Hey fam!

The crypto market saw a mix of contentious headlines and resilient optimism this week. Let’s take a look at what happened in the crypto space over the past seven days:

quick weekly news

Spot Bitcoin ETFs record $450M inflows in ‘early positioning’ push

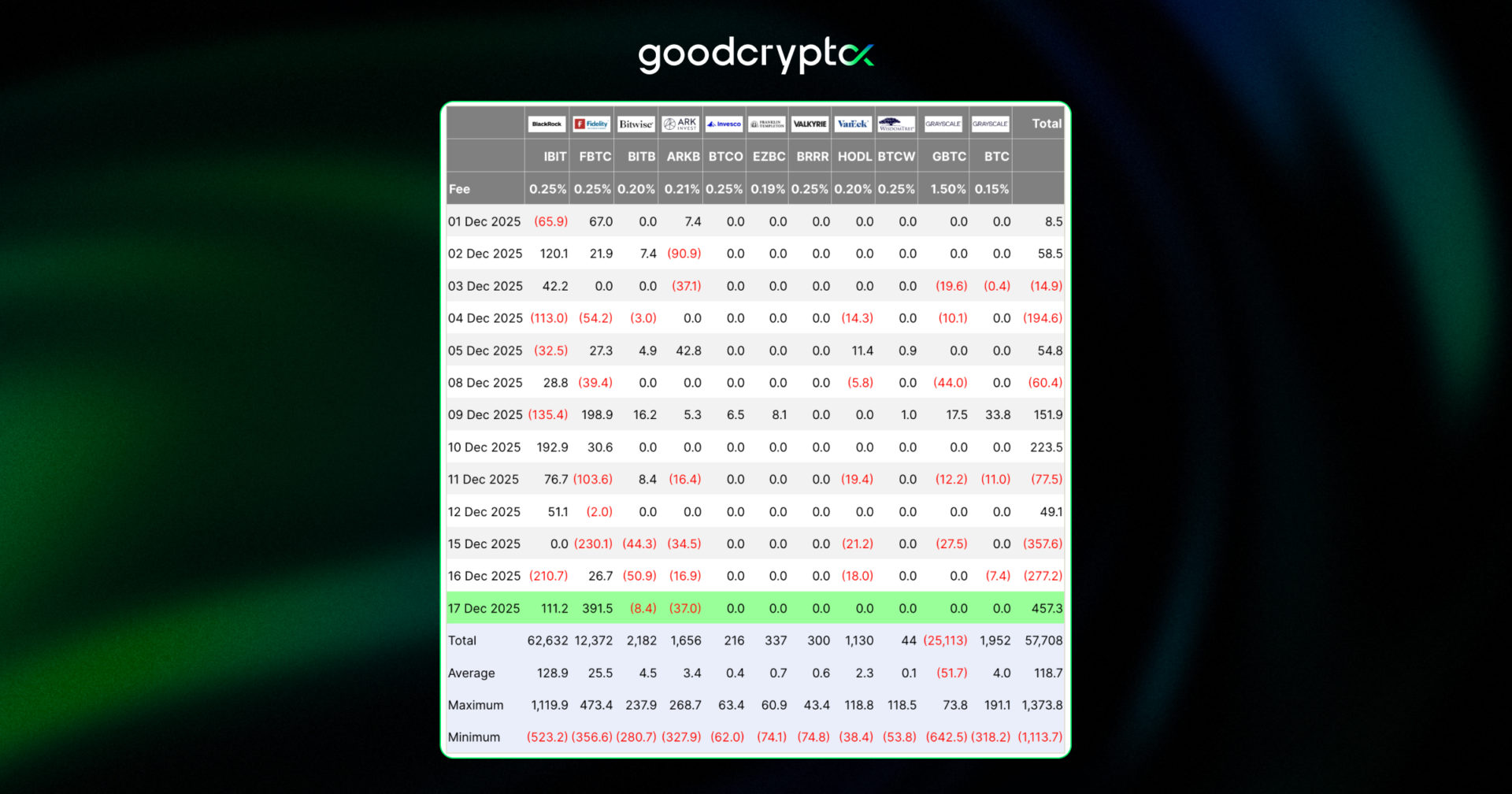

Let’s kick off our digest with some bullish news, as the crypto market received a boost from renewed institutional demand, and spot Bitcoin ETFs recorded their strongest inflows in over a month. On Wednesday, US-listed spot BTC ETFs attracted roughly $457M in net inflows, led by Fidelity’s FBTC and followed by BlackRock’s IBIT, signaling a clear pickup in capital allocation toward Bitcoin exposure.

Source: Farside Investors

In addition to that, expectations around interest rates are beginning to soften, as Trump plans to appoint a new Federal Reserve chair who strongly supports cutting interest rates, thus favouring the crypto market and potentially bringing bullish momentum back.

The inflows pushed cumulative net ETF inflows past $57B, with total assets under management exceeding $112B, around 6.5% of Bitcoin’s total market capitalization. This rebound comes after a volatile period in November and early December, when ETF flows swung between modest inflows and sharp outflows, highlighting how sensitive institutional activity remains to macro signals.

Despite the positive ETF data, underlying market conditions remain fragile. Bitcoin is still trading below heavy overhead supply, leaving about 6.7M $BTC held at a loss, the highest level of the current cycle.

Binance mulls new US strategy, CZ potentially reducing stake

Another notable piece of news this week centers on Binance, which is reportedly reassessing its long-term strategy for the US market. According to Bloomberg, the exchange is exploring structural changes that could make a US return more viable, including the possibility of Changpeng Zhao reducing his controlling stake, which has been viewed as a key regulatory obstacle.

The discussions are still at an early and fluid stage, but Binance is also considering partnerships with US-based entities such as BlackRock and World Liberty Financial, as it was the first CEX to list its native token $WLFI. Speculation around Binance’s US ambitions intensified after Trump pardoned Zhao in October, with CZ publicly stating his intention to support making the US a global hub for crypto and Web3.

Binance officially exited the US in 2019, after which Binance.US was launched as a separate, regulated entity serving American users without access to derivatives or global Binance liquidity. However, US regulators have previously challenged the separation between the two entities, keeping Binance’s regulatory status in the country under close scrutiny.

The potential return of Binance comes as the US remains one of the most important crypto markets globally, ranking second in adoption worldwide. At the same time, Zhao’s pardon has sparked political backlash from some Democratic lawmakers, signaling that while regulatory conditions may be improving, Binance’s path back into the US is likely to remain politically and legally complex.

Acting CFTC chair to join MoonPay after leaving agency

Meanwhile, there is a regulatory shift involving the US Commodity Futures Trading Commission. Acting CFTC chair Caroline Pham confirmed she will leave the agency to join MoonPay once the Senate approves her successor, marking another high-profile move from a regulator into the crypto industry.

MoonPay announced that Pham will take on the role of chief legal and administrative officer. She has served as acting chair since January and has effectively been the lone Republican commissioner at the CFTC for months, following a wave of departures. Earlier this year, Pham said she planned to step down after a new chair was confirmed, a process that has already seen some turbulence after the withdrawal of an initial nominee.

During her tenure, Pham took a notably restrained enforcement approach, reporting just 18 CFTC actions and no new enforcement cases. She also launched initiatives such as the Crypto CEO Forum and the CEO Innovation Council, signaling a more collaborative stance toward the digital asset industry aligned with White House priorities.

Securitize announces ‘real’ tokenized stocks, touts DeFi integration

Let’s finish with some infrastructure-focused news, as Securitize announced plans to launch what it calls the first fully compliant, natively tokenized public stocks in early 2026. Unlike synthetic or price-tracking products, these tokens will represent real share ownership, issued directly on-chain and recorded on the issuer’s official cap table.

The company emphasized that its approach is designed to fix long-standing issues in both traditional markets and current tokenized stock offerings. Many existing products offer only exposure rather than ownership, often relying on offshore structures or intermediaries that introduce counterparty risk and settlement delays. Securitize says its model ensures regulated shares, proper KYC and AML controls, and legally recognized ownership.

Trading will take place through a DeFi-style swap interface, allowing users to trade tokenized stocks fully onchain and potentially outside traditional market hours. Securitize will also act as the registered transfer agent, bridging regulatory requirements with blockchain-native issuance.

Beyond faster settlement, the company highlighted programmability as the real breakthrough. By making real equities compatible with smart contracts, Securitize aims to bring compliant stocks into DeFi ecosystems without sacrificing investor protections, positioning tokenization as an upgrade to traditional finance rather than a replacement: “This is not about replacing traditional finance. It’s about upgrading it.“

average true range (ATR) indicator guide

The Average True Range (ATR) is a volatility indicator that measures the average range of price movement over a set period. It helps traders understand market fluctuations and effectively set stop loss and take profit levels to reduce risks and maximize profits.

Why ATR matters:

- Avoid false stops: Set stop loss levels that reflect actual market movement, not random noise;

- Catch volatility shifts: React to changing market conditions before they impact your trades;

- Improve trade precision: Place trades more accurately, reducing the risk of premature stop-outs.

Want to navigate volatility like a seasoned pro? Check out our comprehensive ATR indicator review.

Receive an instant notification when a new coin is listed with goodcryptoX PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the goodcryptoX app!