Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

Underwhelming Start for Ethereum Futures ETFs

Despite much anticipation, the launch of nine new Ethereum futures exchange-traded funds (ETFs) didn’t attract significant investment.

These ETFs, which track Ethereum’s native token Ether, arrived on the market on Oct. 2. However, only five exclusively follow Ether futures, while the rest include a mix of Bitcoin and ETH futures.

Eric Balchunas, senior Bloomberg ETF analyst, described it as a “meh” day for volume. All nine ETFs recorded less than $2 million in trading volume on their first day.

Valkyrie’s Bitcoin Strategy ETF, which transitioned to include ETH, was the most traded, with $882,000 in volume. In comparison, ProShares Bitcoin Strategy ETF, launched in 2021, generated over $1 billion in trading volume on its debut.

District Court Judge Rejects SEC’s Ripple Appeal Motion

In a recent ruling, District Court Judge Analisa Torres dismissed the SEC’s motion to appeal its case against Ripple Labs, the company behind XRP. The judge stated that the SEC failed to demonstrate significant legal questions or substantial differences of opinion.

“The SEC’s motion for certification of interlocutory appeal is denied, and the SEC’s request for a stay is denied as moot“, Judge Torres ruled.

However, this decision isn’t a complete loss for the SEC. A trial is scheduled for April 23, 2024, to address outstanding issues. Following this news, XRP’s price saw a nearly 6% surge.

Previously, Judge Torres ruled that XRP’s retail sales didn’t qualify as securities but found Ripple in violation for selling XRP to institutional investors. In response, the SEC sought to appeal, citing substantial legal disagreements.

Yield Protocol Announces Shutdown Amid Regulatory Challenges

DeFi lending protocol Yield Protocol is closing its operations by the end of the year due to limited business demand and global regulatory pressures.

Yield Protocol will terminate after its December 2023 series, set to mature on December 29, 2023. The protocol canceled its March 2024 fixed rate series launch, citing unsustainable demand for fixed-rate borrowing.

Stringent crypto regulations in the U.S., Europe, and the U.K. contributed to the decision. Liquidity providers for the March-September strategies will stop accruing fees, and all borrowing and lending will cease by December 31st, following the existing series’ maturity.

Co-Founder of Polygon Steps Back After Six Years

Jaynti Kanani, the co-founder of Polygon, has announced his step back from the project’s day-to-day operations for the first time in six years.

In a Twitter thread on Oct. 4, Kanani expressed his intention to explore new opportunities while contributing to Polygon in a less active role. Polygon, formerly known as the Matic network, was founded in 2017 by Kanani and software engineers Sandeep Nailwal, Anurag Arjun, and Mihailo Bjelic.

Nailwal responded emotionally to the announcement, acknowledging their shared journey and wishing for more time together in Polygon’s ongoing journey.

SMMA vs. EMA: Unraveling Moving Averages

SMMA (Smoothed Moving Average) is a hybrid of both SMA (Simple Moving Average) and EMA (Exponential Moving Average), positioned between these two in terms of responsiveness. Unlike SMA, EMA adapts more swiftly to price changes. When SMMA and EMA are used in tandem, they can generate intriguing signals during crossovers.

Here’s how it works: SMMA moves even closer to the price than EMA, making it more sensitive. When SMMA crosses below EMA, it hints at a potential bearish reversal. Conversely, if SMMA crosses above EMA, it signals a potential bullish reversal.

Visualized, the SMMA (in orange) and EMA (in blue) merge to create a comprehensive analysis tool.

Unlock the full potential of SMMA and EMA crossovers in your trading arsenal. Dive deeper into our comprehensive article to master these moving averages and enhance your trading strategies!

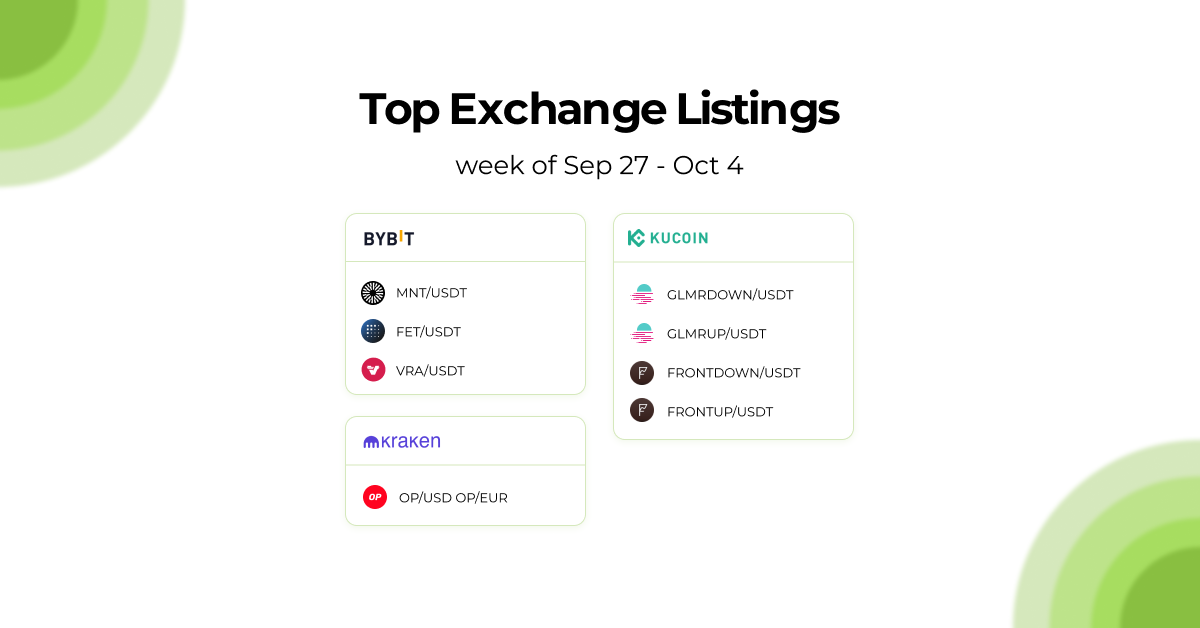

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!