Hey fam!

This week, the crypto market faced turbulence, uncertainty, and sharp moves, testing our nerves. Let’s review the biggest events that shook the crypto world this week:

quick weekly news

Trump confirms US is in a trade war with China

The trade war between the U.S. and China is back in full swing, now officially confirmed by President Donald Trump. When asked by reporters whether the U.S. was preparing for a trade war, Trump bluntly replied, “Well, we’re in one now,” signaling a full-scale economic confrontation between the world’s two largest economies.

The conflict stems from Trump’s recent threat to impose a 100% tariff on all Chinese imports, following China’s decision to tighten export controls on rare earth minerals crucial for semiconductor and chip production. According to Trump, tariffs are a key tool of national defense, claiming that without them, “we would have no protection.”

U.S. Treasury Secretary Scott Bessent reinforced the administration’s stance, criticizing China’s “disappointing actions” and warning that Beijing’s aggressive economic policy will eventually hurt its own economy more than the global one. He emphasized that the U.S. and its allies “will neither be commanded nor controlled” by Chinese bureaucrats.

Meanwhile, the impact on crypto markets has already been felt. Trump’s tariff threats last week triggered a sharp Bitcoin correction from $121,000 to below $103,000, wiping out over $20B in from the crypto market.

The tariffs have also strained U.S. Bitcoin miners, who now face import duties of up to 57.6% on Chinese-origin ASICs, making operations significantly more expensive. Still, no major mining firms have moved overseas, suggesting that, for now, American miners are holding their ground despite rising costs.

US Bitcoin and Ether ETFs rebound as Powell signals rate cuts

Now moving to the macroeconomic news in U.S. Markets flipped bullish after Federal Reserve Chair Jerome Powell signaled that interest rate cuts could come before the end of the year. Powell hinted that the Fed is nearing the end of its balance sheet reduction program and preparing to ease policy as the labor market shows signs of weakness. This shift marks a potential turning point for risk assets, reigniting investor appetite across both traditional and digital markets.

Following Powell’s comments, U.S. spot Bitcoin and Ether ETFs saw strong inflows after a week of heavy outflows tied to the recent market crash. Bitcoin ETFs recorded over $102M in net inflows, led by Fidelity’s Wise Origin Bitcoin Fund, while Ether ETFs brought in $236M, with Fidelity’s Ethereum Fund topping the list. The renewed demand helped push total spot Bitcoin ETF assets to $153.5B, or nearly 7% of Bitcoin’s market cap, meaning that institutional interest remains resilient even amid volatility.

Easier monetary conditions and cooling U.S.-China tariff tensions are setting the stage for a broader recovery in crypto markets. As liquidity returns and capital seeks efficiency in a softer rate environment, digital assets could experience a renewed wave of inflows. Combined with the Fed’s dovish pivot and lingering inflation concerns, the environment may once again favor Bitcoin and Ethereum as macro hedges and high-beta plays on global liquidity expansion.

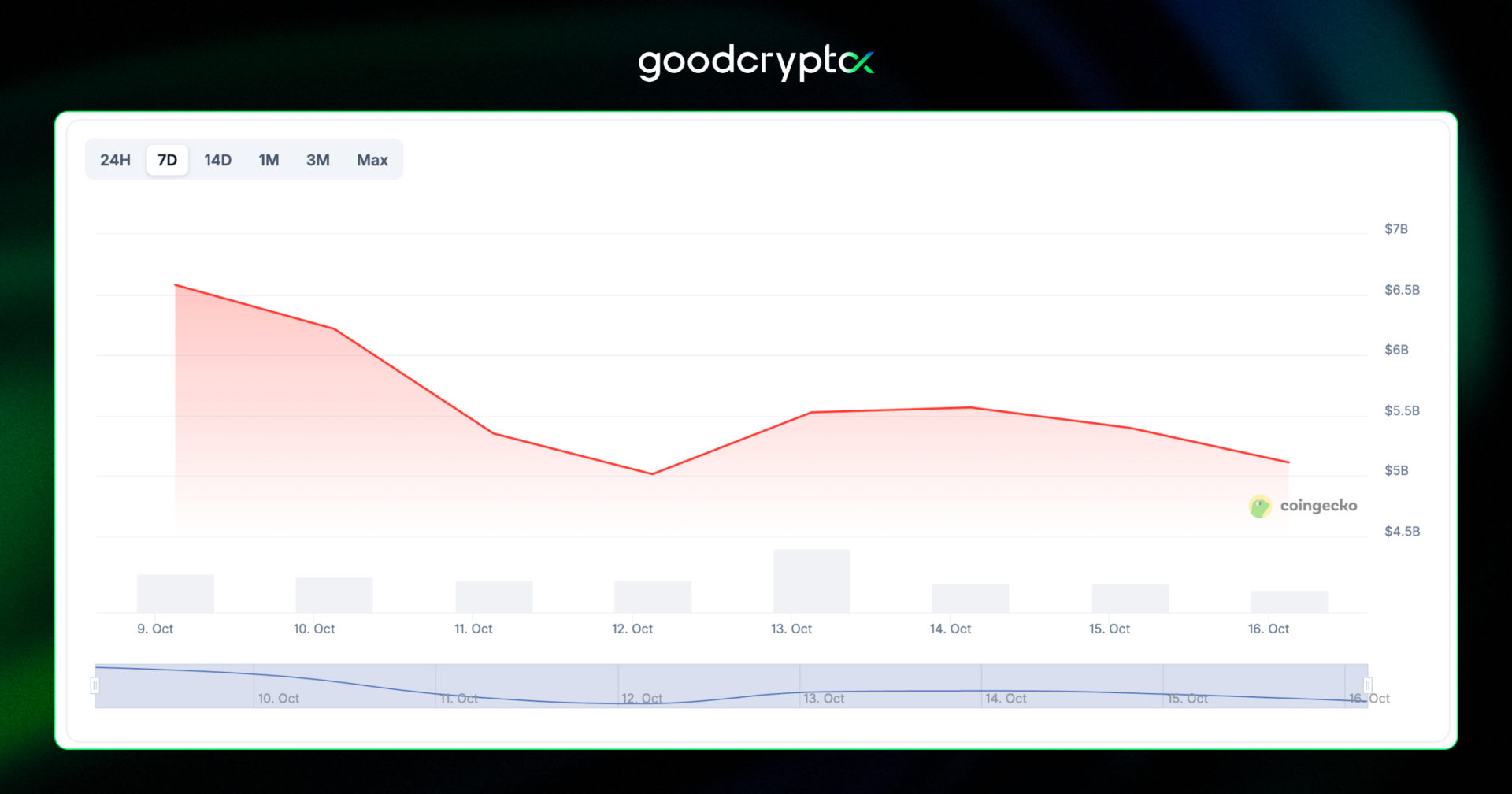

NFT markets rebound after $1.2B wipeout in Friday’s crypto crash

The NFT market is showing early signs of recovery after Friday’s massive sell-off wiped out around $1.2B in market capitalization. According to CoinGecko, total NFT valuation plunged from $6.2B to $5B but later rebounded by 10%, reaching about $5.4B as crypto markets stabilized.

Despite the partial recovery, major Ethereum collections like Bored Ape Yacht Club (BAYC), Pudgy Penguins, and CryptoPunks remain in the red, posting weekly losses between 8% and 21%. A few projects, including Hyperliquid’s Hypurr and Mutant Ape Yacht Club (MAYC), saw small daily gains, suggesting early signs of renewed buyer activity.

The market-wide crash came as Bitcoin dropped sharply following Trump’s 100% tariff threat on China, which triggered over $20B in liquidations. While the NFT sector has started to rebound, most top collections are still struggling to regain their pre-crash valuations.

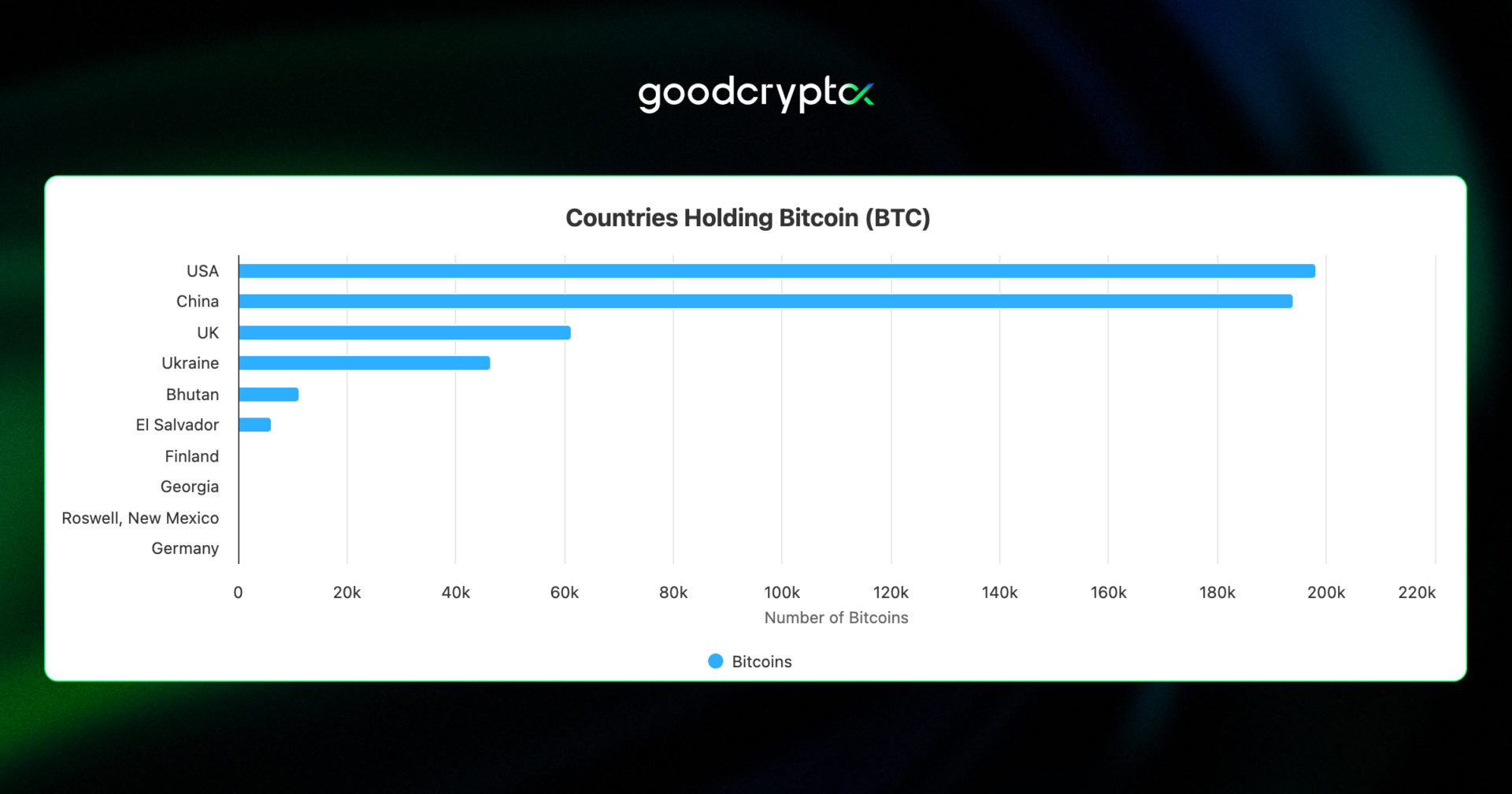

Bhutan migrates its national ID system to Ethereum

Bhutan has officially migrated its national digital ID system from Polygon to Ethereum, enabling nearly 800,000 citizens to verify their identities and access government services through the blockchain. The transition marks the world’s first national identity system built fully on Ethereum, with the migration expected to be completed by Q1 2026, according to the Ethereum Foundation.

Ethereum Foundation President Aya Miyaguchi and co-founder Vitalik Buterin attended the launch ceremony alongside Bhutan’s prime minister and crown prince, calling the integration a major milestone for open and secure digital governance. Bhutan’s ID project had previously operated on Polygon since 2024 and Hyperledger Indy before that.

Beyond its digital identity initiative, Bhutan has quietly become a significant player in crypto adoption, ranking as the world’s fifth-largest Bitcoin-holding nation-state with 11,286 $BTC mined using renewable hydropower energy.

The country has also been in talks with former Binance CEO Changpeng Zhao, hinting at further blockchain collaborations ahead.

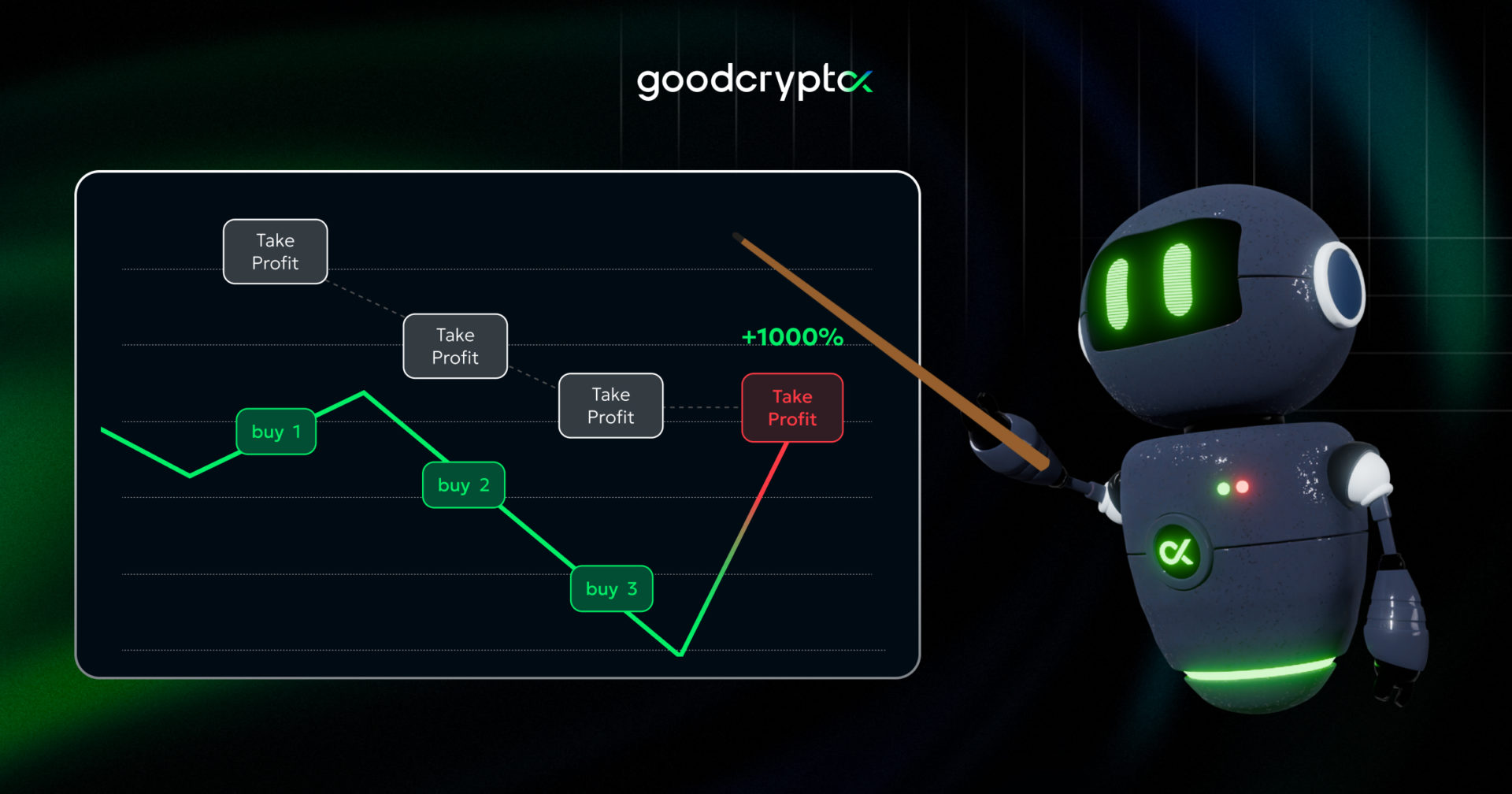

DCA bot guide

📚 DCA trading bot is a pioneering trading tool designed to help you get in the trades at the best price possible by averaging down your position if the market moves against you and adjusting TP at the level accordingly.

With the right setup, a DCA bot lets you capitalize on market volatility without guessing the direction of the trend. To help you master DCA bots, we’ve prepared the ultimate guide that covers:

🔸 Real examples of DCA bot use cases

🔸 Step-by-step DCA bot setup

🔸 Pro tips for managing your DCA bots

🔸 “The Weird Magic of DCA Take Profit”

🚀 Learn how to fully leverage volatility with the complete DCA bot guide by goodcryptoX!

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!