Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want these updates as soon as we post them, follow us on Twitter.

quick weekly news

El Salvador’s Chivo Wallet code leaked by hackers

El Salvador’s state Bitcoin wallet, Chivo, has faced a security breach as hackers from the group CiberInteligenciaSV leaked part of its source code on a hacking forum. The leak, which includes code from Chivo Wallet ATMs and VPN credentials, follows the earlier exposure of personal data belonging to nearly the entire adult population of El Salvador.

The cybersecurity community had been alerted to the potential leak by VenariX, which referenced a Telegram post by the hackers hinting at the release of the Chivo Wallet’s source code. The Chivo wallet, integral to El Salvador’s pioneering move to adopt Bitcoin as legal tender, has been plagued by technical issues since its launch. Despite the significant data breach reported in early April, the Salvadoran government has yet to officially acknowledge or address the incident.

The lack of response from El Salvador’s authorities has added to the uncertainty surrounding the security of the Chivo wallet. The platform, which was introduced to facilitate Bitcoin transactions for Salvadoran citizens, including purchases, sales, and ATM withdrawals, has now become a focal point for concerns about the country’s cybersecurity infrastructure and the protection of its citizens’ personal information.

BlackRock’s IBIT sees zero inflows, breaking streak

For the first time since its introduction, BlackRock’s iShares Bitcoin Trust (IBIT) experienced a day without any new inflows on April 24, marking a pause in its previously unbroken inflow streak. Since launching in January, IBIT had been consistently drawing millions in daily investments, accumulating nearly $15.5 billion within 71 days. This unexpected halt in inflows contrasts with the fund’s strong performance since its inception.

While IBIT’s inflows stalled, other Bitcoin ETFs in the U.S. also saw limited activity, with only Fidelity Wise Origin Bitcoin Fund (FBTC) and ARK 21Shares Bitcoin ETF (ARKB) managing to attract new investments. In contrast, Grayscale Bitcoin Trust (GBTC) faced significant outflows, contributing to a net outflow of $120.6 million from Bitcoin ETFs on the same day. Despite this, the overall U.S. Bitcoin ETF market has seen a net accumulation of $12.3 billion in Bitcoin to date.

The U.S. Securities and Exchange Commission has delayed decisions on several applications for Ether ETFs, extending the review period to ensure thorough consideration. This includes a 60-day extension for the decision on Grayscale’s ETH Trust conversion to a spot ETH exchange-traded product on NYSE Arca, now pushed to June 23. The SEC’s cautious approach reflects the regulatory scrutiny facing cryptocurrency-based investment products.

Chainlink introduces cross-chain interoperability protocol

Chainlink has officially released its Cross-Chain Interoperability Protocol (CCIP), a new tool designed to enhance the way smart contracts operate across different blockchain networks. This protocol allows for seamless cross-chain token transfers and smart contract interactions, enabling developers to create more integrated and interoperable blockchain applications. With CCIP, function calls can be sent and executed on smart contracts residing on separate blockchains, which is a significant step forward in cross-chain communication.

The launch of CCIP is expected to simplify the development process and improve the connectivity between disparate blockchain networks. Sergey Nazarov, co-founder of Chainlink, emphasized that CCIP is poised to become a standard for secure cross-chain transactions in both the banking sector and the broader Web3 space. Chainlink’s Transporter, a cross-chain messaging app that leverages CCIP, aims to provide a secure and user-friendly platform for crypto transfers across chains.

Despite the advancements in interoperability, cross-chain bridges remain a critical vulnerability within the cryptocurrency ecosystem, with over $5.85 billion stolen from DeFi protocols since 2016, nearly half of which is attributed to cross-chain bridge exploits.

Samourai Wallet execs arrested, crypto market shaken

The cryptocurrency market experienced a significant downturn following the arrest of the CEO and CTO of Samourai Wallet, a popular cryptocurrency wallet, by the U.S. Department of Justice (DOJ). The legal action is linked to charges of money laundering and operating an unlicensed money transmitting business. This event added to the market’s volatility, which was already affected by geopolitical tensions in the Middle East and the recent Bitcoin halving.

Bitcoin and Ethereum, along with several major altcoins, saw their values drop sharply in response to the news. Bitcoin fell by 3.6%, breaching crucial support levels, while Ethereum declined by 2.51% and continued to fall. The market reaction led to significant liquidations, with over $33 million in Bitcoin long positions and nearly $30 million in Ethereum positions being liquidated, according to data from CoinGlass.

The arrests have sparked concern within the crypto community, with many viewing it as a potential crackdown on the privacy and autonomy of crypto transactions by the U.S. government. Analysts and commentators have expressed their apprehensions, suggesting that these developments could have broader implications for the perception and regulation of Bitcoin and other cryptocurrencies.

setting ATR trailing stop orders

Looking to optimize your risk management strategy in crypto trading? Dive into the world of Average True Range and unleash the power of multiplier-based Stop Loss and Take Profit orders!

🎯 why does ATR matter?

ATR ensures your trades aren’t prematurely stopped due to temporary price fluctuations, but finding the right SL/TP can be tricky. That’s where the multiplier comes in!

🔍 the multiplier

Multiply the ATR by 1.5, 2, or 3 to set your SL/TP, providing a cushion to adapt to market changes while maintaining a solid risk management strategy.

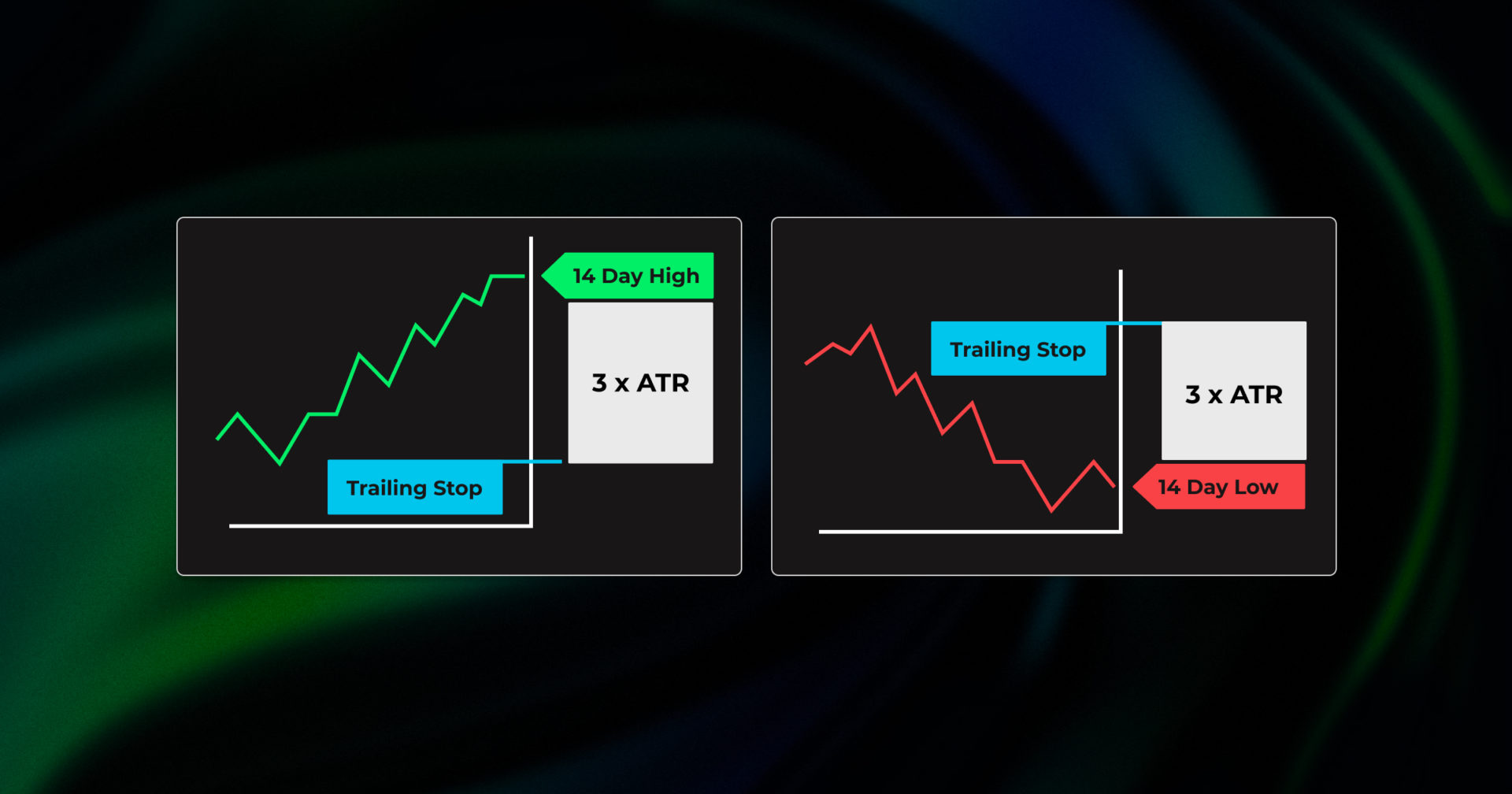

📈 Chandelier Exit strategy

Optimize your trading with ATR-based Trailing Stops. Set your Trailing Stop dynamically, adjusting to the asset’s price movement while protecting your gains and managing risk.

🔄 dynamic adjustments

Unlike traditional SL orders, Trailing Stops move with the market, ensuring you ride the trend while mitigating the risk of an early exit in case of a temporary reversal.

For example, with a 14-day ATR of $2, set your Trailing Stop $6 above or below the current market price, providing a buffer three times the current volatility of the market.

📈 Don’t miss out on this essential guide to maximizing your gains while minimizing risk! Dive deeper and elevate your trading game now.

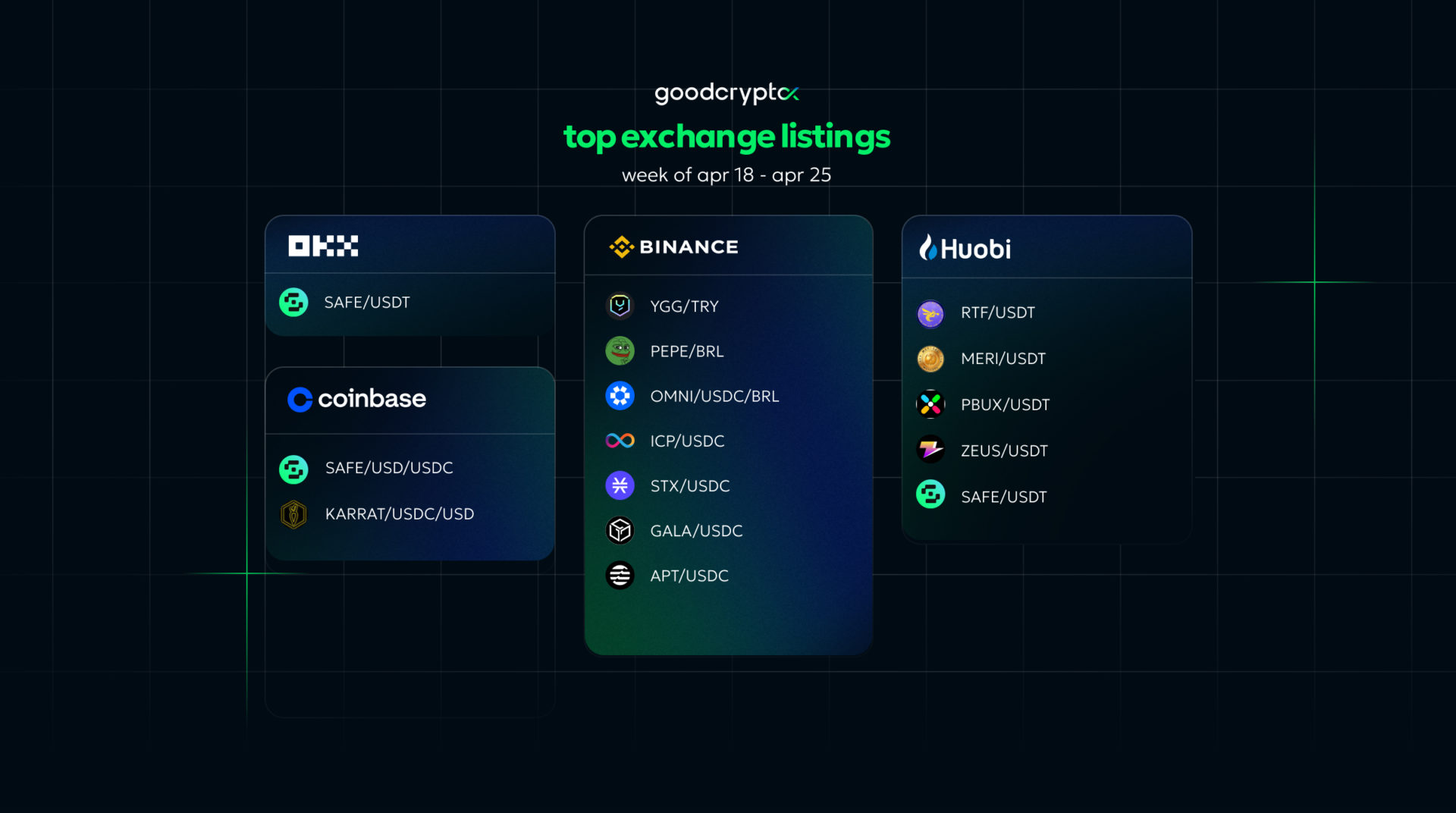

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!