Hi there! 👋

This week has brought several notable developments in the crypto space, shaping the future of the web3 industry. Let’s take a look at some of the most important news stories to help you stay up to date in the ever-evolving crypto market.

quick weekly news

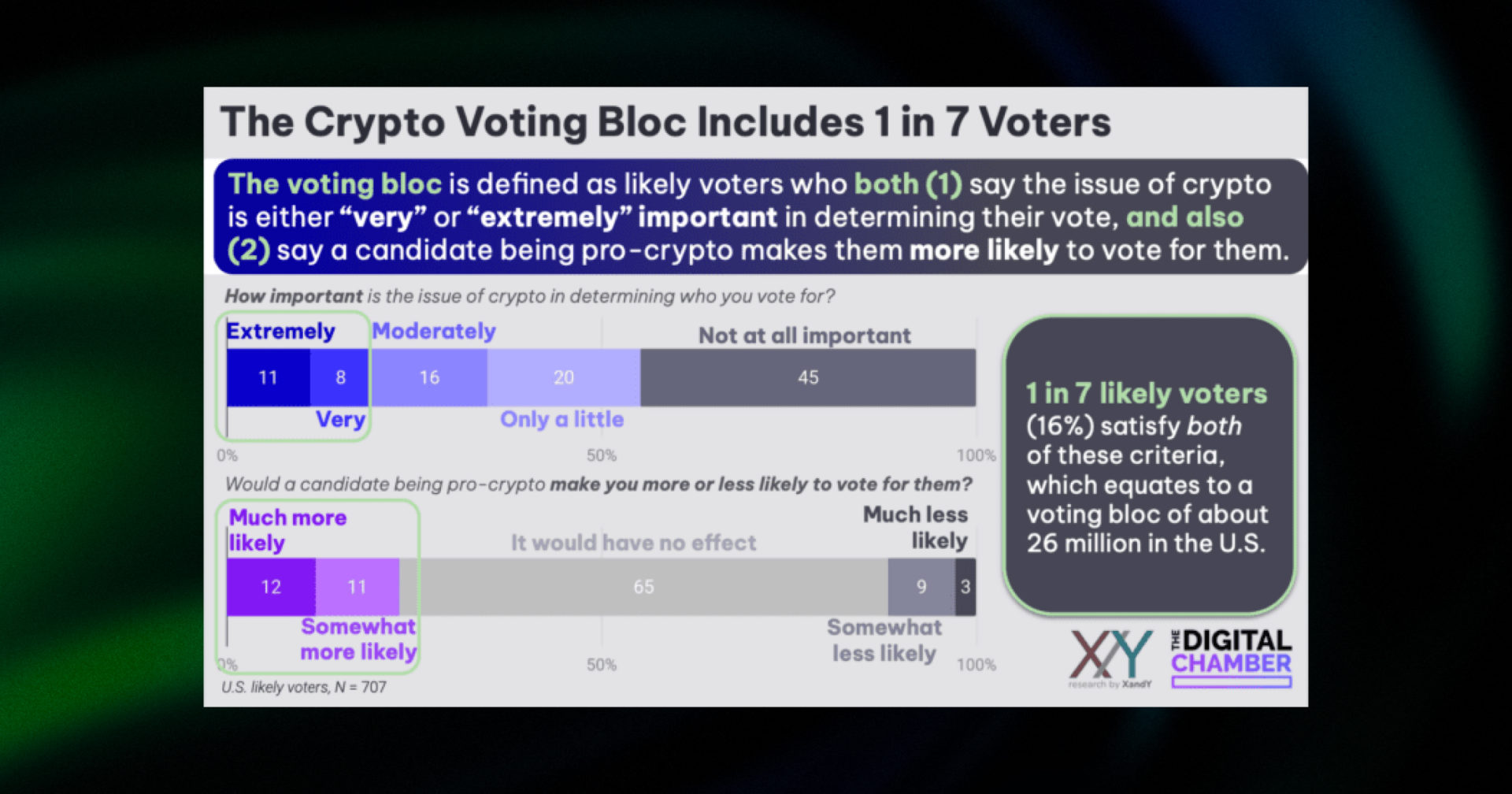

US has 26M strong ‘crypto voting bloc’ ahead of elections

On Oct. 17, The Digital Chamber, a crypto advocating company, released a US national poll report stating that around 16% of US citizens think that the future president’s policy on crypto is “extremely” or “very” important in deciding who to vote for. The poll included 1,004 respondents where The Digital Chamber has been asking two primary questions: “How important is the issue of crypto in determining who you vote for?” and “Would a candidate being pro-crypto make you more or less likely to vote for them?”

Source: The Digital Chamber

The respondents were included in those “16%” only in cases when they said the crypto issue is either “very” or “extremely” important and they would be “much more” or “somewhat more” likely to vote for the pro-crypto candidate at the same time. The crypto advocacy platform also added that at least 25% of Democrats and 21% of Republicans said a candidate’s stance on crypto would positively impact their likelihood of voting for them.

But even if considering the conservative 16% of the total US population, it would be equal to around 26M people. This is a significant amount of potential voters, especially for the current US presidential election, where the gap between both candidates in the swing states in the US is usually within the range of statistical error.

Shortly after the report, The Digital Chamber CEO said that those data should be “a wake-up call for policymakers” also mentioning a tight race between two US presidential candidates. “Voters are sending a clear message — they want smart, balanced regulation that protects consumers without stifling innovation,” she added.

Bitcoin to pump if oil and energy prices surge amid Middle East tension: Hayes

On Oct. 16, the co-founder of BitMEX wrote on his Twitter that in the case of an “oil prices spike scenario” Bitcoin is more likely to surge with it. He said that if Israel attacked the oil infrastructure of Iran and we would see oil price spikes, it would increase the energy prices in the world, and subsequently will increase the fiat cost of Bitcoin.

“Bitcoin is stored energy in digital form. Therefore, if energy prices rise, Bitcoin will be worth more in terms of fiat currency.”

He added that mining profitability might become an issue for the potential Bitcoin surge, but if the hashrate would drop along with the energy prices surge, the mining difficulty would become lower as well, making it “easier for new entrants to mine Bitcoin at higher energy prices profitably.”

Hayes also provided historical data on the significant surge of commodities during the 1973-1982 oil crises caused by the Arab oil embargo and the Iranian revolution. In those years, oil grew by over 412% and gold rose by 380%, almost matching oil’s increase. While cryptocurrency didn’t exist at this time, Bitcoin has shown some correlation with commodities during inflationary periods.

However, it is also important to note that usually, investors consider gold as a more “secure” asset compared to others. Meanwhile, Bitcoin with its big volatility is more likely to be considered as a “high-risk” investment.

Why Trump’s World Liberty Financial token crashed and burned?

Three days have passed since Trump’s World Liberty Financial launched its token presale, aiming to raise over $300M for the public. It started pretty cheerfully as even the website began to give an error due to the load capacity troubles. However, already on the third day of the sale, the progress in the collective funds hadn’t moved much, stopping around the mark of 4.24% of the raise target.

According to the CoinTelegraph, such a crash in sales a few days after the launch has a few reasons, each playing a significant impact on World Liberty Financial’s token performance,

The first reason behind the failure of the $WLFI token launch was the purchase limitations and KYC requirements for all users. They have definitely scared off some percentage of non-US citizens and didn’t allow some US citizens to purchase the tokens as not every one of them had “met the requirements to be deemed an ‘accredited investor’ as defined under Regulation D under the U.S. Securities Act of 1933”

The second reason is the token’s non-transferability meaning that accredited investors won’t be able to sell the coins to non-accredited ones. Such a move is very unpopular among the other ICO tokens as it limits the retail investors’ opportunities to sell or trade the tokens before World Liberty Financial goes live. It is also worth noting that the website’s crush in the first few hours after the launch of the sale has also impacted significantly the amount of users willing to jump in the ICO.

Finally, because of the same lack of transferability and 12 months vesting, along with no public support from top tier backers and the absence of the product released before the sale started some crypto analysts think that World Liberty Financial is a scam, as there are really a lot of projects with same characteristics which became a rug pool or scam even before the pre-sale ended. Eventually, those analysts began to warn their audiences which surely had a negative influence on the sale’s performance.

Ethereum’s Pectra fork adds dynamic blob fees to improve L2 scaling

Christine Kim, Galaxy Digital’s vice president of research, has shared some details of the upcoming Ethereum’s EIP-7742 upgrade in her post on X after attending Ethereum’s “All Core Devs” meeting. There, EIP-7742 proposed a mechanism for the Ethereum consensus layer to “dynamically” set the blob gas target and max values.

Blobs are large, but temporary, chunks of data embedded in Ethereum transactions that aim to make Ethereum layer 2 transactions cheaper. They were implemented via EIP-4844 on March 13 through the Dencun upgrade.

According to Kim’s claims, the new EIP-7742 proposal will increase the currently fixed blob count, which Ethereum co-founder stressed late last month was nearing full capacity and could soon stall scalability. The EIP’s inclusion in the upcoming fork also aligns with Buterin’s vision towards Ethereum mainnet and layer 2 blockchains achieving a combined 100,000 transactions per second through a component of Ethereum’s technical roadmap dubbed “The Surge.”

Notably, the recent Ethereum’s Dencun upgrade while being useful for further facilitating usage of Ethereum’s L2s has been hurting the blockchain’s TVL and token’s price over the past four months, forcing the crypto analyst Sigel to revise VanEck’s bullish prediction that Ether would surpass $22,000 by 2030, as he was expecting that revenue split on Ethereum would be around 90:10 in Ether’s favor, but now he notes exact the opposite situation. If that split were to remain the same, Sigel said VanEck’s Ether price target would fall 67% to $7,330

crypto chart patterns basics explained

Chart patterns are distinctive formations created by the price movements of specific assets on a chart, forming the foundation of technical market analysis. They help you identify potential market reversals or continuation moves, enabling more informed trading decisions.

🔍 Broadly, chart patterns are classified as either reversal or continuation patterns, with each type divided into bullish or bearish categories:

🔸 Bearish reversal patterns signal a shift from an upward trend to a downward one, offering potential sell signals.

🔸 Bullish reversal patterns indicate the opposite, forecasting a trend shift from bearish to bullish.

A similar principle applies to continuation patterns:

🔸 Bullish continuation patterns suggest the continuation of a price increase, providing buy signals.

🔸 Bearish continuation patterns indicate the continuation of a price decline, offering sell signals.

With the rise of crypto trading, many patterns have been borrowed from the stock market and adapted for digital assets.

Want to explore the full details of the most common crypto chart patterns? Read our in-depth chart patterns review! 📈

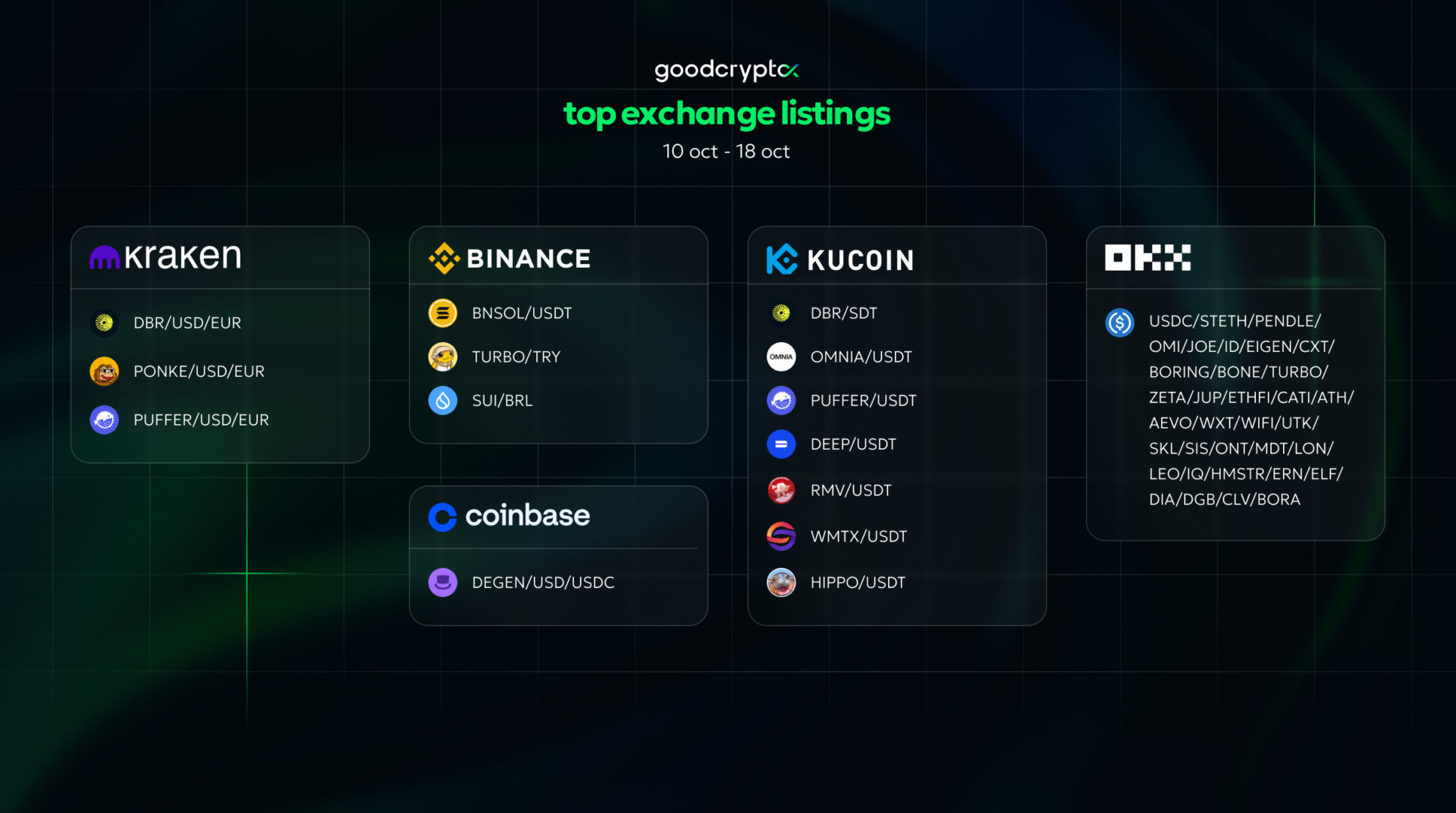

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!