- 1. Intro

- 2. Coinbase Review

- 3. Coinbase Account: Coinbase Verification

- 4. Coinbase Trading

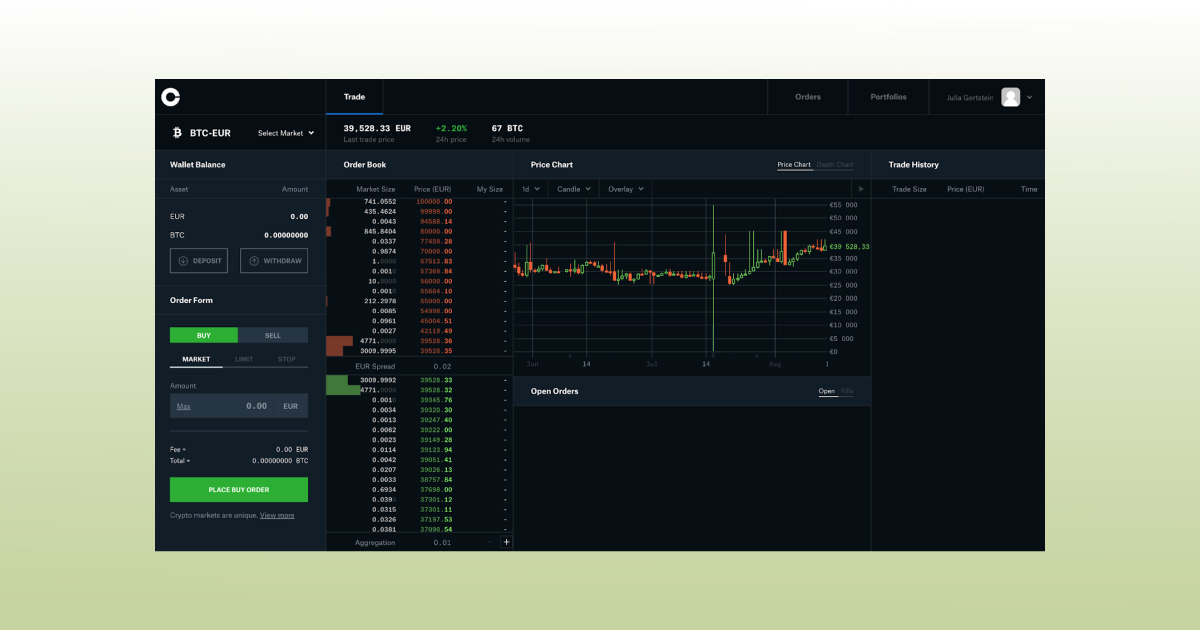

- 4.1. Coinbase Spot Trading

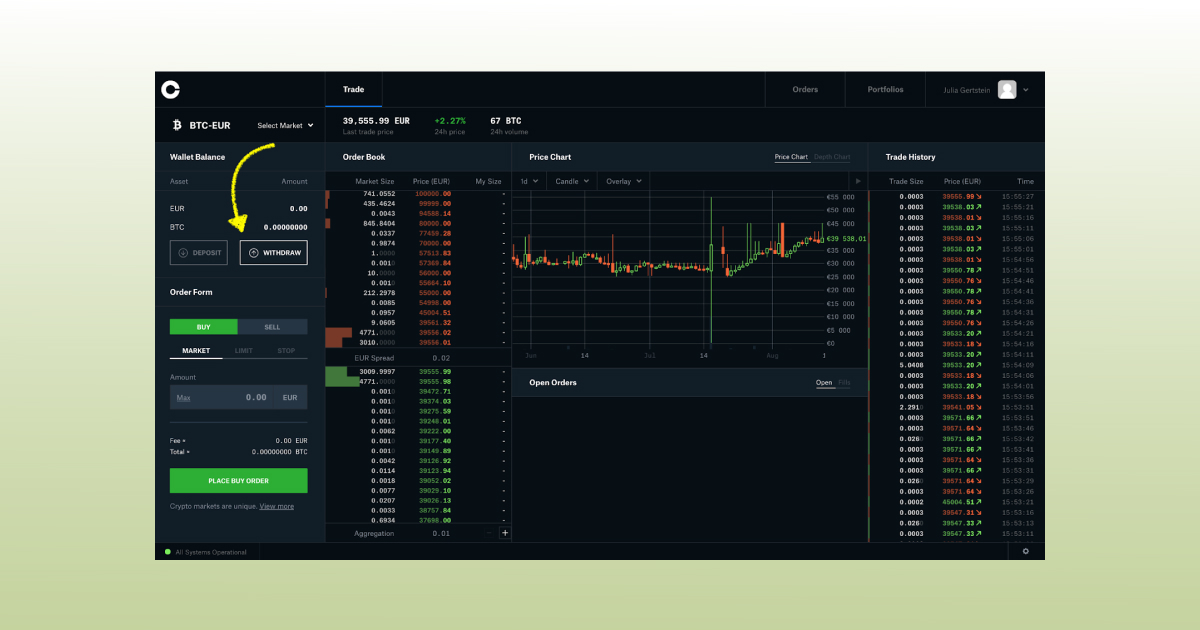

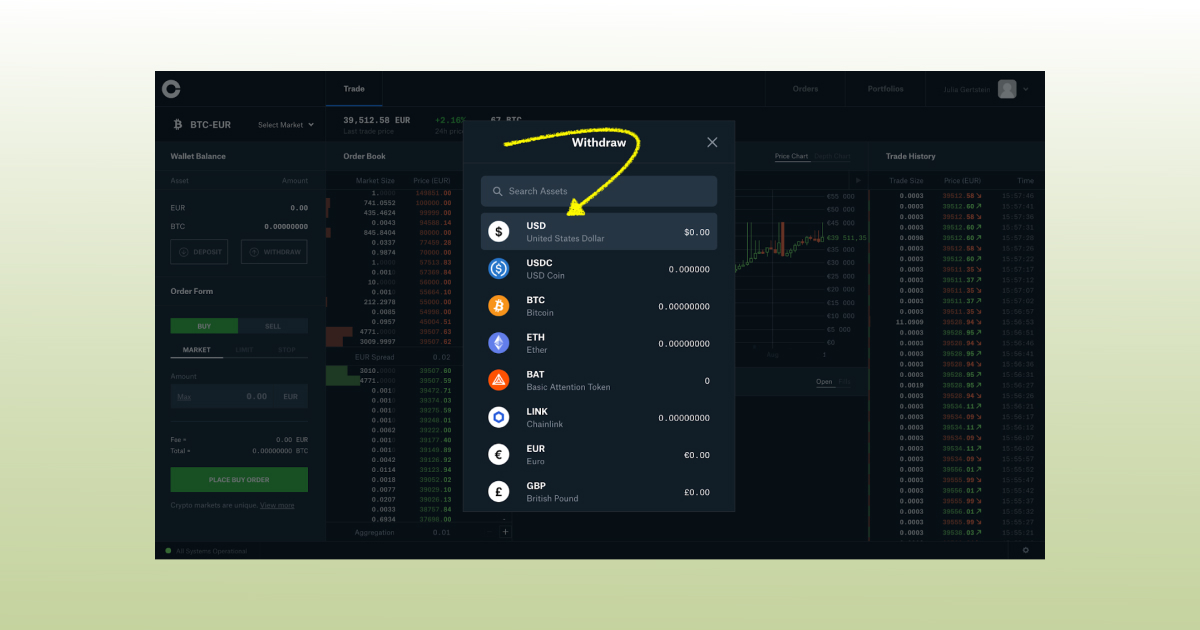

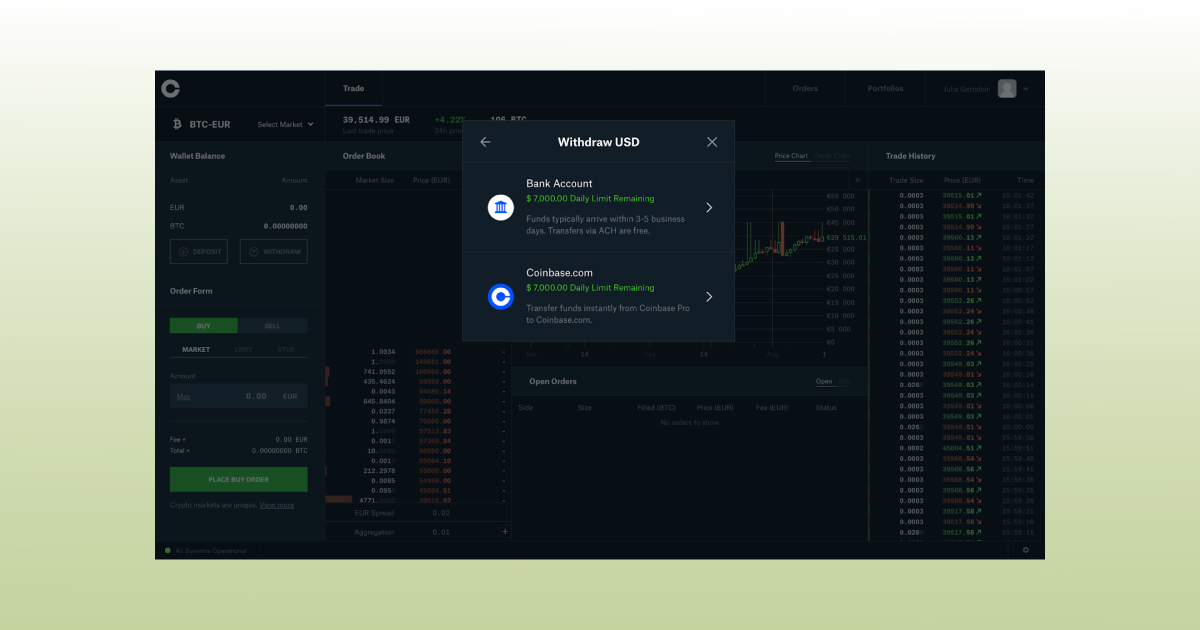

- 5. Coinbase Withdrawal: How to Withdraw Money From Coinbase

- 6. Security: Is Coinbase Safe?

- 7. Coinbase Account: How to Delete Coinbase Account?

- 8. Gemini Review

- 9. Gemini Account: Gemini Verification

- 10. Gemini Trading

- 10.1. Gemini Trading Software

- 11. Gemini Spot Trading

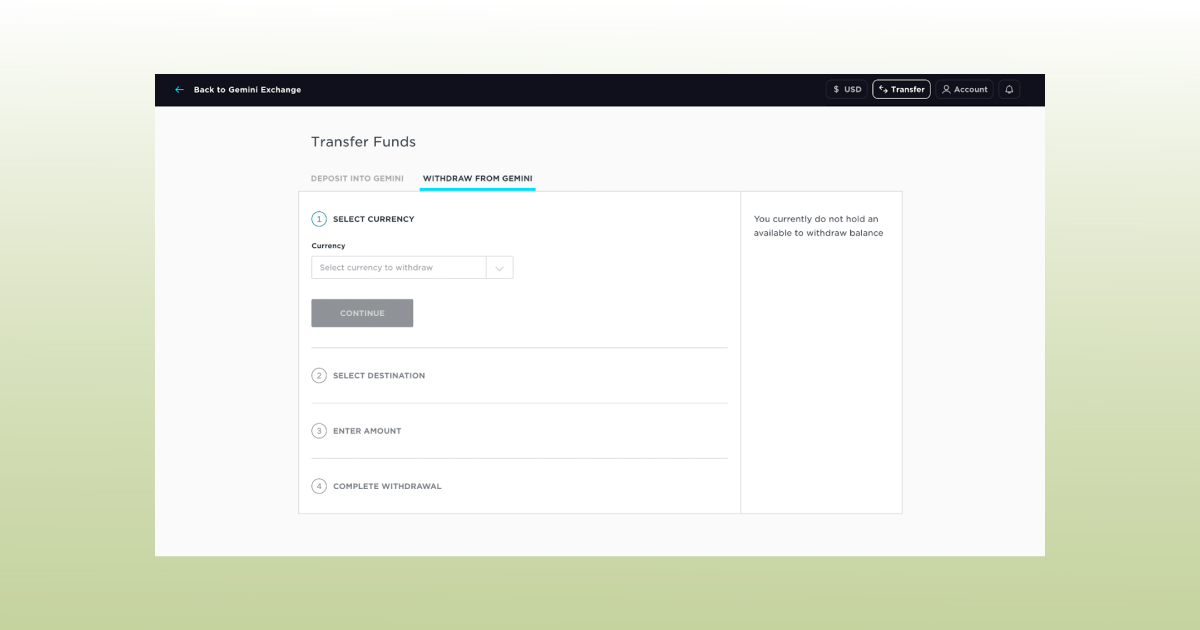

- 12. Gemini Withdrawal: Gemini Withdrawal Fees

- 13. Security: Is Gemini Safe?

- 14. Coinbase vs Gemini Fees

- 15. Comparison Table

- 16. Conclusion

- Coinbase offers a slightly larger amount of markets to trade and a much larger 24-hour trading volume than Gemini

- Compared to Gemini, Coinbase doesn’t have the auction feature and block trading

- Both Coinbase and Gemini offer the FDIC insurance for balances under $250k

- Neither Coinbase nor Gemini offers futures or margin trading

Intro

Before we dive deep into the battle of two crypto rivals, Coinbase and Gemini, it’s important to say that there’s a difference between Coinbase, an app used to buy, store and exchange different cryptocurrencies and Coinbase Pro, a platform for advanced crypto traders. There is also a Coinbase Wallet app – a non-custodial wallet from Coinbase with DeFi capabilities.

Along with that, Gemini’s Active Trader, a venue that delivers professional-level experience, is not the same as Gemini wallet that makes it simple and secure to buy cryptocurrencies. In the following review, we will mostly focus on Coinbase Pro and Gemini’s Active Trader, so if you’re a complete beginner, probably, this review is not for you.

But if you are an active trader, buckle up, and let’s get a taste of some Americana blend. Which of the two U.S. platforms should you choose, Gemini or Coinbase?

***

Basically, Gemini and Coinbase have always been and, all things considered, will always be in direct competition with each other. It’s no wonder they have a lot in common. You’ll see for yourself.

At least one thing strikes the eye when it comes to Coinbase and Gemini. They both have simplistic interfaces for beginners just to “marry fiat with crypto” at a large scale and professional apps for more advanced crypto traders, which are Gemini’s Active Trader and Coinbase Pro respectively.

The differences between the platforms, though, are quite subtle, such as contrasting staking features, as well as the auction feature and block trading that Coinbase Pro doesn’t have.

In general, both exchanges are quite secure, regulated, offer the FDIC insurance (Federal Deposit Insurance Corporation), and have clean interfaces with no annoying information overload. Both of them focus primarily on US customers but are also available in most EU countries. And both of them are more expensive to trade on and offer less trading tools than the leading non-US exchanges.

According to David Farmer, director of product at Coinbase, Coinbase Pro is “an evolution of GDAX, specifically designed for individual crypto traders.”

Farmer further explains that when they launched GDAX (Global Digital Asset Exchange), a Bitcoin exchange for professional traders, they envisioned a product that would help institutions enter the crypto space. It did this – and more. GDAX helped the company discover the active crypto trader, and realize that this new type of customer requires a platform tailored to their needs.

The rebranding of the platform had to do not only with a new name but also with simplified deposit/withdrawal process, improved charts and some new design elements making trading experience more intuitive and easier – and all of that would have sounded just perfect if this review was not about comparing Coinbase Pro with Gemini, right?

It seems very much likely that this rebranding was Coinbase’s way to respond to the Gemini’s Active Trader interface.

Although in its early days Gemini appeared to be positioned as an exchange for institutional traders, not individual investors, people at Coinbase started talking about active crypto traders in 2018 when the Active Trader interface with its advanced charting, multiple order types, auctions and block trading had already been flourishing on Gemini.

Despite the fact that the exchange is falling behind Coinbase Pro in terms of 24-h trading volume, weekly visits and markets supported, the platform is constantly growing. Initially, in 2015, Gemini was primarily a Bitcoin marketplace with no Earn or Auction features, but today, you can trade more than 73 markets on top of it.

Let’s take a deeper look at these exchanges, Coinbase vs Gemini, in the following sections – but before we do, here’s a quick side-by-side comparison of how these platforms’ stack up against each other:

| Coinbase Pro | Gemini Active Trader | |

| Spot trading |

👌 |

👌 |

| Spot Markets | 441 | 100 |

| Spot Maker/Taker trading fee | 0,5% (<$10k)/0,5% (<$10k) | 0,25%/0,35% |

| Margin Trading |

❌ |

❌ |

| Futures Trading | ❌ | ❌ |

| Charting Tools |

Line charts, Candlestick charts |

TradingView Integration |

| Technical Indicators | EMA12, EMA26 | TradingView’s Indicators |

| Advanced order types | Only Market, Limit and Stop orders. | Only Limit, Stop-Limit, Maker-or-Cancel (MOC), Immediate-or-Cancel (IOC), Fill-or-Kill (FOK), Market orders. |

| Mobile app | ❌ | 👌 |

| Available in the US | 👌 | 👌 |

| Countries available | Australia, the United States, Europe (including the UK), Canada and Singapore. | 49 U.S. states, Washington D.C., Puerto Rico, Canada, Hong Kong, Singapore, South Korea, the United Kingdom, and Australia |

| FDIC insured (US only) | 👌 | 👌 |

| Publicly traded | 👌 | ❌ |

Quick comparison of the main features of Coinbase Pro and Gemini’s Active Trader

So far, so good. Also, it’s important to notice that both Coinbase and Gemini offer staking one way or another – but staking is not built directly into their pro interfaces we’re discussing here.

Coinbase Review

What is Coinbase?

Not only is it an umbrella brand for a crypto wallet, a professional trading platform Coinbase Pro, and a suite of services for institutional investors, but also… a legend on everyone’s lips.

Coinbase is the only publicly-traded crypto exchange that came a long way from joining Y Combinator startup program in 2012 to going public and reaching a $100 billion valuation.

This has turned Brian Armstrong, the CEO of the platform, into a mogul and threw him into giving digital coins to people in need.

But again – why such a success? Honestly speaking, there are many reasons.

Coinbase CEO Brian Armstrong, photo businessinsider.com

They were one of the first mainstream Bitcoin wallets in the industry, they have cooperated with the regulators from the very beginning and, ultimately, have become the first ever crypto platform to get through to the other side of the strict U.S. regulations and go public.

The Coinbase stock is currently listed on NASDAQ under the ticker COIN and traded at the price of $231.13.

In general, the platform is, hands down, one of the best venues in terms of security and usability. But because their target audience is mostly mass traders, they understandably don’t work on thickening the interface with more complex chart or order types.

This approach sometimes drives off more sophisticated users who do like Coinbase Pro for its safety and federal insurance perks, but can’t use advanced functionality. In this case, we always suggest using Good Crypto, to upgrade to trailing and concurrent orders as well as TradingView charts and custom market alerts.

The app enhances your trading options, never keeps your balances on hold and, yet, leaves you hanging with your favourite cryptocurrency exchange, Coinbase Pro.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pros and cons of Coinbase Pro

That’s basically what all the pros and cons on Coinbase Pro look like. So, all things considered, is this American cutie high maintenance or not? Down below, you’ll find a more detailed Coinbase review that will, hopefully, help you find an answer to this question.

Coinbase Account: Coinbase Verification

Surfing, spending time with your family, reading or maybe even cooking – surely, you’ve got more interesting things to do in your life than getting verified on multiple crypto trading platforms. And luckily, multiple crypto trading platforms realize that. Coinbase does.

If you have a verification with one of their venues, say, with the famous wallet, you can use the same credentials to access Coinbase Pro. But if not, don’t worry, Coinbase verification doesn’t take long. The team of the platform recommends you to use the Coinbase mobile app to get verified because it’s the easiest option. Just go to Settings and click on Identity Verification.

It takes less than a minute in a mobile app, it’s not tiring, but prepare yourself to be exposed.

There are three verification levels on Coinbase you need to be aware of. Take a look at the table down below:

| KYC types | Phone Number | Personal Information | ID |

| Level 1 | ✅ | ||

| Level 2 | ✅ | ✅ | |

| Level 3 | ✅ | ✅ | ✅ |

Coinbase verification levels

The first level requires your phone number. The second one asks for your full name, date of birth and residential address. Also, at this point, the platform might ask you to take a quiz exposing your source of funds, your employment status and your commercial goals on Coinbase.

On the third level of verification, you will have to upload your ID document (either passport, or driver’s license, or national ID card) and be prepared to provide the platform with additional details including, but not limited to taxpayer identification number, a government identification and information regarding your bank account such as the name of the bank, the account type, routing number, and account number. In some cases, where permitted by law, the platform also requires special categories of personal data, such as biometric information – but you can leave your hat on, as Joe Cocker would probably say.

In general, the Coinbase ID verification time is anywhere between 2 and 3 minutes.

Here’s one more table that can help you navigate through certain verification benefits:

| KYC types | Difficulty | Verification time | Deposits/Withdrawals | Withdrawal limits |

| Level 1 |

😄 |

2-3 mins | Bank account Credit/Debit Card |

Up to $9,5k |

| Level 2 | 🙃 | 2-3 mins | Bank account Credit/Debit Card Wire transfer |

Up to $250k |

| Level 3 | 🙃 | 2-3 mins | Bank account Credit/Debit Card Wire transfer Send / Receive crypto |

Unlimited |

Coinbase verification benefits

Verify a US bank account:

Open the trading view at pro.coinbase.com/trade

On the left-hand column under Wallet Balance, select the Deposit option

In the Currency Type field, select USD

Select the Bank Account tab, then select From, then select Add Account

You will be redirected to Coinbase.com to complete the bank account verification process

Verify a US business account:

Visit Coinbase Business Application Center

Fill out the application, including such information as type of business, global number of employees, fund assets under management in USD etc

Check your application’s status in the Business Application Center. Once approved, they will email you via the email address used to submit the application.

Coinbase Trading

On the territory of the United States, Coinbase Pro, as you can see from the table down below, is an undisputed leader across crypto currency exchanges, with the maximum numbers as to weekly visits and trading volume.

However, one of the burning issues to help us decide in their favour or not is if the platform can offer the coins that we dig. In this sense, there’s still room for improvement when it comes to Brian Armstrong’s venue. Honestly speaking, following figures demonstrate that one of the alternatives to Coinbase, Kraken, has got a lot more to say with its 322 markets supported.

| Weekly Visits | 24h Trading Volume | Markets supported | Coins listed | Fiat currencies offered | |

| Coinbase Pro | 3 million weekly visits | $3,476,420,769 | 252 | 84 |

Up to $9,5k |

| Gemini | 307 thousand weekly visits | $371,669,947 | 73 | 51 | Up to $250k |

| Kraken | 2 million weekly visits | $1,276,574,292 | 322 | 75 | Up to $250k |

| Binance. US | 835,041 thousand weekly visits | $694,365,231 | 115 | 59 | Unlimited |

Coinmarketcap figures across the most prominent American crypto exchanges

In general, the most-traded Coinbase coins include BTC, Ethereum, Chainlink, Polygon, Solana, Stellar, Chainlink and Cardano, but new assets are always in the process of being explored and considered. Brian Armstrong has recently said that they “are working hard to keep up with the incredible amount of assets being issued, and responding to and interacting with the amazing asset issuers who are doing their own hard work, day and night, to build the future of this industry.”

Loosely translated into English, this means that the company is attempting to list all the digital assets under the moon as soon as possible. Recently, the lineup of the Coinbase new coins has been enriched by Gitcoin (GTC), Enzyme Token (MLN), Amp (AMP), Dogecoin (DOGE), Internet Computer (ICP), Cartesi (CTSI), iExec (RLC), Mirror Protocol (MIR), Tellor (TRB), Tether (USDT), Ampleforth Governance Token (FORTH),1inch (1INCH), Enjin Coin (ENJ), NKN (NKN), Origin Token (OGN), Ankr (ANKR) Curve DAO Token (CRV), Storj (STORJ), Cardano (ADA), SushiSwap (SUSHI), Polygon (MATIC), & SKALE (SKL).

Coinbase Spot Trading

Say, you like the fact that all the fiat funds under $250k on Coinbase Pro are federally secured by the U.S. government and want to give this platform a try. But if you’re fishing for such things as Coinbase margin trading or Coinbase futures trading, you will not find them here.

The platform used to have margin trading before, yet, as of 2021, it is disabled in response to new guidance from the Commodity Futures Trading Commission. The only trading type the platform now offers is Spot Trading – which is maybe a good thing? Take a look.

The interface is newbie-friendly, clean and there’s no visual information glut. That contrasts to some advanced crypto platforms producing masses of information, often impossible to navigate through them or draw any conclusion. Check out the interface for yourself!

Coinbase Pro Interface

On the left, there’s a trading terminal with your wallet balance, deposit and withdrawal options as well as an order form, consisting of three order types: market, limit and stop. Down below, you can also find Coinbase trading fees. Generally, Maker and Taker fees on Coinbase Pro are 0.5%.

Almost in the middle, there’s an order book painted green and red for your convenience. The Coinbase charts on the right can be customized based on time range, chart type (candlestick and line) and overlay (12- and 26-Day EMAs). Furthest to the right, there’s your trade history.

Of course, the platform, Coinbase charts, for example, might look a little bit too easy for professional crypto traders, but it has got a certain number of advantages, too, for example, excellent security and insurance for fiat funds. So, here’s a question.

Did you know that you could have your cake and eat it, too? As simple as Coinbase Pro might look, you actually can enjoy the security and simplicity of the platform together with the most advanced trading tools.

PRO TIP: Install Good Crypto, add your Coinbase Pro API key and place advanced orders such as Connected Stop Loss or Take Profit, Trailing Stop, Trailing Take Profit or Trailing Stop Limit right on your favourite platform. In comparison with Coinbase Pro, Good Crypto doesn’t freeze your balances, when you set orders, so you can freely operate these funds before the order execution. You can use advanced TradingView charts instead of only candlestick and line Coinbase charts available on the platform. Plus, Infinity Trailing Algo has been turned on all Spot exchanges, including Binance, Binance US, Bybit Spot, KuCoin etc. This Algo buys a coin with Trailing Stop and sells with Trailing Sell at a certain distance, repeating the cycle forever until you stop the bot manually.

Coinbase Withdrawal: How to Withdraw Money From Coinbase

If the interface and the number of various coins are not only important criteria for you while choosing a platform, keep reading. In this next section, we’ll see what Coinbase Pro looks like in terms of withdrawal options and safety.

By the look of withdrawal options across the platform, Coinbase Pro is not necessarily cheap.

| Withdrawal fee | Coinbase Pro |

|

SEPA withdrawal |

€0.15 EUR |

|

Wire Transfer withdrawal |

$25 USD |

|

Swift (GBP) |

£1 GBP |

|

ACH Transfer withdrawal |

Free |

|

PayPal withdrawal |

Withdrawal fees and options across the most prominent American crypto exchanges

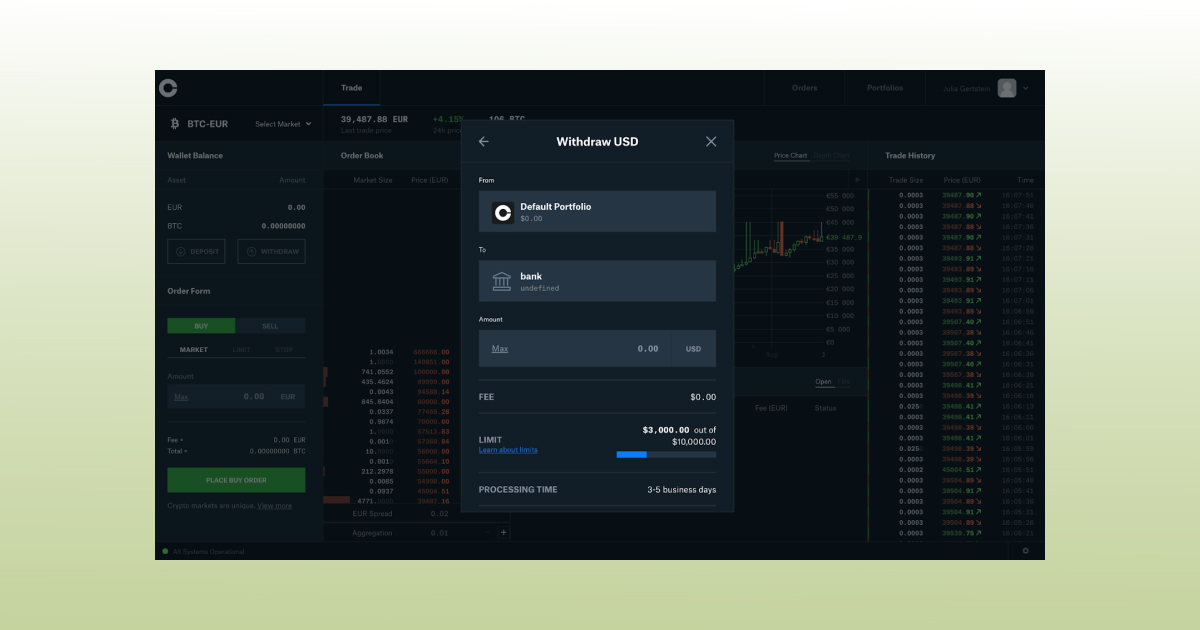

Are you wondering how to withdraw money from Coinbase Pro? Actually, Coinbase withdrawal is quite easy. In order to transfer money from this platform, go to the homepage of the exchange and click on the Withdraw button:

Then, proceed to the next window and choose the currency, USD, in this case:

As you can see, you’ve got two options. You can withdraw either to your Bank or Coinbase Account. Daily limits are $7k for both options. The funds arrive instantly to your Coinbase wallet. But you will have to wait for up to 5 business days to receive money to your bank account:

If you withdraw to your bank account, you will have a $10k limit per day:

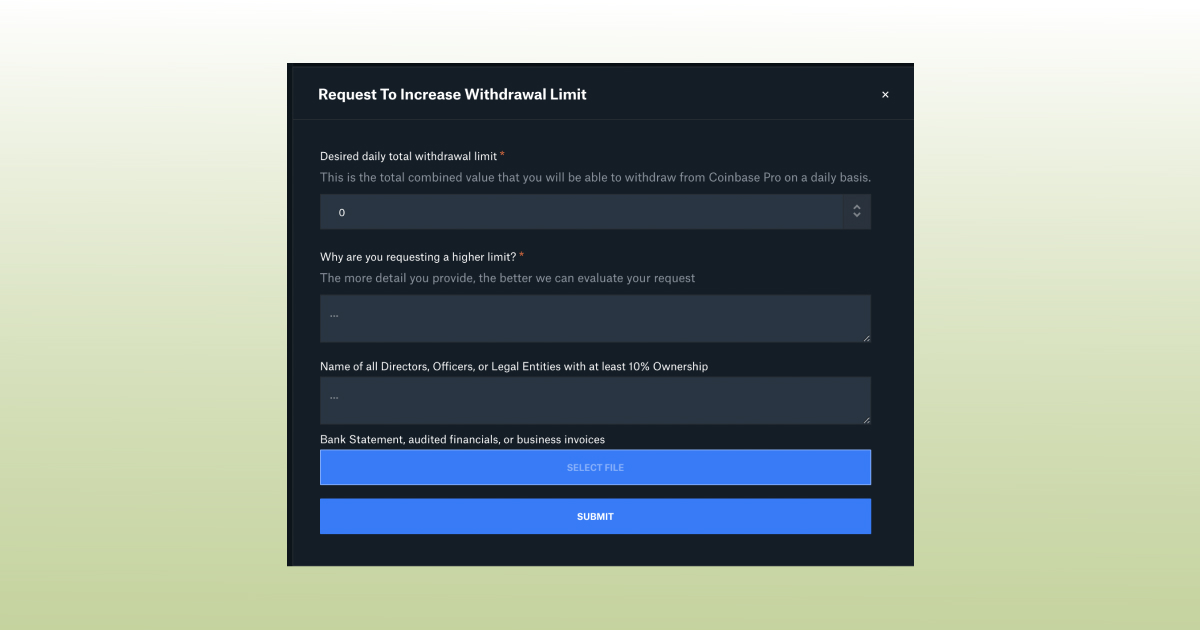

Are you not satisfied and want to increase your $10k limit? Send a specific request to Coinbase Pro to explain why you request a higher limit, enlist the names of all directors, officers and legal entities at your company and, last but not least, add your business invoices, a bank statement and audited financials.

That being said, are you still sure you want to increase your Coinbase limit?

Security: Is Coinbase Safe?

In short, yes, Coinbase is safe. All of your fiat funds under $250k are federally secured by the U.S. government in case there’s a breach of the platform’s physical security, cyber security or by employee theft. So, is it safe to link a bank account to Coinbase? It is safe.

As to your crypto funds, the situation is trickier. According to their help page, Coinbase carries crime insurance that protects a portion of digital assets held across their storage systems against losses from theft, including cybersecurity breaches.

However, their policy does not cover any losses resulting from unauthorized access to your personal Coinbase or Coinbase Pro account(s) due to a breach or loss of your credentials. It is your responsibility to use a strong password and maintain control of all login credentials you use to access Coinbase and Coinbase Pro.

So, how exactly do they protect your private keys? While the mobile version of the Coinbase wallet helps users manage their own private keys and stores their crypto assets directly on their devices, the other venue, Coinbase Pro, stores 98% of all customer funds offline in vaults or safe deposit boxes. 2% of those funds are stored online to serve the liquidity needs.

In order to safeguard security, the exchange limits a variety of actions on the site (login attempts, for example) and whitelists withdrawal addresses to go only to addresses already designated in your Address Book.

Coinbase also uses SQL injection filters that don’t allow attackers to spoof identity. They verify, in addition to that, the authenticity of POST, PUT and DELETE requests changing the state or side effects on the server and, thus, prevent CSRF attacks.

Just in case you’re wondering, CSRF attack is when the attacker causes the victim user to carry out an action unintentionally. For example, this might be to change the email address on their account, to change their password or to make a funds transfer.

Do you want to learn more about Coinbase security measures? Go to their website where they describe various safety measures implemented.

The exchange encourages responsible disclosure of security vulnerabilities via their bug bounty program. But remember that Coinbase Pro doesn’t refund you if your password was too weak, and an attacker managed to hack your account.

So, is Coinbase wallet safe? Depending on what you think safe is.

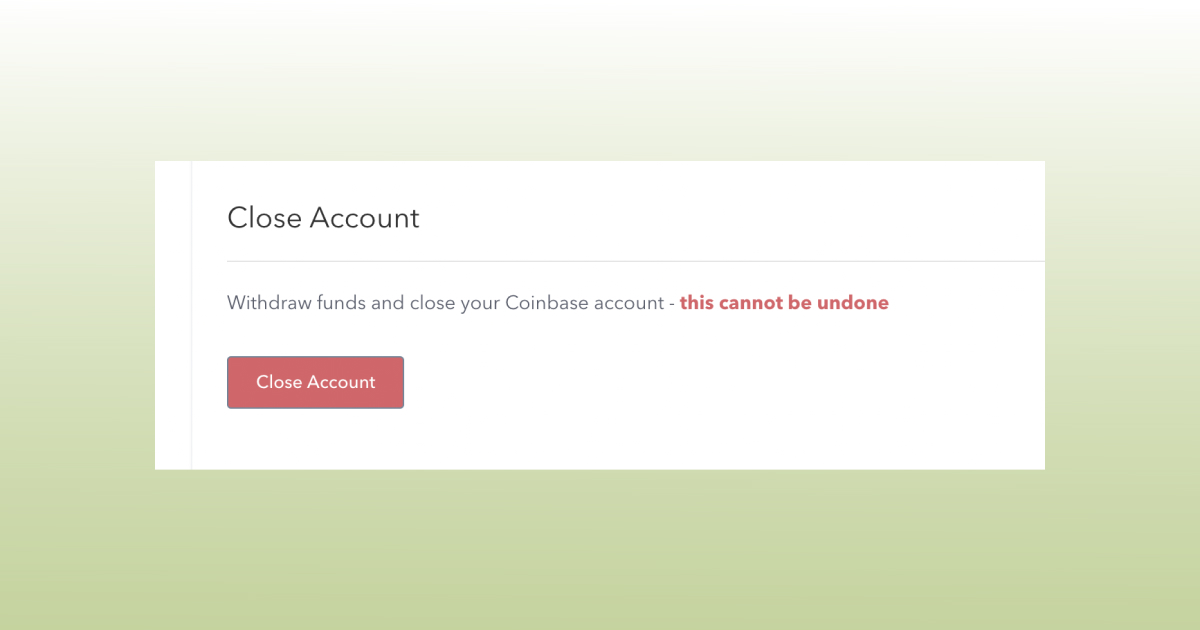

Coinbase Account: How to Delete Coinbase Account?

If you’re wondering how to close your Coinbase Pro account, you will have to go and, and so to speak, destroy the mothership, first, which is your account on the Coinbase wallet website.

For that, proceed to your account activity page, scroll down and click the Close Account page as shown in the pic down below:

As the team of the venue reports on their help page, you will need to have a zero balance to close the Coinbase account.

If you still have a remaining balance in any of your wallets, you’ll need to send your funds to an external wallet or another user first.

Gemini Review

It’s really hard to start writing the Gemini crypto review without focusing even a little bit on the story behind the platform – simply because this story is kind of… non-conventional. You probably know that this exchange was founded in New York in 2015 as a result of the Winklevoss twins’ fascination with Bitcoin.

A major role, however, was played by Facebook that “sponsored” the twins and paid a reported $65 mln in a settlement in 2011 – the fact you can learn literally from every Gemini crypto exchange review. The brothers claimed Mark Zuckerberg copied their idea for a social network and some of the code they’d paid him to create. When it happened, all three were students at Harvard University.

No-one knows exactly what happened there and what led to this bad blood. But a version of it is well-described in an award-winning movie “The Social Network” directed by David Fincher and written by Aaron Sorkin.

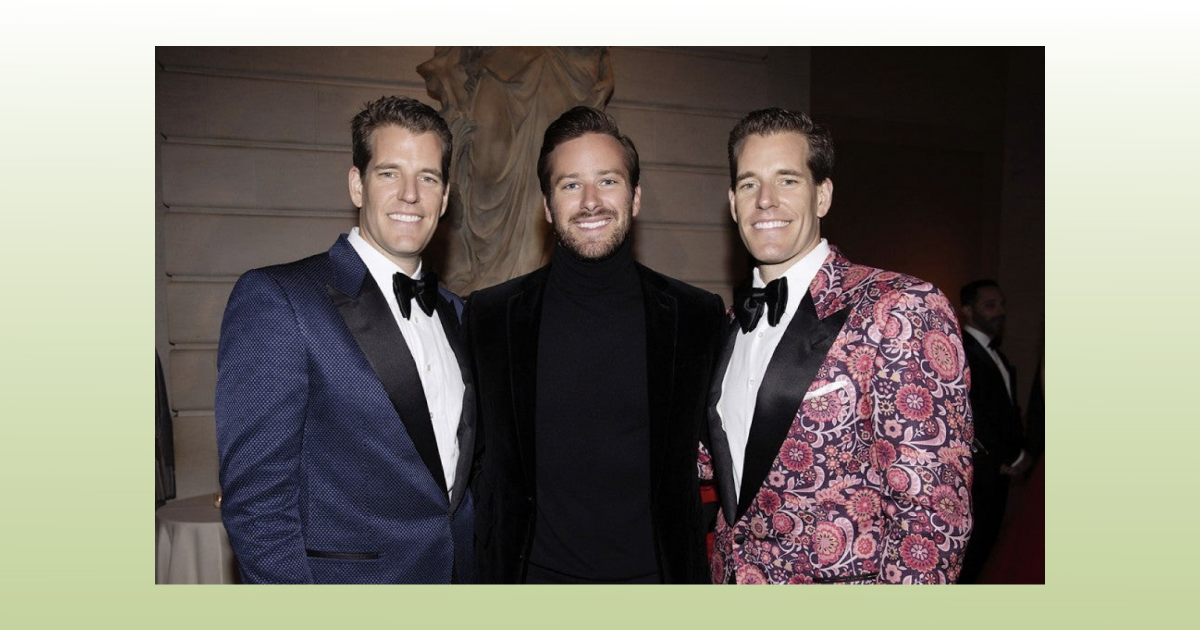

The Winklevoss twins and Armie Hammer who portrayed them in the movie The Social Network (2010). Photo Taylor Jewell/Shutterstock

So, years later, the Winklevosses invested in Bitcoin and turned into billionaires. In their blog post, the twins explain that their interest began in 2012. They’ve spent a great deal of time educating themselves and others about Bitcoin; investing in Bitcoin; investing in Bitcoin-related companies; filing an S-1 registration statement with the Securities and Exchange Commission to create the Winklevoss Bitcoin Trust. But, then, they decided to look into exactly what it would take to create a US-based Bitcoin exchange – and successfully accomplished the mission.

The story with the name for the exchange is also interesting, although might speak for itself up to a point. The twins explain that “after white-boarding a list of possible names for several weeks, we settled on Gemini for a host of reasons. Gemini is the Latin word for “twins” and as such, it inherently explores the concept of duality. We were drawn to this both because of the two worlds of money (old and new) that will intersect on the Gemini platform as well as the two-way nature of trade that it will facilitate. But that’s not all. Once we picked our name, a fun fact emerged. We realized that NASA’s Project Gemini was a spaceflight program focused on laying the groundwork for Apollo’s later mission to land man on the Moon. As such, it was coined (no pun intended) man’s “bridge to the moon.” In this spirit, we’ve built Gemini to be “your bridge to the future of money.” Oh, and Tyler and I just happen to be identical twin brothers.”

Now probably is a good time in this Gemini exchange review to take a deeper look at the product the identical twin brothers have created.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pros and cons of Gemini

Gemini Account: Gemini Verification

A considerable number of legends have grown around Gemini account verification time, since for some people it’s ridiculously difficult to get verified. Our team didn’t seem to have problems with the KYC process at this exchange. It took the platform 3 days to grant us verified status.

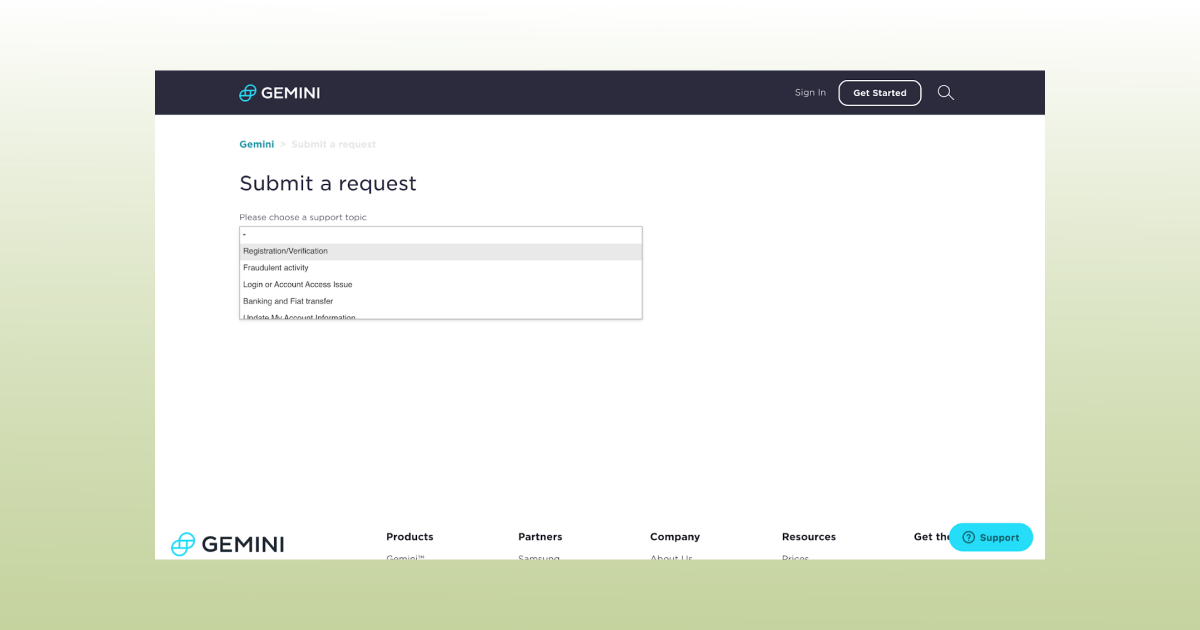

However, to make sure that everything goes alright, after sending your proof of identity (your valid state-issued ID, driver’s license, passport, passport card, or Permanent Resident Cards for U.S. citizens or your passport from your country of citizenship; national ID and/or driver’s license from your country of residence), just in case, submit an additional form and choose Registration/Verification. You can also send an extra email to hello@gemini.com or support@gemini.com

The problem here is that full trading and withdrawal capabilities will be enabled for your account only when the verification process is completed. So be very careful and don’t do a bank transfer on Gemini before ID verification.

| Withdrawal methods | Daily | Monthly | Fully verified/daily |

| ACH |

$5,000 |

$30,000 |

$100,000 |

| Debit Cards | $1,000 The limit resets every 24 hours |

||

| Wire Transfers | No limits Min withdrawal $100 |

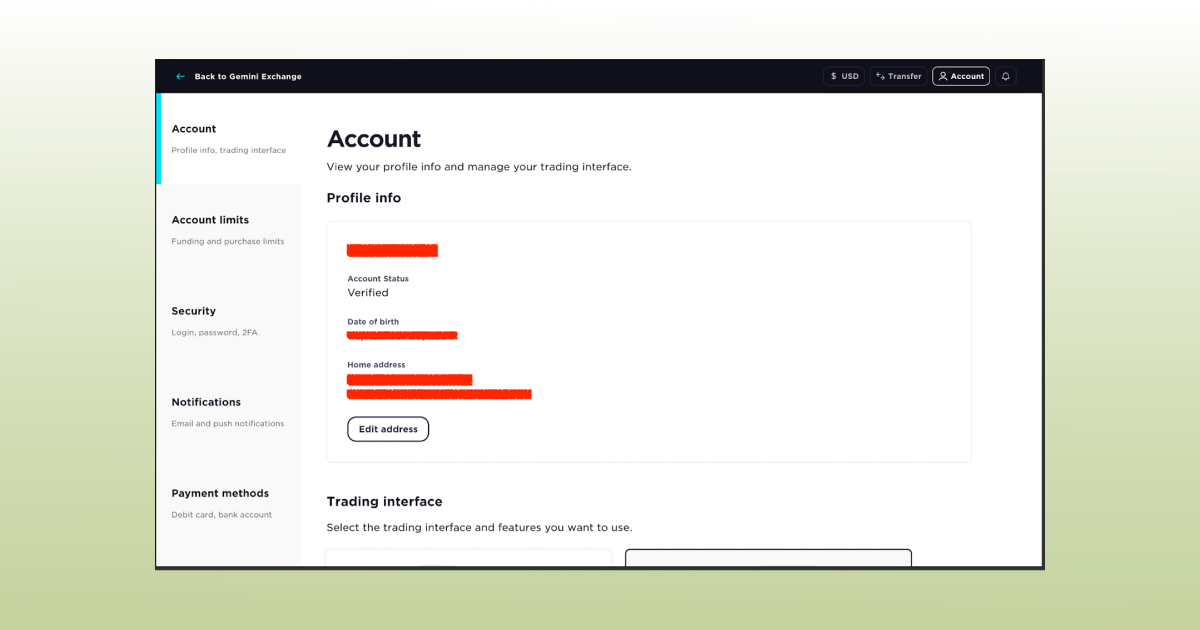

When verified, your account should look somewhat like this, so you can see that in addition to your ID you have to provide your date of birth and home address.

In order to delete the Gemini account, you need to proceed to your Account, to Settings and, then, click on Close account.

Gemini Trading

Gemini Trading Software

When it boils down to the Gemini trading software, there are primarily two options available. As we’ve mentioned above, there’s an interface for beginners with very simple Gemini BTC charts and the Active Trader interface for more advanced users.

We’ll discuss both interfaces one by one, but first let’s take a look at payment methods you will have to add regardless of the interface of your preference.

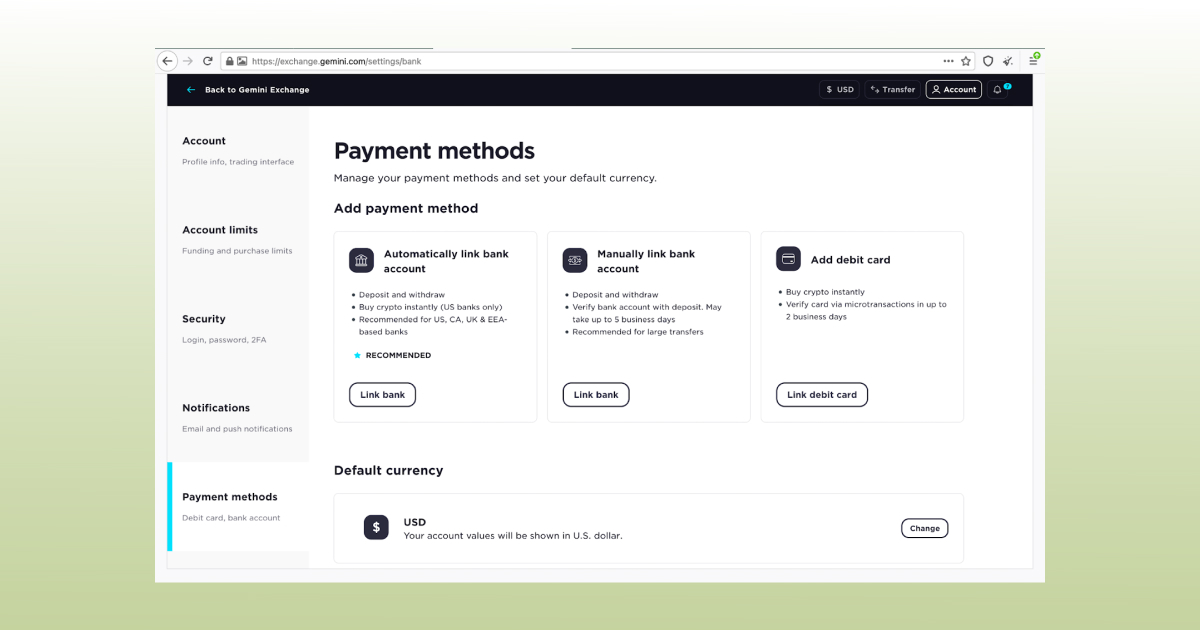

In order to start purchasing crypto by using the simple one or the more advanced interface, you have to add a specific payment method in advance, as shown in the pic down below:

In the settings of your account, find payment methods and choose one of the three following options:

The first one, the automatic one and the recommended one, is Plaid (available for the customers from the U.S., the U.K. and the Netherlands). It’s a special service that securely keeps your financial data safe across different financial apps.

The second one is your regular bank account that you can link manually. For that, you will need to choose the native currency you hold a balance in (USD, AUD, CAD, EUR, GBP, HKD, SGD) and add some financial details: account holder’s full name, routing number and bank account number.

The third method is a regular debit card that you can only use to purchase crypto. In order to withdraw fiat, you will have to add a bank account anyway.

Remember that in most cases, the verification process will take some time. For example, to verify your bank account normally takes 5 business days; with the debit card it is 2 to 3 business days.

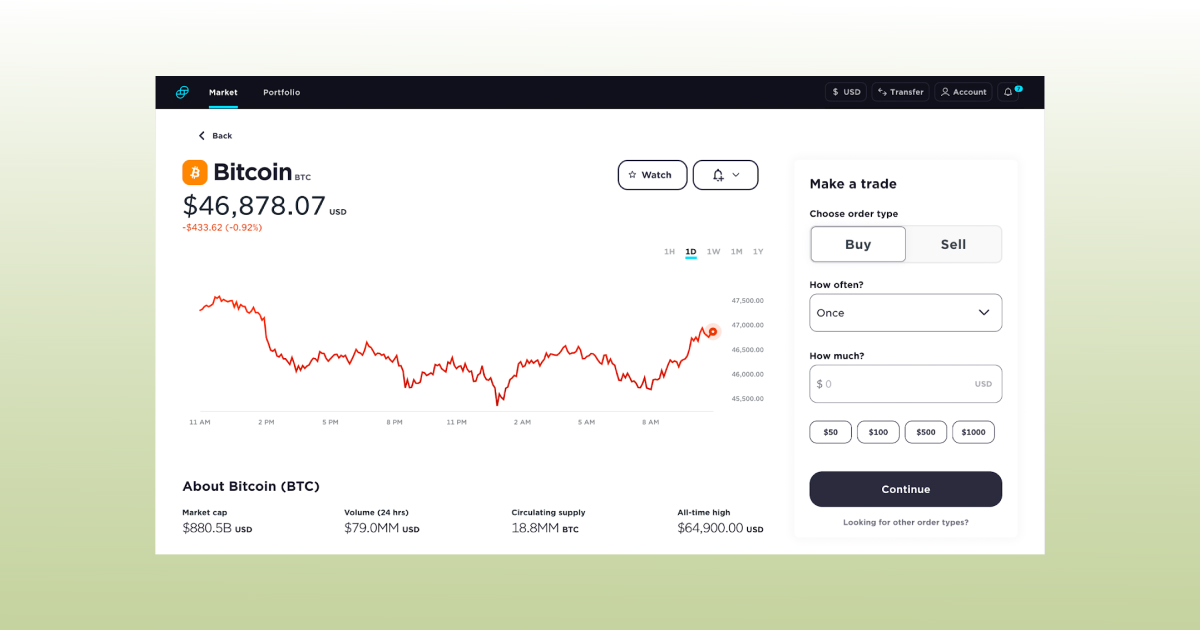

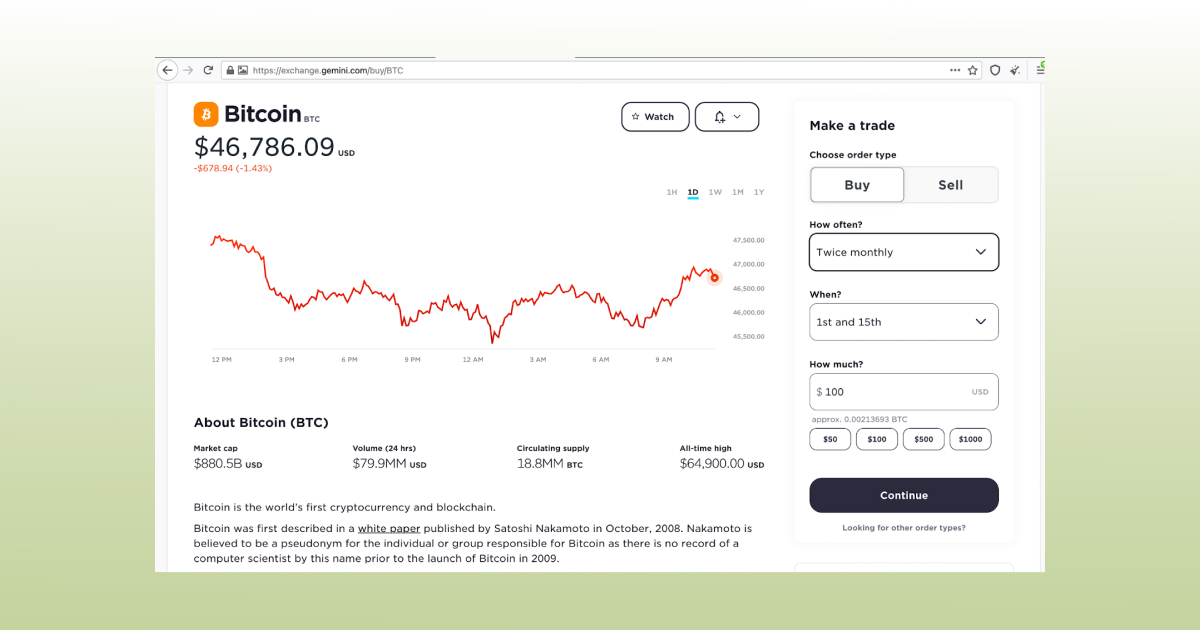

Now, let’s talk about different interfaces. This is a beginner-focused interface with a line chart for buying and selling crypto once, daily, weekly, twice monthly or monthly:

A beginner-friendly Gemini Bitcoin chart

So, let’s say, you want to buy $100 worth of Bitcoin twice monthly…

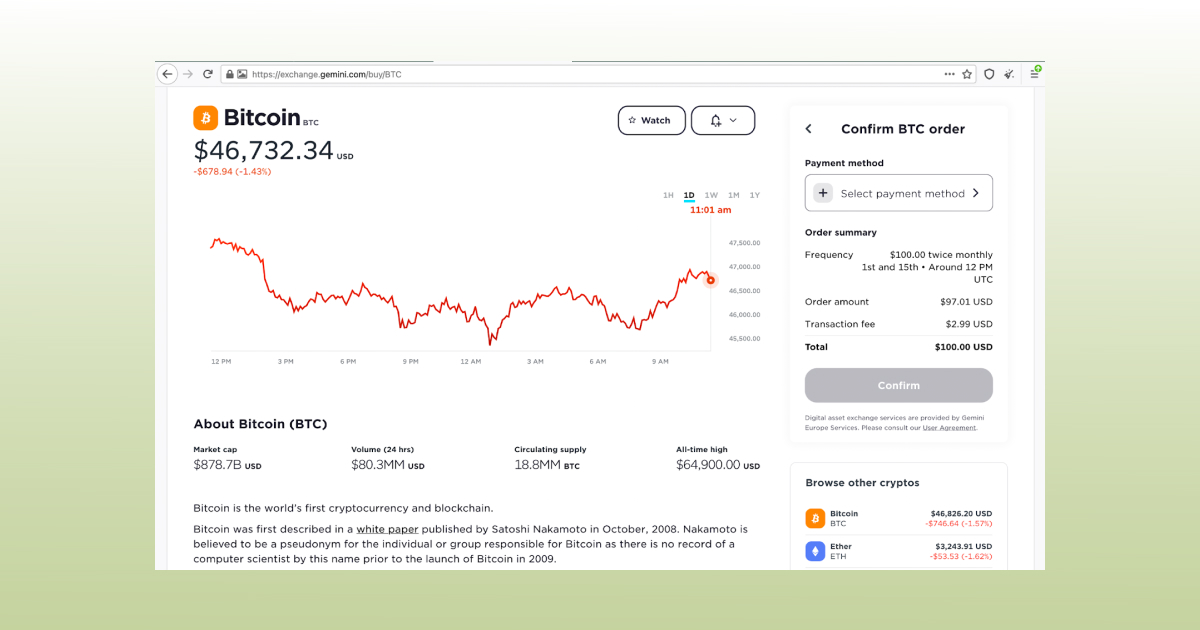

What will it cost you if you want to buy Bitcoin with this newbie-oriented interface? Let’s see.

For each $100 spent, you will have to pay $2.99 in fees, which makes 2.99% and leads us to the next question: isn’t it too much?

For lower fees, you should go to the other interface type, to the Active Trader interface. Click on your Account icon in the upper right corner and proceed to Settings. Under the account tab, choose Active Trader and go back to Gemini Exchange.

Voila!

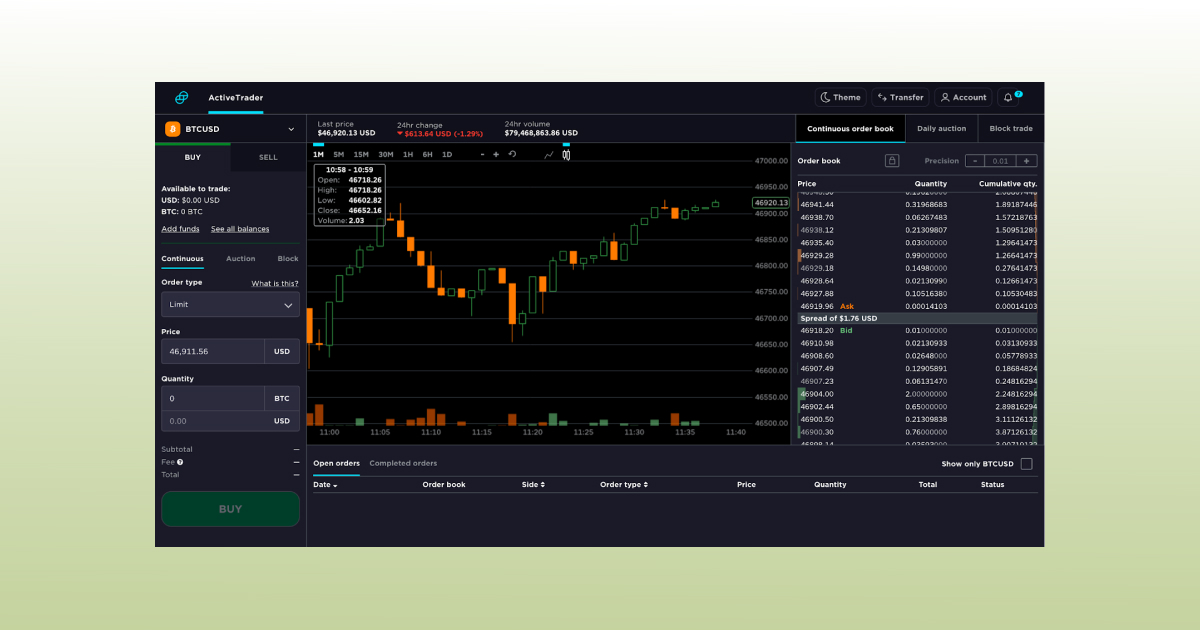

Here’s your upgraded trading terminal:

Active Trader interface on Gemini

Rings a bell, right? Because, again, the Gemini trading software is in direct competition with the likes of Coinbase Pro.

So, what instruments are there at your disposal if you use the Active Trader terminal?

On the left, there’s a panel with your available balance to trade, a traditional order book, Gemini Auction and Gemini Block Trading.

Gemini Block Trading, as the team states, is a way to trade large amounts of digital assets outside of Gemini’s continuous order books. This creates an additional mechanism for customers to source liquidity when trading in greater size.

As to Gemini Auction, according to their help page, market participants can place an auction-only market order (which will execute at the final auction price) or a limit order indicating the maximum buy price they are willing to pay, or minimum sell price they are willing to receive

After that, an order form follows with such order types as Limit, Stop-Limit, Maker-or-Cancel (MOC), Immediate-or-Cancel (IOC), Fill-or-Kill (FOK) and Market.

Market order is filled immediately against resting orders at the current best available price – can’t be traded in Auction.

Limit order is filled at or better than a specified price. Any quantity that is not filled rests on the continuous order book until it is filled or canceled – can be traded in Auction.

Limit: Immediate-or-Cancel (IOC) is filled immediately at or better than a specified price. Any quantity that is not filled immediately is canceled and does not rest on the continuous order book – can’t be traded in Auction.

Limit: Fill-or-Kill (FOK) is filled immediately at or better than a specified price. If the order cannot be filled in full immediately, the entire quantity is canceled. The order does not rest on the continuous order book – can’t be traded in Auction.

Limit: Maker-or-Cancel (MOC) rests on the continuous order book at a specified price. If any quantity can be filled immediately, the entire order is canceled – can be traded in Auction.

Limit: Auction-Only (AO) Limit rests on the auction order book and is filled at or better than a specified price at the conclusion of an auction. Any quantity that is not filled is canceled – doesn’t rest on the continuous order book, can be traded in Auction.

Limit: Indication-of-Interest (IOI) initiates Gemini’s block trading workflow to source liquidity for large block quantities – can’t be traded against resting orders, doesn’t rest on the continuous order book, can’t be traded in Auction.

Stop-Limit places a Limit order when a Last Trade Price crosses the Stop Price of the order – specifies the price, can be traded against resting orders, rests on the continuous order book, can be traded in Auction.

Below the panel with order types, you can also find trading fees. Generally, Maker and Taker fees on Gemini depend on the volume. If your 30-day trading volume in USD is less than $1 million, then it is 0.35% in Taker Fee and 0.1% in Maker Fee.

Gemini price charts are quite simple to read and don’t muddy the water by contrast with some other exchanges.

As you can see for yourself, Gemini margin trading and Gemini Futures trading are not implemented.

Gemini Spot Trading

In general, across Coinbase alternatives, such as Kraken and Binance.US, Gemini is one of the least popular ones based on the 24h trading volume of $371,669,947. Coinbase Pro offers $3,476,420,769 and Kraken – $694,365,231. Binance.US that lists only 59 coins, 109 markets and one fiat currency, USD, also has a higher trading volume of $694,365,231.

Gemini supports 72 markets, lists 51 coins and offers a few fiat currencies for trading and withdrawal, USD, AUD, CAD, EUR, GBP, SGD and HKD.

Currently, the exchange supports the following cryptos for trading: Bitcoin (BTC), Ether (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Zcash (ZEC), Filecoin (FIL), Dogecoin (DOGE), Tezos (XTZ).

As to supported ERC-20 tokens, they include 0x (ZRX), 1INCH (1INCH), Aave (AAVE), Alchemix (ALCX), Amp (AMP), Ankr Network (ANKR), Bancor Network (BNT), BarnBridge (BOND), Basic Attention (BAT), Balancer (BAL), Chainlink (LINK), Compound (COMP), Cryptex (CTX), Curve (CRV), Dai (DAI), Decentraland (MANA), Enjin (ENJ), Fantom (FTM), The Graph (GRT), Injective Protocol (INJ), Kyber Network (KNC), Livepeer (LPT), Loopring (LRC), Maker (MKR), Mirror Protocol (MIR), Orchid (OXT), Pax Gold (PAXG), Polygon (MATIC), Ren (REN), The Sandbox (SAND), Skale (SKL), Somnium Space (CUBE), Storj (STORJ), SushiSwap (SUSHI), Synthetix (SNX), Uma (UMA), Uniswap (UNI), Yearn Finance (YFI).

Gemini Withdrawal: Gemini Withdrawal Fees

Just to give you a perspective, here’s a comparison table for Coinbase Pro and Gemini withdrawal fees, but don’t get too excited.

The fee structure on Gemini is far from charitable, which we’ll discuss later, but here’s a little spoiler.

In addition to Maker and Taker Fee, they require extra commissions for a certain number of withdrawals per month, a convenience fee (a flat fee) and transaction fees for USD web and mobile transactions.

According to Gemini, the Convenience Fee is calculated at a rate of 0.50% (or 50 basis points) above the prevailing Gemini market price for a given trading pair at the time they provide you the Quoted Price. Your actual Convenience Fee may be greater or lower than 0.50% due to price movement in the market between the time they provide you the Quoted Price and the time your Mobile Order is filled; however, this will not affect the price you pay.

So – yes, a one-time withdrawal is free, except for the fee that your bank might ask, of course.

But consider also their exotic fees listed above.

| Withdrawal fee | Gemini | Coinbase Pro |

| SEPA withdrawal | – | €0.15 EUR |

| Wire Transfer withdrawal | Free | $25 USD |

| Swift (GBP) | – | £1 GBP |

| ACH Transfer withdrawal |

Free |

|

| PayPal withdrawal | – | Free |

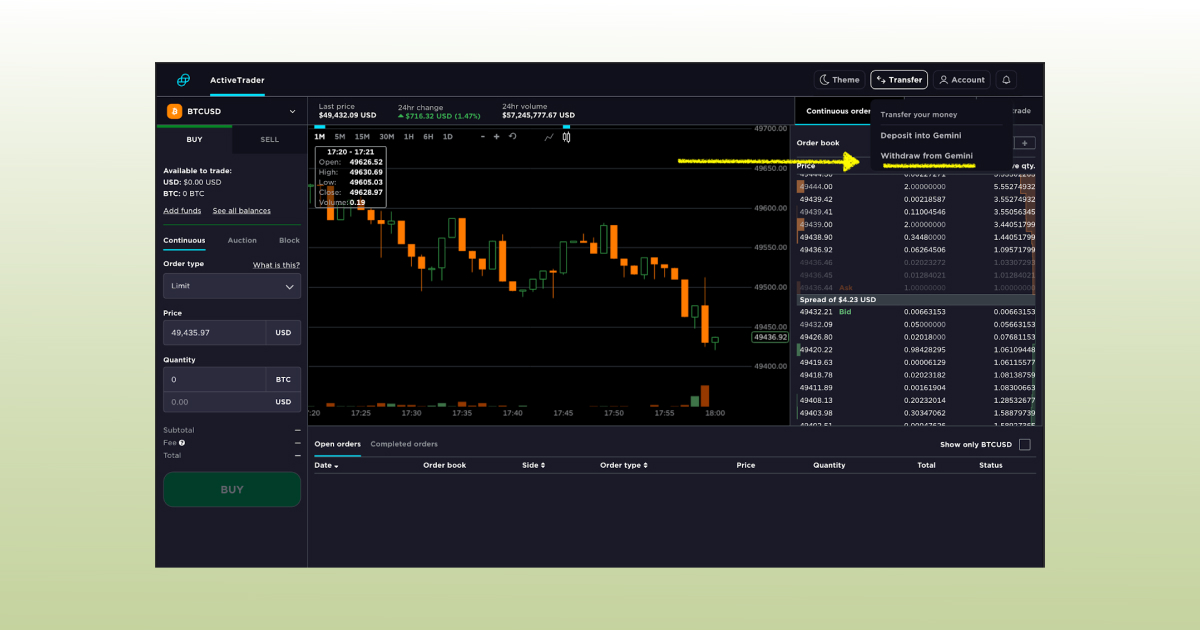

In order to withdraw money from Gemini, you need to click the Transfer icon as shown down below…

and provide payment details:

Security: Is Gemini Safe?

What’s interesting about Gemini is that, by contrast to their manifold competitors, they have focused on transparency and regulations from the very beginning.

As the motto on their website states, the platform has operated with a security-first mentality from day one. Indeed, a batch of bloggers, like this one or that one, insist that Gemini is the safest crypto exchange in the niche – remember, however, that it’s, of course, just their opinion.

So, let’s see how this opinion stacks up against some facts. First of all, Gemini has never been hacked. Well, how did they manage to go untouchable like that?

Three main vulnerability issues the exchange confronts are external threats, human error and misuse of insider access.

The majority of the users’ crypto funds is held in the offline, air-gapped cold storage system which is based on hardware security modules that have achieved a FIPS 140-2 Level 3 rating or higher. Their hot storage has also achieved this rating.

FIPS is a U.S. government computer security standard used to approve cryptographic modules.

Level 3 modules detect and respond to attempts at physical access, use or modification of the cryptographic module.

The Coinbase website never mentions the level 3 rating in this context, although Coinbase and Kraken use the FIPS 140 standard, too.

Gemini also gives you a chance to create a list of approved addresses to restrict your crypto withdrawals to approved wallets only.

Financially speaking, all your USD balances are FDIC insured up to $250k. But unlike Coinbase Pro, your digital assets are protected by the digital asset insurance. Also, Gemini undergoes regular bank exams and is subject to the cyber security regulations promulgated by the New York Department of Financial Services.

They emphasize that they are the world’s first cryptocurrency exchange and custodian to complete a SOC 1 Type 2 exam and SOC 2 Type 2 exam, the exams proving that an organization stays up-to-date with data security best practices.

Gemini has got an ISO 27001 certification, which is a security standard that helps identify a hidden risk within an infrastructure.

Last but not least, the exchange offers a private bug bounty program that you can take part in if you email them to bugbounty@gemini.com.

That being said, is Gemini exchange safe to use? Yes, pretty much.

Coinbase vs Gemini Fees

The main thing you should probably know while comparing Coinbase Pro with Gemini is that on Gemini, the system of fees is slightly different, maybe even a little bit more complicated than on Coinbase Pro.

It’s not enough to talk only about Maker and Taker Fees. As we’ve mentioned above, in addition to those, Gemini requires extra commissions for a certain number of withdrawals per month, a convenience fee as well as transaction fees for USD web and mobile transactions, so keep that in mind.

On Coinbase Pro, fees seem more expensive, but don’t forget that the twins’ platform has a whole system of Gemini trading fees not seen across other platforms.

| Fee Type | Coinbase Pro | Gemini |

| SEPA withdrawal |

€0,15 EUR |

– |

| SEPA Deposit |

€0,15 EUR |

– |

| Wire Transfer Withdrawal |

$25 USD |

Free |

| Wire Transfer Deposit |

$10 USD |

Free |

| ACH Transfer Withdrawal |

$0 USD |

Free |

| ACH Transfer Deposit |

$0 USD |

Free |

| Maker Fee |

0,5% (<$10k) |

0,25% |

| Taker Fee |

0,5% (<$10k) |

0,35% |

| Debit Card Buy |

3,99% |

3,49% |

| Convenience fee |

– |

0.5% |

| Transaction fee (mobile) | – | > $200.00 – 1.49% |

| Transaction fee (web) | – | > $200.00 – 1.49% |

| ≤ 10 withdrawals per calendar month |

– |

0 BTC |

| > 10 withdrawals per calendar month | – | 0.001 BTC |

Comparison Table

As you can see for yourself, the differences between these two platforms are quite subtle, but neither of them have the system of advanced orders that the Good Crypto app offers. Plus, the charts on both platforms are quite simplistic, which, of course, makes it so much easier for all the newbies, but if you really want a combo of professional tools and safety, maybe you should think about enhancing this experience with additional tools.

| Features | Coinbase Pro | Gemini |

| Maker Fee/Taker Fee |

0.5%/0.5% |

0.25%/0.35% |

| Markets (trending pairs) |

284 |

73 |

| Margin Trading |

❌ |

❌ |

| Futures Trading |

❌ |

❌ |

| Mobile App |

Android, iOS |

Android, iOS |

| Trading in the U.S. |

✔️ |

✔️ |

| Professional Trading Terminal |

✔️ |

✔️ |

| Advanced Charting Tools |

Line charts, Candlestick charts |

Line charts, Candlestick charts |

| Advanced Order Types |

❌ |

Partially |

| Mandatory KYC |

✔️ |

✔️ |

| Federal Insurance | ✔️ | ✔️ |

| Fiat Currencies | USD, EUR, GBP | AUD, CAD, EUR, GBP, SGD and HKD |

| Fiat withdrawal to debit card |

✔️ |

✔️ |

| Payment methods accepted |

|

|

Conclusion

Do you still think which exchange suits you better? Gemini or Coinbase? Take a look at the most important features of each trading venue.

Coinbase Pro so far is the most popular exchange across American customers with 3 million weekly visits against Gemini’s 307 thousand visits. In this sense, Brian Armstrong’s crypto venue is not only more popular than Gemini, but other U.S. venues, too.

The twins’ platform has a 24-hour trading volume of $371,669,947, which is far less than the Coinbase exchange’s $3,476,420,769. But Coinbase Pro has more trending pairs supported, 252, against Gemini’s 51.

Both companies offer services for institutional investors and interesting features, such as staking, however, block trading and auction is the only privilege of Gemini users.

Gemini withdrawal fees are lower than Coinbase Pro’s, but you should remember that on Gemini, the fee increases with the number of withdrawals, plus, there are additional fees, such as web and mobile transaction fees and convenience fees.

The balances on Coinbase Pro have FDIC insurance, meaning all clients who store less than $250,000 on their accounts are federally secured by the U.S. government, and you can verify yourself easily via their mobile app. The same situation is applicable to Gemini, but the verification process might be trickier, so verify yourself before transferring money to or from the account.

As for advanced order types, neither Gemini or Coinbase Pro offers the same range of orders as the Good Crypto App. On Coinbase Pro, you can place only Market, Limit, Stop Market and Stop Limit orders.

Gemini’s Active Trader interface offers Market order, Limit order, Immediate-or-cancel order, Fill-or-Kill order, Maker-or-Cancel order, Auction-Only order, Indication-of-Interest order, Stop-Limit order.

Neither of these exchanges have a hotline to call. Coinbase customer support and Gemini customer support only offer you to contact them via email if you seem to have problems. We’ll leave the links to the respective pages down below:

Gemini Exchange Customer Support

So, whether you choose Gemini or Coinbase Pro, Good Crypto allows you to add to your trading arsenal Trailing Stop and Trailing Stop Limit orders, attach concurrent Stop Loss and Take Profit to any order you send, and even set Trailing Take Profit.