This month, progress on almost every front was largely overshadowed by the broader market drawdown.

Bitcoin corrected hard, the entire market followed, and once that happens in crypto, there is no escaping it. No matter what you build, no matter what you ship, the market sets the mood, the numbers, and the narrative.

We’ve been in this space long enough to know this pattern well. When the market goes down, it doesn’t just go down linearly. The effects multiply.

Trading volume drops. Volatility collapses. Opportunities disappear. Traders get liquidated or sidelined. Fear kicks in. People stop experimenting. Bots trade less because there’s simply less to trade.

This hits from all directions at once – spot, perps, CEXs, DEXs, and it propagates forward into subscriptions, revenue, and ultimately the token.

The result is always the same: metrics shrink much faster than the market itself. A 20% drawdown in prices can easily mean a 50–70% drawdown in business activity as public companies like Coinbase have shown clearly across multiple cycles.

This month was no exception.

It was, in fact, our worst month on record in over a year.

That’s not an excuse. It’s context.

GOOD holders HODL

Everyone says they understand drawdowns. Almost no one is actually prepared for them.

Even if you’ve lived through multiple cycles, even if you know intellectually that drawdowns are where opportunities are created, it’s still hard.

I’ve been in crypto since 2017 and investing in the stock market long before that. I’ve read the books, studied behavioral finance, and lived through multiple 20%+ drawdowns. And still – every time the market falls hard, your brain goes into survival mode.

The first few times, you freeze. You do nothing. Exactly when you should be acting.

It takes years of repetition, reflection, and discipline to even partially overcome that reaction. I’m better at it now than I was years ago – but it’s still difficult.

So when markets fall, frustration rises. Fear turns into anger. And unfortunately, the most vocal supporters often become the most vocal critics.

That’s human. It’s understandable – but still sad.

At the same time, what really matters becomes visible.

The vast majority of our token holders stayed strong. They didn’t panic, they didn’t shout, they didn’t leave. And when you look at the data, their actions speak much louder than words.

That’s exactly the token holder base we want to build.

Warren Buffett and Charlie Munger often spoke about how proud they were of Berkshire Hathaway’s shareholder base – the lowest turnover among any public company, long‑term thinking, aligned incentives.

We are obviously very far from Berkshire in every possible way – but the principle holds. Slowly and steadily, we want to build a token holder base that understands what we’re doing, why we’re doing it, and sticks with us through thick and thin.

Because, as the saying goes, markets are ultimately a mechanism for transferring wealth from the impatient to the patient, and we now have over 1,000 patient $GOOD holders 💪

the HYPE…

Despite the market environment, we kept shipping.

The biggest launch this month was our Hyperliquid integration – our first perp DEX.

We’ve been very explicit about how we choose new exchanges to integrate:

- The exchange must have a real, long‑term user base (not short‑lived hype or farming).

- It must offer a solid, well‑designed API that we can integrate deeply.

- It must allow us to charge integrator fees, because those fees directly support the token economy.

Hyperliquid fits all three.

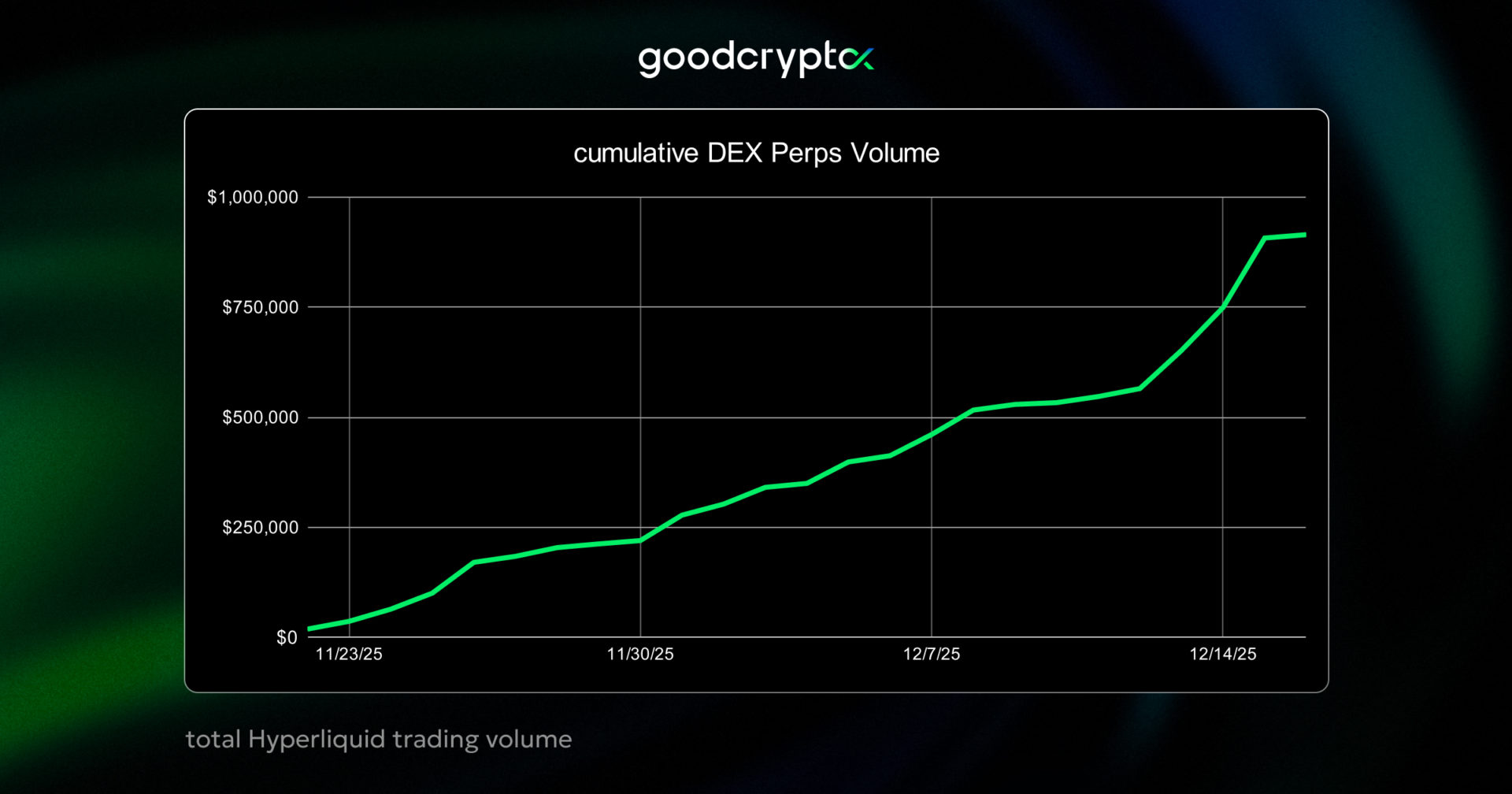

Despite launching into one of the worst market environments of the year, Hyperliquid usage ramped up steadily. We are already at ~1M in traded volume:

All our existing tools are being used there – manual orders, Grid and DCA bots, TradingView strategies, and we are building more!

Even at this early stage, Hyperliquid already contributes roughly ~30% of all fees collected.

Given the market conditions, that’s a very strong signal. Without this integration, the month would have looked materially worse.

Like with every major product launch, real impact doesn’t show up in weeks – it shows up over months. And this one is just getting started.

…and more

Alongside Hyperliquid, we continued working on several major initiatives:

- Finalizing full trading mode for DEX Gems Sniper bot (delayed, but for structural reasons – it required rebuilding large parts of our architecture).

- Upgrading Binance integration (support for portfolio margin accounts, multi‑asset, and credits modes).

- Advancing DEX limit orders, which unlock Grid bots on DEXs.

- Upgrading our DEX screener and laying the groundwork for a CEX screener.

- Preparing Gems Sniper expansion from DEXs to centralized exchanges.

Much of this work is invisible on the surface – but it fundamentally expands what we can build next.

revshare – the anchor

Revshare remains the backbone of the $GOOD token economy.

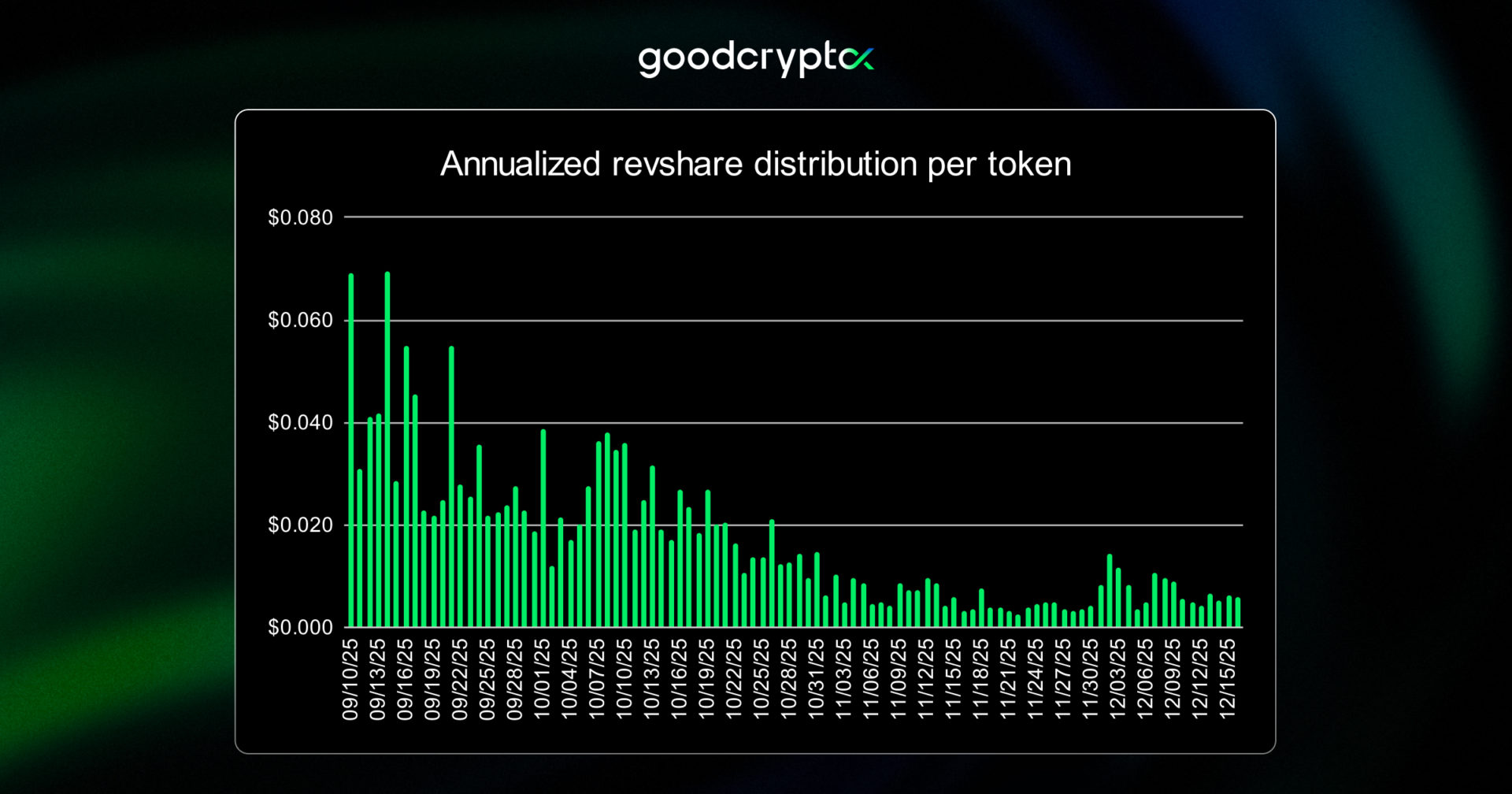

As expected, revenue sharing per token dropped sharply during the market slump.

But two things are important here:

- Revshare has already started recovering as volume stabilizes.

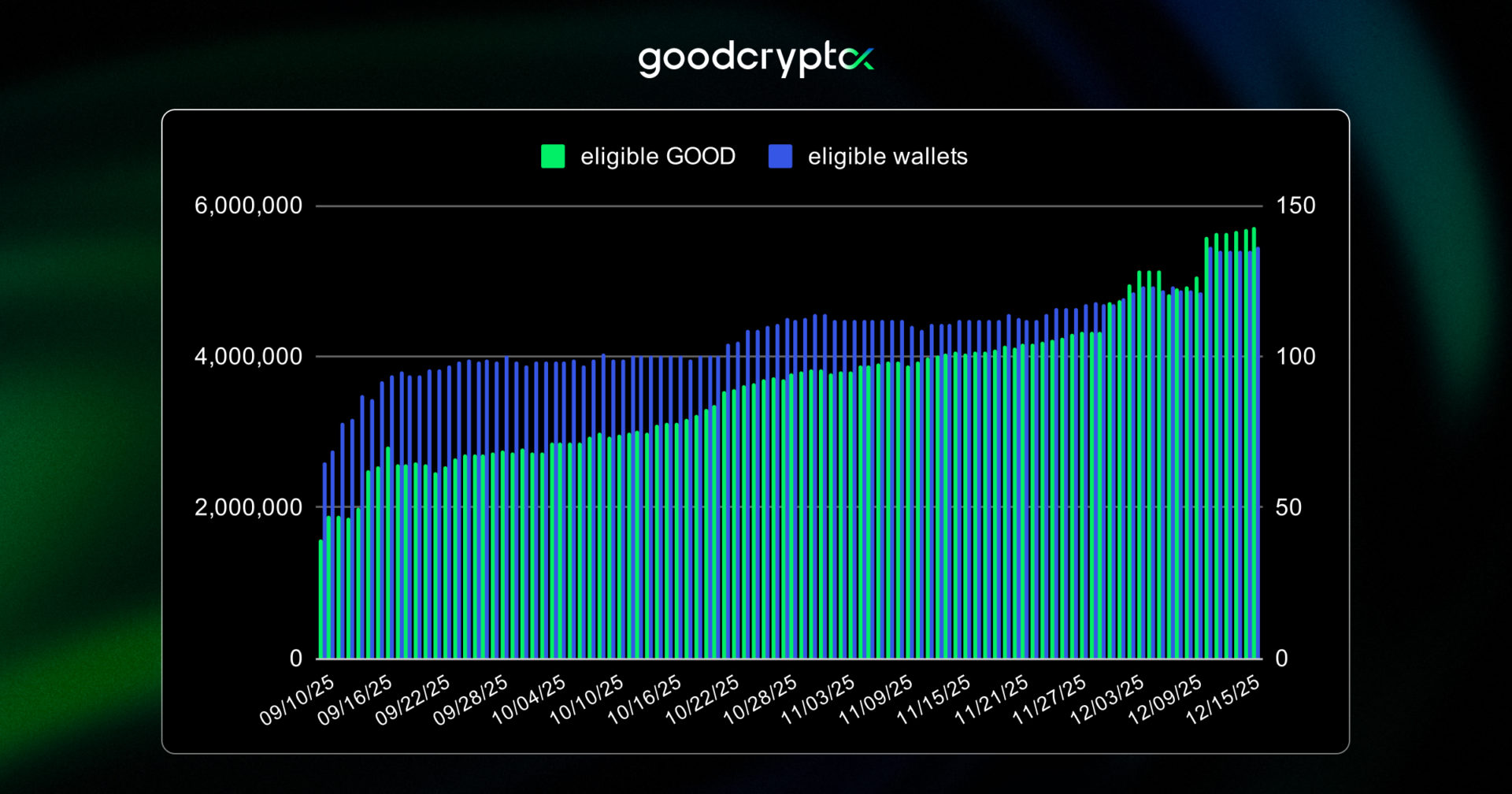

- The number of eligible tokens kept increasing throughout the downturn.

Eligible tokens grew from roughly 4.0M at the start of the month to 4.9M at the end of the month to 5.7M at the time of this writing.

The number of wallets receiving Revshare kept growing as well: we had ~100 wallets receiving revshare after month 1, we’ve added 10% more in month 2, and yet another 10% in month 3. The growth continued into the month 4 with another 10% added in the first 10 days.

Eligible wallets grow steadily, eligible tokens grow even faster!

That means two things:

- New holders are joining.

- Existing holders are increasing their exposure.

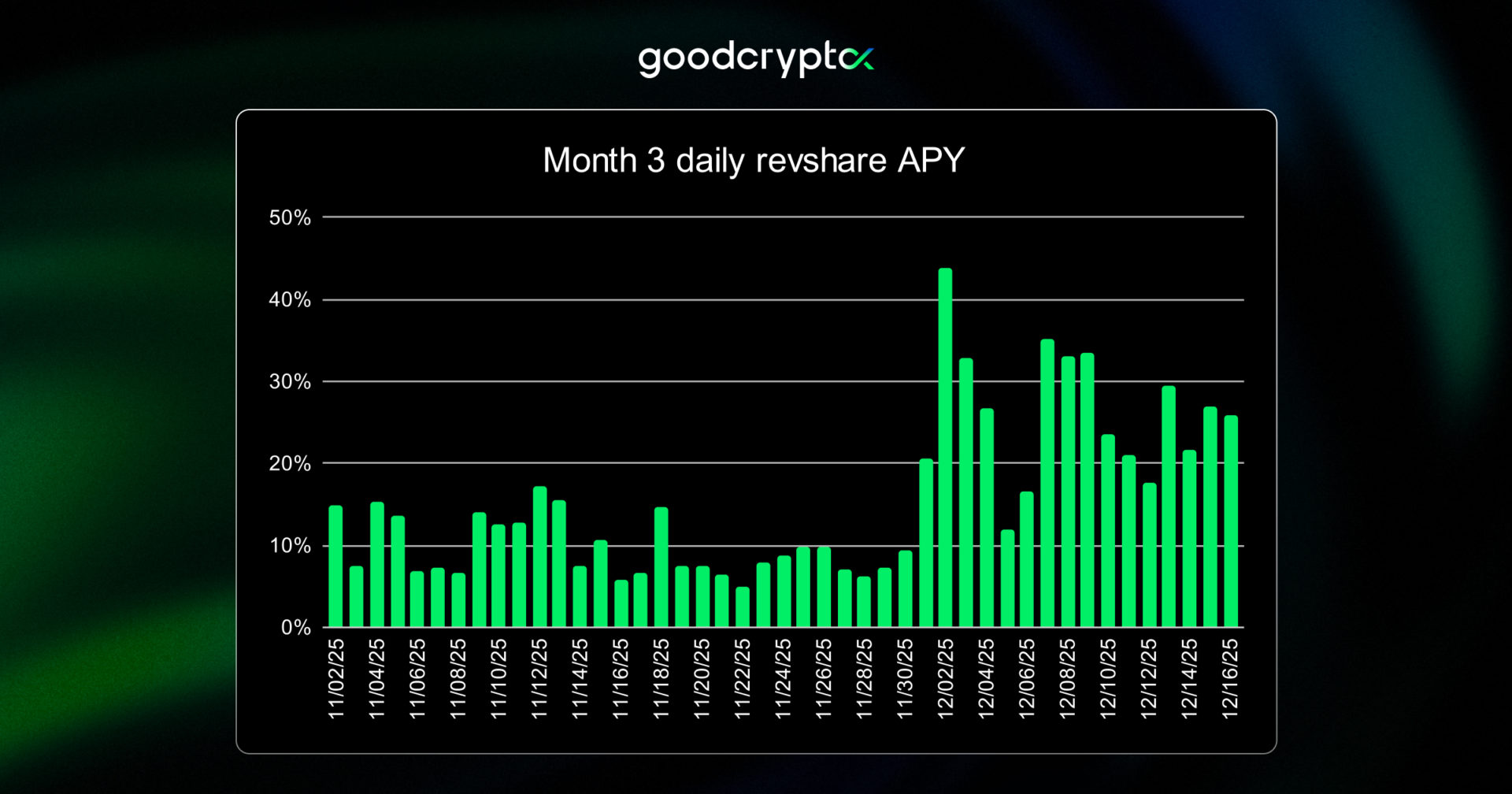

At the same time, revshare APY moved from a low of ~6% to 20–30% – creating an attractive entry point for new holders and an opportunity to add more for existing ones:

Revshare APY increase is driven by both the growing trading volume and decreasing token price. This is exactly how the system is designed to behave.

Over 90% of wallets auto‑compound, and so far, more than 170,000 GOOD have been bought from the market for compounding alone.

ripping the band-aid off

Before this downturn, a single large trader group accounted for ~50% of our DEX spot volume.

During the market collapse, that group stopped trading.

Whether they ran out of dry powder, paused their strategy, or simply found the environment unsuitable – we don’t know.

What matters is this: despite losing that concentrated volume, a large part of it was replaced by new users.

Headline numbers went down, but the breadth of activity improved.

That’s a much healthier foundation long‑term.

And if/when that group resumes trading, we’ll all be better-off.

🔥burns – the long‑term accelerator

If revshare is the anchor, daily and monthly burns are the long‑term accelerator of the $GOOD flywheel.

During the worst part of the downturn, daily burns dropped from ~500 GOOD to ~250–300 GOOD, as volume dried up.

Later in the month, two things happened:

- Volume showed early signs of recovery.

- The token price adjusted to new market conditions.

As a result, daily burns accelerated sharply – now averaging ~900–1,000 GOOD per day, with a clear upward trend:

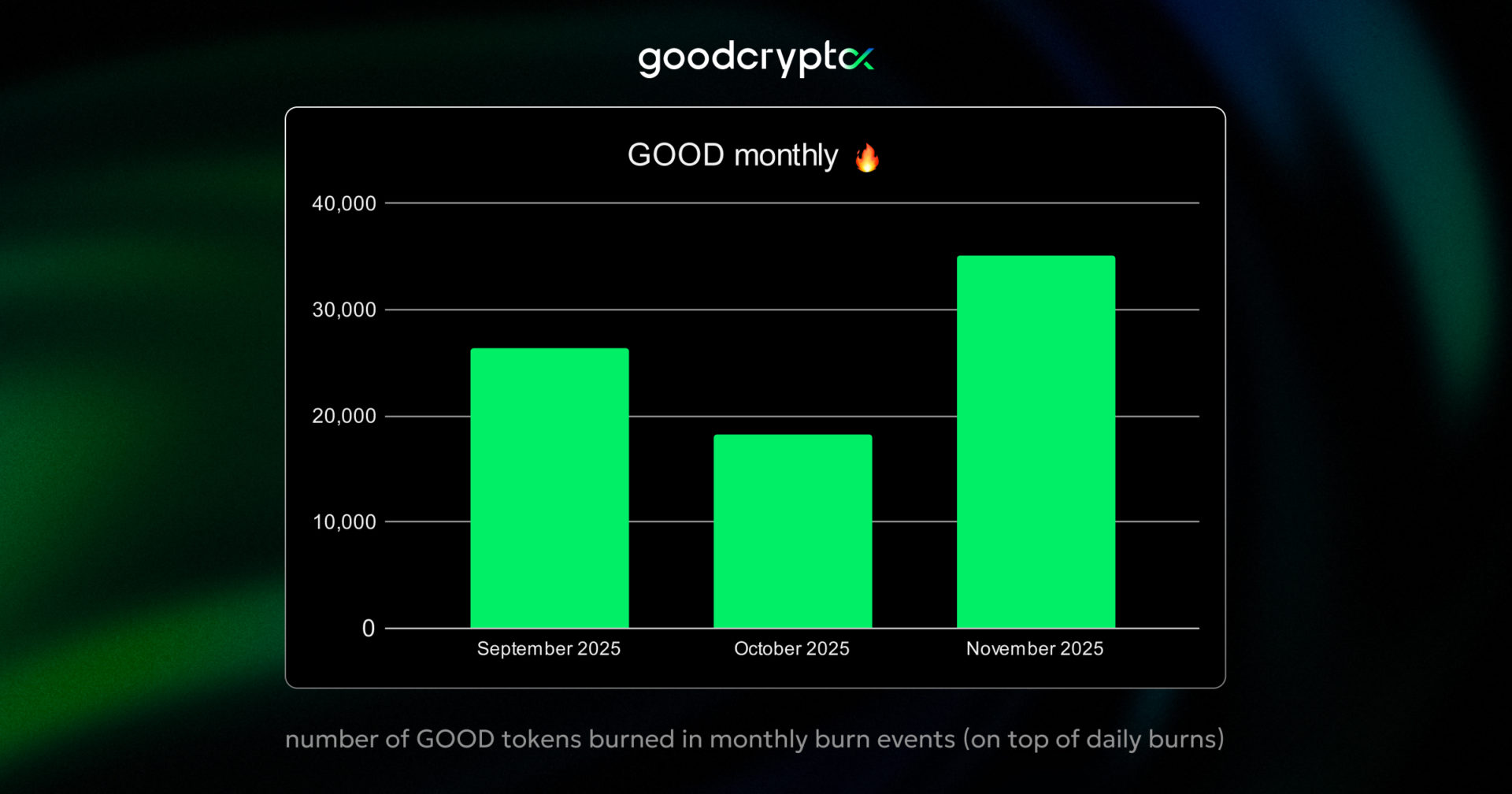

Month three also marked our highest monthly burn ever:

- ~35,000 GOOD burned in a single month

- Total burned supply now at 140,000 GOOD

number of GOOD tokens burned in monthly burn events (on top of daily burns)

All of this happened during our lowest‑revenue month of the year!

That’s not accidental – it’s the system working as intended.

trading rewards

Trading rewards continued uninterrupted.

~100–200 users received rewards weekly.

Quite a few CEX traders finally discovered the rewards mechanism and created wallets to claim them.

Still, at the time of writing, ~50,000 GOOD in trading rewards is reserved for 250+ traders without a built-in wallet.

airdrop 3

What comes after 2?

Introducing Airdrop 3, which marks an important next step for the GOOD ecosystem.

Airdrop 3 is tied to perp DEX trading, starting with Hyperliquid.

- Triggered once we reach 1B in perp DEX trading volume

- Distributed proportionally to Hyperliquid traders based on their contribution

- Requires holding at least 10,000 GOOD throughout the entire period

This airdrop is designed with a very clear goal in mind.

It rewards real trading activity over time, while at the same time encouraging long-term alignment through holding. No snapshots. No short-term farming. No “in and out”.

As we expand perp DEX integrations, this mechanism becomes a powerful flywheel:

more venues → more volume → more rewards → stronger token alignment.

If you trade perps, this is where $GOOD starts to matter in a very tangible way.

Now, wherever you trade – spot or perps – participation is rewarded.

Detailed Airdrop 3 announcement to follow.

zooming out

This report marks not just month three, but the end of 2025.

And if you zoom out, it’s been an extraordinary year for crypto.

Beyond price action, 2025 brought regulatory support, institutional participation, and opportunities that many of us stopped hoping for years ago.

For goodcryptoX, it’s been transformative as well.

A year ago, we had:

- No DEX DCA bot

- No Solana support

- No Hyperliquid integration

- And no $GOOD token.

Today:

- Solana accounts for the vast majority of our DEX volume

- DEX DCA bot is our most used feature

- Hyperliquid is integrated

And the token ecosystem is live and growing!

goodcryptoX has become a fundamentally different product over the last 12 months.

Not incrementally different – structurally different.

A year ago, many of the things that now define the product simply did not exist. Today, they form the core of how the platform works.

And this transformation is not slowing down.

A year from now, goodcryptoX will again be operating at a completely different level!

Thank you for staying with us – especially through the difficult times.

Happy holidays!