Hey traders!

The market this week was far from ideal, but a few encouraging headlines still stood out. Let’s take a look at them:

quick weekly news

BlackRock pins Bitcoin ETF as a major theme alongside T-bills and tech stocks

Let’s start with a strong institutional signal, as BlackRock officially positioned its spot Bitcoin ETF among its top three investment themes heading into 2026. The asset manager highlighted IBIT alongside US Treasury bill exposure and the “Magnificent 7” tech stocks, placing Bitcoin in the same strategic league as two of the most dominant macro investment narratives of the cycle.

Despite Bitcoin’s ~30% drawdown from October highs, IBIT has already attracted over $25B in inflows in 2025, bringing total lifetime inflows to more than $62.5B. Nate Geraci, president of NovaDius Wealth Management, noted that this demonstrates deep conviction rather than speculative enthusiasm, with Bloomberg’s Eric Balchunas remarking that if IBIT can bring in this much capital in a “bad year,” its inflow potential in a stronger environment could be far greater.

Meanwhile, Ethereum exposure is also gaining traction through BlackRock. Its iShares ETH Trust ETF (ETHA) has seen $9B+ inflows in 2025. The firm also filed for a staked ETH ETF, signaling growing institutional appetite for yield-bearing crypto products as regulatory conditions become more favorable.

Interestingly, BlackRock has avoided the broader altcoin ETF race, reinforcing its focus on Bitcoin, Ethereum, and institutional-grade infrastructure rather than chasing hype. Overall, BlackRock’s positioning underscores that, even through market turbulence, crypto remains firmly embedded in long-term institutional strategy, rather than treated as a passing speculative trend.

Amplify launches ETFs for stablecoins, and tokenization goes live for trading

Adding more institutional adoption news, traditional finance keeps deepening its integration with crypto infrastructure. Digital asset manager Amplify has launched two new exchange-traded funds on NYSE Arca, designed to give investors exposure to companies building the backbone of stablecoins and tokenization. The Amplify Stablecoin Technology ETF (STBQ) and Amplify Tokenization Technology ETF (TKNQ) track diversified baskets of firms powering payments, blockchain infrastructure, tokenized assets, and digital financial rails.

The stablecoin-focused fund includes exposure to major players such as Visa, Mastercard, PayPal, Circle, and leading crypto ETF issuers like Grayscale, iShares, and Bitwise, reflecting how deeply stablecoin innovation has merged with mainstream finance. Amplify highlighted that supportive regulations like the GENIUS Act in the US and MiCA in Europe are helping position stablecoins as a compliant and scalable backbone for global digital finance.

Meanwhile, the tokenization ETF offers exposure to institutions leading the real-world asset tokenization push, including BlackRock, JPMorgan, Citi, Nasdaq, and Figure. As tokenization becomes one of the strongest investment narratives, these firms are building systems that bring traditional financial assets fully onchain.

IMF says El Salvador is in talks to sell state-run Chivo Bitcoin wallet

Some important international policy news also took place this week, as the IMF confirmed that El Salvador is in advanced negotiations to sell its state-run Chivo Bitcoin wallet, marking a major shift in the country’s $BTC infrastructure strategy. According to an IMF statement, the discussions are part of a broader $1.4B loan framework agreed earlier, which also included commitments to limit direct government involvement in Bitcoin-related activities and confine public-sector engagement with $BTC.

Under the agreement, El Salvador was expected to stop purchasing Bitcoin and scale back state participation in the Bitcoin ecosystem. However, the situation remains unclear. While the IMF reported earlier this year that no $BTC had been purchased since December 2024, El Salvador’s Bitcoin Office has continued to announce sizable acquisitions, including the purchase of roughly 1,090 $BTC in November, worth around $100M at the time.

Despite the IMF’s conditions, President Nayib Bukele has doubled down on his pro-Bitcoin stance, reiterating that the country’s strategy is “not stopping” and maintaining his pledge to continue daily $BTC purchases. As of now, government holdings reportedly stand at around 7,500 $BTC, worth over $650M.

The sale of Chivo would mark a symbolic step away from direct state management of Bitcoin infrastructure, but Bukele’s continued accumulation signals that El Salvador has no intention of backing away from its crypto strategy anytime soon.

Crypto hack counts fall, but supply chain attacks reshape threat landscape

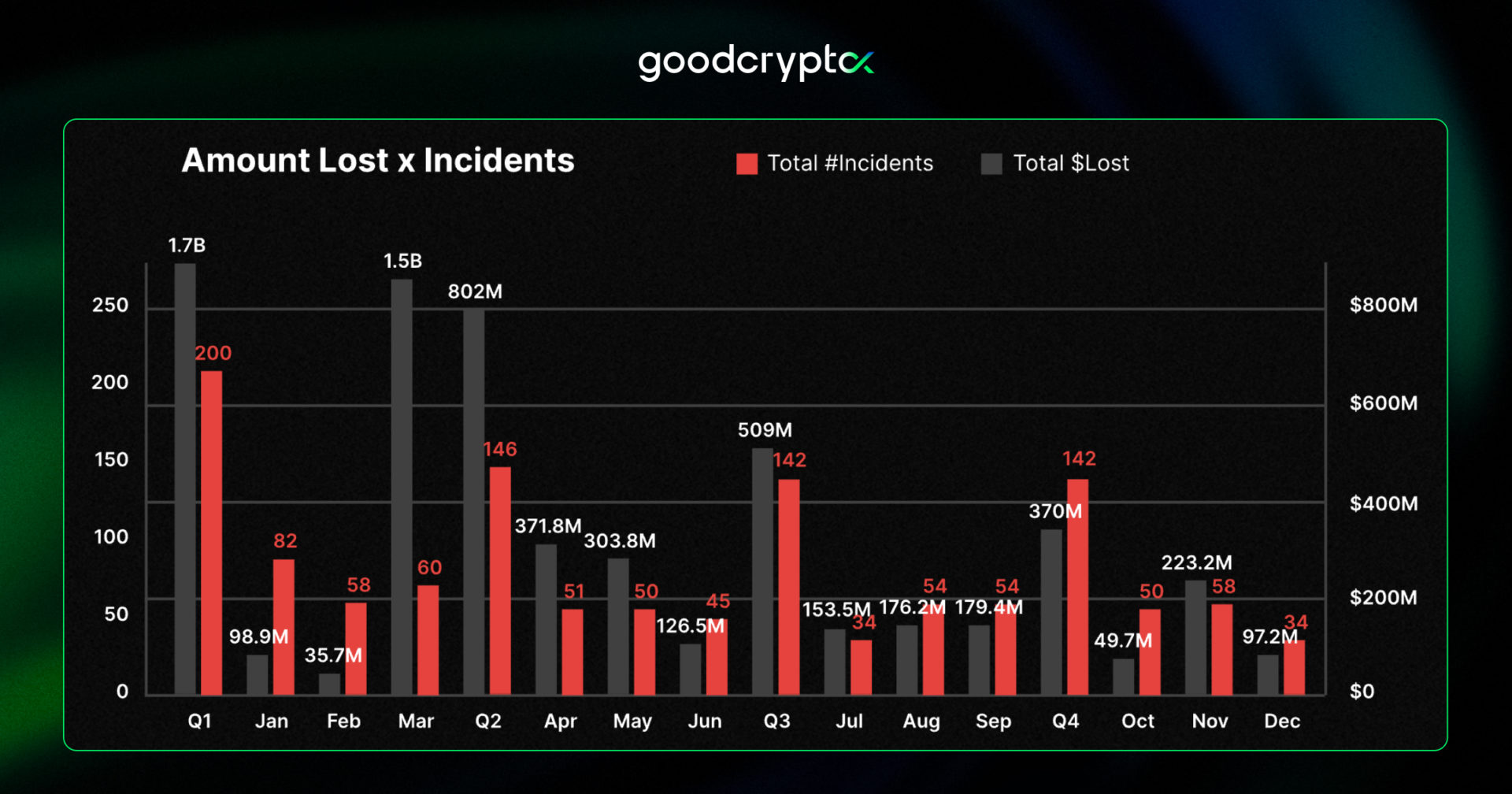

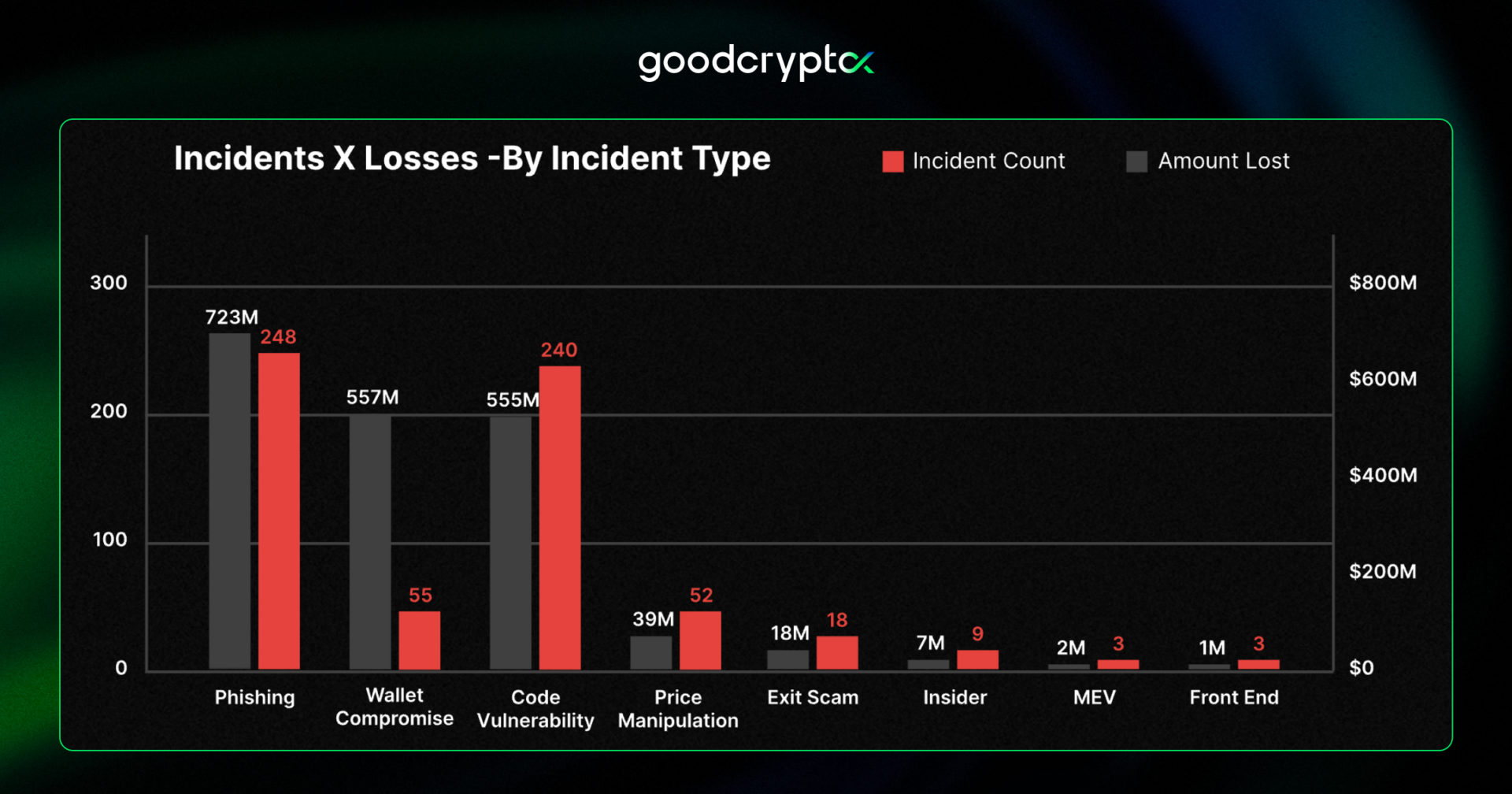

Let’s wrap up our digest with cybersecurity, where 2025 delivered a mixed but revealing picture for crypto security. According to fresh CertiK data, hackers stole roughly $3.3B this year, but the number of individual incidents actually fell sharply. This suggests that protocol-level defenses and code security are improving, forcing attackers to pivot away from simple smart contract exploits toward more advanced strategies.

Source: CertiK Skynet Hack3d Report

The biggest emerging threat is supply-chain attacks, which caused $1.45B in losses across just two incidents, including the massive $1.4B Bybit hack. CertiK warns that well-funded, highly coordinated threat groups are becoming more active, and future attacks are likely to increasingly target wallets, infrastructure providers, and backend systems rather than direct protocol flaws. While average losses per hack rose to $5.3M, the median loss actually fell by more than 35%, reinforcing the trend toward fewer but dramatically larger exploits.

At the same time, phishing and social engineering remain a major danger, costing users $722M across 248 incidents, with “pig butchering” romance scams continuing to devastate retail investors. Many of these scams involve weeks or months of psychological manipulation before funds are drained, making them difficult to detect and prevent through technical defenses alone.

Source: CertiK Skynet Hack3d Report

volume profile indicator explained

Volume Profile is a set of volume-based indicators that map out where the most trading activity happened at each price level. It helps you find strong support/resistance zones, identify value areas, and time entries based on real volume, not just price action.

Volume Profile indicators:

- VPVR (Visible Range Volume Profile): Automatically displays volume distribution across the visible chart, uncovering strong support and resistance based on actual market activity;

- VPSV (Session Volume Profile): Breaks down volume by session (daily, weekly, etc.), making it easier to spot value areas, POCs (Point of Control), and session imbalances;

- VPFR (Fixed Range Volume Profile): Lets you manually select a custom range to analyze how volume behaved across specific trends, pumps, or consolidations.

Want to better understand market structure? Check out our comprehensive Volume Profile guide.

Receive an instant notification when a new coin is listed with goodcryptoX PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the goodcryptoX app!