Polymarket, or tokenized prediction markets on Solana. The opportunity is there, and we are evaluating the right implementation and prioritization within the broader roadmap.

Nothing to announce yet. But it’s firmly on our radar.

zooming out

If I’ve learned anything since falling into the crypto rabbit hole back in 2017, it’s that cycles rarely feel rational in real time.

Whenever Bitcoin looks unstoppable, it usually isn’t. And whenever crypto feels completely broken, it usually isn’t either.

The euphoria is the sign of the top. The despair is the sign of the bottom.

It certainly feels like the latter at the moment.

This month gave us a preview of how the system behaves when activity appears – even briefly.

If this is what the system can do with the wind blowing in our face, imagine what happens when that wind eventually turns.

Until then, we keep building.

stay GOOD